Though term loans are one form of working capital finances, they differ in many ways. Let us check some of the major differences between the two loan options:

Table Of Contents

Working Capital Loan Meaning

Working capital loan refers to a company's finance to meet its everyday operational requirements. It is not a fund that entities seek for long-term investments or asset building. Instead, the loan helps companies meet their short-term working needs, which they require repaying within a few months.

When the companies run short of funds but understand that the production would help them earn significant profits, they apply for working capital finances to fund the processes. As soon as the production yields considerable profits, they easily repay that loan.

Key Takeaways

- A working capital loan is a loan taken by a company to finance its day-to-day operational needs for a short duration, including debt payments, rents, or payroll.

- The company takes a short-term loan to meet its day-to-day business requirements.

- A company’s liquidity can be measured by its working capital, which indicates its capacity to meet short-term cash requirements/obligations.

- Large businesses usually have in-house resources to determine the working capital amount. In other cases, entrepreneurs can seek outside professional help from firms that help businesses meet their financial needs.

How Does A Working Capital Loan Work?

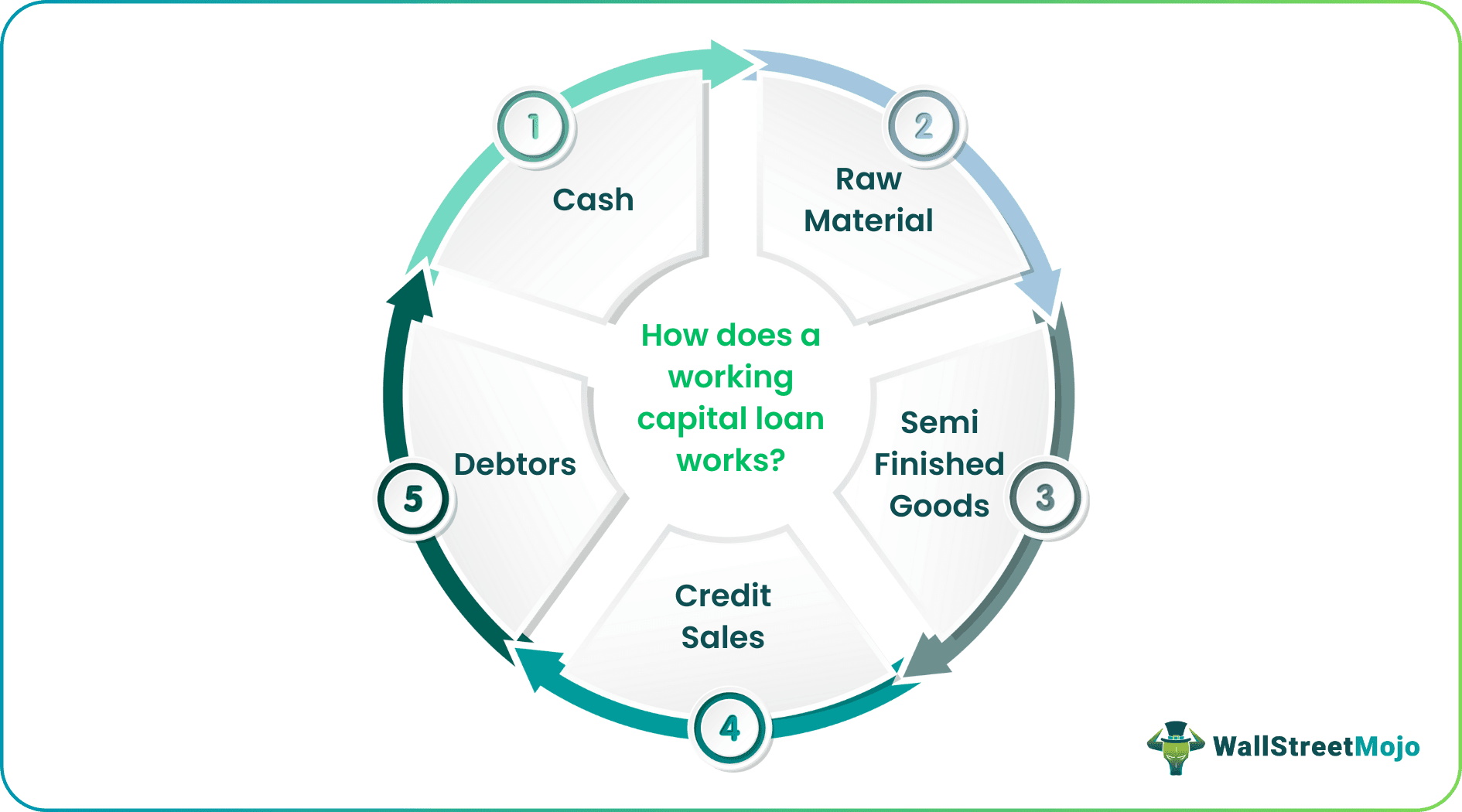

A working capital loan works best for seasonal businesses, which do not require a lumpsum to keep going. The companies apply for these loans to pay rent or buy raw materials, which lets them preserve their capital for the time being. For example, the company buys raw materials using such finances, begins production, manufactures the finished goods, generates income or profit, and repays the debtors using the same money.

There can be many reasons why companies opt for such loans. For example, the company may have heavily invested in its capex; hence the shortage of funds for day-to-day operations is obvious. Using these loans helps them cater to such needs. In addition, there are instances where entities are unable to convert their debtors or investments or unable to make sales as expected. The working capital loan for businesses, in such scenarios, help them in finding monetary aid.

Even when they have unexpected cash requirements, they can apply for it. Shortage of funds to take up new projects/sales orders or purchase raw materials at a lower market rate can also be one of the reasons behind taking up these loans.

It helps businesses or entrepreneurs focus on capital outlays, project financing, expansions, new products, and ideas. Depending on creditworthiness, a loan can be easily obtained from the bank at a low-interest rate. In addition, it helps the businesses settle their creditors and other expenses, which maintains the firm's goodwill and causes smooth functioning of day-to-day operations.

