Table Of Contents

Leveraged Buyout (LBO) Meaning

Leveraged Buyout (LBO) analysis helps determine the maximum value a financial buyer could pay for the target company. For example, the amount of debt that needs to be raised and financial considerations like the present and future free cash flows of the target company, equity investors require hurdle rates and interest rates, financing structure, and banking agreements that lenders require.

Leveraged buyout (LBO) sounds like a dense word, and indeed it is. However, the billion-dollar deals taking place each year have made LBOs quite fascinating. It is the term used synonymously with acquisition. Investors adopt both equity and debt financing measures to buy the target company.

Key Takeaways

- Leveraged Buyout (LBO) analysis estimates the maximum value a financial buyer can pay for the target company.

- It is similar to a DCF analysis. The standard calculation involves cash flows, terminal value, present value, and discount rate.

- It also focuses on whether enough projected cash flow is available to operate and pay debt principal and interest payments.

- The sources of funds to finance the transaction are a revolving credit facility, bank debt, Mezzanine debt, subordinated or high-yield notes, seller notes, and common equity.

How Does LBO Analysis Work?

Leveraged Buyout analysis is similar to a DCF analysis. The common calculation includes cash flows, terminal value present value, and discount rate.

However, the difference is that in DCF analysis, we look at the company's present value (enterprise value). In contrast, we look for LBO analysis's internal rate of return (IRR). LBO analysis also focuses on whether there is enough projected cash flow to operate and pay debt principal and interest payments.

The concept of a leveraged buyout is very simple: Buy a company –> Fix it up –> Sell it.

Usually, the entire plan is a private equity firm targets a company, buys it, fixes it up, pays down the debt, and then sells it for large profits. Let us consider a more specific example to understand the concept better.

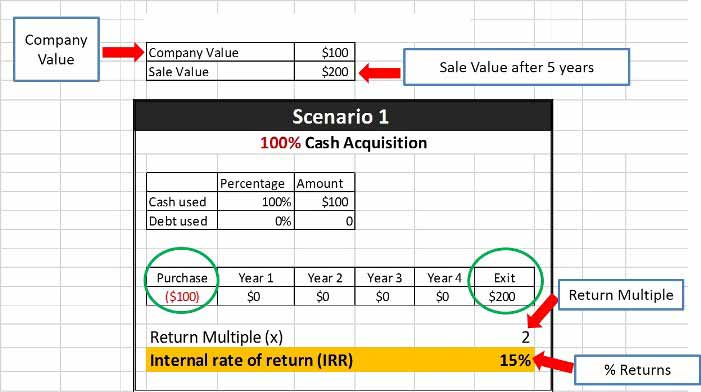

Scenario 1:

Suppose you buy a company for $100 using 100% cash. You then sell it five years later for $200.

In this case, the return multiple comes to 2x. So, the internal rate of return for you, in this case, will be 15%.

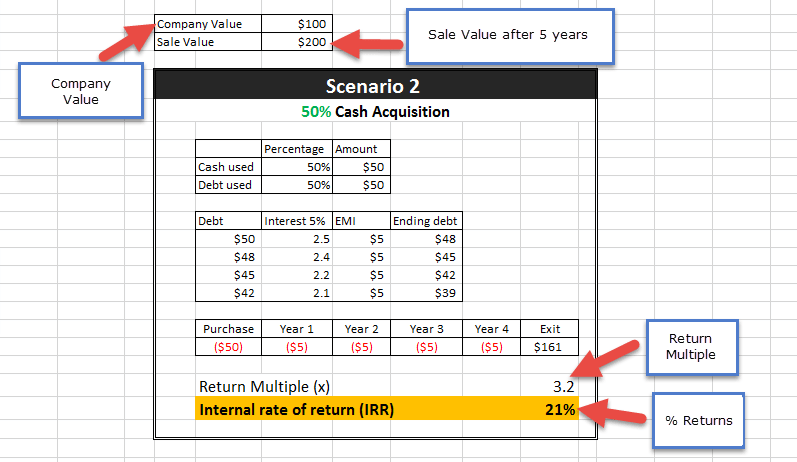

Scenario 2:

Let us compare that to what happens when you buy the same company for $100 but use only 50% cash and sell it five years later, still for $200 (shown as $161 here because the $50 in debt must be repaid).

In this case, the return multiple comes to 3x, and the internal rate of return for you will be 21%. The reason for this is as follows: -

You had taken 50% debt and paid 50% cash. So, you had paid $50 from your pocket and grabbed a loan of $50 for the remaining payment.

