Table Of Contents

What Is Return on Equity (ROE)?

Return on Equity (ROE) is a profitability metric used to compare the profits earned by a business to the value of its shareholders’ equity. The figure obtained helps the management and investors understand the financial position of the company, which thereby helps them make appropriate business and investment decisions.

ROE is calculated by dividing the Net Income of a firm by Shareholders' Equity and is presented as a percentage. Thus, if a company’s RoE is 15%, it indicates that the corporation earns $15 on every $100 of its share capital.

Table of contents

- Return on equity measures a company's profitability by comparing earnings to shareholders' equity as a percentage.

- To better understand a company's ROE, one can use the DuPont ROE equation by expanding the ROE formula. The DuPont model allows one to analyze three different ratios to determine whether investing in the company is wise.

- If you are an investor and want to know why a company's ROE is high or low, you can use DuPont analysis. It will help you pinpoint the company's strengths and weaknesses.

Return on Equity Explained

Return on Equity (RoE) helps assess the performance of a firm with respect to its finances. A good return on equity signifies the better financial performance of a company. The net income of a firm is divided by shareholder’s equity, which is the difference between the assets of the firm and its debt, to obtain the RoE. When the assets earned or acquired by a company is more than the debt, it automatically indicates a positive growth of the company. Additionally, the net income divided by that difference, if brings out a significant figure, the growth indicated is in the positive direction.

When the RoE is significant, the management knows their business is on the right track. However, if the figure is not good, improvement measures are taken up so that the figure is better the next time. Similarly, for institutional investors, if the RoE figure is convincing, they invest in the shares of the company, else they look for an entity having a better hold in the market.

A good RoE is a must for investors to trust a firm. If the RoE is better, it proves that the management of the firm is stable and progressive. A bad figure indicates the untrustworthiness of the management of the company.

Return on Equity (ROE) Explained in Video

Formula

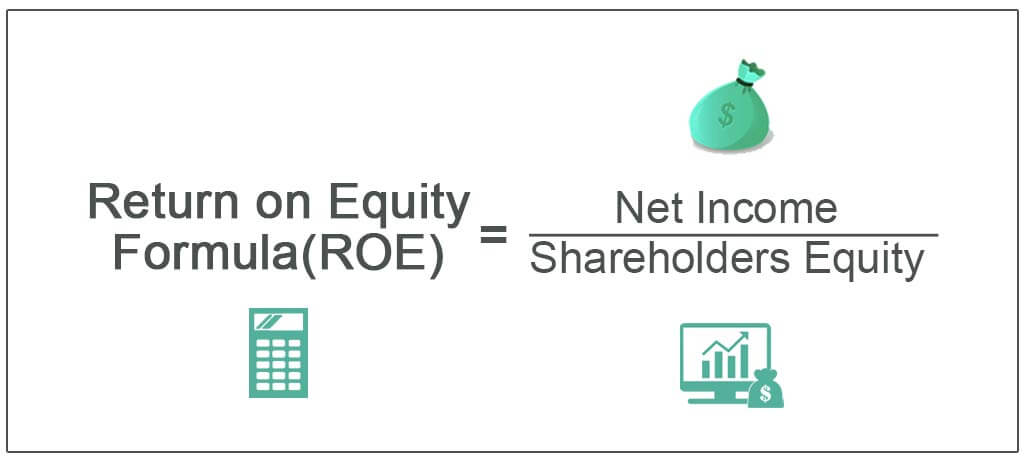

The formula of Return on Equity is stated below –

Return on Equity Formula = Net Income / Total Equity

To see how to calculate the return on equity of a company, let us consider the following example of two companies having the same net income but different shareholder equity components.

| Particulars | Company A | Company B |

|---|---|---|

| Net Income | $5,000 | $5,000 |

| Shareholder's Equity | $20,000 | $12,000 |

The ROE arrived after applying the formula are given as under

If one were to notice, we could see that the net income earned by the companies is the same. However, they differ concerning the equity component.

Hence by looking at the example, we can understand that a higher ROE is always preferred as it indicates efficiency from the side of the management in generating higher profits from the given amount of capital.

Interpretation

You can interpret ROE by expanding the ROE formula and using the Dupont ROE equation.

DuPont ROE = (Net Income / Net Sales) x ( Net Sales / Total Assets) x Total Assets / Total Equity

DuPont Return on Equity = Profit Margin * Total Asset Turnover * Equity Multiplier

Now you can interpret that they all are different ratios. If you wonder how come we have concluded that if we multiply these three ratios, we will get a return on equity, here's how we have concluded.

- Profit Margin = Net Income / Net Sales

- Total Asset Turnover = Net Sales / Average Total Assets (or Total Assets)

- Equity Multiplier = Total Assets / Total Equity

ROE is always useful. But those investors who want to find out the "why" behind the current ROE (high or low) need to use DuPont analysis to pinpoint where the actual problem lies and where the firm has done well.

In the DuPont model, we can look at three different ratios by comparing which they can conclude whether it's wise for them to invest in the company.

