Table Of Contents

What Is Capital Budgeting?

Capital Budgeting refers to the planning process which is used for decision making of the long term investment. It helps in deciding whether the projects are fruitful for the business and will provide the required returns in the future years.

It is important because capital expenditure requires a huge amount of funds. So before making such expenditures in the capital, the companies need to assure themselves that the spending will bring profits to the business. Investments in heavy machinery or big constructions are examples of capital budgeting.

Key Takeaways

- Capital budgeting meaning refers to a crucial planning process used for making long-term investment decisions, regardless of whether the projects are expected to be profitable and provide the required returns later on.

- It is important because capital expenditures require significant funds, so companies must ensure that the payouts generate profits before investing such costs in the capital.

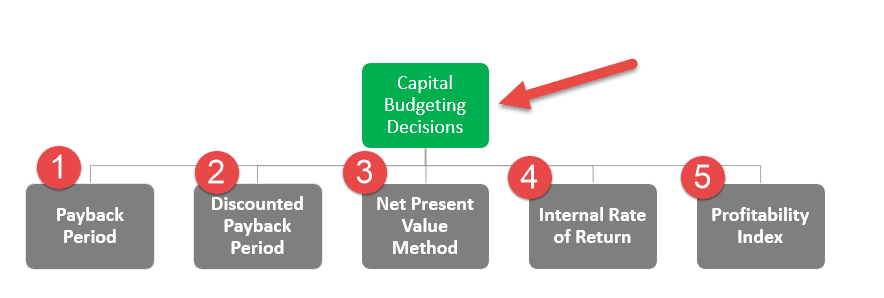

- The payback period, discounted payback period, net present value (NPV) method, internal rate of return (IRR), and profitability index are commonly used for capital budgeting decisions to select viable investments.

- A key capital budgeting objective is to ensure a firm’s financial stability.

Capital Budgeting Explained

Capital budgeting meaning refers to a a decision-making process where a company plans and determines any long-term Capex whose returns in terms of cash flows are expected to be received beyond a year. Investment decisions may include any of the below:

- Expansion

- Acquisition

- Replacement

- New Product

- R&D

- Major Advertisement Campaign

- Welfare investment

The capital budgeting decision making remains in understanding whether the projects and investment areas are worth the funding of cash through the capitalization structure of the company debt, equity, retained earnings – or not.

Capital budgeting process is a necessary and critical process for a company to choose between projects from a long-term perspective. It gives the management methods to adequately calculate the returns on investment and make a calculated judgment always to understand whether the selection would be beneficial for improving the company's value in the long term or not. Therefore, it is necessary to follow before investing in any long-term project or business.

Process

The following steps can provide a clear idea of how one can conduct the capital budgeting process:

- Identification Of Potential Projects: The first step involves seeking investment opportunities that are in line with the organization’s strategic objectives, for example, introducing new product lines, setting up manufacturing facilities, etc.

- Evaluation of Projects: Organizations utilize different methods to evaluate the financial viability of a product. Some common techniques are internal rate of return, payback period, and net present value.

- Selecting A Profitable Investment: After companies identify investment opportunities and complete the assessment of the same, they must decide which one is the most profitable and choose it. When choosing a specific project, a company may need to utilize the capital rationing technique to rank projects per the projected returns and choose the most lucrative option available to them.

- Funding The Project: After selecting the project, the organization must implement it. For that, it has to identify the fund sources and allocate resources efficiently. A few examples of these sources include loans, reserves, investments, etc.

- Tracking And Review: The last step of the process involves reviewing the investment. Precisely, it involves tracking the performance of the investment and comparing the actual performance of the investment with the anticipated performance. Based on the review, they can take measures to refine the process for the future.

For individuals who wish to develop a practical understanding of capital budgeting, enrolling in the Financial Planning & Analysis Course can be helpful. The expert-led course explains key concepts related to the topic and aims to build practical knowledge through examples.

Objectives

Let us look at the capital budgeting objectives in detail.

- Maximization of shareholders’ wealth via the selection of investment projects that raise the company’s value

- Making improvements in long-term planning via the evaluation and selection of projects that are in line with the organization’s strategic objectives.

