Table Of Contents

What Is Revenue Run Rate?

Revenue run rate is a metric used by companies to forecast the annual revenue that will be generated based on the current revenue levels, growth rate, market demand, and other relevant factors, assuming that the present revenue is free from any seasonality or outlier effect and the present market conditions will prevail throughout the year.

Explanation

A company formulates a budget for a given period before the period starts, which contains the estimation of numbers such as revenue, costs, profit, etc. During the year, the company monitors the trajectory of these numbers and tries to estimate the deviations from the budgeted figures. This budget is a long-term outline.

This exercise aims to modulate the strategies and techniques used by the company to steer the numbers back on track if they have gone astray or to continue with the same efforts if we are expecting to meet the target. Therefore, Revenue run rate is one measure that helps determine interim strategies to keep revenue on track.

Formula

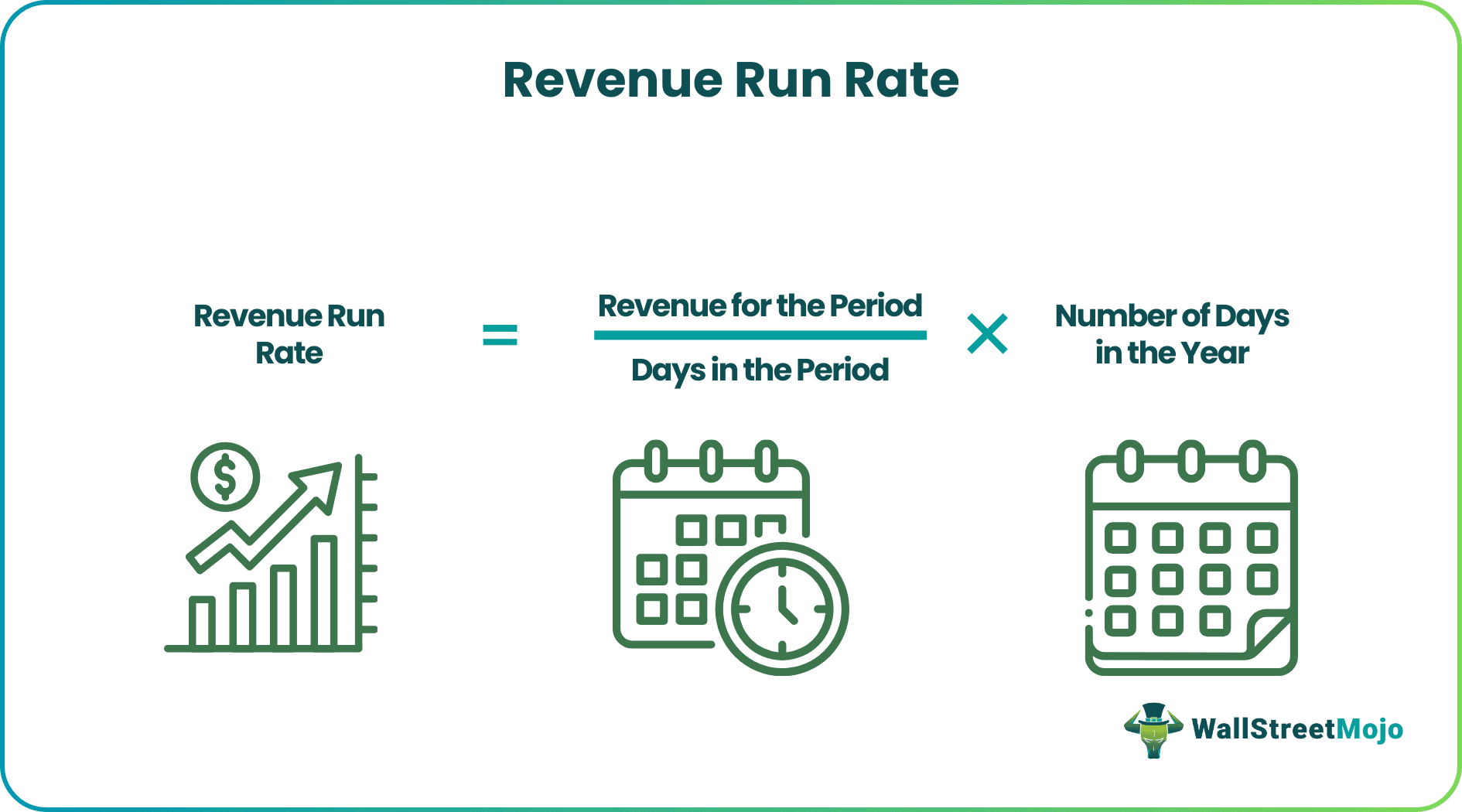

Following is the formula for the revenue run rate:

Revenue Run Rate = Revenue for the Period / Days in the Period * Number of days in the Year

- The above formula can be converted into a monthly format as well by dividing by the number of the month and multiplying by the number of months in a year;

- The number of days in the year is assumed to be 365. However, we may even take numbers such as 360 or 250 depending on whether we want to consider only working days or even the holidays, or we want to have a more straightforward calculation because the number is only for estimating. Hence, a close enough approximation is sufficient.

