Table Of Contents

What Are Debt Instruments?

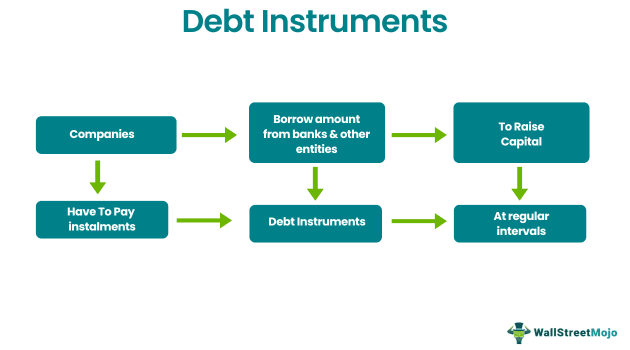

Debt instruments are the instruments used by the companies to provide finance (short term as well as long term) for their growth, investments and future planning and comes with an agreement to repay the same within the stipulated time period.

Debt instruments are divided into long-term instruments which include debentures, bonds, long-term loans from financial institutions, GDRs from foreign investors, and short-term instruments, which include working capital loans, and short-term loans from financial instruments.

Debt Instruments Explained

The meaning of debt instruments clearly states how two parties, the lenders and the borrowers, are legally bound to obey the agreement, whereby the amount lent to the latter along with the repayment terms and conditions for the borrowers are mentioned. These are available in both paper and electronic form.

These instruments become an obligation for debtors to pay a fixed amount to lenders at regular intervals. This is mainly the payment made monthly in the form of installments or all at once, which is a sum total of the principal and interest for that debt period per the contract.

These can either be secured or unsecured. In the case of a secured debt vehicle, there is an underlying asset acting as collateral for that loan. This asset is a backup of the loan amount for lenders, who can utilize the property to recover the loan amount in the event of defaults. The debts that are unsecured are completely based on the repayment promise that borrowers make.

Types

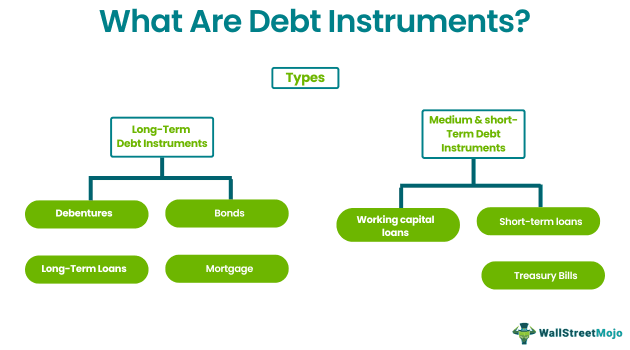

There are two types of debts instruments, which are as follows:

- Long-term

- Medium & Short-term

Let us now explain these in detail.

Long-Term Debt Instruments

The company uses these instruments for its growth, heavy investments, and future planning. These are those instruments that generally have a period of financing of more than 5 years. These instruments have a charge on the company's assets and also bear an interest paid regularly.

Medium & Short-Term Debt Instruments

These are those instruments that are generally used by companies for their day-to-day activities and the working capital requirements of the companies. The period of financing in this case of Instruments is generally less than 2-5 years. They don’t have any charge over the companies' assets and also don’t have a high-interest liability on the companies.

Examples

Let us consider the debt instruments examples based on the above classification:

Example 1 (Long-Term Instruments)

#1 - Debentures

A debenture fixed Interest Rate on the finance raised by the company through this mode of the debt instrument. These are raised for a minimum period of 5 years.

Debenture forms part of the capital structure of the company but is not clubbed with calculating share capital in the balance sheet.

#2 - Bonds

Bonds are just like debentures, but the main difference is that bonds are used by the government, central bank & large companies, and also these are backed by securities, which means these have a charge over the company’s assets. These also have a fixed interest rate, and the minimum period is also at least 5 years.

#3 - Long-Term Loans

It is another method that is used by companies to get loans from banks, financial institutions. It is not a favorable option method of financing as the companies have to mortgage their assets to banks or financial institutions. And also, the Interest rates are too high compared to Debentures.

#4 - Mortgage

Under this option, the company can raise funds by mortgaging its assets with anyone either from other companies, individuals, banks, or financial institutions. These have a higher rate of interest in funding the companies. The interest of the party providing funds is secured as they have a charge over the asset being mortgaged.

Example 2 (Medium or Short-Term Instruments)

#1 - Working Capital Loans

Working capital loans are the loans that are used by the companies for their day to day activities like clearing of creditors outstanding, payment for the rent of the premises, purchase of raw material, repairs of machinery. These have interest charges on the monthly limit used by the company during the month from the limit allowed by financial institutions.

#2 - Short-Term Loans

Banks and financial institutions also finance these, but they do not charge interest monthly; they have a fixed rate of interest, but the period for funds transferred is for less than 5 years.

#3 - Treasury Bills

Treasury Bills are short-term debt instruments that mature within 12 months. They are redeemed at the maturity in full, and if sold before maturity, then they can be sold at a discounted price. The interest on these T-bills is covered in the issue price as they are issued at a premium and redeemed at par value.

Advantages

- Tax Benefit for Interest Paid:- In debt financing, the companies get the benefit of interest deduction from the profit before the calculation of tax liability.

- Ownership of Company:- One of the major advantages of debt financing is that the company does not lose its ownership to the new shareholders as the debenture does not form part of the share capital.

- Flexibility in Raising Funds:- Funds can be raised from debts instruments more easily as compared to equity funding as there is a fixed rate of interest payment to the debt holder at regular intervals

- Easier Planning for Cashflows:- The companies know the payment schedule of the funds raised from debt instruments such as there is an annual payment of interest and a fixed time period for redemption of these instruments, which helps companies to plan well in advance regarding their cash flow/funds flow status.

- Periodic Meetings of Companies:- The companies raising funds from such instruments do not require sending notices, or emails to debt holders for the regular meetings, as in the case of equity holders. Only those meetings which affect the interest of the debt holders need sending of notifications.

Disadvantages

- Repayment:- They come with a repayment tag on them. Once companies raise funds from debt instruments, they must repay the same on their maturity.

- Interest Burden:- This instrument carries an interest payment at a regular interval, which needs to be met for which the company needs to maintain sufficient cash flow. Interest payment reduces the company's profit by a significant amount.

- Cashflow Requirement:- The company needs to pay interest as well as the principal amount for the company to keep the cash flows for making these payments well in time.

- Debt-Equity Ratio:- The companies having a larger debt-equity Ratio are considered risky by the lenders and investors. It should be up to an amount that does not fall below that risky debt financing.

- Charge Over the Assets:- It has a charge over the company's assets. Many of these require the company to pledge/mortgage their assets in order to keep their interest/funds safe for redemption.

Debt Instruments Vs Equity Instruments

Though debt and equity instruments sound similar, they differ in many respects. Let us check out some of them:

| Category | Debt Instruments | Equity Instruments |

|---|---|---|

| Meaning | These are borrowed funds in the form of loans and leases that help raise capital. | These are owned funds that help businesses raise capital. |

| Working | Fixed installment payments involved to the lender | The investors who buy equities receive a share in the profits the company makes. |

| Form | Corporate borrowing | Offers ownership rights to investors who buy equity in the form of shares |

| Examples | Bonds, term loans, etc. | Stocks, shares, etc. |