Table Of Contents

What Is Loss Aversion Bias?

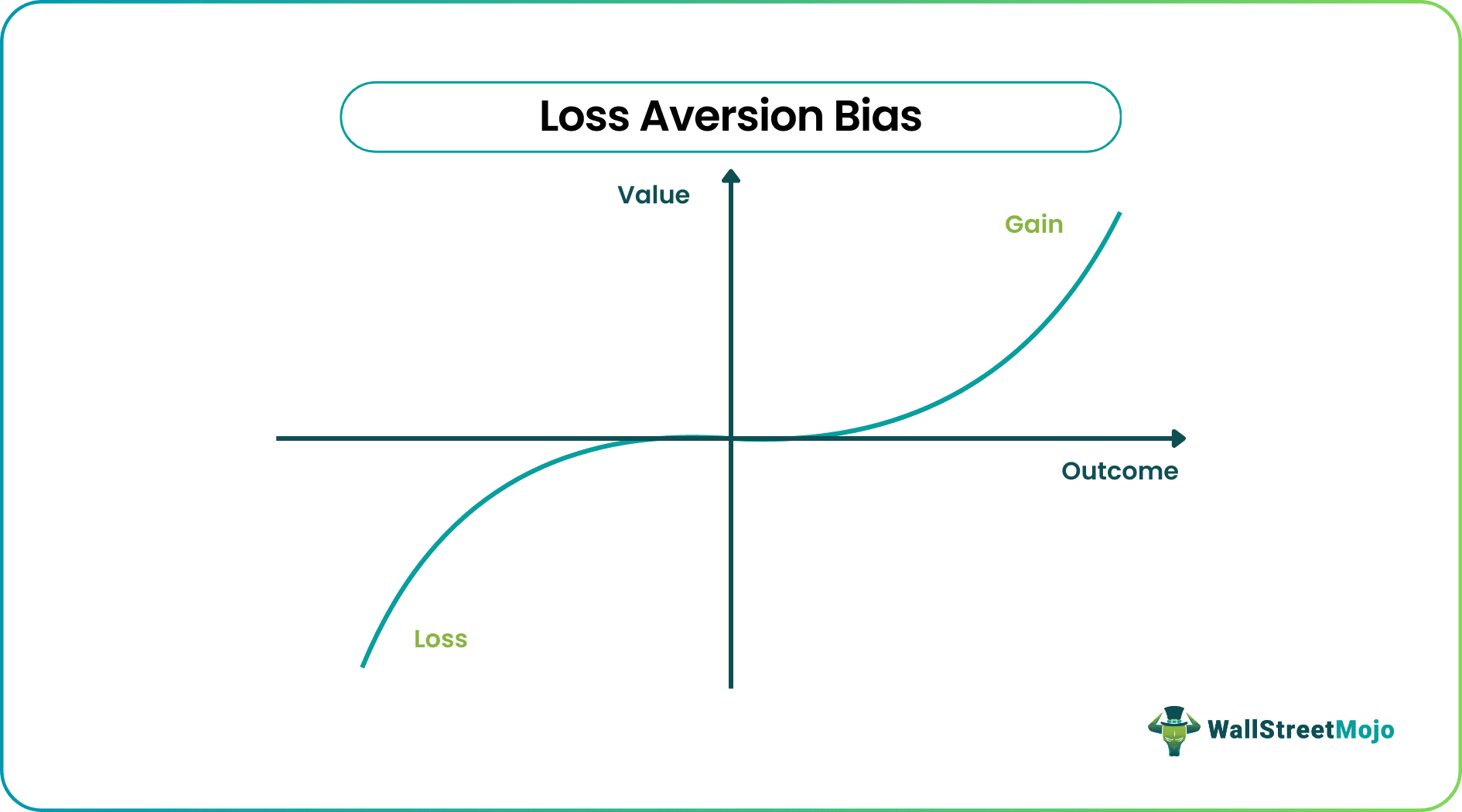

Loss aversion bias is a cognitive phenomenon where a person would be affected more by the loss than by the gain, i.e., in economic terms, the fear of losing money is greater than gaining money. Therefore, a bias is present to avert the loss first.

The first preference of an individual would be to avoid loss. Then they would into tracking the gain. Therefore, psychologically, the negative power of losing money is much more than the positive power of gaining money, because of which the effect of the penalty is more than the effect of reward in motivating individuals.

Table of contents

- What Is Loss Aversion Bias?

- Loss aversion bias refers to a cognitive aspect where a person is affected more by the loss than the gain. In economic terms, the losing money fear is more significant than gaining money and more than the amount that one might lose. Hence, a loss aversion bias exists to oppose the loss first.

- Myopic loss aversion bias is a temporary situation where one loses the big picture due sight to a particular event. It mostly happens to people in investment fields. But unfortunately, even the most professional and informed investor gets into the trap of myopic loss aversion bias.

- Avoiding loss aversion bias is more challenging than avoiding myopic loss aversion bias, as myopic loss aversion is momentary.

Loss Aversion Bias Explained

Loss aversion bias in behavioral finance is the overpowering negative effect of incurring loss over the positive effect of gain. The expression – “the losses loom larger than gains is quite famous. However, in this article, we will peep into a concept called “loss aversion.” This concept is an integral part of behavioral finance. And if the investor is involved in investing, trading, marketing, or any business, it is necessary to know this concept in detail.

