Table Of Contents

Full Form of SENSEX - Stock Exchange Sensitive Index

The full form of SENSEX is Stock Exchange Sensitive Index. It can define as an index, which also means indicator. If they have gone up or down, it provides a general idea concerning the movement of the maximum stock number. In other words, one can understand it as the index or indicator of all the companies listed on the Bombay Stock Exchange.

Key Takeaways

- SENSEX stands for the Stock Exchange Sensitive Index and indicates the overall stock market performance in India.

- It provides a general idea of the movement of many stocks listed on the Bombay Stock Exchange (BSE).

- The SENSEX offers a broader view of the performance of stocks listed on the BSE and can be used to gauge the potential impact of a specific stock on the index.

- The SENSEX focuses on the top thirty stocks in the country based on their liquidity and market capitalization, making it a useful tool for determining the performance trends of major companies in India.

List of Companies Included in SENSEX

We can define it as the weighted index of thirty chosen companies based on overall financial well-being and performance. The following are the names of the thirty companies that include: –

- Lupin

- Tata Steel Limited

- Wipro Limited

- Tata Motors Limited

- State Bank of India

- Sun Pharmaceutical Industry Limited

- Tata Motors- DVR Ordinary

- Tata Consultancy Services Limited

- Kotak Mahindra Bank Limited

- Mahindra and Mahindra Limited

- Maruti Suzuki India Limited

- Larsen and Toubro Limited

- Reliance Industries Limited

- NTPC Limited

- Power Grid Corporation of India Limited

- Oil and Natural Gas Corporation Limited

- Viola

- ITC Limited

- Infosys Limited

- ICICI Bank Limited

- HDFC Bank Limited

- Hindustan Unilever Limited

- Hero MotorCorp Limited

- Housing Development Finance Corporation Limited

- Asian Paints Limited

- Bajaj Auto Limited

- Axis Bank Limited

- Bharti Airtel Limited

- Adani Ports and Special Economic Zone Limited

- Coal India Limited

- Reddys Laboratories Limited

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Purpose

It offers a broader view of the performance of stocks enlisted on the Bombay Stock Exchange. One may use SENSEX to measure the ability of a particular stock to induce movements in an index. Also, one may use it to evaluate and indicate the financial strength of the stock market.

The primary purpose is it indicates the movement in the market. Stock Exchange Sensitive Index helps measure the performances of the trending top thirty stocks in the country based on liquidity and market cap.

How Does it Work?

At SENSEX, all differential voting right shares and common stocks that form a part of S&P BSE 100 qualify for index inclusion. It offers a time series of data over a longer duration of time. One may calculate the closing figure with the help of a weighted average concerning all the trades on the Stock Exchange Sensitive Index constituents in the final fifteen minutes of a trading session.

If the Stock Exchange Sensitive Index constituent is untraded in the final fifteen minutes, then the last price dealt is considered for the calculation of the closure of the index. And, if the same is untraded for the entire day, then the closing price for the last day is considered for calculating the index closure.

How is it Calculated?

- One can measure Stock Exchange Sensitive Index by calculating the performance of the trending 30 stocks. Now, one may calculate it using the free-float market capitalization method.

- However, earlier people used the full market capitalization method to calculate. On 1st September 2003, the free-float market capitalization method came into existence. The free-float market capitalization method is globally accepted and acknowledged and is regarded as the industry’s best practice.

- One may use the free-float market capitalization method, market capitalization weighting scheme method, and the divisor method to calculate the SENSEX concerning the top thirty stocks. One may use the market capitalization weighting method is used to evaluate the market capitalization of an entity by taking the price of its stock and multiplying the same by the total number of shares issued by that particular entity.

- The market capitalization evaluated will be used for further multiplication, where it will be multiplied with the free-float factor to ascertain the free-float market capitalization. One may calculate the Stock Exchange Sensitive Index by taking the free-float market capitalization of the top 30 companies ranked in the index and dividing the same using a number known as the index divisor.

- The index divisor helps keep the index comparable over some time. Therefore, it acts as an adjustment point for every index adjustment arising from script replacement, corporate actions, etc.