- Assessment of growth opportunities and expanding business operations sustainably

- Making investments in projects that can provide the company with a competitive edge

- Ensuring the financial stability of an organization

- Evaluating and managing risks linked with investment projects

- Ensuring compliance with regulatory requirements and adherence to corporate governance principles

Capital Budgeting Principles

Let us look at the capital budgeting principles that individuals need to keep in mind when carrying out the process.

- Time Value Of Money: Businesses need to utilize discounted cash flow methods to factor in the time value of money and carry out a comparison of projects on a consistent basis.

- Cost of Capital: Organizations need to figure out the discount rate on the basis of their cost of capital.

- Sensitivity Analysis: Businesses need to carry out a sensitivity analysis to evaluate how altering key variables affects the investment’s volatility.

- Alignment With Strategic Objectives: The decisions taken by businesses with regard to the process must be in line with their strategic direction.

- Capital Rationing: Organizations need to carry out the allocation of the available capital resources efficiently through the prioritization of projects on the basis of risk profiles and anticipated returns.

- Control And Monitoring: Companies need to establish systems to track investment projects’ performance and take the necessary corrective measures.

- Incremental Cash Flows: Organizations should focus on incremental cash flows that are generated from the investment project instead of accounting profits.

- Flexibility: This capital budgeting principle requires businesses to assess the flexibility to contract, abandon, or expand in the future on the basis of changing market decisions.

- Project Interactions: Organizations need to consider interactions between multiple investment projects and their effect on business performance.

- Risk Evaluation: Businesses must assess the risks linked with every investment project and take into account the trade-off between risk and reward.

Methods

Given below are the various methods of capital budgeting analysis.

There are five major techniques used for capital budgeting decision analysis to select the viable investment are as below:

#1 - Payback Period

Payback Period is the number of years it takes to recover the investment's initial cost – the cash outflow –. The shorter the payback period, the better it is.

Features:

- Provides a crude measure of liquidity

- Provides some information on the risk of the investment

- Simple to calculate

#2 - Discounted Payback Period

Features:

- It considers the time value of money

- Considers the risk involved in the project cash flows by using the cost of capital

#3 - Net Present Value Method

NPV is the sum of the present values of all the expected cash flows in case a project is undertaken.

NPV = CF0 + CF1/(1+k)1+ . . . + CFn/(1+k)n

where,

- CF0 = Initial Investment

- CFn = AfterTax Cash Flow

- K = Required Rate of Return

The required rate of return is usually the Weighted Average Cost of Capital (WACC) – which includes the rate of both debt and equity as the total capital

Features:

- This method of capital budgeting analysis considers the time value of money

- Considers all the cash flows of the project

- Considers the risk involved in the project cash flows by using the cost of capital

- Indicates whether the investment will increase the project’s or the company’s value

#4 - Internal Rate of Return (IRR)

IRR is the discount rate when the present value of the expected incremental cash inflows equals the project's initial cost.

i.e. when PV(Inflows) = PV(Outflows)

Features:

- It considers the time value of money

- Considers all the cash flows of the project

- Considers the risk involved in the project cash flows by using the cost of capital

- Indicates whether the investment will increase the project’s or the company’s value

#5 - Profitability Index

Profitability Index is the Present Value of a Project's future cash flows divided by the initial cash outlay.

PI = PV of Future Cash Flow / CF0

Where,

CF0 is the initial investment

This ratio is also known as Profit Investment Ratio (PIR) or Value Investment Ratio (VIR).

Features:

- It considers the time value of money

- Considers all the cash flows of the project

- Considers the risk involved in the project cash flows by using the cost of capital

- Indicates whether the investment will increase the project’s or the company’s value

- Useful in ranking and selecting projects when capital is rationed

Examples

Let us go through some examples to understand the capital budgeting techniques.

Example #1

A company is considering two projects to select anyone. The projected cash flows are as follows.

WACC for the company is 10 %.

Solution:

Using the more common capital budgeting decision tools, let us calculate and see which project should be selected over the other.

NPV For Project A -

The NPV For Project A = $1.27

NPV For Project B-

NPV For Project B = $1.30

Internal Rate of Return For Project A-

The Internal Rate of Return For Project A = 14.5%

Internal Rate of Return For Project B-

Internal Rate of Return For Project B = 13.1%

The net present value for both the projects is very close, and therefore taking a decision here is very difficult.

