Table Of Contents

What is Coupon Bond?

Coupon bonds are a type of bond that pay fixed interest (coupons) at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond’s nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5.

Coupon Bonds were more prevalent in an era that was not dominated by computers. In the 1980s, a trend of selling the coupons of the coupon bond as separate securities, called strips, was started by some institutions. However, the procedure of investing in bonds has seen a sea change since the prevalence of using computers. You no longer present hard copies of coupons to redeem your interest amount.

Key Takeaways

- A coupon bond is a type of debt instrument that pays periodic interest payments, known as coupon payments, to bondholders until the bond's maturity date, when the principal amount is repaid.

- The coupon payments of a bond are typically fixed and stated as a percentage of the bond's face value or par value. These payments are made at regular intervals, such as annually, semi-annually, or quarterly.

- Coupon bonds have a predetermined maturity date, at which the issuer is obligated to repay the bondholders the bond's face value or par value. This represents the original amount invested in the bond.

Coupon Bond Pricing

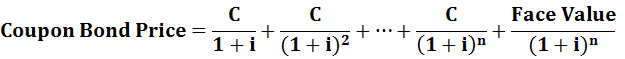

These bonds are relatively simple, but their price remains a key issue. If you are investing in these bonds, then you should know the pricing well so that you can reap the maximum benefit out of it. Knowing the pricing of these bonds tells them the maximum price that they will have to pay for the bond. The investors may need a higher rate of return on the bond if the probability rate is high by default. There is a formula to determine the price of coupon bonds:

- c = coupon rate

- i = interest rate

- n = number of payments

Who should Invest in Coupon Bonds?

Investors make money from bearer bonds on maturity. The interest is paid to them at the maturity of the bond. The time required to reach maturity depends on whether the bond is a long-term or short-term investment. Short-term bearer bonds are known as bills. In case the coupon bond is for a long period, from fifteen to twenty years, then the investor gets paid their interest after a period of two decades.

These bonds are not a good option for someone looking for a steady flow of income. However, they are ideal for families who are looking into systematic investment plans. If you want a vacation home after your retirement, a coupon bond is a good option. Bearer bonds are also a good way of passing on wealth to your heir. A coupon bond is a good way of increasing your income over a period of time.

Coupon bonds are subjected to taxation in the US. Hence they can be held in a tax-deferred retirement account in order to save investors on paying taxes on the future income. On top of this, if the US government entity—state or local issues a coupon bond, it is exempted from all taxes.