Table Of Contents

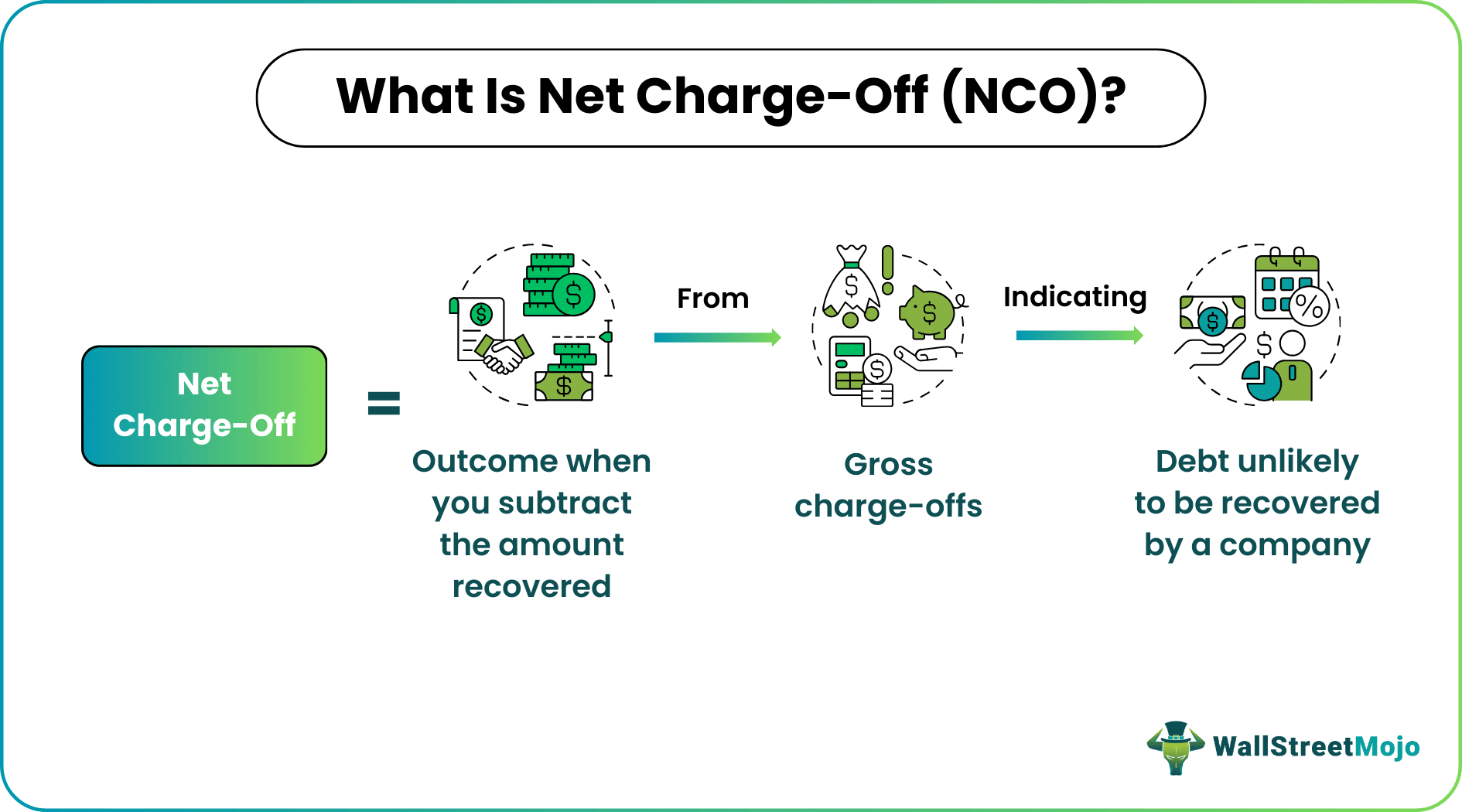

What Is Net Charge-Off (NCO)?