During five years, you pay the loan of $50 step-by-step.

At the end of the five years, you sell the company for $200. Now, taking out the outstanding loan of $39 of debt from this, the amount that remains with you comes to $161 ($200-$50).

The rate of return is higher in this case, as you had initially invested $50 of your cash and got $161 in return.

You may want to remember that predictable cash flows are essential to have a good buyout. And this is the reason why target companies are usually mature businesses that have proven themselves over the years.

Characteristics of Target Company

Before opting for an LBO, it is important to check out the features of the candidate company that is being targeted.

- A company from a mature industry.

- A clean balance sheet with no or low amount of outstanding debt.

- The strong management team and potential cost-cutting measures.

- Inadequate working capital requirement and steady cash flows.

- Low future CAPEX requirements

- Feasible exit options.

- Strong competitive advantages and market position

- Possibility of selling some underperforming or non-core assets.

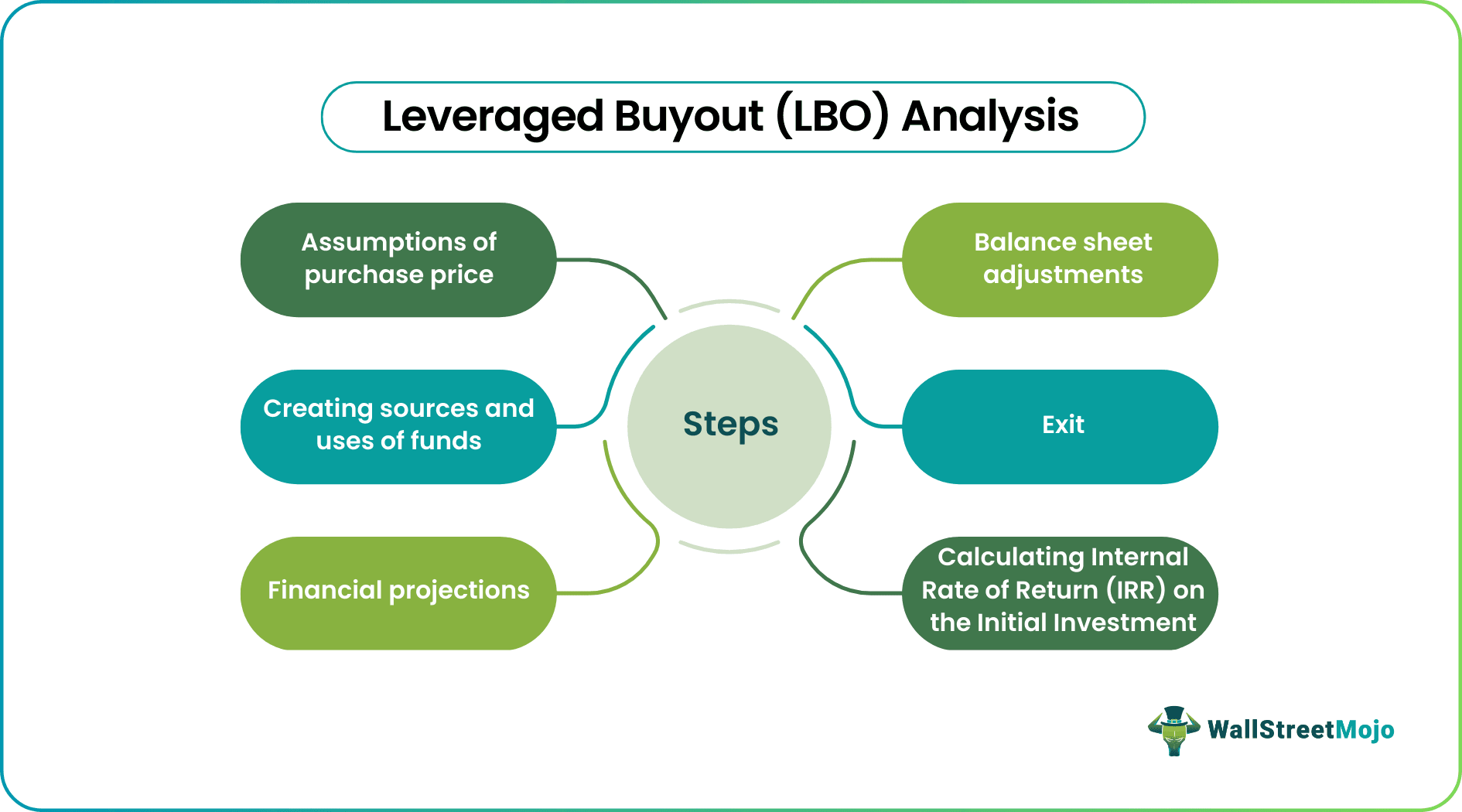

Steps

Follow the steps for Leveraged Buyout Analysis

Assumptions of Purchase Price

The first step is making assumptions on the purchase price, debt interest rate, etc.

