Table Of Contents

What is Confirmation Bias?

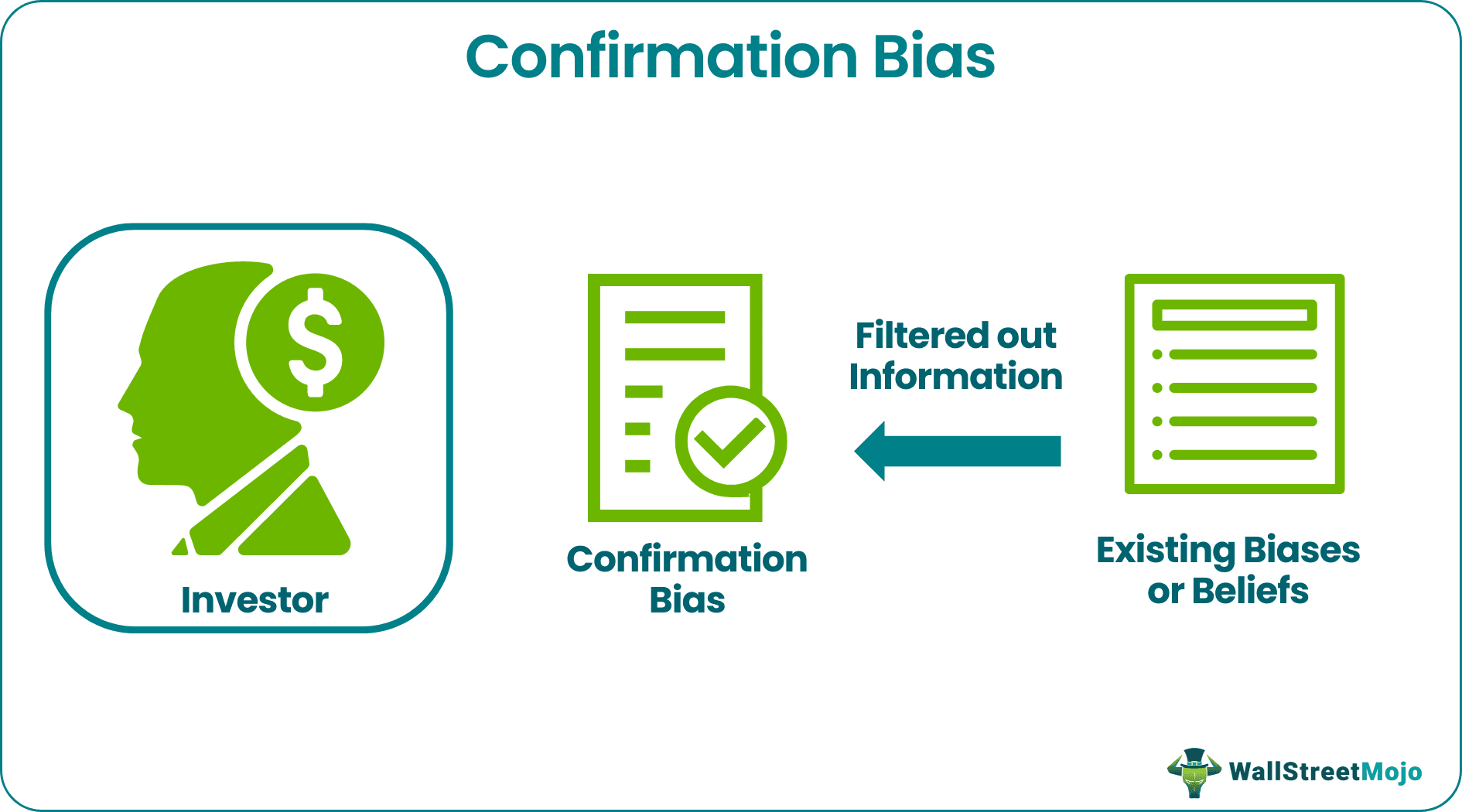

Confirmation bias is a cognitive bias that involves favoring the information confirming one's previously existing biases or beliefs. Hence, the investor would only seek information that will guarantee their existing belief and filter out information based on that. In its true essence, the confirmation bias theory states that investors would see only what their belief system allows them to see.