A Net Charge-Off (NCO) in the realm of finance is the discrepancy between a gross charge-off and any subsequent recoveries that the lender manages to obtain from a delinquent debt. A charge-off is an amount a lender has written off as an unrecoverable debt when the borrower delays interest payments.

NCO indicates the lender's inability to recover a part of the loan they offer to the borrower. However, a decrease in the value of an NCO means that the lender has recovered a part of the loan amount they had written off as bad debt.

Key Takeaways

- A net charge-off is a financial figure representing the disparity between gross charge-offs and any subsequent recoveries from a delinquent debt.

- It refers to the reduction in the amount written off as bad debt when the lender declares it unrecoverable due to the borrower's failure to make interest payments.

- The net charge-off ratio implies the portion of the total debt written as a charge-off. The NCO amount is divided by the total outstanding loan amount to determine the ratio.

Net Charge-Off Explained

A net charge-off represents the variance in the dollar amount when recoveries are accomplished from a gross charge-off. Let us study a few concepts to understand this topic better. A loan is considered delinquent when the borrower misses a few payments, usually two interest payments in a row. Subsequent failure to pay the interest leads to a default.

When banks or financial institutions lend money, they establish a loan loss provision as a precautionary measure, acknowledging that they may not recover the entire loan amount. This provision is influenced by economic conditions, the borrower's credit history, and other factors.

If a debtor misses multiple consecutive interest payments during the loan period, the bank may opt for a charge-off. It signifies the bank's loss of confidence in recovering the debt. The loan loss provision is recorded as an expense on the income statement, while the bad debts are reflected on the balance sheet.

Even if a debt is written off, the borrower remains legally obligated to repay it. Charge-offs can negatively impact a borrower's credit history for seven years, potentially lowering their credit score and creditworthiness, which can hinder future borrowing. However, if the borrower later makes a payment on the loan, the lender can recoup some losses. This payment reduces the charge-off amount, with the recovered sum subtracted from the gross charge-off to calculate the net amount.

NCO = Gross charge-off – Recovered amount

NCOs reduce bad debt, and as borrowers repay delinquent debt, NCO values decrease. A lower NCO is preferable as it signifies higher recovery by the lender. However, the NCO's presence indicates inefficient loans. When the NCO reaches zero, the debt is fully paid. In some cases, NCO can be negative, signifying recovery exceeding debt liability, often due to asset sales by collection agencies. This extra amount helps compensate for bad debt losses.