For example, if an equity multiplier, if we find out that the firm is more dependent on debt rather than equity, we may not invest in the company because that may become a risky investment.

On the other hand, using this DuPont model would be able to pare down the chances of losses by looking at profit margin and asset turnover and vice versa.

Examples

Let us consider the following examples to understand the return on equity meaning better along with how it is calculated.

Example # 1

Let’s look at two firms, A and B. Both of these companies operate in the same apparel industry, and most astonishingly, both of their Return on Equity (ROE) is 45%. Let’s look at the following ratios of each company so that we can understand where the problem lies (or opportunity) –

| Ratio | Firm A | Firm B |

|---|---|---|

| Profit Margin | 40% | 20% |

| Total Asset Turnover | 0.30 | 5.00 |

| Equity Multiplier | 5.00 | 0.60 |

Now let’s look at each of the firms and analyze them.

For Firm A, the profit margin is great, i.e., 40%, and financial leverage is also quite good, i.e., 4.00. But if we look at the total asset turnover, it’s much less. That means Firm A is not able to utilize its assets properly. But still, due to the other two factors, the Return on Equity is higher (0.40 * 0.30 * 5.00 = 0.60).

For Firm B, the profit margin is much lower, i.e., just 20%, and the financial leverage is very poor, i.e., 0.60. But the total asset turnover is 5.00. Thus, for higher asset turnover, Firm B has performed well in the overall sense of Return on Equity (0.20 * 5.00 * 0.60 = 0.60).

Now imagine what would happen if the investors would only look at the Return on Equity of both these firms, they would only see that the ROE is quite good for both firms. But after doing DuPont analysis, the investors would get the actual picture of both of these firms.

Example # 2

At the of the year, we have these details about two companies –

| In US $ | Company X | Company Y |

|---|---|---|

| Net Income | 15,000 | 20,000 |

| Net Sales | 120,000 | 140,000 |

| Total Assets | 100,000 | 150,000 |

| Total Equity | 50,000 | 50,000 |

Now, if we directly calculate the ROE from the above information, we would get –

| In US $ | Company X | Company Y |

|---|---|---|

| Net Income (1) | 15,000 | 20,000 |

| Total Equity (2) | 50,000 | 50,000 |

| Return on Equity (1 / 2) | 0.30 | 0.40 |

Using the DuPont Analysis, we would look at each of the components (three ratios) and find out the real picture of both of these companies.

Let’s calculate the profit margin first.

| In US $ | Company X | Company Y |

|---|---|---|

| Net Income (3) | 15,000 | 20,000 |

| Net Sales (4) | 120,000 | 140,000 |

| Profit Margin (3 / 4) | 0.125 | 0.143 |

Now, let’s look at total asset turnover.

| In US $ | Company X | Company Y |

|---|---|---|

| Net Sales (5) | 120,000 | 140,000 |

| Total Assets (6) | 100,000 | 150,000 |

| Total Asset Turnover (5 / 6) | 1.20 | 0.93 |

We will now calculate the last ratio, i.e., the companies' financial leverage.

| In US $ | Company X | Company Y |

|---|---|---|

| Total Assets (7) | 100,000 | 150,000 |

| Total Equity (8) | 50,000 | 50,000 |

| Financial Leverage (7 / 8) | 2.00 | 3.00 |

Using DuPont analysis, here’s the ROE for both of the companies.

| In US $ | Company X | Company Y |

|---|---|---|

| Profit Margin (A) | 0.125 | 0.143 |

| Total Asset Turnover (B) | 1.20 | 0.93 |

| Financial Leverage (C) | 2.00 | 3.00 |

| Return on Equity (DuPont) (A*B*C) | 0.30 | 0.40 |

If we compare each of the ratios, we will see a clear picture of each company. For Company X and Company Y, financial leverage is the strongest point. Both of them have a higher ratio of financial leverage. In the case of profit margin, both companies have a lesser profit margin, even less than 15%. The asset turnover of Company X is much better than Company Y. So when investors would use DuPont, they would be able to understand the critical points of the company before investing.

Example 3 (Nestle)

Let’s look at Nestle's income statement and balance sheet, and then we will calculate the ROE and ROE using DuPont.

Consolidated income statement for the year ended 31st December 2014 & 2015

The consolidated balance sheet as of 31st December 2014 & 2015

Source: Nestle.com

- ROE Formula = Net Income / Sales

- Return on Equity (2015) = 9467 / 63986 = 14.8%

- Return on Equity (2014) = 14904 / 71,884 = 20.7%

We would use DuPont analysis to calculate Return on Equity for 2014 and 2015.

| In millions of CHF | 2015 | 2014 |

|---|---|---|

| Profit for the year (1) | 9467 | 14904 |

| Sales (2) | 88785 | 91612 |

| Total assets (3) | 123992 | 133450 |

| Total Equity (4) | 63986 | 71884 |

| Profit Margin (A = 1/2) | 10.7% | 16.3% |

| Total Asset Turnover (B = 2/3) | 0.716x | 0.686x |

| Equity Multiplier (C = 3/4) | 1.938x | 1.856x |

| Return on Equity (A*B*C) | 14.8% | 20.7% |

As we noted above, the basic ROE formula and DuPont Formula provide us with the same answer. However, DuPont analysis helps us analyze why there was an increase or decrease in ROE.