Loss aversion prospect theory expresses the one-liner – “the pain of losses is twice as much as the pleasure of gains.” For example, for new investors to invest in the equity market, the first response they will give is negative. The hilarious part is that they do not know anything about the equity market but still want to avoid losses/risks at all costs.

Loss aversion bias is connected with the certainty effect, isolation effect, status-quo bias, endowment effect, sunk cost fallacy, etc. So, to look at loss aversion bias in investing, it is important to know the context of the decision and the content.

And no one can tell whether they are right or wrong without knowing why they did what they did. Loss aversion is not only a habit; it is psychology too. Knowing the psychology behind loss aversion bias in behavioral finance a particular behavior will allow them to pare down most biases and decide from the facts presented.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Importance

We often think we make logical judgments when trying to buy/sell anything. But after understanding loss aversion prospect theory, there’s a question mark in how logical/rational our thinking is. This kind of bias actually decreases unnecessary competition and creates a healthy environment of peace and stability. It also leads to an increase in attention while conducting a task involving risk or loss.

Before avoiding loss aversion bias, let us look at another related concept, which is equally important.

Myopic Loss Aversion

Myopic loss aversion bias is a temporary situation where one loses sight of the big picture due to a certain event. Myopic loss aversion happens to people, mostly in investment fields. But unfortunately, even the most professional and informed investor falls into the trap of myopic loss aversion bias in investing.

If an investor has been investing for a long time, it is common that they panicked during a sudden crash in the stock market and tried to sell out all the stocks because they did not want to lose out on everything. So even if try to be logical, rational, and experienced investors, still there is a chance that they will not be able to see the big picture at the moment.

It happens with all investors (professional and new)! To avoid myopic loss aversion bias, it is necessary to know that one cannot make a buying/selling decision based on emotion/ during a panic-stricken moment. Whenever experiencing myopic loss aversion, the investor must let the moment go without making any hasty decisions.

Example

Let us say a brand would suddenly increase its price. Previously, when someone used to buy their shirts, they offered a 10% discount on the costs. Now, they are offering the same shirt at 10% more prices. What would happen to the demand for the shirts? It will drastically reduce. Now, let us change the scenario and say that the brand suddenly decreases its price. Previously, when someone used to buy their shirts, they offered the shirts at $15. Now, they are offering the same shirt at $12. What will happen to the demand? It will certainly increase, but not as much as one would have reduced it in the previous scenario.

Through this scenario, one can understand and can price their products in a way that would generate more revenue, increase demand, and help them stand out. At the same time, as a buyer, we would be more aware of these biases and would not fall prey to them while purchasing/choosing anything. . Thus, it helps in avoiding loss aversion bias in decision making.

Video Explanation of Loss Aversion Bias

How To Avoid?

Avoiding loss aversion bias in decision making is tougher than avoiding myopic loss aversion bias because myopic loss aversion is momentary. Still, loss aversion is much more ingrained in our subconscious mind, and even when trying to become sane, we still fall into the trap of loss aversion bias.

So how would one avoid loss aversion bias?

Loss aversion is not a thing of behavioral finance or behavioral economics only. It is a philosophy that society encourages us to follow (remember status-quo bias). For example, Team A is playing a football match with Team B. Now; Team A is defending Team B with all its might. Team B is attacking all the time. Of course, Team B will win the match, but both of these teams tried to avoid loss by: -

- Playing not to lose

- Playing to win so they do not need to go through the pain of loss.

The idea of loss is ingrained in the human mind, and no matter what decision humans try to make (even when they think they are making the most logical decision), they try to become loss averse all the time.

Asking to avoid loss aversion bias is like saying that one must eliminate society. Of course, it is possible, but somehow, we can benefit from loss aversion bias too.

Here is how.

Winning has importance too. As we have seen earlier in the football match example, loss aversion can help a team win (if they can strategize rightly). Loss aversion bias can also help a new investor avoid loss by becoming less greedy about earning more money.

Society only values the top performer. In the bestselling book “The Dip,” marketing guru Seth Godin argues that quitting has different forms. It is possible to win if you can leave the right thing at the right time. For example, if an investor has invested a hefty sum of money and notice that the stock price has declined for a few consecutive months that case, they will immediately call their stockbroker and sell the declining stocks.

However, quitting does not always turn out to be useful. Loss averse without having sufficient proof to validate the decision, reduce the chances of winning. One cannot generally speak about avoiding loss aversion bias. It is very subjective, and it differs from person to person and from situation to situation. If the investor wants to prevent the loss but, at the same time, does not want to miss out on new opportunities, they try to take a balanced approach. It is a given that they will not be able to win always and in every situation.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

One can avoid loss aversion by not getting engrossed emotionally in the investments. Although investments involve risks, many are beyond your control, and one cannot always be correct. Therefore, it is sometimes better to record a loss and move forward to any alternative investment options.

Loss aversion bias in psychology is the observation that human beings experience losses asymmetrically more severely than equivalent gains. This failure and overwhelming fear can cause investors to act irrationally and make terrible decisions.

Loss aversion bias is a cognitive bias explaining why, for individuals, losing pain is psychologically twice as powerful as gaining contentment.

Regret loss aversion is a theory in the anticipated theory (Kahneman and Tversky, 1979) expressing a negative emotional bias that urges investors to avoid regret, thus sometimes making the wrong decision. In 2000, Tsiros and Mittal also examined that regret aversion is a powerful negative emotion.