Formula

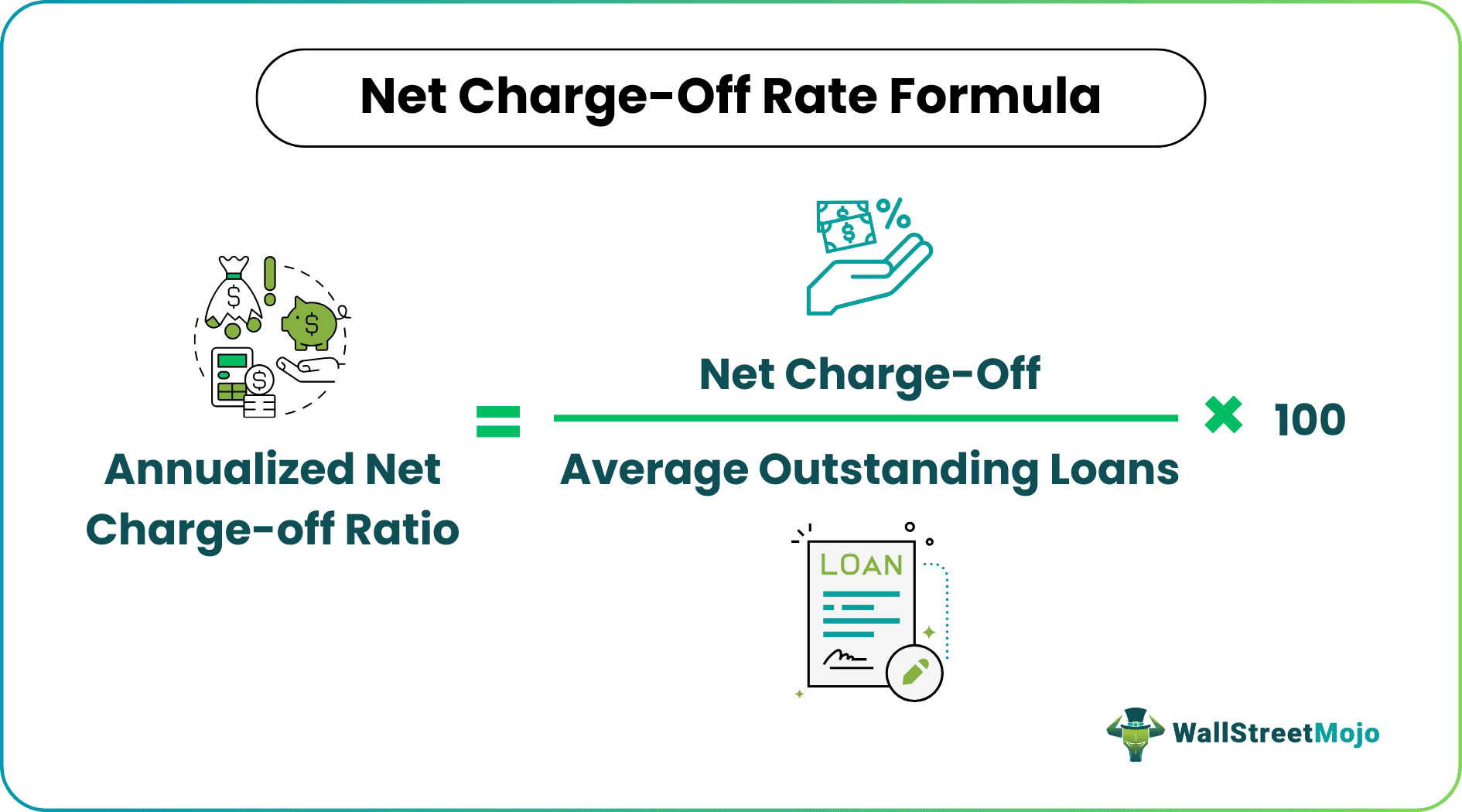

The expression that can help entities calculate the net charge-off rate is as follows:

The NCO rate measures the percentage of a particular debt that is not recoverable. The United States Federal Reserve monitors and tracks the NCO rates for banks across the country. For an economy, the NCO rates should be low, as it shows that most loans are recoverable and efficient.

Examples

Here are a few examples to understand NCOs better.

Example #1

Let us begin with a calculation example.

Gross charge-off as of December 2022: $50 million

Amount recovered in 2022: $16 million

Total outstanding loans in 2022: $780 million

Let us calculate the NCO and NCO ratio for the year 2022.

NCO = Gross charge-off – Recovered amount

= $50 million - $16 million

= $34 million

NCO ratio =

= x 100

= 4.36%

Example #2

According to a Reuters report, borrowers in the United States demonstrated resilience by proactively managing their credit card and loan payments despite the prevailing economic challenges. Although there has been a slight increase in delinquencies and NCOs, it is essential to underscore that these rises remain well within manageable levels.

On a positive note, prominent US banks such as Bank of America, JPMorgan Chase, Wells Fargo, and Citigroup have outperformed expectations by reporting robust profits. These financial institutions have effectively harnessed the benefits of rising interest rates.

It is expected that delinquency rates for branded cards will gradually increase, reaching 3-3.5% by early 2024, up from the current healthy rate of 2.8%. Similarly, delinquency rates for retail services are expected to experience a modest uptick from the current 4% to a still-manageable range of 5-5.5%.

In anticipation of the expected rise in NCO rates, Wells Fargo proactively allocated $1.2 billion as a loan loss provision in the first quarter. In comparison, Bank of America set aside $931 million during the same period. It's worth noting that Bank of America's total NCO with credit reached $807 million, reflecting a manageable increase from the previous quarter, indicative of their prudent risk management approach.