Table Of Contents

What Is Marginal Cost Formula?

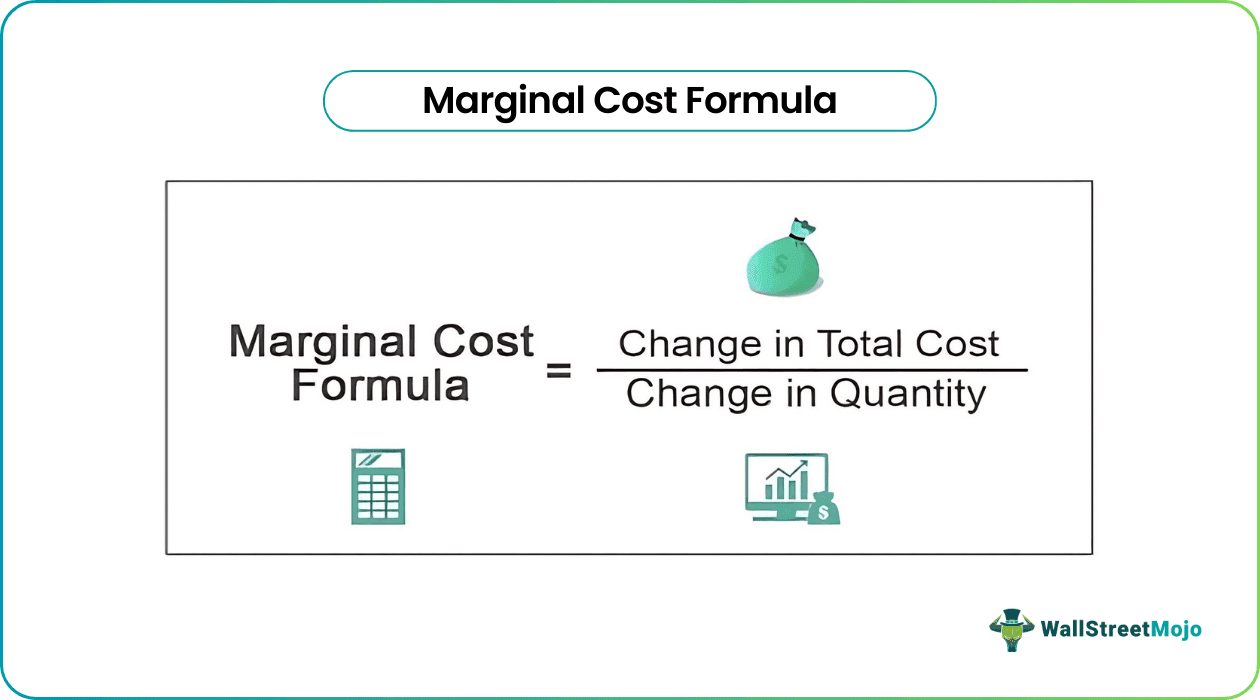

The marginal cost formula helps calculate the value of the increase or decrease of the total production cost of the company during the period under consideration if there is a change in output by one extra unit and is calculated by dividing the change in the costs by the change in quantity.

Marginal cost is the change in the total cost of production upon a change in output that is the change in the quantity of production. In short, the change in total cost arises when the quantity produced changes by one unit. Mathematically, it is expressed as a derivative of the total cost concerning quantity.

Marginal Cost Formula Explained

Marginal cost formula in economics is the change in the total cost of production due to a change in the production of one extra unit of a commodity. It is mainly used by manufacturers to understand which is the level where the company can achieve economies of scale. When the producer reaches that level at which the cost of producing one extra unit is less than the price of selling one extra unit, they start earning profit.

The marginal cost of production is affected by many factors labor and raw material cost, or cost of energy consumption. Due to increase in production, the marginal cost may continue rising upto a certain level due to rise in the cost of extra resource needed to increase production.

It is a very important concept that the business owners should understand because it helps in taking informative production decisions of designing strategies for pricing.

