Table Of Contents

Risk Budgeting Definition

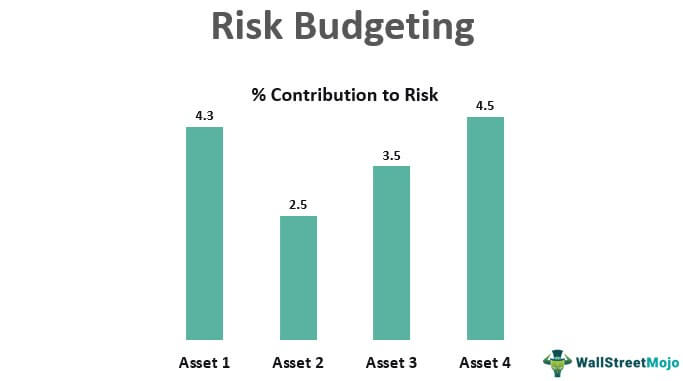

Risk budgeting is a type of portfolio allocation in which the risk of the portfolio is distributed among various asset classes with the objective of maximizing total portfolio returns while keeping the total portfolio risk at the minimum.

Risk Budgeting Calculation with Example

The most common approach to portfolio allocation is based on capital i.e., how much proportion of the capital should go in stocks or bonds or other such asset classes. For example, if I have $100 with me and invest $80 in stocks and $20 in bonds, we know our capital allocation to each asset class, but we have no idea of how much risk quantitatively we have assigned to stocks and how much to bonds. In risk budgeting, the investor has to first calculate what proportion of the overall portfolio risk each asset class represents and then reverse calculate the proportions of each asset class so as to minimize the total portfolio risk.

Risk budgeting primarily used three steps i.e., risk measurement, risk attribution, and risk allocation.

Let us look at an example to understand how risk budgeting works. Suppose we have two asset classes X & Y, with equal weights and the following five returns values.

| X | Y | Portfolio Returns |

|---|---|---|

| 4.00% | 6.00% | 5.00% |

| 6.00% | 3.00% | 4.50% |

| 8.00% | 5.00% | 6.50% |

| 9.00% | 11.00% | 10.00% |

| 11.00% | 12.00% | 11.50% |

The portfolio returns can be easily calculated using the weighted average method considering 50:50 weights (Wx, Wy) of each asset class. Next, we calculate the standard deviation (which is a measure of risk or volatility) of each asset class (σx,σy) using the built-in formula. We also calculate the correlation between the two asset classes (Corexy) using the built-in formula.

Therefore, the calculation of portfolio standard deviation (σp) using the below formula can be done as follows,

- σp2 = (Wx*σx)2 + (Wy*σy)2 + 2*Wx*σx*Wy*σy* Corrxy

- =(50%*2.42%)^2+(50%*3.50%)^2+(2*50%*50%*2.42%*3.50%*0.752246166))^0.5

- Portfolio SD = 2.775%

The objective of risk budgeting is to minimize the overall portfolio risk σp by varying the portfolio weights Wx and Wy.

The most obvious way to achieve this is by decreasing the proportion of riskiest assets. But this will affect the return of the portfolio because the riskiest asset often has the highest return.

To solve this issue, instead of minimizing portfolio standard deviation, we minimize a ratio called Sharpe Ratio, which is given by the following formula:

SR = (Rp – Rf) / σp, where Rp and Rf are overall portfolio return and risk-free return, respectively.

Sharpe ratio, in a crude way, signifies the return per unit risk of a portfolio. Hence we minimize the Sharpe Ratio of a portfolio (SR) by varying the proportion of various asset classes.

The following table gives the values for the different parameters of risk budgeting for the above example.

Therefore, the calculation of the Sharpe ratio using the above formula is as follows,

- = (7.5%-3%)/2.775%

- Sharpe Ratio = 1.62

Types/Components of Risk Budgeting

Unlike capital budgeting in risk budgeting models, we can include the risk exposure of a portfolio to various external factors like inflation, economic growth, interest rates, and so on. To assign risk budgets to external factors, the investor must establish a relationship between each asset class and the external factors, and then after considering the volatility and correlation assumptions between these, an appropriate risk model can be built.

A portfolio’s risk can also be decomposed into active and passive components similar to the technique discussed above. The passive component is generally an appropriate benchmark, while the active component represents the risk due to the fund manager employed by the investor.

In the above figure, we can see that 95% of the portfolio’s risk is due to the behavior of the individual asset class, whereas 5% is due to that of the fund managers employed.

Advantages

- Risk budgeting helps an investor to optimize portfolio performance and, at the same time, maintain the risk with which he is comfortable.

- It is a powerful technique because it accounts not only for asset classes but also for the correlation effects of the various asset classes.

- Risk budgeting can also account for the effects of an external factor on a portfolio and its interaction with various asset classes, which is not possible in capital budgeting.

Disadvantages/Limitations

- The primary limitation of risk budgeting is its operational difficulty. Active portfolio management using risk budgeting requires continuous data and statistical analysis.

- Secondly, risk budgeting requires technical expertise, which is very difficult for most of the retail investors to attain or make time for, and hence this method is less acceptable among the masses.

Conclusion

Risk Budgeting is one of the most recent methods of portfolio optimization and is to be used in conjunction with the more prevalent capital budgeting method. Risk Budgeting’s primary benefit is that it helps the investor to carefully balance his risk among the various asset classes, external factors, and the active fund manager’s role. But detailed analysis is needed for coming up with the correlation between the external factors and asset classes, which, if done improperly, may invalidate the entire optimization model.