Table Of Contents

What is the Multiplier Formula in Economics?

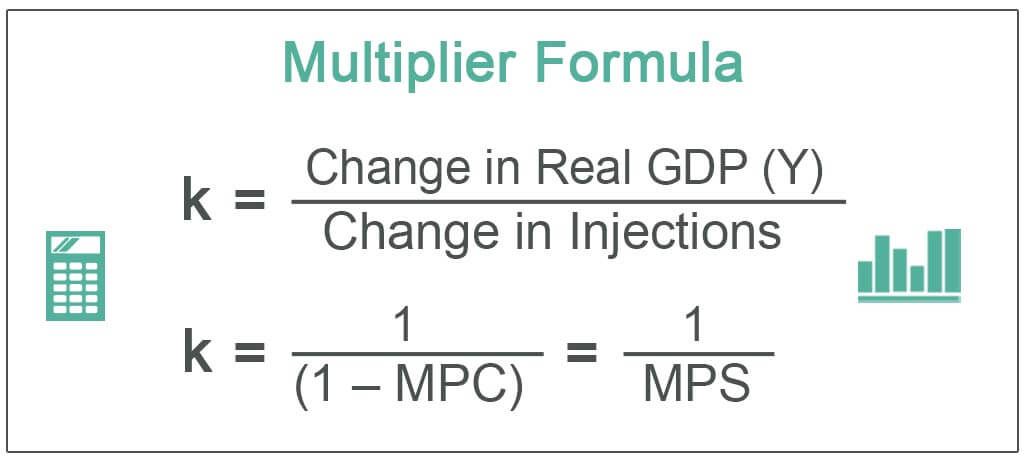

The multiplier formula denotes an effect that initiates because of increased investments (from the government or corporate levels), causing the proportional increase in the economy's overall income. However, it is also observed that this phenomenon works in the opposite direction (the decrease in income affects a reduction in total spending). Following is the formula for the calculation of the multiplier effect: -

Multiplier (k) = Change in Real GDP (Y) / Change in Injections

For the calculation of the multiplier formula in economics, the formula used is

Multiplier (k) = 1 / MPS

Or

k = 1 / (1 – MPC)

Where,

- MPS = (1- MPC)

This formula shows the relation between the increase in the earning of the nation due to the investments by the respective government or the corporates, if, there is a fixed pattern of expenditure from the additional income.

This formula works on the premise that one person's expenditure is the income for another person apart from that portion which the earning person is saving. So, there is an assumption that one person's expenditure is another person's income in the form of profit, wages, salaries, etc. That person, in turn, spends it again, majorly on the consumption front. This circle continues until the saving equals the amount injected into the economy.

Important Definitions

- GDP: GDP or Gross Domestic Product denotes the production of finished goods or services for a specific period in market value terms. It indicates the commercial well-being of the economy of a nation. It helps gauge the country's economic condition and is used heavily for national policymaking.

- Real GDP: GDP could be of two types; Real GDP, and Nominal GDP. Inflation is the difference between the real GDP and nominal GDP. The real GDP accounts for the value of all goods and services produced at a constant price and does not consider the effects of inflation. On the contrary, the nominal GDP does view the actual costs of all the produced goods and services and the full impact of inflation in its calculation. So, suppose the primary consideration is to evaluate the relative production levels of the nation. In that case, real GDP turns out to be a winner because it does not consider the inflationary prices and keeps the focus fixed on the actual production.

- Injections: Injections are an addition to the total expenditures already happening in the economy. These expenditures could come from any direction, be it from corporations, government, export contributions, etc. A few examples to understand it clearly would be the corporates investing in the company's capital goods or taking up expansion plans, the government taking up the infrastructure activities and or spending on welfare schemes, or international companies purchasing goods from domestic producers. All these would fall under the injections criteria.

