Table Of Contents

What Is Hang Seng Index (HSI)?

Hang Seng Index (HSI) is a market capitalization index that represents the Hong Kong stock exchange. It is located in Hong Kong. HSI is treated as a barometer to study the environment of Asian capital markets.

Hang Seng Bank owns it. Although Hang Seng is a private company, it also compiles stock market indexes in Shanghai and Shenzhen capital markets. The Index debuted in 1969, and its base was at 100 points, equal to the HSI's total value on July 31 when the market closed on July 31, 1964.

Table of contents

- What Is Hang Seng Index (HSI)?

- The Hang Seng Index (HSI) is a stock market index. It is the most critical indicator for the Hong Kong capital market.

- It comprises 50 global corporations—nearly half of the Hong Kong stock exchange.

- HSI evaluates the performance of a share based on the current price, yesterday's closing price, issued shares, and capitalization factor.

- HSBC Holdings plc, China Construction Bank, China Life, Hong Kong, China Gas Company Limited, Country Garden, China Resources Land Limited, Swire Group, Geely Auto, China Mobile Ltd, and Mengniu Dairy are some popular examples of Hang Seng Index companies.

Hang Seng Index (HSI) Explained

Hang Seng Index (HSI) is a market capitalization index that reflects the market performance of the Hong Kong stock exchange. HSI mainly focuses on blue-chip stocks listed on the Hong Kong stock exchange. The Hang Seng Bank regulates it. In addition to HSI, the Hang Seng Bank creates indexes in Shanghai, Shenzhen, and other Chinese markets. The Index debuted in 1969 at 100 points—equal to the HSI's total value on July 31, 1964.

Before venturing into Hang Seng, let us define a stock index first. A stock index (also known as a stock market index) is a tool used to determine the performance of shares (securities) in the market.

Indexes are often used as a benchmark against which the performances of mutual funds and ETFs are compared. The index is further used for investment decisions before adjusting the portfolio.

To understand the role of Hang Seng, we need to understand its implications on the global market. The Shenzhen and Shanghai Stock exchanges in Mainland China are very restrictive—open only to Chinese citizens and (foreign) institutional Investors. Unlike, other developed countries, not everyone can invest in Chinese equities.

Therefore, foreign investors buy shares belonging to Chinese companies from the Hong Kong Stock Exchange. It was a massive relief for international investors.

HSI includes stocks from the best-performing companies—the 50 largest companies. The stocks undergo critical analysis before getting included. For example, HSI will include a company if it ranks in the top 90th percentile total market turnover in the past year. In addition, the market value of the company’s ordinary shares must be in the top 10%. Also, the company needs to be listed for a minimum period of 24 months. Newer, up-and-coming companies are rejected.

The Index also checks basics like market capitalization and financial health. Thus, investors track HSI strategies to identify blue-chip stocks. In addition, they try to comprehend the reasons behind HSI decisions. Thus, the impact of HSI news extends beyond Asian markets; it is felt worldwide.

Advanced traders use the HSI's daily bulletin, index performance summary, total returns index, and other stock performance indicators to compare HSI with other markets.

HSI is not the only index in the world; globally, there are multiple indexes representing different stock exchanges. Almost, every country has its own index depending on the size and scale of its economy. S&P500, Nifty 50, Russell 2000, EURO STOXX 50, and Nikkei 225 index are similar to HSI.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

Let us look at the history of the Hang Seng Index.

