Table of Contents

What Is Emerging Market Bond?

An emerging market bond refers to a fixed-income debt security that is issued by a corporation or a government entity of a developing nation, I.e., the one that has a growing economy. These high-risk high-yield investment options are critical for diversifying the investor’s portfolio.

The investors include such investments in their portfolio due to their high growth potential when compared to the US corporate bonds and treasuries. Moreover, the investment in these bonds can either be direct or facilitated through different investment vehicles like mutual funds and exchange-traded funds. The issuers can release such bonds in local or foreign currency denominations.

Key Takeaways

- An emerging market bond is a fixed-income debt instrument that a private company, government entity, or sovereign body of a growing or developing country issues.

- It is generally a high-return investment opportunity for the investors and provides a diversification benefit by letting them invest in economies that have a rapid growth potential.

- These bonds can be categorized as local and hard currency bonds. Also, these can be distinguished as sovereign, quasi-sovereign, and corporate EM bonds.

- However, such assets are more vulnerable to liquidity, currency, credit, political, economic, and interest rate risks.

Emerging Market Bond Explained

An emerging market bond refers to a fixed-income debt instrument that is issued by the sovereign, quasi-sovereign, or corporation of a nation that has a growing economy and is designated as a developing country. While such investment inclusions have significant diversification benefits along with a high yield potential, these are exposed to various uncertainties including currency, credit, liquidity, political, and interest rate risks.

Given below is a list of various factors to consider before selecting a particular emerging market bond ETF or mutual fund for investment:

- The foremost check point is the credit quality of the bond which can be gauged through the verification of the issuer’s creditworthiness. Agencies like Fitch, Standard Poor’s, and Moody’s issue the credit ratings of the issuer and the bond for this purpose.

- The various charges such as the management fees, spreads, commission, and taxes involved in purchasing such an asset are the next priority consideration.

- Also, the investors need to find out the bond’s tenure or lock-in period before investing to waive off the interest rate risk.

- Another thing to notice is the level of liquidity, I.e., whether such funds can be easily bought or sold in the financial market.

- Lastly, the investors must ensure that the bond has a limited currency exposure for sustaining the bond value, which is not the case with hard currency bonds.

Therefore, investors and fund managers should often maintain a strategic balance between emerging market bonds and other asset classes while creating an investment portfolio to ensure maximum returns at the minimum possible risk, I.e., to achieve a risk-return tradeoff.

Types

Investors have diverse investment options to buy EM bonds based on their risk and return profile, investment time, and financial condition. However, these bonds can be divided into the following two major categories based on the currency in which these are issued:

- Local Currency Bonds: The local debt involves the bonds that the government bodies and corporations of the growing country issue in their local currencies or denominations. These bonds provide favorable returns at comparatively lower risk-taking.

- Hard Currency Bonds: Such external debt involves those bonds that are issued by an emerging market’s sovereign body or corporation in a foreign currency denomination of a developed nation, like in Euros, US dollars, or other currencies. Although these vehicles offer comparatively higher returns, they are also more susceptible to currency and exchange rate risks.

Also, the EM bonds can be classified into the following three kinds based on the type of issuers:

- Sovereign Bonds: The EM bonds that are issued by the central government of a nation with a developing economy are termed sovereign bonds. These investments are exposed to political and economic risk and stability of the issuing country but have higher liquidity.

- Quasi-Sovereign Bonds: Such bonds are offered by the state government, local bodies, municipalities, development banks, or other public sector organizations of a developing nation. The risk and return profile of the quasi-sovereign debt instruments depends upon the issuer’s financial and operational efficiency.