- MPC: Marginal Propensity to Consume is an essential tenet of the multiplier formula. It indicates the basic idea of consumption patterns that would remain constant over the consumption series. For instance, let us assume the MPC is 0.8 or 80% of the earning, and in simple terminology, it reflects the spending behavior of the person. If a person earns $100, around 80% or $80 would be spent on consumer goods. It would save the remaining amount. Again, one person's spending would become the earning of another party, and that too would spend 80% of it on consumer spending. This circle continues over time unless it reaches a negligible amount. The formula of MPC is changed in the expenditure over the change in the earning. (Change in Consumption / Change in the Earning)

- Marginal Propensity to Save: It speaks about a person's savings when changes in earnings. In other words, it is arrived at by deducting the income by marginal propensity to spend. So, the formula for MPS would be: - Earning – Marginal propensity to spend.

Examples of Multiplier Formula in Economics

Given below are the examples of multiplier formula.

Example #1

Let us assume that the government has come up with an investment of $2,00,000 in the infrastructure project in the country. This additional income would follow the marginal propensity to save and consume. Therefore, calculate the multiplier if the marginal propensity to consume is 0.8 or 80%.

Solution:

We got the following data for the calculation of multiplier.

- Expenditure: $100,000.00

- MPC: 0.80

Calculation of multiplier formula is as follows -

- Multiplier Or (k) = 1 / (1 – MPC)

- = 1/( 1 – 0.8)

- = 1/( 0.2)

Value of multiplier is

- = 5. 0

Now we will calculate the change in Real GDP

- Change in Real GDP = Investment * Multiplier

- = $ 1,00,000 * 5

- = $ 5,00,000

In the example mentioned above, the government has invested $1,00,000 in the economy for infrastructure development. Therefore, after applying the multiplier effect (k), which resulted in multiples of 5, the real GDP would increase to $5,00,000.

This increase in GDP is based on the assumption that there is a constant expenditure pattern to the tune of 0.8 or 80% of the change in differential income.

Example #2

In the year 2019, there was an investment of $600,000 in the private sector Therefore, the marginal propensity to consume is 0.9, which will remain constant over the period. Accordingly, calculate the multiplier effect and find out the real GDP change.

Solution:

We got the following data for the calculation of the multiplier effect.

- Expenditure: $600,000.00

- MPC: 0.90

Calculation of multiplier effect formula is as follows -

- Multiplier Or (k) = 1 / (1 – MPC)

- = 1 / ( 1 – 0.9)

- = 1 / ( 0.1)

Value of multiplier effect is

- = 10. 0

Now we will calculate the change in Real GDP

- Change in Real GDP = Investment * Multiplier

- = $ 6,00,000 * 10

- = $ 60,00,000

Here again, the investment of $ 6,00,000 would bring a change in the real GDP by $ 60,00,000. And the multiplier is calculated as 10.

Example #3

The government is trying to boost the economy, and one of the measures suggested by the committees is to invest $200,000 into the economy and let it roll for a while. Then, calculate the multiplier effect and find out the real GDP change if the multiple propensities to consume is 0.7.

Solution:

We got the following data for the calculation of the multiplier effect.

- Expenditure: $200,000.00

- MPC: 0.70

Calculation of multiplier effect formula is as follows -

- Multiplier Or (K) = 1 / (1 – MPC)

- = 1 / ( 1 – 0.70)

- = 1 / ( 0.30)

Value of multiplier effect is

- = 3.33

Now we will calculate the change in Real GDP

- Change in Real GDP = Investment * Multiplier

- = $ 2,00,000 * 3.33

- = $ 6,66,667

Again, the investment of $2,00,000 would change the real GDP by $6,66,667. And the multiplier is calculated at 3.33. So, it indicates that if the consumption pattern would remain at 70% throughout the time of investments, it will help change GDP by $6,66,667.

Importance and Uses of Multiplier Formula in Economics

Even though the multiplier formula in economics has various limitations, it has a far-reaching impact on the nation's economic decisions and policy making. The following are some noted uses and importance of the multiplier formula: -

- This formula has directly connected with investments in the economy and job creation. The multiplier theory also states that pumping funds into the economy would create a ripple-like effect in the economy's cash flow; even a percentage of the amount is being saved at every level.

- Multiplier provides that even if the small investment has been put in the system, eventually, after some time, the invested figure would grow manifolds. That is because it encourages the ruling government and public or private investors to remain invested and increase investments in the market.

- Sound knowledge of this concept helps to judge and understand various business cycles as it entails a fairly accurate understanding.