For an investor or a business executive, it is important to strike the right balance between their belief system and the actual availability of data. The database gives a detailed idea of the reality of the concept and its implications. Moreover, the hierarchy in a business organization is framed to eliminate individuals’ biases at different levels.

Key Takeaways

- Confirmation bias is a cognitive bias where individuals tend to favor and seek out information that confirms their existing beliefs while disregarding or downplaying contradictory evidence.

- It can significantly impact investors as it influences their perceptions and judgments about financial markets, leading to a biased interpretation of information.

- It can sometimes reinforce investors' confidence in their beliefs and contribute to successful outcomes based on their past experiences.

- However, it can also be detrimental as it can limit an investor's ability to consider alternative perspectives, adapt to changing market conditions, and make well-informed decisions.

Confirmation Bias Explained

Confirmation bias is the phenomenon where an individual interprets, processes, and makes decisions based on their pre conceived notions or commonly referred to as their belief systems. These decisions or the act of looking at things based on principles are unintentional more often than not.

As a result, individuals or organizations ignore or look beyond information that is against their belief systems. These can sometimes result in good outcomes or sometimes otherwise. It is vital to rely on an actual database as well to reconfirm or affirm the interpretation of the situation.

In an extremely dynamic and diverse environment such as investing or business, it is important to remain objective about the happenings in the market to stay on top of trends and make the most of them in monetary terms.

It is one of the most common biases seen in the real world and day-to-day life, where people seek only evidence that supports their initial view and filters any information that would disconfirm their belief. To avoid confirmation bias psychology, one should look for contrary advice, avoid confirming questions, seek more information, study the impact of the same, and then act accordingly.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

Let us understand the different types of confirmation bias psychology present in the market through the discussion below. These types breed from different levels of understanding and the strength of the belief system of the individual.

- Search For Information: When an individual searches for details and depth about a concept, company, or asset class, they tend to look for and search for information that aligns with their belief system and their past experiences that have been hardwired into their system. As a result, more vital information or the current trend in the market might get missed.

- Interpretation of Information: Even if the individual goes out of their way to search and analyze the information about the concept or business, their interpretation of the information might be based on their principles and anything from the other end of the spectrum might be conveniently ignored.

- Experience: This is also referred to as a memory recall of the information. For example, if the stock markets have shown a decline in the past week, and gold prices have shown improvement in the past in similar circumstances, the investor or the business executive might think the same will happen this time around too without digging out more information or data to support such a belief.

Examples

Let us understand the intricate details of the confirmation bias theory with the help of a few examples.

Example #1

Vivek is a long-time investor in the stock market. He invests by researching and screening the stock by himself. One of the stocks that he has recently shortlisted is Reliance Power, and he has learned about the firm's bankruptcy and is considering selling the stock.

A few days later, a piece of news was published that Reliance Power is getting help from the brother of the chairman of Reliance Power and the firm is expected to revive. Still, however, Vivek prefers to avoid the information and looks for information that signs towards bankruptcy.

What kind of bias is Vivek suffering from?

Solution:

Even though Vivek has been a long-time investor in the market, when it comes to its view, he prefers to stick to that and look for the information that will confirm his view. As given in the example, the first created a view of selling the stock of Reliance Power based upon his initial view of bankruptcy. Later, when some positive news is published through which the firm can revive itself, he ignores that view and looks for other information which would confirm its existing view of selling the stock. Hence, this is a case of confirmation bias where the investor forms an initial thought and filters out information that supports their belief.

Example #2

John is the lead analyst of a multinational investment bank. He is researching the macro markets and recently attended a seminar on market views for next year. He heard a renowned economist who published books on the macro market and stated a few facts like their slow growth in the market, which was witnessed in 2008, sales were falling, liquidity crunching cost-cutting by big firms. Hence, he created a view that the next year could be a year of recession again. As a result, he publishes reports and releases to his client, starting to be cautious as a recession could be ahead soon and investing accordingly in debt securities and avoiding equities for the time being.

After a few months, the world bank came with the data stating that a new trade treaty was signed between the US and China to cut import taxes and welcome globalization further.

One of the clients of John emails him asking whether he has revised his view.