Benefits

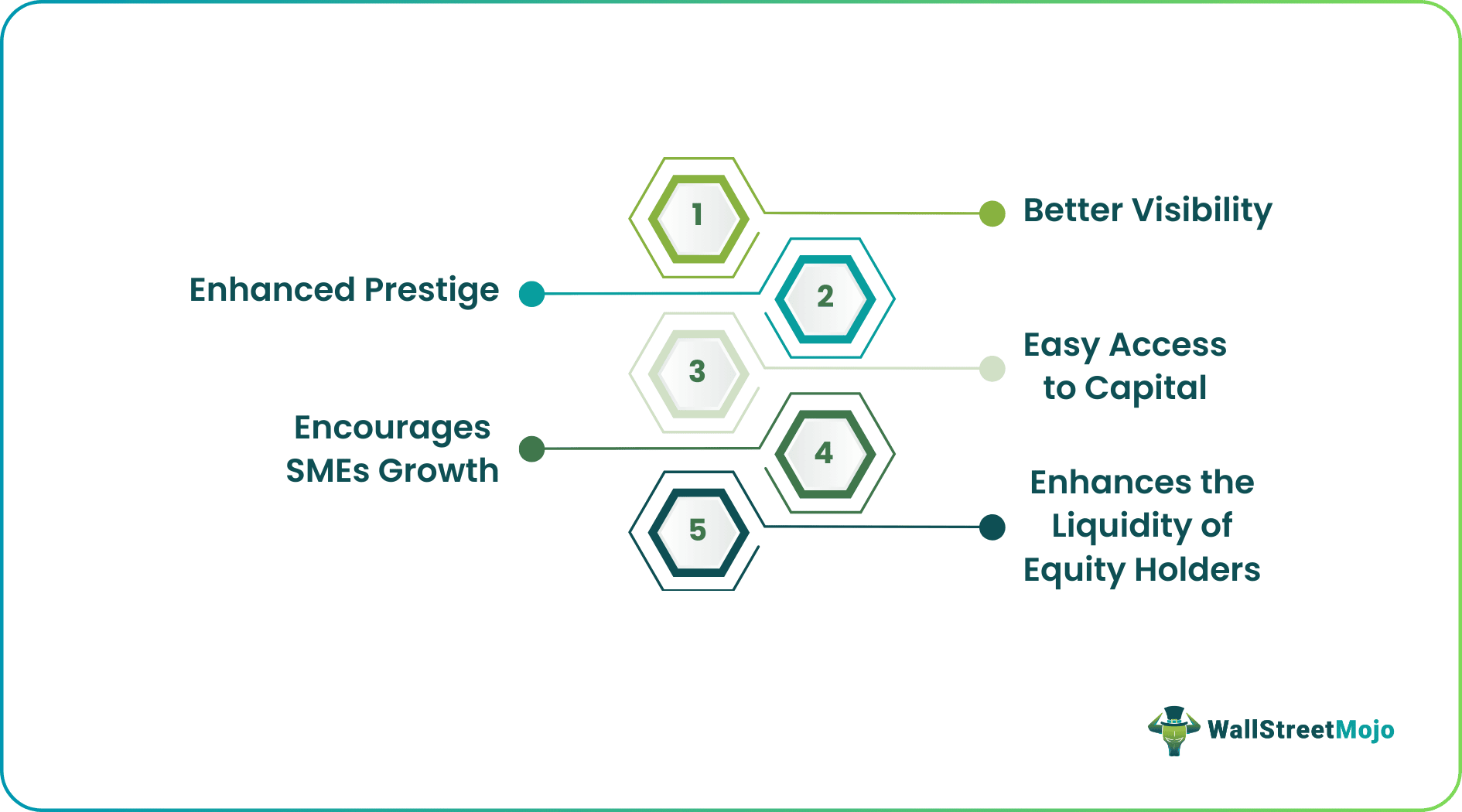

The following are the benefits: -

- Better Visibility – SENSEX provides better visibility and enhances a company’s credibility. As a result, it increases the demand for its shares and leverages the same valuation.

- Enhanced Prestige – It even enhances the prestige of the companies since it incorporates the top best-performing companies, which is a matter of reputation for them.

- Easy Access to Capital – It allows a company to raise its share capital.

- Encourages SMEs Growth – SENSEX offers opportunities concerning growth like mergers, acquisitions, and expansions.

- Enhances the Liquidity of Equity Holders – It also enhances the shareholders’ liquidity. It offers them various growth opportunities such as mergers, acquisitions, and expansions.

- It provides various other benefits, too, such as scope for employee incentives and efficiency in risk distribution.

Conclusion

The Stock Exchange Sensitive Index was compiled in 1986 and is the country’s oldest stock market index. It acts as the pulse of the national stock markets. The calculation happens primarily by using the full market capitalization method.

From 1st September 2003, they calculated SENSEX with the help of the free-float market capitalization method instead of the full market capitalization method. The free-float market capitalization method is considered the best method of all. However, this method depends on the fact that the level of indexes at all points reflects the free-float market values of thirty component stocks related to a base period.

Stock Exchange Sensitive Index is used widely in national markets and international markets. Investors worldwide follow the Stock Exchange Sensitive Index closely to use it as a base for constructing investment-related decisions.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Sensex and Nifty are both stock market indices in India. The Sensex, also known as the S&P BSE Sensex, is a benchmark index of the Bombay Stock Exchange (BSE), consisting of 30 large, actively traded stocks across various sectors. The Nifty, officially known as the Nifty 50, is the benchmark index of the National Stock Exchange (NSE) and represents the performance of 50 actively traded stocks from various sectors.

Sensex represents the performance of the stock market, particularly the BSE, while gold is a precious metal known for its value and is considered a safe-haven investment. The chart allows investors and analysts to analyze the historical price movements of Sensex and gold, identifying trends and potential correlations between the two assets.

Sensex is the benchmark index of the BSE in India, while NASDAQ is a major stock exchange in the United States. Sensex comprises 30 large companies listed on the BSE, while NASDAQ is known for its focus on technology and growth stocks, including prominent companies like Apple, Microsoft, and Amazon.