Marginal cost can be said as an extra expense on producing one additional unit. It helps management make the best decision for the company and utilize its resources in a better and more profitable way, as with quantity, profit increases if the price is higher than this cost.

Several factors affect the marginal cost formula in economics and application. Some of them are considered a market failure. It also includes information asymmetries, the presence of externalities, transaction costs, etc.

How To Calculate?

In order to calculate marginal cost formula the method is as follows:

where,

- Change in Total Cost = Total Cost of Production including additional unit – Total Cost of Production of a normal unit

- Change in Quantity = Total quantity product including additional unit – Total quantity product of normal unit

Marginal Cost = Change in Total Cost / Change in Quantity

Let us look at the detailed steps to calculate marginal cost formula.

Below are the steps to calculate marginal cost -

Consider the total output, fixed cost, variable cost, and total cost as input.

Prepare a production graph considering a different quantity of output.

Find the change in cost i.e., a difference in the total cost of production, including additional unit and total cost of production of the normal unit.

Find the change in quantity, i.e., total quantity product, including additional unit and total quantity product of normal unit.

- Now, as per the formula of Marginal cost, divide change in cost by a change in quantity, and we will get marginal cost.

Example

Now let us understand the concept of marginal cost formula with example.

A manufacturing company has a current cost of production of 1000 pens at $1,00,000, and its future output expectation is 2000 pens with a future cost of production of $1,25,000. So the calculation of the marginal cost will be 25.

| Particulars | Amount |

|---|---|

| Current Unit of Production | 1000 |

| Current Cost of Product | $100,000.00 |

| Future Unit of Production | 2000 |

| Future Cost of Production | $125,000.00 |

| Marginal Cost Formula | 25 |

Here,

- Change in Total cost = $1,25,000 - $1,00,000 = $25,000

- Change in Quantity = 2000 – 1000 = 1000

Now,

- Marginal Cost = 25000/1000

- = 25

The above marginal cost formula with example clearly explains the concept.

Formula In Excel (with excel template)

Now let us take the case mentioned in the above example to illustrate the same example in the excel template below.

In below template is the data of the manufacturing company for the calculation.

So the total calculation of marginal cost will be-

Benefits

The marginal cost formula in cost accounting has a number of benefits as follows:

- The marginal cost formula is used in financial modeling to optimize cash flow generation.

- It is used to calculate the incremental cost of production. This ensures that the business has a control on the cost levels and does not go overboard with the output level even though the cost is increasing.

- It helps to make production decisions. The business can understand and estimate the feasibility of producing one extra unit and also identify the level where the marginal cost is equal to the marginal revenue, thus maximizing profit.

- It helps the producer allocate the resources effectively so that the production increases but at the same time the cost is under control. The formula helps in identifying the level at which the cost is below the revenue of producing one extra unit of the commodity.

- It guides the business regarding whether to increase production, go for expansion, launch new product or service, etc by evaluating the viability of them through comparison of the cost and revenue.

- The marginal cost formula in cost accounting also assesses the performance of each decision after they have been taken. This is a method of identifying the efficiency level and judging the overall performance improvement.

Limitations

The marginal cost formula is a decision-making tool with some limitations as follows:

- The cost can be affected by various external economic factors like information asymmetry, external factors like environmental and social problems, price discrimination of increase in transaction cost.

- The formula ignores the quality factor of the output. It is not enough fro the business to be able to earn profit by keeping the marginal cost below marginal revenue. If the quality of the products falls due to rise in production level, the automatically the revenue will come down due to fall in sales.

- The data collected for the purpose of calculation should be from reliable source. It is not always so easy to collect the data from authentic source and due to that the calculation and analysis may go wrong.

It is important to analyze both the pros and cons of the method before using it so that it can help the business achieve its objective.

The marginal cost at each production level includes additional costs required to produce the unit of product. Practically, analyses are segregated into short-term, long-term, and longest-term. At each level of production and period being considered, it includes all costs that vary with the production level. Other costs are considered fixed costs, whereas practically, there is inflation, which affects the cost in the long run and may increase in the future.