Table Of Contents

What Is The Sinking Fund Formula?

A sinking fundrefers to a fund that is set aside by an economic entity over a period of time to take care of the planned expenses or the debt obligations. An investor, on the contrary, uses it to repurchase a definite portion of the bond issue or for the replenishment of a major asset or any other similar capital expenditure. This amount saved serves multiple purposes during emergency situations.

When one starts a business, there are lots of planned expenses, which must be fulfilled gradually to record a successful business. The sinking fund calculated using the formula allows businesses to keep aside a fund that would help them bear the planned expenditure for their business.

Sinking Fund Formula Explained

Sinking Fund formula helps calculate the amount to be kept aside from the revenue over a period to bear other planned future expenses. It, in short, becomes a saving for the business, which stores this amount intentionally to bear the expenses that have been already planned.

There are multiple expenses of a business throughout the month, these sinking funds that are simply kept aside help businesses to not touch its incoming profits and deal with those expenses from the savings that it does in the form of sinking fund.

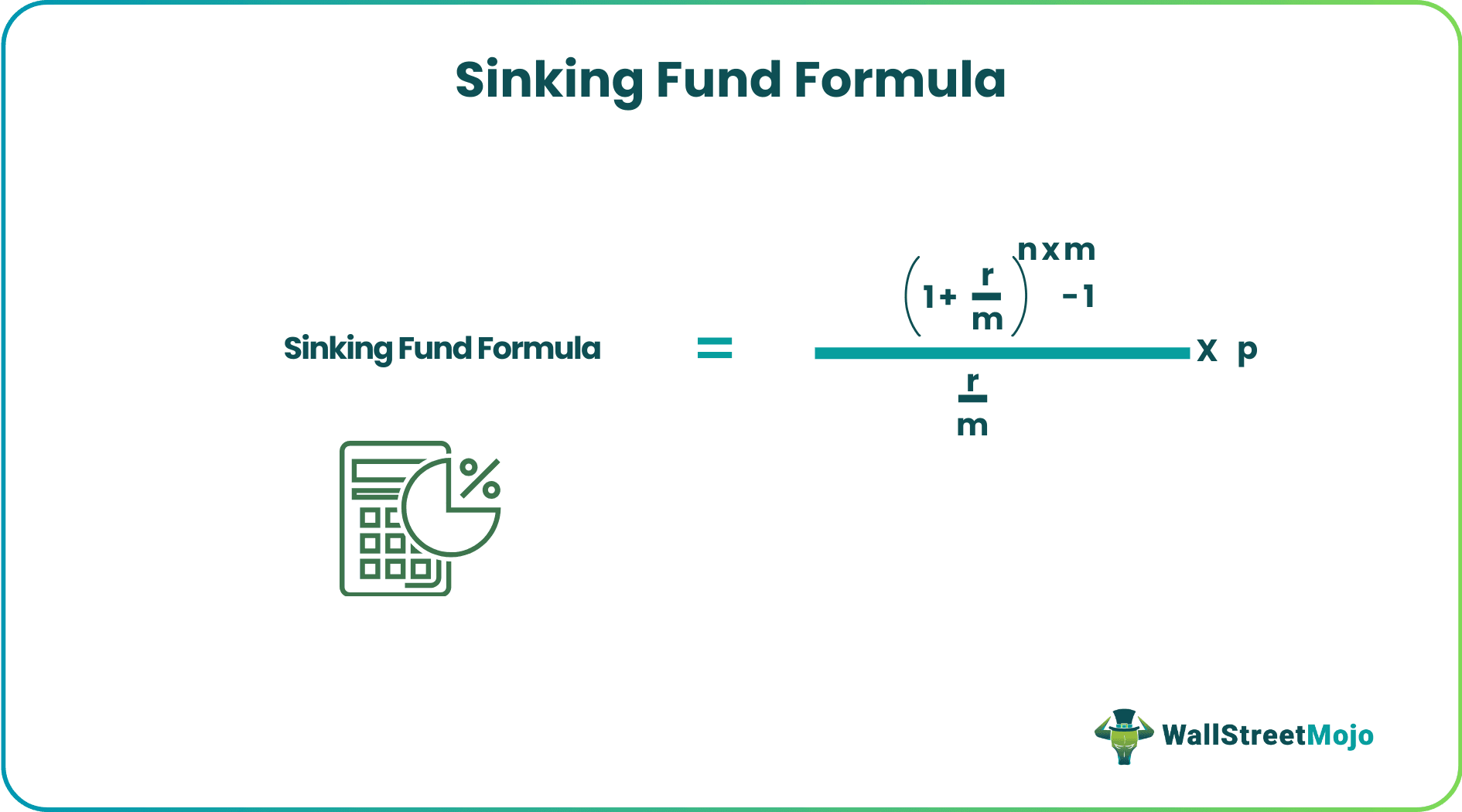

Once the entities know what to save for, they can plan the amount accordingly. For investors, sinking fund is a slightly different concept. Here, the corporate bond issue gets a safety cover in the form of sinking fund. The bond issuer is required to contribute a certain amount of money to the sinking fund each period, and the formula to calculate the sinking fund is as shown below.

