Table Of Contents

Formula to Calculate Cross-Price Elasticity of Demand

Cross price elasticity of demand formula is used to measure the percentage change in the quantity demanded of a product concerning the percentage change in the price of a related product, and it can be evaluated by dividing the percentage change in quantity demanded of a particular product by the percentage change in the price of its corresponding product.

Ec = Percent change in a quantity of good A/Percent change in the price of good B

or

Ec = *

Where,

- Ec is the cross-price elasticity of the demand

- P1A is the price of good A at time 1

- P2A is the price of good A at time 2

- Q1B is the quantity of good B at time 1

- Q2B is the quantity of good B at time 2

Key Takeaways

- The cross-price elasticity of demand formula helps to find the relationship between the amount required for a product and the price of a comparable product.

- When the cross-price elasticity of two goods is positive, they are treated as supplementary goods (Car and Petrol);

- however, when the elasticity of the goods is negative, the two are known as complementary goods (Mobile Phones and Sim Cards).

- Large enterprises use the cross-price elasticity of demand to guide their pricing strategy. As a result, large companies typically offer a wider range of comparable and related products.

Explanation

- If the cross-price elasticity of demand is positive, the two goods are said to be supplementary goods, i.e., if the price of one good increases, then the demand for other goods will increase.

- However, if the cross-price elasticity is negative, then the two goods are complementary, i.e., if the price of one good increases, the demand for the other goods will decrease.

Examples

Example #1

A company producing torches and batteries is analyzing the cross-price elasticity of the two goods. For example, the demand for torches was 10,000 when the price of batteries was $10, and the demand rose to 15,000 when the price of batteries was reduced to $8.

Solution:-

- Percentage change in the number of torches

= / 2 = 5000 / 12500 = 40%

- Percentage change in price of batteries

= / 2 = -2 / 9 = -22.22%

Thus, cross-price elasticity of demand = 40%/-22.22% = -1.8

Since the cross-price elasticity of demand for torches and batteries is negative, thus these two are complementary goods.

Example #2

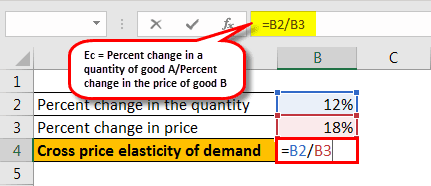

Calculate the cross-price elasticity of demand. For example, the percentage change in the price of apple juice changed by 18%, and the percentage change in the quantity of demand changed by 12%.

The following is the data used to calculate the cross-price elasticity of demand.

| Percent Change in the Quantity | 12% |

| Percent Change in the Price | 18% |

Therefore, it will be

= 12%/18% = 0.667

The Cross-price elasticity of demand will be -

The cross-price elasticity of the demand formula of apple juice and orange juice is positive hence they are substitute goods.

Example #3

The annual price of cinema tickets sold in 2010 was $3.5, whereas the number of popcorn sold at cinema halls was 100,000. The ticket price increased from $3.5 in 2010 to $6 in 2015. There was a decrease in the sale of popcorn to 80,000 units. Calculate Ec.

The following is the data used to calculate the cross-price elasticity of demand.

| Price of Ticket in 2010 | 3.5 |

| Price of Ticket in 2015 | 6 |

| Quantity of Popcorn sold in 2010 | 100000 |

| Quantity of Popcorn sold in 2015 | 80000 |

Price of the ticket in 2010 = $3.5

Price of the ticket in 2015 = $6

Quantity of popcorn sold in 2010 = 100,000

Sold amount of popcorn in 2015 = 80,000

Percentage change in price of ticket

- = / 2

- = 0.131579

Percentage change in the quantity of popcorn sold

- = / 2

- = -0.05556

Calculation of cross-price elasticity of demand is

Cross price elasticity of demand will be -

=-0.422222

Since the cross elasticity of demand is negative, the two products are complementary.

Relevance and Use

- The cross-price elasticity of the demand formula measures the demand sensitivity of one product (say A) when the price of an unrelated product (say B) is changed.

- The cross-price elasticity of demand is used to classify goods. The goods are classified as substitute or complementary goods based on cross-price elasticity of demand. If the cross elasticity of demand is positive, the two goods are the substitute, and if the cross elasticity is negative, the two goods are complementary. Further, if the magnitude of cross elasticity is high, the two goods are a closer substitute or closer complementary depending on the sign.

- It also helps in classifying the market structure. If the cross elasticity of demand is infinite, the markets are considered perfectly competitive, whereas zero or close to zero cross elasticity makes the market structure a monopoly. If there is a high cross-elasticity, it is called an imperfect market.

- The cross-price elasticity of demand helps large firms decide their pricing policy. Large firms generally have more variety of similar and related goods. Thus, cross elasticity of demand helps such firms in deciding whether to increase the price of such related products or not.

- The cross-price elasticity of the demand formula helps classify products between various industries. The cross elasticity is negative if the complementary goods are classified in different industries. If the goods have positive cross-price elasticity, i.e., substitute goods, they belong to one industry.