John replies to his email stating that a deal signed doesn't change the numbers, and there has been no progress in the market, and in fact, it was drowning more as per his more recent research.

Discuss the type of bias John is suffering from.

Solution:

John first created an initial view of the recession based on his seminar's information. i.e., sales were falling, liquidity crunching, cost-cutting by big firms, etc. However, when a big deal was signed between the US and China, he avoided that information and again looked for the information that confirmed his view and bias of recession. This is a clear sign that John is suffering from cognitive bias and confirmation bias as he is looking for only that information that supports his view and filtered out the information of the US and China deal.

Example #3

Josh William is a new doctor in the colony. He was recently visited by the famous actor Mr. Khan who came to him for a diagnosis. He had symptoms like headache, excessive sweat, and chills, but when he measured his temperature, he noticed that it was less than 100.40 F (38 C), and despite that, he concluded that he had been suffering from high fever since 3 out of 4 symptoms confirmed that he has a high fever. So after prescribing medicines the next day, he checked the body temperature, which was still below 100.40 F, and body skin was also not hot. Still, the doctor didn't change his medicine.

Is the doctor suffering from any bias, and if so, kindly elaborate?

Solution:

The patient was suffering from headaches, excessive sweat, chills, which are also common features of fever. Still, the doctor avoided major information that disconfirms his belief about fever, which is that the patient's temperature was lower than 100.40 F (38 C). He avoided that information, and again the next day, he also observed that his body skin was not hot, and the temperature was lower than 38 C; still, he didn't change the medication.

It suggests that he is suffering from cognitive bias. The type of cognitive bias that he is suffering from is confirmation bias. He only looks for information that supports his belief and avoids any information that disconfirms his initial view.

Example #4

Aditya, who has become a new investment advisor, is approached by his client Vijay to put his views on Walmart. Before Aditya can put his views, Vijay informs him about the way stock has been performing like very good YoY growth in EBITDA, EBIT, and net profit, also growth in revenues, and the way the market has been perceiving the stock, which has already put the stock in premium. Vijay is interested in buying long-term and wants to create a concentrated position. However, after hearing Aditya state that Walmart has started more aggressive marketing and offering discounts now 7% from earlier 5%, which could impact their margins, Vijay avoids that information. Instead, he asks him to include the stock in the portfolio.

Solution:

Again, here it appears that Vijay is suffering from confirmation bias as he ignores the critical information that could hamper Walmart's margin and later impact the stock price.

How To Avoid?

To ensure no profitable information bites the dust due to ignorance or due to pre-determined notions, it is important to understand how confirmation bias psychology works and how it can be avoided. Let us understand this pivotal aspect of the concept through the discussion below.

- Introspection: The first step to eliminating such biases is to understand personal belief systems and how these systems affect objectivity in interpretation and decision-making. Without this step, it becomes difficult to sort such situations because only when the root of a problem is detected, it can be completely eliminated.

- Critical Evaluation: Every piece of information in the business world can be turned into a profitable deal or a deal that went down the drain due to multiple reasons. Therefore, it is vital to critically analyze and scrutinize every piece of information as objectively and practically as possible.

- Involve The Team: When more than one person is involved in the decision-making process, it becomes a more transparent activity where objectivity and the best interest of the organization take the front seat. Sometimes, a second opinion or an expert opinion on the matter can open up new perspectives not just for the particular deal but with the individual’s belief system itself.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Another name for confirmation bias is "myside bias" or "confirmatory bias". These terms reflect the tendency of individuals to favor information that aligns with their pre-existing beliefs or opinions.

Managing confirmation bias can be challenging but important. It is crucial to actively seek out diverse perspectives and information that challenge existing beliefs to mitigate its impact. Engaging in open discussions with individuals with different viewpoints can broaden one's understanding. Additionally, cultivating a habit of considering multiple scenarios and possibilities before concluding fosters a more balanced and objective approach to decision-making.

The opposite of confirmation bias is "disconfirmation bias" or "falsificationism". Disconfirmation bias is the willingness to actively seek and consider evidence contradicting one's beliefs or hypotheses. It involves being open to challenging one's own assumptions and actively testing and evaluating information that goes against one's initial inclinations. This approach promotes critical thinking and a more balanced evaluation of evidence.