Creating Sources and Uses of Funds

With purchase price, interest, etc., one can create sources and use a table. Uses reflect the amount of money required to effectuate the transaction. Sources tell us where the money is coming from.

Financial Projections

In this step, we project financial statements, i.e., income statement balance sheets, usually for five years.

Balance Sheet Adjustments

Here, we adjust the new debt and equity balance sheet.

Exit

Once adjustments are made, one can make assumptions about the private equity firm’s withdrawal from its investment.

A general belief is that they will sell the company after five years at the same implied EBITDA multiple at which the company was purchased (not necessary).Calculating Internal Rate of Return (IRR) on the Initial Investment

There is a reason why we calculate the sale value of the company. It also allows us to calculate the value of the private equity firm’s equity stake, which we can then analyze its Internal Rate of Return (IRR).

IRR is used to determine; how much you will get back on your initial investment.

Video Explanation of Leverage Buyout (LBO)

Example

Now, we have to understand the steps involved in LBO analysis. But, just reading the theory does not give us the whole picture. So let us try to jam with some numbers to get clear insights into an LBO.

Let us get you into a role play now. Yes, you have to think that you are a successful businessman.

- So, your first step would be making some assumptions concerning sources and uses of funds. Next, it would help determine how much you will pay for the company.

- You can do this with the help of EBITDA multiple. For example, assume that you are spending eight times the current EBITDA.

- The company's recent sales (revenue) are $500, and the EBITDA margin is 20%, then the EBITDA comes to $100.

- It means that you may have to pay 8*$100= $800.

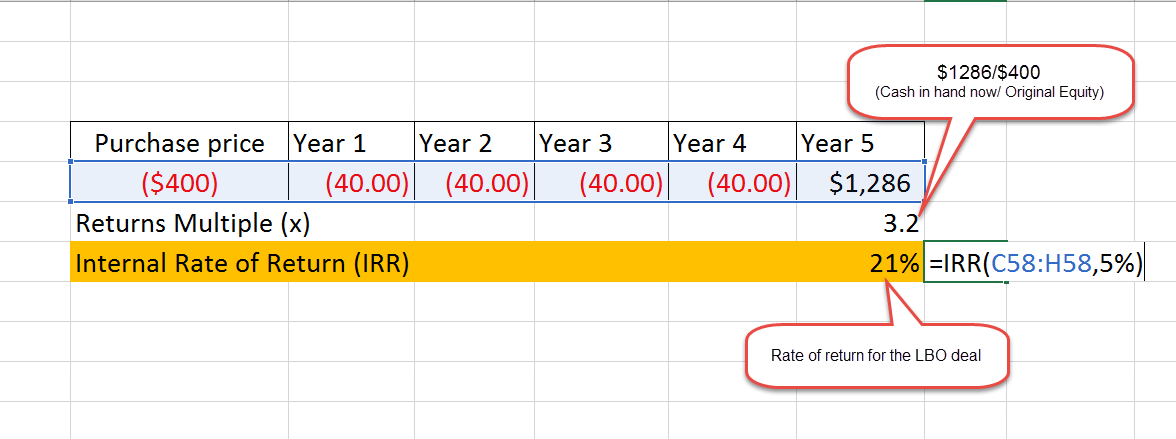

Then, it would be best if you determined how much of the purchase price will be spent on equity and debt. Let us assume that we use 50% equity and 50% debt. So, it means that you will use $400 of equity and $400 of debt.

- Now, I think you plan to sell that company after five years at the same EBITDA multiple of 8.

- The next step is to do some financial forecasting to see the company's future cash flows.

- You can calculate the cash flows before the debt repayment using the following formula: (EBITDA- changes in working capital – Capex – Interest after-tax).

- Initially, we have found the EBITDA for the company to be $100. Now we will assume that the EBITDA of the company grows from $100 to $200 over five years.

