Table Of Contents

STRATS Meaning

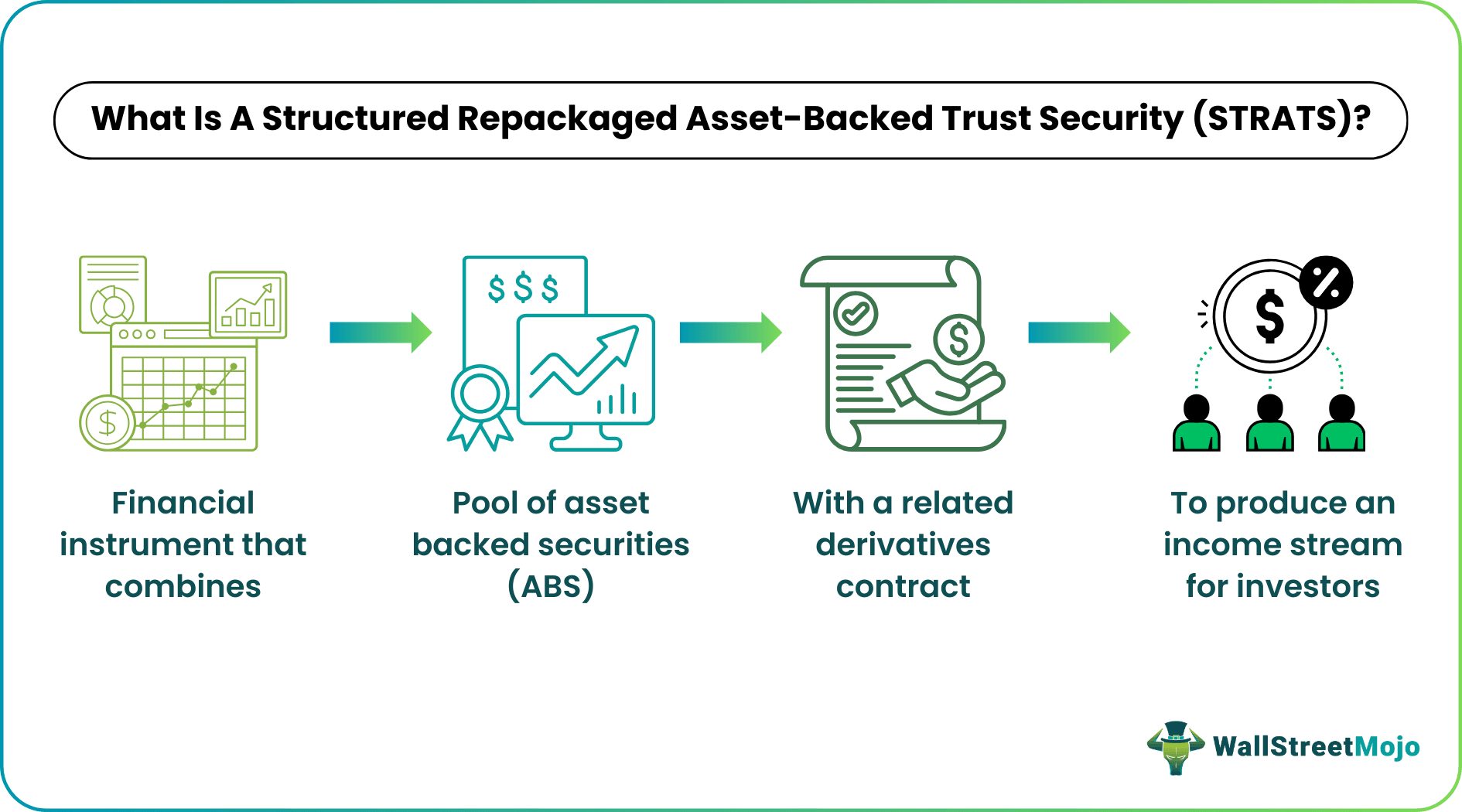

A STRATS, or Structured Repackaged Asset-Backed Trust Security, is a financial instrument that combines different assets, such as mortgages or loans, into a single security. It provides investors with exposure to diversified securities portfolios while also allowing issuers to raise capital by selling them.

It uses securitization to pool assets together for repackaging into tradable securities. Financial institutions and lenders employ risk transfers by selling assets to Structured Repackaged Asset-Backed Trust Security, thereby reducing exposure to potential losses. This mechanism enables investors to invest in residential mortgages or auto loans without directly owning them.

Table of contents

- STRATS Meaning

- A STRATS, or Structured Repackaged Asset-Backed Trust Security, is a financial instrument that consolidates various assets, such as mortgages or loans, into a single security.

- It allows investors to access a diversified portfolio of securities and provides a means for issuers to raise capital by selling these consolidated securities.

- STRATS securitizes debt instruments, commercial mortgages, and auto loans into different tranches, with senior tranches offering lower risk and lower yields and junior tranches offering higher yields but higher risk.

- Key benefits of Structured Repackaged Asset-Backed Trust Security include diversification, customization, enhanced yield, credit enhancement, liquidity, transparency, income stream, and risk management.

