Table Of Contents

American Stock Exchange Definition

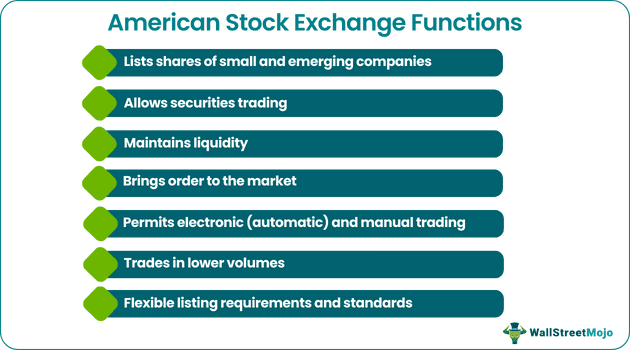

The American Stock Exchange or AMEX, now known as the NYSE American, is a marketplace in New York City, New York, allowing traders to trade securities in small volumes. It lists more than 1,200 small-cap stocks and other trading instruments, including options, bonds, derivatives, and exchange-traded funds (ETFs).

Besides listing the blue-chip companies, NYSE American lists shares of emerging entrepreneurs and companies. AMEX has been a prominent exchange in the United States with flexible listing requirements and standards. It is also responsible for ensuring that the securities market is liquid and orderly. Traders can execute automated or manual trades at AMEX.

Key Takeaways

- The American Stock Exchange or AMEX is a marketplace in New York City, New York, where traders can trade all types of securities. It is now known as the NYSE American.

- The exchange trades over 1,200 stocks, options, bonds, derivatives, and exchange-traded funds (ETFs) of small and emerging companies.

- NYSE American is also responsible for keeping the securities market liquid and orderly while allowing traders to execute automatic or manual trades.

- Trading volumes at AMEX are lower than those of the NYSE and NASDAQ. However, it has less strict listing requirements and standards than its rivals.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Explanation

The American Stock Exchange (AMEX), or NYSE American, is one of the most well-known exchanges in the world. It is also the third-largest stock exchange in the United States by market capitalization and a daily trading volume of over 80 million securities.

Investors and customers are more likely to invest in companies that trade on the exchange. For this reason, many companies wish to list on the NYSE American. Most of the exchange's trading is in small-cap stocks. It is also why companies listed in the NYSE American are revered.

Contrary to its peers, such as the New York Stock Exchange (NYSE), AMEX has lesser and more flexible rules and standards for small companies seeking to be listed. It increases the likelihood of a company's shares being traded and increasing in value quickly. NYSE American aims to bring liquidity and order in the marketplace for all companies and traders.

A company must meet many strict specifications to get listed on AMEX and before issuing an IPO, such as having:

- More than 400 shareholders

- Over 100 stocks

- At least one million shares of publicly traded stock

- Publicly traded stock prices costing more than $4 each

- Must be profitable

- A minimum of $200 million in market capitalization globally

- Or pre-tax incomes of $10 million for more than three consecutive years

The company that meets the above criteria can file documents prepared by a security underwriter. The exchange has discretion in the listing or delisting of any company for any reason.

History of American Stock Exchange

AMEX began its earliest and most basic starts in the 1900s. It has undergone several changes in its more than 100-year history caused by mismanagement, scandals, and other crises. The exchange has since expanded to become one of the largest stock exchanges in the U.S. The timeline defining the evolution of NYSE American over the years is as follows:

1908: Establishment of the exchange as the New York Curb Market Agency to regulate securities trading

1911: Formalization of the New York Curb Market Agency with the creation of the New York Curb Market Association

1921: Trading took place literally in a curb till this time as brokers would trade securities of emerging companies on streets, curbsides, or cafes near NYSE. These were called curbstone brokers.

1929: The New York Curb Market changed to the New York Curb Exchange

1953: The New York Curb Exchange renamed to American Stock Exchange trading structured products, closed-end funds, index options, shares of small to medium-sized companies, and cash equities

1975: The exchange launched its options market

1993: AMEX introduced the first exchange-traded fund

2008: NYSE Euronext acquired AMEX, integrated it with the small-cap exchange Alternext European, and renamed it to NYSE Alternext US

2009: NYSE Alternext rebranded as NYSE Amex Equities

2012: NYSE Amex Equities renamed to NYSE Market (MKT)

2016: The U.S. Securities and Exchange Commission (SEC) approved rebranding of the NYSE Market as the NYSE American

2017: The exchange renamed to NYSE American

While the exchange-traded shares of emerging companies initially, most of the firms that trade today on AMEX have joined it after many years of success. Trading has become faster and more secure on the NYSE American after digitization.

Important Things To Note

- Since AMEX’s inception, SEC has set many rules and regulations to regulate securities trading and reduce unfair advantages to more powerful brokers. The SEC also oversees the exchange's operations and assures swift response on discovering any unethical conduct.

- Today, the Intercontinental Exchange owns NYSE American. Intercontinental Exchange operates various other stock exchanges, including the International Petroleum Exchange, the Winnipeg Commodity Exchange, and the Chicago Stock Exchange.

- The main competitors of AMEX are the NYSE and the National Association of Securities Dealers Automated Quotations (NASDAQ).

- NYSE American has substantially lower trading volumes than its counterparts.

- AMEX started to rely more on technology recently to compete with its rivals. Despite the lower volumes, it now uses electronic market makers to ensure stable trading.

- AMEX has served as a model for some developing countries' stock exchanges with few technical problems.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The American Stock Exchange (AMEX), often known as NYSE American, is one of the most well-known stock exchanges in the world. It is also the third-largest exchange in the United States in market value and a daily trading volume of over 80 million shares. The New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations are its major competitors (NASDAQ).

AMEX trades over 1,200 small and emerging company stocks, options, bonds, derivatives, and exchange-traded funds (ETFs). It is also in charge of keeping the securities market liquid and orderly and allowing traders to trade automatically or manually. It has complete discretion over whether or not to list or delist any corporation for any reason.

NYSE American differs from the NYSE in many respects, including having more flexible regulations and standards for companies seeking to be listed, lower trading volumes, and a focus on small and emerging businesses.