Let us say that you can pay $40 as a yearly installment. Below is the schedule of interest payments and ending debt after each year. Please note that at the end of the fourth year, the total outstanding debt is $313.80.

Assuming that EBITDA is $200 after five years and with the valuation of 8x EBITDA multiple, you will get 200*8=$1600 as the firm's total valuation.

Out of $1600, you need to repay the outstanding debt of $313.80. So, that leaves you with 1600-313.80= $1,286 of equity.

- Therefore, your overall return will be 1,286/400= 3.2x returns over five years or incorporating the cash flows; we get 21% IRR.

Sources of Funds

When it comes to opting for an LBO, there need to be options that fund the process. The following are the sources of funds to finance the transaction: -

Revolving credit facility

A revolving credit facility is a form of senior bank debt. It acts like a credit card for companies. A revolving credit facility is used to help fund a company’s working capital needs. Generally, a company in the market will “drawdown” the revolver up to the credit limit when it needs cash and repays the revolver when excess cash is available.

Bank Debt

Bank debt is a lower interest rate security than subordinated debt. But it has more solemn covenants and limitations. For example, bank debt typically requires full payback over 5 to 8 years.

Bank debt generally is of two types: -

- Term Loan A

Here, the debt is evenly paid back over 5 to 7 years.

- Term Loan B

This layer of debt usually involves minimal repayment over 5 to 8 years, with a large payment in the last year.

Mezzanine debt

It is a form of the hybrid debt issue. The reason behind that is it generally has equity instruments (usually warrants) attached to it. It increases the value of the subordinated debt and allows for greater flexibility when dealing with bondholders.

Subordinated or High-Yield Notes

They are commonly referred to as junk bonds. These are usually sold to the public and command the highest interest rates to compensate holders for increased risk exposure. They may raise subordinated debt in the public bond market or the private institutional market that usually has 8 to 10 years of maturity. It may have different maturities and repayment terms.

Seller Notes

A leveraged buyout can use seller notes to finance a portion of the purchase price. In the case of seller notes, a buyer issues a promissory note to the seller, wherein he agrees to repay over a fixed period. Seller notes are attractive sources of finance because it is generally cheaper than other forms of junior debt. Also, at the same time, it is easier to negotiate terms with the seller than a bank or other investors.

Common Equity

Equity capital is contributed through a private equity fund. The fund pools the money, which is raised from various sources. These sources include pensions, endowments, insurance companies, and HNI’s.

Sources of Revenue

Figuring out the possibilities of fund accumulation and revenue generation makes an LBO analysis useful. It is with the help of these buyouts that buyers know of their capabilities to involve in a deal.The sources of finance have already been discussed above. Let us now take a look at the sources of revenue below:

Carried Interest

Carried interest is a share of the profit that the acquisitions made by the fund generates. Once all the partners have received an amount equal to their contributed capital, the remaining profit is split between the general and limited partners. Typically, the general partner’s carried interest is 20% of any profits remaining once all the partners’ capital has been returned.

Management Fees

LBO firms charge a management fee associated with identifying, evaluating, and executing acquisitions by the fund. Management fees typically range from 0.75% to 3% of committed capital, although 2% is common.

Co-Investment

Executives and employees of the leveraged buyout firm may co-invest along with the partnership, provided the terms of the investment are equal to those afforded to the association.

Returns

In leverage buyout, the financial buyers evaluate investment opportunities by analyzing expected Internal Rates of Return (IRR), which measure returns on invested equity.

IRR represents the discount rate at which the net present value of cash flows equals zero.

Historically, the financial sponsors' hurdle rate, the minimum required rate, has been more than 30%, but maybe as low as 15%-20% for special deals under adverse economic conditions.

Sponsors also measure the success of a leveraged buyout investment using a metric called “cash on cash.”

Typical LBO investments return a range between 2x – 5x cash-on-cash. If investment returns 2x cash on cash, the sponsor is said to have “doubled its money.”

The following three factors drive the returns in a leveraged buyout: -

- De-levering (paying down debt)

- Operational improvement (e.g., margin expansion, revenue growth)

- Multiple developments (buying low and selling high)

Exit Strategies

Exit Strategies are used by the private equity firms while selling the company after, e.g., five years.

An exit strategy helps financial buyers to realize gains on their investments. An exit strategy includes an outright sale of the company to a strategic buyer, another financial sponsor, or an IPO.

A financial buyer typically expects to realize returns within three to seven years via one of these exit strategies.

