Table Of Contents

Value In Use Meaning

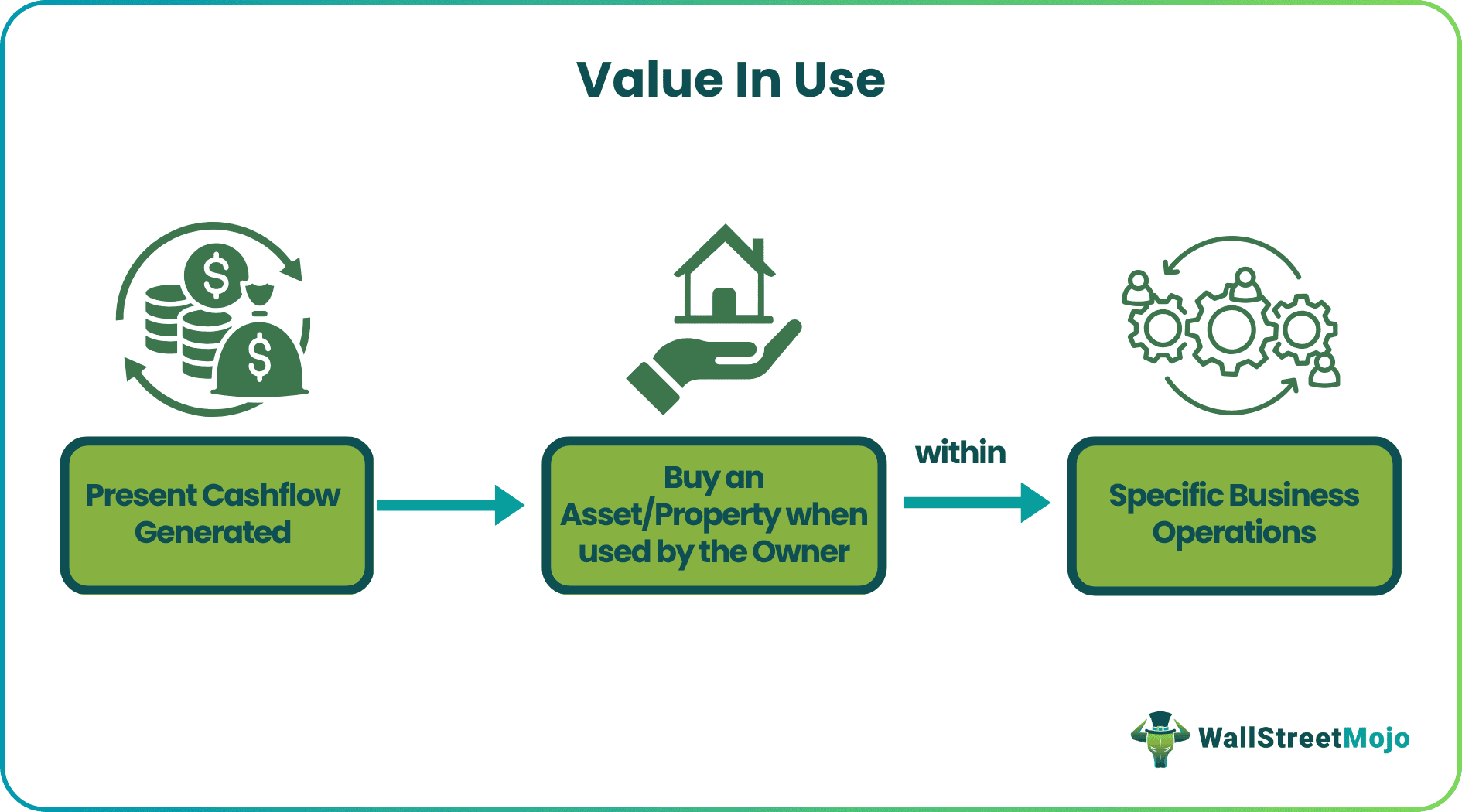

Value in Use refers to the net present value generated from an asset. This is not limited to a monetary value but also applies to goodwill and other assets acquired in business operations when used for price determination. In simple terms, it represents the present net worth of an asset.