STRATS Explained

Structured Repackaged Asset-Backed Trust Security (STRATS) is a financial instrument derived from a combination of asset-backed securities (ABS), collateralized debt obligations (CDOs), securitization, and structured finance. The process entails the repackaging and sale of various assets, such as auto loans, credit card receivables, loans, and mortgages, into trust structures and tradable securities.

Structured Repackaged Asset-Backed Trust Security commences by identifying and selecting the class of assets to be securitized, which may include other debt instruments, commercial mortgages, credit card receivables, and auto loans. These assets are subsequently transferred to a trust, or a particular special purpose vehicle (SPV) created for this purpose. The SPV then creates different layers or tranches of securities, each representing distinct levels of return and risk for investors.

The senior tranches take precedence in receiving payments from the underlying assets, offering higher credit quality and lower yields. In contrast, junior tranches offer higher yields but are exposed to potential losses. The cash flows generated by the underlying assets of structured repackaged asset-backed trust securities are programmed to prioritize the allocation of funds to senior tranches before distributing any remaining funds to junior tranches.

Structured repackaged asset-backed trust securities have several implications, such as transferring risk from the lenders' balance sheets, enabling them to access free capital for additional investments or lending. Individual investors gain exposure to assets that they may not have been able to invest in individually. Furthermore, the different tranches provide flexibility in selecting return and risk profiles in line with the investors' objectives.

STRATS has significantly impacted the financial world by creating new investment opportunities, channeling capital into various sectors of the economy, and providing banks with additional funds for their operations. However, the complexity of STRATS played a role in the growth of mortgage-backed lending, which ultimately contributed to the 2008 financial crisis.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us take help from examples to understand the topic.

Example #1

FINRA, the Financial Industry Regulatory Authority, levied a $500,000 penalty against Wells Fargo Advisors, LLC (Case No. 2012033568901) for making unsuitable recommendations to retail customers regarding the purchase of Structured Repackaged Asset-Backed Trust Securities (STRATS) between August 2005 and July 2012, resulting in around $12 million in sales during that period.

STRATS, intricate financial instruments, were initially valued at $25 per share. They generated income payments that fluctuated based on the capital security and interest rate swap associated with JP Morgan Chase, offering interest rates ranging from 3% to 8%. In the report, FINRA stated that STRATS can be terminated under specific conditions, potentially causing clients to receive an amount less than their initial investment due to a swap termination fee.

Wells Fargo's shortcoming was in its failure to adequately inform its brokers about these risks and provide proper training. Consequently, numerous clients who had invested in structured repackaged asset-backed trust securities suffered financial losses when JP Morgan redeemed the underlying capital security in July 2012. This, in turn, dragged Wells Fargo into legal trouble.

Example #2

Imagine Smart investor A is interested in the structured repackaged asset-backed trust securities offered by Company XYZ. These financial instruments have a share price of $25. Depending on the performance of a capital instrument issued by a respected organization like JP Morgan Chase, they offer returns that range from 3% to 8%. The possibility of a consistent income appeals to investor A.

There is one crucial point to keep in mind, though: structured repackaged asset-backed trust security can be discontinued under specific circumstances. Investor A might not get their whole investment back in that case because of a swap termination charge. Before moving further with investments in structured repackaged asset-backed trust security, it is essential to understand these nuances.

Benefits

STRATS offer a bouquet of benefits to investors and lenders alike. Let's understand them briefly.

- Diversification: Investors can diversify their portfolios by spreading risk across various loans and assets.

- Customization: Investors can select from high-yield, high-risk junior tranches or low-risk, lower-return senior tranches based on their risk tolerance and return expectations.

- Enhanced Yield: Junior tranches offer higher yields to compensate for their higher risk.

- Credit Enhancement: These securities include risk mitigation mechanisms that enhance protection against losses.

- Liquidity: STRATS can be traded in secondary markets, allowing investors to adjust their investment positions as needed.

- Transparency: Regulators require disclosure of the details of underlying assets, ensuring transparency in the nature and type of securities for investors.

- Income Stream: Income-oriented investors may prefer structured repackaged asset-backed trust securities due to the steady income stream provided through interest payments.

- Risk Management: The availability of junior and senior tranches allows investors to tailor their investment profiles according to their risk tolerance and yield expectations.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Institutional investors, including banks, insurance companies, and hedge funds, typically purchase structured Repackaged Asset-Backed Trust Securities. These investors possess the knowledge and tools required to assess and understand the complexities associated with STRATS. However, ordinary investors can also access structured repackaged asset-backed trust securities through specific investment vehicles like mutual funds or exchange-traded funds (ETFs).

STRATS distinguishes itself from other structured products due to its hybrid nature, combining characteristics of both debt and equity instruments. This unique structure allows for greater flexibility in cash flow distributions and risk profiles.

Structured repackaged asset-backed trust securities may only be suitable for some investors due to their complexity and associated risk factors. They require a specific level of financial competence and a deep understanding of the underlying assets and market dynamics.

One of the risks associated with STRATS is the credit risk linked to their underlying assets. Additionally, due to their complexity, structured repackaged asset-backed trust securities are susceptible to market, liquidity, and regulatory risks.

Recommended Articles

This article has been a guide to STRATS and its meaning. Here, we explain the topic in detail along with its examples and benefits. You may also find some useful articles here -