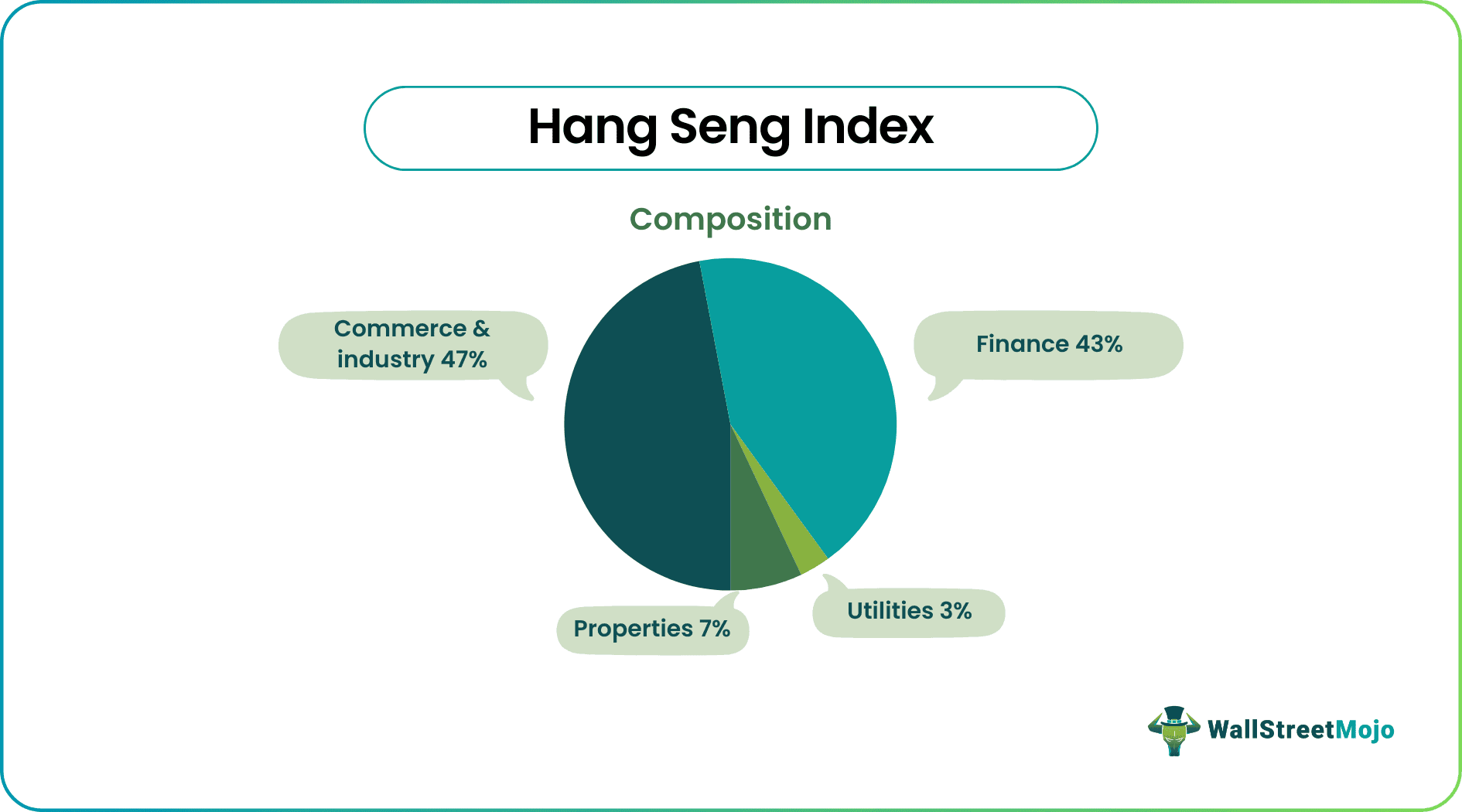

Ho Sin Hang introduced the Hang Seng Index in November 1969. He was the chairman of the Hang Seng Bank. Hang wanted to construct a Dow Jones Index for Hong Kong. Within a decade, the Index was categorized into four sub-indices; the four categories represented four distinct sectors of the economy.

The four categories are as follows:

- HSI Finance Sub-Index - It represents the finance industry.

- HSI Utilities Sub-Index - It comprises the utility sector.

- HSI Properties Sub-Index - It resembles the real estate of Hong Kong.

- HSI Commerce & Industry Sub-Index - It explains the commerce industry.

On August 31, 1993, the Index reached its lowest at 58.61 points. At the opposite end of the spectrum, HSI attained its benchmark of 10000 points on December 1993. It took another 12 years to double the 1993 benchmark. Finally, in December 2006, HSI touched 20000 points.

Perpetually rising, the Index reached 30000 points in October 2007. The rally continued, and HSI set an all-time high on January 2018—at 33,223.58 points.

In 2022, the Index is experiencing a fall around the 14,000-point mark. Since 1969, HSI has witnessed an average change of he19.2%; The highest return came in 1972 with a hike of 147.07%; the lowest return of - 60.54% was recorded in 1974.

In the 2010s, the Index increased its annual average to 3.7%. The decade's highest returns were recorded in 2017, when the Index grew by 35.99%. Comparatively, the decade's lowest returns occurred in 2011, when it fell by -19.97%.

Chart

Following is a Hang Seng Index chart.

The above chart depicts live values of HSI for October 28, 2022 (4:08 PM) GMT+8. The Han Seng rebounded slightly following a rise in Asian markets. Although HSI fluctuates daily, it is considered highly dynamic.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The Index lists the best-performing stocks from Hong Kong Stock Exchange. HSI performance, therefore, impacts the Asian capital markets. It is followed by analysts, traders, and investors. They study HSI trends and the reasons behind them.

The index picks blue chip stocks from the Hong Kong Stock Exchange. It includes the most prominent companies. But, HSI rejects new, up-and-coming performers. To mitigate risks, HSI has a minimum criterion of 24 months. Stocks that were listed for less than 24 months are not considered. China Mengniu Dairy Company Limited, CITIC Limited, Techtronic Industries. Company Limited, Industrial and Commercial Bank of China Limited, China Petroleum & Chemical Corporation, New World Development Company Limited, and CLP Holdings Limited, are some examples.

Yes, HSI has a fund. The HSI fund comprises global conglomerates like Meituan, Alibaba Group, Tencent, China Construction Bank, and the Industrial and Commercial Bank of China. The Index has categorized the companies into four sub-indexes: finance, utilities, commerce, and properties.