Therefore, we pick the next method to calculate the rate of return from the investments if done in each of the two projects. It now provides an insight that Project A would yield better returns (14.5%) than the 2nd project, which is generating good but lesser than Project A.

Hence, Project A gets selected over Project B.

Example #2

In selecting a project based on the Payback period, we need to check for the inflows each year and which year the inflows cover the outflow.

There are two methods to calculate the payback period based on the cash inflows – which can be even or different.

Payback Period for Project A-

10 years, the inflow remains the same as $100 mn always

Project A depicts a constant cash flow; hence the payback period, in this case, is calculated as Initial Investment / Net Cash Inflow. Therefore, for project A to meet the initial investment, it would take approximately ten years.

Payback Period for Project B-

Adding the inflows, the investment of $1000 mn is covered in 4 years

On the other hand, Project B has uneven cash flows. In this case, if you add up the yearly inflows, you can easily identify in which year the investment and returns would close. So, the initial investment requirement for project B is met in the 4th year.

In comparison, Project A is taking more time to generate any benefits for the entire business, and therefore project B should be selected over project A.

Example #3

Consider a project where the initial investment is $10000. Using the Discounted Payback period method, we can check if the project selection is worthwhile or not.

It is an extended form of payback period, where it considers the time value of the money factor, hence using the discounted cash flows to arrive at the number of years required to meet the initial investment.

Given the below observations:

There are certain cash inflows over the years under the same project. Using the time value of money, we calculate the discounted cash flows at a predetermined discount rate. In column C above are the discounted cash flows, and column D identifies the initial outflow that is covered each year by the expected discount cash inflows.

The payback period would lie somewhere between years 5 & 6. Now, since the project's life is seen to be six years, and the project gives returns in a lesser period, we can infer that this project has a better NPV. Therefore, it will be a good decision to pick this project that can add value to the business.

Example #4

Using the budgeting method of the Profitability index to select between two projects, which are the options tentative with a given business. Below are the cash inflows expected from the two projects:

Profitability Index for Project A-

The Profitability Index for Project A =$1.16

Profitability Index for Project B-

Profitability Index for Project B = $0.90

The profitability index also involves converting the regular estimated future cash inflows using a discount rate, which is mostly the WACC % for the business. Then, the sum of these present values of the future cash inflows is compared with the initial investment, and thus, the profitability index is obtained.

If the Profitability index is > 1, it is acceptable, which would mean that inflows are more favorable than outflows.

In this case, Project A has an index of $1.16 compared to Project B, which has the Index of $0.90, which is clearly that Project A is a better option than Project B, hence, selected.

Thus, the above examples give us a clear picture about the different ways in which the concept is used to evaluate investment opportunity and also make suitable plans to implement the idea to bring about growth and expansion in the business.

Benefits

Let us look at some advantages of various capital budgeting techniques.

- It helps in making decisions in the investments opportunities so that the investment can give useful return and lead to growth and expansion of the business.

- Adequate control over expenditures of the company is possible if budgeting is proper because financial resources are properly allocated and this helps in avoiding wastage.

- One of the main objectives of capital budgeting process is to promote an understanding of risks and their effects on the business. Since proper analysis is done, and the prospective investment is evaluated it is possible to easily identify the risk factor in the investment and its effects if implemented.

- It leads to increase in shareholders’ wealth and improve market holding because due to profitable investments, the business can grow which increases stakeholder’s faith and confidence in the organization.

- The business can abstain from over or under Investment.

Limitations

- Decisions are for the long term and not reversible in most cases. Thus, if the management is not able to properly evaluate the opportunity which is one of the most important objectives of capital budgeting and later the investment is not able to generate the return as projected initially, then it is not possible to undo the process and get back the money.

- It is reflective in nature due to the subjective risk and discounting factor included in it.

- Few techniques or calculations are based on assumptions. Any uncertainty might lead to incorrect application and loss of valuable funds which could have been otherwise used for some productive purpose.

Capital Budgeting Vs Capital Structure

Some differences between the above two concepts are as follows:

- The former are the investment decisions the management takes for expanding the business whereas the latter is the total fund collected by the business for meeting its operational and investment expense.

- The capital structure includes the shareholders’equity and liabilities whereas the budgeting process includes the projects, infrastructure building, acquisitions, etc.

- The former is an evaluation process whereas the latter is the collection of funds.