- Corporate Bonds: These bonds hold the highest risk in the category since they are issued by the private sector companies of the growing nations. Such investments have a low liquidity but provide the benefit of diversification and high yields. Although these bonds involve significant currency and credit risk, they are secured by the issuing firm’s cash flows and assets

Examples

Emerging market bonds have been gaining immense popularity among investors due to their high yield potential and comparatively lower risk than equity investments. Given below are some of the popular examples of EM bonds:

Example #1

Suppose, a private power generation and distribution company, XYZ Power Pvt. Ltd. in Nigeria issued 10 years of corporate bonds in 2022, which were worth US Dollar 10 million, to expand its power generation capacity. These are the hard currency emerging market bonds issued in US Dollars. Now, the performance of this debt instrument hinges upon the success of XYZ Power Pvt. Ltd.’s expansion project. Also, these bonds possess low liquidity and are exposed to a higher risk of fluctuation in the US Dollar and relevant exchange rates.

Example #2

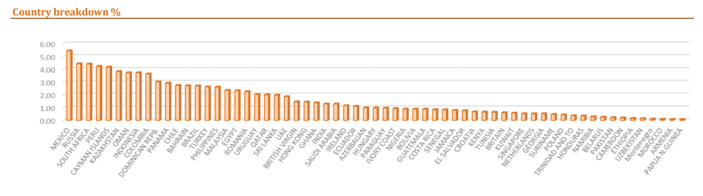

The NEF emerging market bond R fund aims at capital appreciation. It invests mainly in government bonds from non-G7 countries, focusing on the Euro, Japanese Yen, Pound Sterling, and US Dollar. Moreover, this emerging market bond fund employs financial techniques for hedging purposes and reinvests the generated income. However, it can be traded daily, but it is not a favorable investment for those who prefer to withdraw the invested sum within 3 to 4 years. Moreover, given below is a nation-wise breakdown of the fund investment:

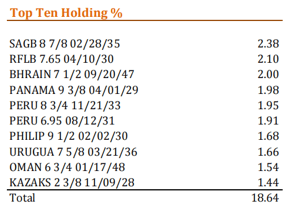

Also, the top 10 holdings as per the emerging markets of this fund are as follows:

Example #3

In 2023, emerging market bonds have offered strong returns amidst numerous obstacles like surging interest rates, geopolitical unrest, and China's sluggish economic growth. Looking ahead to 2024, the stabilization of economic growth in developing nations, potential easing of global financial conditions through Federal Reserve rate adjustments, and the improvement of fiscal conditions in more than 70% of monitored emerging-market countries frame an optimistic expectation from the EM bonds.

Moreover, some good signs include the easing impact of China's economic slowdown, curbed bond issuance, and declining inflation. However, some of the potential concerns regarding the bond market include the potential weakening of the US dollar and upcoming elections worldwide. All in all, 2024, is expected to be a good time for investing in EM bonds but with proper market analysis and a strategic approach.

Advantages And Disadvantages

The investors whether institutional or individual, need to compare the benefits and risks of the EM bonds to devise an optimal investment strategy. Given below are the various pros and cons to be considered before investing in such fixed-income debt securities:

| Advantages | Disadvantages |

|---|---|

| Emerging market bond funds are favorable investments to generate high returns on investments while lending funds for projects backed by a government or the assets and cash flow of such debt-issuing companies in growing economies. | The foremost risk in these bonds is the higher chances of default by the issuer since the developing nations often face issues about economic, political, and social stability. |

| Investors can geographically diversify their investment portfolio by including debt instruments of different growing markets or nations and taking advantage of their economic cycles. | When compared to the bonds issued by the developed nations, EM bonds, especially the corporate debts have poor liquidity, due to their broad bid-asks spread and limited trading volume. |

| The EM bond funds are often professionally handled by expert fund managers, ensuring the investors that their funds are in the right hands. | The hard currency EM bonds are vulnerable to a higher currency risk since their value and income are comprised of exchange rate fluctuations. |

| Investors who have a high-risk appetite can often include such investments in their portfolio to generate positive returns in the long run. | Some of these bonds may possess a high charge including taxes, commission, management fees, and spreads which may reduce their overall return potential. |

| Also, these bonds have a significant potential for capital appreciation since they belong to developing nations which exhibit rapid growth in comparison to the developed economies. | When invested for a longer horizon, these investment vehicles may possess a higher interest rate risk due to the bond’s price volatility over the period. |

| Such debt instruments serve as a critical medium for funding projects in emerging markets, fostering their growth and development. |