For example, for Nestle, Return on Equity decreased from 20.7% in 2014 to 14.8% in 2015. Why?

DuPont Analysis helps us find out the reasons.

We note that Nestle’s Profit Margin for 2014 was 16.3%; however, it was 10.7% in 2015. We note that this is a huge dip in profit margin.

Comparatively, if we look at other components of DuPont, we do not see such substantial differences.

- Asset Turnover was 0.716x in 2015 as compared to 0.686x in 2014

- Equity Multiplier was at 1.938x in 20.15 as compared to 1.856x in 2014.

We conclude that the decrease in profit margin has led to the reduction of ROE for Nestle.

Example 4 (Colgate)

Now that we know how to calculate Return on Equity from Annual Filings, let us analyze the ROE of Colgate and identify reasons for its increase/decrease.

Below is a snapshot of the Colgate Ratio Analysis Excel Sheet. You can download this sheet from Ratio Analysis Tutorial. Please note that in Colgate’s calculation of ROE, we have used Average Balance Sheet numbers (instead of year-end).

Colgate Return on Equity has remained healthy in the last 7-8 years. Between 2008 to 2013, ROE was around 90% on average.

In 2014, the Return on Equity was at 126.4%, and in 2015, it jumped significantly to 327.2%.

It has happened despite a 34% decrease in Net Income in 2015. Return on Equity jumped significantly because of the decrease in Shareholders Equity in 2015. Shareholder's equity decreased due to share buyback and accumulated losses that flow through the Shareholder's Equity.

Colgate Dupont Return on Equity = (Net Income / Sales) x (Sales / Total Assets) x (Total Assets / Shareholder's Equity). Please note that the Net Income is after the minority shareholder's payment. Also, the shareholder’s equity consists of only the common shareholders of Colgate.

We note that the asset turnover has shown a declining trend over the past 7-8 years. Profitability has also declined over the past 5-6 years.

However, ROE has not shown a declining trend. It is increasing overall. It is because of the Equity Multiplier (total assets / total equity). The Equity Multiplier has shown a steady increase over the past five years and stands at 30x.

Importance

RoE is a metric that lets the management and investors assess the financial performance of a company.

- The figure obtained shows how well the shareholder’s equity is utilized by a particular form.

- It helps assess the growth rate of the firm in question,

- The consistency and sustainability in growth is easily figured out.

- It helps the management make proper decisions, be it improving the operational measures or continuing with the same pace, depending on how proper the RoE obtained is.

- It allows investors to check the performance rate of a company and decide whether to invest in its assets or not.

Limitations

Though Return on Equity (RoE) allows companies and investors learn about how progressive an entity is, the metric does have some limitations too. Some of the challenges that one may face while computing the figure are as follows:

- There are so many inputs to be fed. So if there is one error in the calculation, the whole thing would go wrong. Moreover, the source of information also needs to be reliable. The wrong calculation means a wrong interpretation.

- Seasonal factors should also be considered in terms of calculating the ratios. In the case of DuPont Analysis, the seasonal factors should be taken into account, which most of the time isn’t possible.

Return On Equity Vs Return On Capital Employed

Both Return on Equity (RoE) and Return on Capital Employed (RoCE) are metrics that check how efficiently a firm utilizes its resources and evaluates the financial performance of a firm. Both these figures are studied and observed separately to see how well a company is performing financially. However, there are a few differences between the two terms that the investors must be aware of before they decide which one of them should be given more weightage:

- RoE indicates the earnings of shareholders associated with the firm for every penny that they have invested in it. RoCE, on the other hand, informs how properly or improperly a company utilizes the available capital for maximum profits.

- A higher RoE means better returns for the shareholders with respect to what they have invested, while a higher RoCE indicates that a company is more likely to earn profits.

- RoE only takes into consideration the shareholder’s capital employed, while RoCE considers the total capital employed by a firm.

- The former helps assess how a company utilizes shareholder’s equity; whereas the latter lets evaluate how a company utilizes the total resources available to it.

ROE Video

Frequently Asked Questions (FAQs)

Understanding your business's profitability for owners and investors is crucial. Return on equity is a valuable tool that provides insights into this area. It helps investors determine if their investment generates a good return. Additionally, it serves as an effective way to assess how efficiently your company is utilizing its equity.

ROE and ROI are two financial ratios used to evaluate investments. ROE calculates the return on invested equity as a percentage, while ROI calculates the return on investment. ROE measures how efficiently an investment is utilized, while ROI measures profitability.

To calculate ROE, divide net profit by net worth. A low ROE suggests the company could have used shareholder capital more effectively. A company with an ROE above 20% is considered a good investment.

Recommended Articles

This article has been a guide to what is Return on Equity. Here, we explain the concept with formula, vs RoCE, examples, interpretation, importance, and limitations. You may also have a look at the following articles: