Table Of Contents

Key Takeaways

- ABS (Asset-Backed Securities) and MBS (Mortgage-Backed Securities) indices are benchmarks tracking the performance of pools of such securities. They offer diversification without individually selecting and managing each security.

- These indices reflect market trends, sentiment, and factors affecting asset-backed or mortgage-backed securities. Investors can monitor the overall market performance through these indices.

- ABS and MBS indices are benchmarks for comparing specific securities or investment products. They help assess investment performance relative to the index.

- Investing in ABS and MBS indices allows investors to gain exposure to various underlying assets, facilitating portfolio diversification.

What Is An ABS And MBS Index?

An ABS and MBS index refer to the respective indices that offer exposure to the asset-backed securities (ABS) and mortgage-backed securities (MBS), respectively. The indices when referred to helps set performance standards for the securities in question and also help in trading to gain maximum profits.

The ABS and MBS indexes consider two different types of assets to reflect their performances on a public platform. With the help of these indices, investors and traders learn about the market’s performance and the future health of the industries. This helps them make wiser investment decisions, while making traders identify fruitful trades and take them accordingly.

ABS And MBS Index Explained

ABS and MBS Index signify two different indices to benchmark performance of the asset-backed and mortgage-based securities, respectively. The investors, traders, and brokers get exposure to the ABS and MBS type of securities they are aiming to deal in. Referring to these indices let them choose their security and take trades that seem favorable.

As the market deepens, various indices are created about the functioning and rate of change in the assets which are also useful for determining value of a derivative instrument, which are of two types:

- Asset-backed securities index (ABS) shows the market performance of ABS Market which is calculated as the weighted average of a portfolio of ABS, and

- Mortgaged backed securities (MBS) index shows the MBS market movement as the weighted average of bonds and promissory notes backed by only property mortgages.

These indices are developed to get a sense of how the market is performing. They are also used as the base for derivatives, which are instruments that take their value from the movement of the indices..

To understand the exposure these indices offer t investors and traders, it is important to explore more about ABS and MBS.

Financial institutions can pool receivables, be it loans or the credit that they have extended, which have similar tenure and risk profile and sell it to investors. These pools are typically in the form of a bond or promissory note. These securities are called Asset-Backed Securities (ABS). The investor in these securities owns a part of the loan or receivable. This allows the institution to turn its illiquid assets into ready cash to use in their business. The typical assets which are securitized into Asset-Backed Securities (ABS) are credit card receivables, leases, company receivables, royalties, etc.

Mortgage-Backed Securities (MBS) are a subset of ABS and are backed by mortgages on residential properties, i.e., home loans. MBS is a subset of the ABS that contains a specific type of asset.

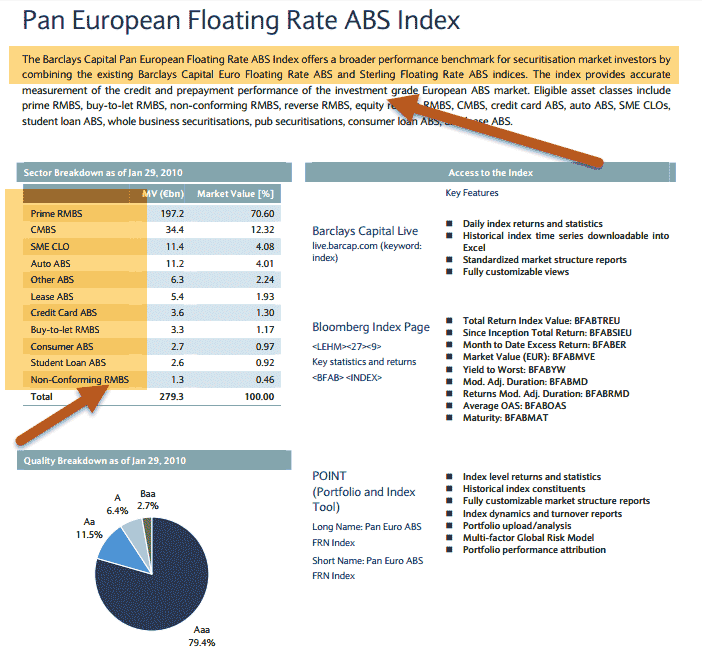

Source: Barclays

ABX Index

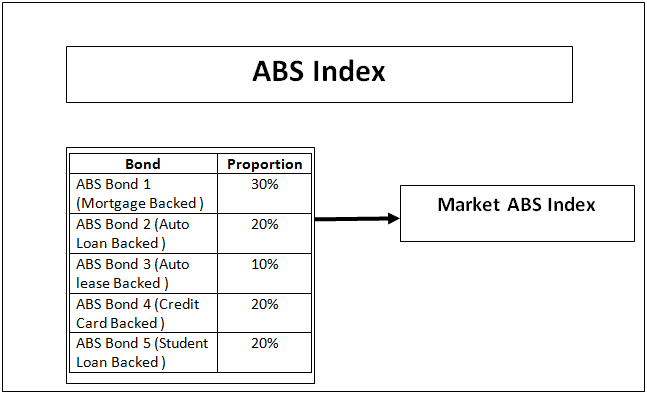

An ABS index is a method of measuring the value of the ABS market. It is a weighted average value of a portfolio of the Asset-backed securities. Different indices use different ABS in varying proportions as weights to determine the value Index h index. Hence an ABS Index is the weighted average value of various ABS bonds/ promissory notes traded in the market.

An MBS Index is a kind of ABS index that takes the weighted average value of bonds/ promissory notes, which are backed only by property mortgages.

The major risk that ABS bonds face is the interest rate and prepayment risk. Interest rate risk is what the entire market faces with regard to market-wide. Many people, rather than investing in any single ABS bond, prefer to invest in a portfolio to mitigate their price risk. Any instrument like an exchange-traded fund (ETF), which mirrors the ABS index, would offer such an investment avenue.

ABS Indices are of different types, with some specialized indices consisting of bonds with assets as auto loans or credit cards or mortgages only, while there are other broad-based ABS indices that have bonds backed by assets of all types.

In the US, the Asset-Backed Securities were first introduced in the 1980s, and hence the market is mature and deep enough to have numerous ABS indices. These indices are designed by financial institutions like investment banks as a product for their clients.

Exchange Traded Fund (ETF) is a security that contains many types of securities such as bonds, stocks, commodities, and so on, and that trades on the exchange like a stock, with the price fluctuating many times throughout the day when the exchange-traded fund is bought and sold on the exchange." url="https://www.wallstreetmojo.com/exchange-traded-funds-etf/"]Exchange-traded funds (ETFs) have also been developed, which invest in all the bonds of the ABS index in the same proportion. These funds, which are like mutual funds, allow investors to put their money in a number of ABS bonds without actually investing in each of them but give them the return of an ABS portfolio.

MBS Index

As home mortgages form a very large part of the lending portfolio of the financial system, Mortgage-Backed Securities (MBS) form a majority of the securitization market. The ABS market evolved from the MBS market when it had matured, and the market needed newer avenues of financing. The ABS market represents a higher risk than the MBS as they are usually shorter in duration and their cash flows are not as predictable. Also, there is a credit risk, which is higher as it is not easy to separate the legal and financial aspects from the originator of the loans. Also, obtaining information about the ABS is more cumbersome as there are a wide number of institutions that are involved in it from loan originationSecuritizationtion.

Tracking the MBS market helps in analyzing the health of the economy to a large extent as most mortgages have not defaulted unless it is really unaffordable for the homeowner to pay. If a large number of people start defaulting, it is a clear indication that the economy is tanking. Hence there are numerous MBS indices in the US that track this market. Not only are there broad-based indices that track a large part of the market, but there are also numerous specialized MBS indices that track a part of the MBS market like only those MBS which are backed by “ subprime mortgages” or those which “issued for a certain number of years” etc.

Examples

Let us consider the following types of ABS and MBS indices available for investors and traders to refer to:

Example 1 – ABS Index

#1 - Barclays U.S. Floating-Rate Asset-Backed Securities (ABS) Index includes Asset-Backed Securities of one year or more maturity, with $250 million outstanding and has home loans, credit cards, auto loans, and student loans as the “assets.” The one year return Indexes index as of June 30, 2016, was 4.06%.

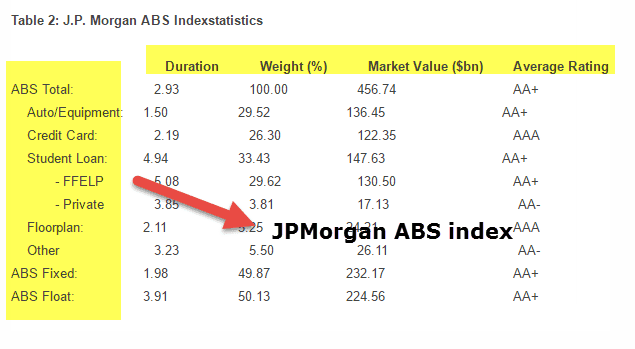

#2 - JP. Morgan ABS Index has over 2000 ABS instruments in the US market which are backed by different assets like auto and Equipment, Credit Card, Student Loan, consumer loans, timeshare, franchise, settlement, tax liens, insurance premium, servicing advances, and miscellaneous esoteric asset index is index aims to capture about 70% of the ABS market and also have sub-indices that track specific sector ABS instruments.

source: www.businesswire.com

ABS indices in Europe

In Europe also the ABS market is also quite matured and there are many pan European ABS indices that comprise of Asset-backed securities issued by European originators. There are ABS Indices in various other countries also. Some of them are:

#1 – Barclays Pan European ABS Benchmark Index includes bonds that are backed by residential and commercial mortgages, auto loans, and credit cards with a Eu 300 million outstanding with at least one-year maturity.

#2 - European Auto ABS Index comprises Auto loan-backed securities issued by European originators.

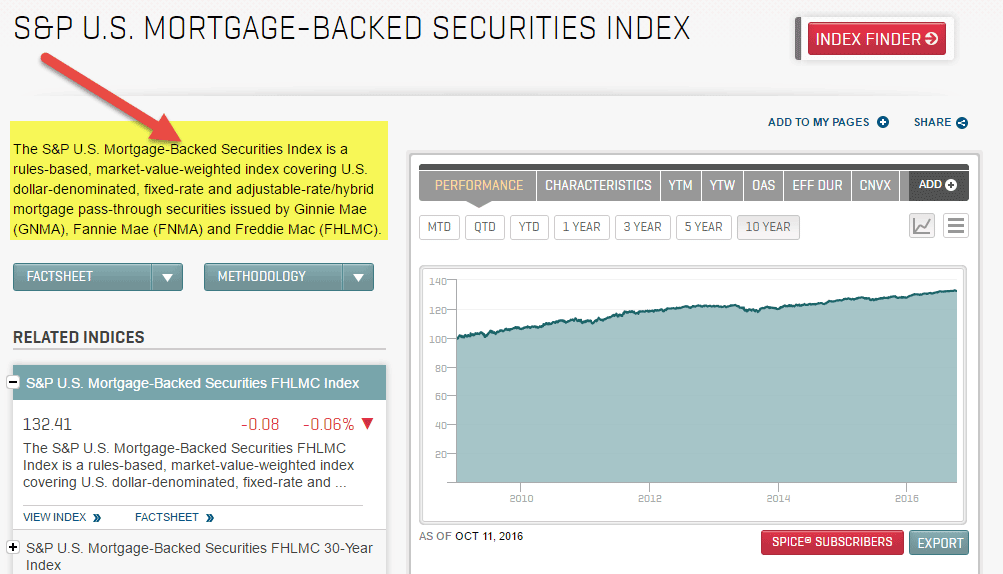

#3 - Mexico's Autofinanciamiento ABS Index comprises Mexican Auto loan-backed securities. In the US and Europe, many Fannie Mae (FNMA) and Freddie Mac (FHLMC)” where GNMA, FNMA, and FHLMC are institutions which issue the MBS

source: S&P

#2 – S & P US Mortgage Backed FHLMC 30 Year Index is a subset of the above S&P U.S. Mortgage-Backed Securities Index and tracks FHLMC issued 30 year MBS bonds.

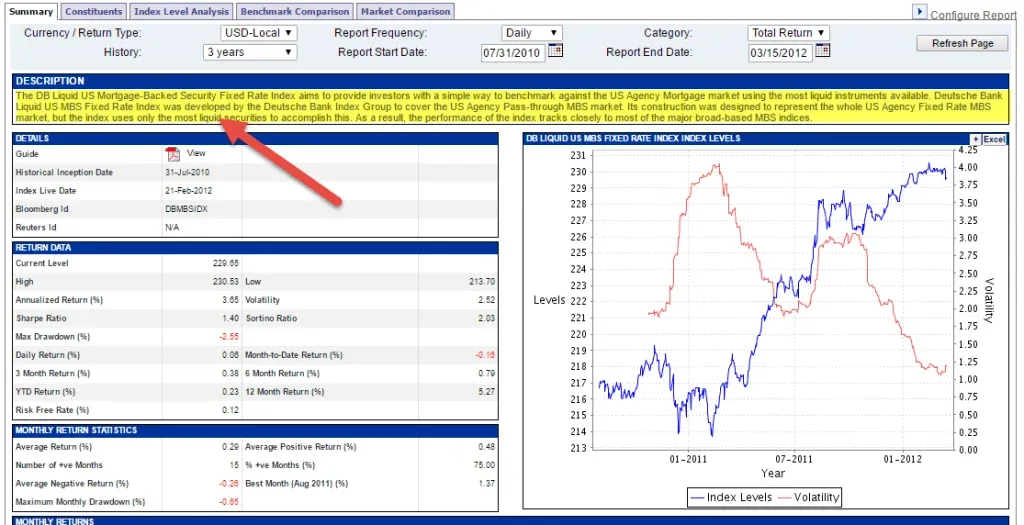

#3 – The Deutsche Bank Liquid MBS Index tracks the most liquid MBS in the US market.

source: db.com

In India, the ABS market has not yet evolved too much. The main asset classes in this market are bonds backed by auto loans, microloans, and residential mortgages. In 2013 DLF Ltd., a property development company, issued a bond backed by rental income from its office buildings. In India, ABS has NBFC Full-Form as originators and banks as investors. Banks usually invest in these asset-backed bonds to meet their “priority sector” lending norms. As the asset-backed microloans or auto loans to farmers, these help banks meet their priority sector lending. With the existing legal and tax structures, the securitization market in India is very nascent with very low demand. Due to this, there has been no need for the evolution of an ABS index.

ABS/MBS Indices and Economic Crisis

One of the biggest contributors to the 2009 economic crisis in the US has been the subprime mortgage lending, i.e., lending to entities that do not have perfect credit and have a greater risk of default. The mortgage lending was further fuelled by Securitizationtion available for these loans, which led to the market being flush with funds for further lending. It was a non-virtuous cycle of subprime lending being fuelled by more and more money being risked in the same high-risk lending. When the borrowers started defaulting, the market collapse was exacerbated as not only did the lenders lose their money but also all those who had invested in the ABS bonds, which were issued by securitizing these loans. The other set of investors who lost their money were those who invested in ABS indices linked ETFs.

When the loans have defaulted, the bonds lost their market price, which in turn led to a collapse of the ABS/ MBS indices and hence all the ETFs linked to them. So one set of defaults had a cascading effect affecting three different sets of investors, i.e., the lenders, the ABS investors, and investors in ETFs of ABS indices. Though MBS has been said as a major factor in the credit crisis, it has to be said that the instrument by itself was not a reason, but the subprime loans backing these instruments were the cause. Until the credit crisis, the market had been very creative in issuing MBS and ABS instruments, but after the crisis, the emphasis has been on the simplicity and stability of the instrument and issuer. The issuance of exotic instruments made the indices difficult to construct and predict as there were new issues at frequent intervals with different assets and complexities in the cash flows.