Example of Revenue Run Rate

Suppose there is a company that goes by the name of MoveFast Inc. It sells fitness wearable equipment and has sold an average of 100 units of its product for $ 100 in two 20 days periods in the current year. It has an annual target of $200,000. It wants to know whether the current level of sales can generate the required revenue or should it reduce the price to $90, which can lead to the expected growth of 20% in the number of units sold. Therefore, it has decided to calculate the Revenue run rate to understand whether it should continue or alter its strategy. It assumes 365 days in the year.

Solution

Calculation of Revenue Run Rate of Existing Strategy

- =$10000/20*365

- =$182500

Calculation of Revenue Run Rate of Altered Strategy

- =$11400/20*365

- =$208050

Therefore it now knows that the annual targeted revenue will not be met, so it should try to alter its strategy. It can recalculate the Revenue run rate with the expected numbers to see if that strategy can work.

It exceeds the annual target so that the altered strategy can work in the company's favor.

Revenue vs Income Explained in Video

Risk of Revenue Run Rate

- Corrupt Revenue Numbers - At times, the revenue numbers can be affected by the seasonal effects, such as festival months such as Christmas and new years, when the sales are high throughout the market. Such revenue numbers can’t be considered an unbiased predictor of the average annual sales. So such numbers should not be used in calculating this metric; otherwise, they can give us misleading results.

- Violation of Assumptions - This metric assumes that the current market environment will continue and leaves out the possibility of unforeseen changes. Therefore it underestimates the impact of such disruptions and might present an over-optimistic or pessimistic outlook of revenue, leading to a lack of strategy change till it is very late to do anything.

- Internal Changes - The company might undergo many changes during the year, leading to a change in its performance. For example, the management might increase the sales team's incentives, resulting in higher sales; if that is the case, then the upcoming revenue might be higher than expected. If this is not considered, the company may implement a price reduction strategy even when it is not needed.

Uses

- Alter Short Term Strategies - As explained in the above example, this metric can give us the clarity required for modulating our strategies to reach the budgeted targets. If timely implemented, it can help the company in achieving its goal.

- Raising Funds - When startup companies require funding and don’t have a profitability number to show, this metric can help gain the interest of the investors who may need at least something concrete to base their investment upon.

- Budget Preparation - Budgeting uses the previous year’s information to outline the future numbers of the company. The revenue run rate is based on the actual data and, therefore, can be used to formulate future budgets on a realistic basis.

Benefits

- Simple Measure - It is a simple calculation and is therefore preferred by the management of young enterprises as it doesn’t require very highly skilled professionals and can be done at a low cost.

- Helpful when a company is making losses - Younger companies that are not yet profitable can use this measure to assess their capabilities and formulate their short-term strategies based on the same to keep up the morale until they become profitable.

Limitations

- Unrealistic Assumption - The calculation assumes that the market environment will remain the same. However, that is not always true; if the market changes drastically, this metric is rendered useless, so this assumption should not be violated for it to have any actual impact.

- Short Term Measure - It cannot be used for a longer-term analysis because it will have to be adjusted for longer-term internal and external changes, so using it in the long term is not advisable.

- It can be affected by Accounting Manipulation - As it considers the revenues instead of cash flows, it can be impacted by the company's revenue recognition practices. If the company recognizes revenue when it is unreasonable, the revenue numbers will be inflated and not give an accurate and fair outlook of the upcoming period.

- Lack of Data for Extrapolation - As we consider revenues of only a short period, we might not be confident enough of it being an average number reflecting the actual performance capacity of the company. And as the period for which prediction is made is generally short, if not calculated quickly, then the residual portion might not be sufficient to implement any strategy change if required.

Conclusion

The measure's pros and cons formulate a trade-off for the companies; however, it can be a good indicator of the achievable numbers and, therefore, can be used as a monitoring system for the tactics the companies need to implement to achieve their budgeted targets.

A lot depends on the measure's intention, as it can be easily manipulated; we need to take good care of revenue recognition practices so that the measure doesn't get corrupted and doesn't produce a misleading result.