Exit Multiples

The exit multiple refers to the return of investment.

If you invest $100 in a company and sell it for $300, the exit multiple is 3x. EBITDA is the generally used exit multiple.

Exiting the investment at a multiple higher than the acquisition multiple will help boost IRR (Internal Rate of Return). But exit assumptions must reflect realistic approaches.

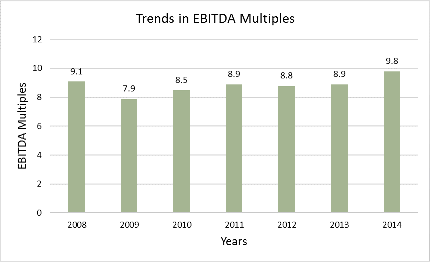

As we saw in the above examples, EV to EBITDA Multiples are also largely used. Following is the chart showing the trend in the EBITDA multiple over the years. The deal multiples in 2014 have reached the 2007 level of about 9.7x-9.8x.

Issues to Consider

Think of you as an investor who wants to invest in a share of that company.

Will you directly start trading from day 1?

No, right! You will analyze the industry and the company and then come to a particular decision.

Similar is the case in LBO analysis. You may want to consider the various issues before entering the transaction: -

Industry characteristics

- Type of industry

- Competitive landscape

- Cyclicality

- Major industry drivers

- Outside factors like the political environment, changing laws and regulations, etc.

Company-specific characteristics

- Market share

- Growth opportunity

- Operating leverage

- Sustainability of operating margins

- Margin improvement potential

- Minimum working capital requirements

- Cash required to run the business

- The ability of management to operate efficiently in a highly levered situation;

Considerations

The following chart summarizes some of the important considerations of a Leveraged Buyout. You can get a quick gist of an LBO through it. I hope you have learned about what LBOs are through this article.

| Parameters | Range |

|---|---|

| Returns | Between 20%-30% generally |

| Exit Time Horizon | 3-5 years |

| Capital Structure | A mixture of Debt (High) and Equity |

| Debt Payment | Bank debt is usually paid in 6-8 yrs. Higher yield debt paid in 10-12 yrs. |

| EXIT Multiples | EBITDA, PE ratio, EV/EBITDA |

| Potential exits | Sale, IPO, Recapitalization |

Advantages

Leveraged Buyout has a lot of advantages, which makes individuals and companies opt for it. Let us have a look at a few of them:

- LBO analysis helps determine the purchase price of the prospective company or industry.

- It helps develop a view of the leverage and equity characteristics of the transaction.

- Calculate the minimum valuation for a company since, in the absence of strategic buyers, an LBO firm should be a willing buyer at a price that delivers an expected equity return that meets the firm’s hurdle rate.

Disadvantages

Besides the benefits that these options offer, there are limitations as well that entities have to be ready for if they opt for them. Moreover, knowing about the flaws helps them decide whether LBOs are the right option for them.

- LBO analysis lets entities assess the financial shield that LBOs offer. This financial backup left with the companies is not often enough to deal with the risks that might emerge at a later stage. While a few firms take this demerit seriously, there are many that ignore it and proceed with the option. In such cases, if the companies are unprepared, they might end up paying heavy costs.

- Most people opt for LBOs for the high returns they offer. This, in turn, might affect their equity reserve, which may disappear quite quickly in such cases.

- In case investors look for obtaining additional finance after LBOs, they might find it difficult to do so. For LBOs to happen smoothly, they opt for debt financing and most of their assets are collateralized. Thus, their creditworthiness is at stake.

Frequently Asked Questions (FAQs)

A leveraged buyout (LBO) is an acquisition where the company buying cost is financed mainly with borrowed funds. It is often executed by private equity firms that raise funds utilizing various debt types to complete the deal.

The impact of leveraged buyouts can vary depending on the specific circumstances and how they are structured. However, here are some key points: increased debt burden, financial distress, bankruptcy risk, impact on employees and stakeholders, short-term focus and exit strategy, and potential for value creation.

The objective of leveraged buyouts is to allow companies to make significant acquisitions without committing humongous capital. Companies may pursue these buyouts for various reasons, including value creation, unlocking synergies, strategic transformation, management buyouts, undervalued stock, and long-term focus.

Securities firms play a crucial role in facilitating leveraged buyouts. Here's how securities firms contribute to the LBO process by organizing deals, valuation, due diligence, structuring the transaction, financing agreements, equity capital raising, and transaction execution.