This model focuses on the cash flow generation when used by the owner, not the purchase value. The concept's utility is employed for business valuation, measuring a purchase price allocation. At indications, companies conduct impairment tests on an asset or cash generating unit.

Key Takeaways

- Value in use definition refers to the net present cash flow value received from an asset or a cash-generating unit.

- It is a distinct concept under the International Financial Reporting Standards; hence, the model differs from the asset's market value and accounting rules.

- The term determines not the asset's worth but the value it can contribute to a company, primarily through monetary gains.

- It can never be calculated collectively. Therefore, each asset has its value before and after impairment.

Value In Use Explained

Value in use, also known as use value or utility value, defines the present cash flow generated by an asset through its utility. When put to use, it measures the value an asset or property generates for an individual, business, or entity. Therefore, it is not the market value of the asset but the usability structure that is more significant. It is an important metric used to assess the actual value of an asset when it starts working as a cash-generating unit.

It elaborates on how much a company can benefit from a particular asset before it trades or degenerates it. It is essential to understand how an asset or cash generating unit can impact the company's cash flow. An asset can be worth thousands of dollars but slow in cash flow generation; similarly, a cheap property can generate high income for a business.

While accounting and performing calculations, companies often check and adjust assets for impairment. An impaired asset is when its market value is less than its list value in the company books and financial statements. If it happens, the asset is written down on the balance sheet with its current market value.

How To Calculate?

Every asset has its specific utility and cannot be calculated for a group of assets together. The expected cash flow and the time are considered when calculating it for any asset. The present value is adjusted for a risk-free interest rate using a discount rate. It also contains currency risk, liquidity risk, and other external factors influencing the value.

The real discount rate is used with actual cash flows, and the nominal rate is used with nominal cash flows on a pretax basis. Ideally, there should be a prevailing market rate adjusted for risk, but in its absence, the company can use its pretax cost of capital and borrowing rate.

There are typically five factors that constitute its determination – Price, Cost, Performance, Features, and Convenience.

Value in use = price + cost + performance + features + convenience

This formula allows companies to make better decisions and manufacture good products and services.

Examples

Let us understand the concept with the help of some examples.

Example #1

Jason interviewed for a company just after college and got the job, which requires Jason to have a laptop. Now, Jason has never owned a laptop in his whole life and has been working around it with the help of friends and family. Jason finally decides it is time to buy the laptop; he buys a new one for $450.

If his annual salary is $90,000, he makes $7,500 a month. Now, all the money he makes is through that laptop, as it was the mandatory job requirement, and all the work he does is on the laptop only. In this scenario, the laptop is an asset. Its use value monthly is $7,500, and the annual value is $90,000.

Now, it may be possible that after a year, if Jason decides to sell the laptop again, the fair market price, after adjusting for depreciation and usage, will come to around $225.

Example #2

Suppose Miley runs a photography business, and her primary tool for capturing high-quality photographs is her camera, which she had purchased for $3000. This camera is considered a valuable asset for running her business.

Suppose she charges $500 per photo from her client, and she completes an average of six photoshoots per month.

The monthly utility of the camera can now be calculated as follows:

$500 (revenue per photoshoot) * 6 (number of photoshoots) = $3,000.

Therefore, Miley's income per month is distinct from her camera value. It showcases how she generates cash flow through her assets in use.

Value In Use vs Fair Value vs Value In Exchange

These concepts are crucially used in the financial context to understand the ways in which the utility of an asset can be assessed. Let us understand their differences through the points given below:

- Use value refers to the present cash flow generated from an asset. Fair value is the price estimation of a property agreed upon by both parties. In contrast, value in exchange means the number of goods and services that can be obtained in exchange for certain things.

- The use value explains the utility of an asset, whereas fair value and value in exchange express the worth of an asset or property that can be obtained.

- Value in use is the cash flow presently generated from an asset's usability. But fair value defines the trade value of the asset. In comparison, value in exchange represents the power of purchasing other goods.