Video Explanation Of Working Capital

Types

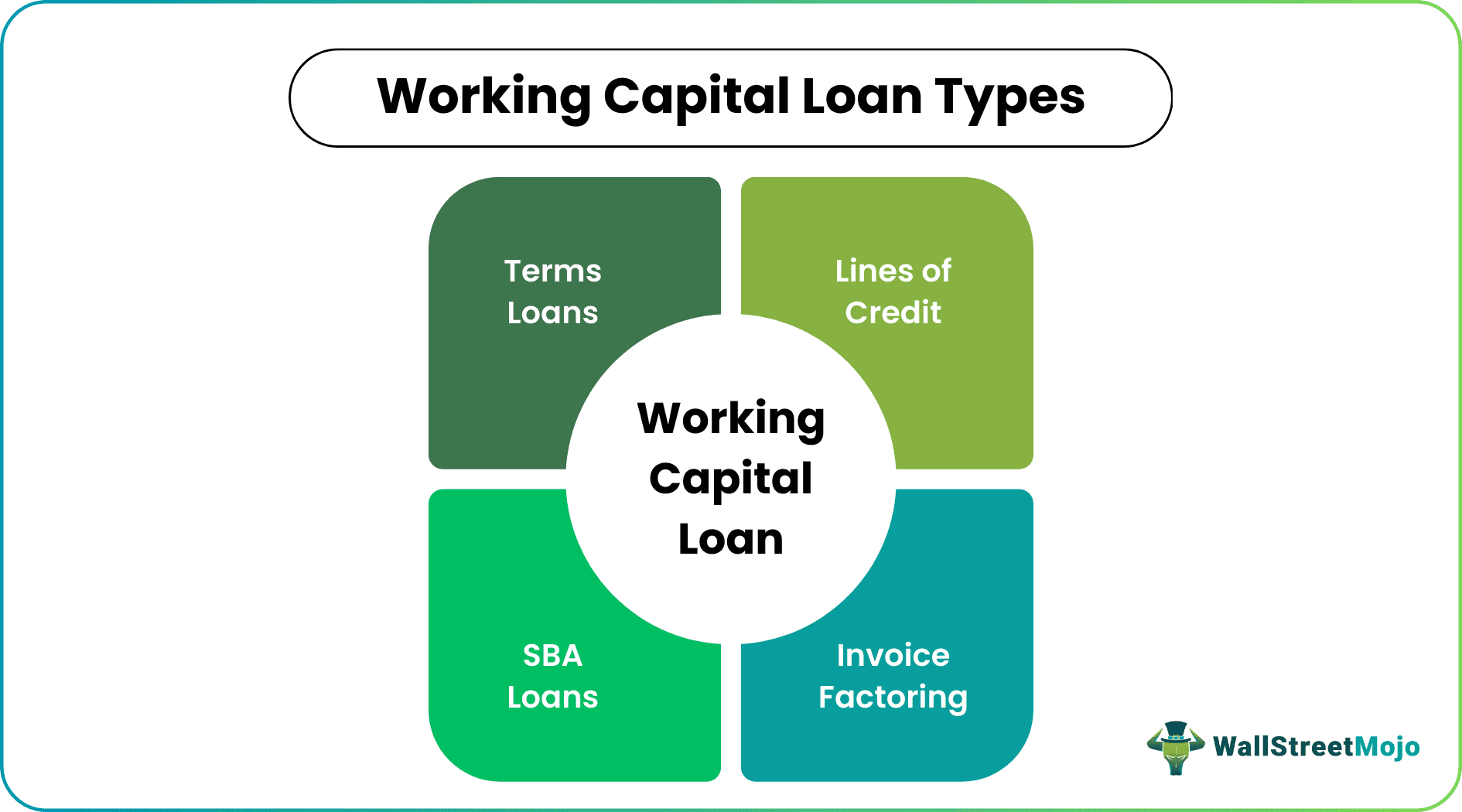

Before companies apply for working capital loans, they must be aware of the available forms. The most common types of working capital finances are – term loans, lines of credit, Small Business Administration (SBA) loans, and invoice factoring.

1. Term Loans

The first on the list is a term loan, the definition of which often makes it appear as working capital finance, which is known for its short-term payment requirement. A bank or any lender offers the term loan to be paid within a set period, extending to 25 years.

2. Line of Credit

This loan type lets companies obtain money as and when needed at different stages of the business. The business applies for these loans and does not receive money in a lump sum but rather as a lined-up credit, ranging from $2,000 to $250,000, as required during the draw period, extending to five years.

3. SBA Loans

SBA loans backed by the U.S. Small Business Administration are available mainly to businesses that have just started. Companies can obtain these loans to maintain their reserves and grow their business.

4. Invoice Factoring

Invoice factoring is a uniquely identifiable form of working capital finances. Businesses sell all or part of the accounts payable to another party in exchange for a fee. This third party offers factoring services and becomes the factor. These factors offer loans by purchasing the invoices as and when collected.

Eligibility

The working capital finances can be secured or unsecured. While the lenders approve the former against collateral, the approval of the other depends on fulfilling the eligibility criteria. For example, the approval of secured loans depends on the value of the property or asset backing the loan. On the other hand, companies need to have a high credit rating to be eligible for an unsecured loan per working capital loan terms.

Example

Let us consider the example below to understand the working of this type of financing:

The following details are available from the balance sheet of XYZ Ltd.

| Operation/Material | Amount Involved |

|---|---|

| Raw Material | $1,000 |

| Work in progress | $800 |

| Finished Goods | $1,200 |

| Current Investments | $4,000 |

| Short-term Borrowings | $15,000 |

| Prepaid Expenses | $2,000 |

| Short Term Loan and Advances | $4,500 |

| Trade Receivables | $1,500 |

| Trade Payables | $2,500 |

| Short Term Provisions | $2,500 |

| Other Current Liabilities | $5,000 |

| Fixed Assets | $80,000 |

| Cash and equivalents | $10,000 |

| Advance Tax | $9,000 |

Considering the above details, the company calculates the current assets and current liabilities, first:

Current Assets = Inventories (Raw material + work in progress + Finished Goods) + Current Investments + Prepaid Expenses + Short term loans and advances + Trade receivables + Cash and Cash Equivalents + Advance Tax

= $(1,000+800+1,200+4,000+2,000+4,500+1,500+10,000 + 9,000)

= $34,00

Current Liabilities = Short term borrowings + Trade payables + Short term provisions + Other current liabilities

= $(15,000+2,500+2,500+5,000)

= $25,000

Working Capital = Current assets – Current liabilities

=$34,000 – $25,000

=$9,000

This helps the company learn about the loan amount they would require applying for. XYZ Ltd. realizes that the manufacture of the products will let them repay easily. Hence, given their strong credit records, they apply for unsecured working capital financing.

Working Capital Loan vs Term Loan

| Category | Working Capital Finance | Term Loan |

|---|---|---|

| 1. Duration | Short-term to be paid back within a couple of months | Short, medium, and long-term, extending to up to 5 years |

| 2. Use | Short-term requirements, like buying raw materials, paying rent, etc. | Long-term requirements, including business expansion, etc. |

| 3. Installments | Limited | Multiple |

| 4. Documentation | None or minimum

| Significant |

| 5. Interest | High | Low |

| 6. Collateral | May or may not be secured

| Secured |

| 7. Amount | The loan amount is small. | The loan amount is high. |