where

- P = Periodic contribution to the sinking fund,

- r = Annualized rate of interest,

- n = No. of years

- m = No. of payments per year

And the formula for the periodic contribution to the sinking fund can be represented as,

The savings calculated using the formula helps investors have funds to pay off bonds at maturity.

How To Calculate?

Given below are the steps to follow to calculate sinking fund using the formula:

- Firstly, determine the required periodic contribution to be made to the sinking fund as per the company strategy. The periodic contribution is denoted by P.

- Now, the annualized rate of interest of the fund and the frequency of the periodic payment has to be determined, which are denoted by r and m, respectively. Then the periodic interest rate is computed by dividing the annualized interest rate by the number of pay per year. i.e Periodic interest rate = r / m

- Now, the number of years has to be determined, and it is denoted by n. Then the total number of periods is computed by multiplying the number of years and the frequency of payments in a year. i.e Total number of periods = n * m

- Finally, the calculation of the sinking fund can be done by using the periodic interest rate (step 2) and the total number of periods (step 3), as shown above.

Examples

Let us consider the following examples to understand the concept better and check its calculation aspects:

Example #1

Let us take an example of a sinking fund with a monthly periodic contribution of $1,500. The fund will be required to retire a newly taken debt (zero-coupon bonds) raised for the ongoing expansion project. Do the calculation of the amount of the sinking fund if the annualized rate of interest is 6%, and the debt will be repaid in 5 years.

Use the following data for the calculation of the Sinking Fund.

Therefore, the calculation of the amount of the sinking fund is as follows,

- Sinking Fund = ((1+6%/12) ^(5-12) - 1)/(6%/12) * $1,500

Sinking Fund will be -

- Sinking Fund = $104,655.05 ~ $104,655

Therefore, the company will require a sinking fund of $104,655 to retire the entire debt five years from now.

Example #2

Let us take an example of a company ABC Ltd which has raised funds in the form of 1,000 zero-coupon bonds worth $1,000 each. The company wants to set up a sinking fund for repayment of the bonds, which will be after 10 years. Determine the amount of the periodic contribution if the annualized rate of interest is 5%, and the contribution will be done half-yearly.

First, do the calculation of the Sinking Fund Required for the calculation of Periodic Contribution.

- Given, Sinking fund, A = Par value of bond * No. of bonds

- = $1,000 * 1,000 = $1,000,000

Use the following data for the calculation of Periodic Contribution.

Therefore, the amount of the periodic contribution can be calculated using the above formula as,

- Periodic contribution = (5%/2)/((1+5%/2)^(10*2) -1) * $1,000,000

The periodic contribution will be -

- Periodic contribution = $39,147.13 ~ $39,147

Therefore, the company will be required to contribute a sum of $39,147 half-yearly in order to build the sinking fund to retire the zero-coupon bonds after 10 years.

Relevance and Uses

From the point of view of an investor, a sinking fund can be beneficial in three major ways-

- The interim retirement of debt results in lower principal outstanding that makes the final repayment much more comfortable and likely. This lowers the risk of default.

- In case the rate of interest increases, which lowers the bond prices, an investor gets some downside risk protection because the issuer is required to redeem a certain portion of these bonds. The redemption is executed at the sinking fund call price, which is usually fixed at the par value.

- A sinking fund is required to maintain liquidity of the bonds in the secondary market by acting as a buyer. When the interest rates increase, leading to a lower value for the bonds, this provision benefits the investors because the issuers have to buy the bonds even if the prices fall.

Limitations

The demerits of using the formula for calculating the sinking fund are as follows:

- If the bond prices increase due to a decrease in interest rate, the investor’s upside may end up limited because of the compulsory redemption mandated for the sinking fund of the bond. This means that the investors would receive the fixed sinking-fund price for their bonds despite the fact that the bonds are priced higher in the open market.

- Further, the investors might end up reinvesting their money elsewhere at a lower rate due to the sinking fund provisions in a market with a declining interest rate.

For issuers, the sinking fund acts as credit enhancement and, as such, enables companies to borrow cheaply. Consequently, bonds with sinking funds often offer lower yields than similar bonds without sinking funds because of lower default risk and downside protection.