Table Of Contents

What is the Inflation Formula?

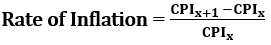

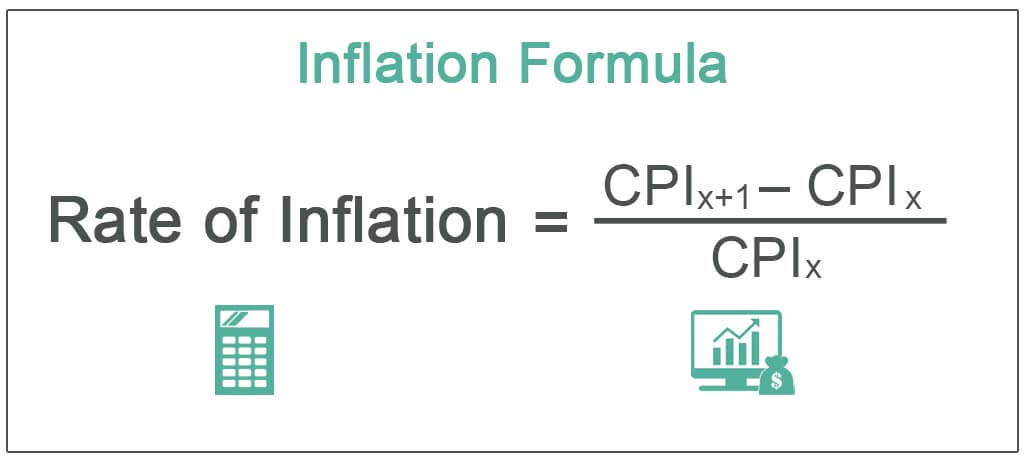

The rise in prices of goods and services is referred to as inflation. One of the measures of inflation is the Consumer Price Index (CPI), and the formula for calculating inflation is:

Rate of Inflation = (CPIx+1 - CPIx ) / CPIx

Where,

- CPIx is Consumer Price Index of Initial Year

- CPIx+1 is Consumer Price Index of next year

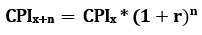

In certain cases, we need to calculate the rate of average inflation over a number of years. The formula for the same is:

CPIx+n = CPIx * (1+r)n

Where,

- CPIx is Consumer Price Index of Initial Year,

- n is number of years after the initial year,

- CPIx+n is Consumer Price Index of n years after the initial CPI year,

- r is the rate of interest

Key Takeaways

- The inflation formula calculates the rate at which the prices of goods and services have increased in an economy over a year.

- It is typically measured using the Consumer Price Index (CPI), which can be obtained from reports released by the Bureau of Labor Statistics in the USA.

- Inflation is a crucial indicator as it impacts the prices of consumer goods and services, affecting the purchasing power of consumers.

Explanation of Inflation Formula

To find out the rate of inflation for one year, follow the given steps:

Step 1: Find out the CPI of the initial year. CPIx denotes it.

Step 2: Find out the CPI of next year. It is denoted by CPIx+1.

Step 3: Calculate the inflation using the formula:

Multiply the above number obtained by 100 if you want the inflation rate in percentage terms.

To find out the average rate of inflation over several years, follow the given steps:

Step 1: Find out the initial CPI.

Step 2: Find out the CPI after n years.

Step 3: Use the following formula to find out the rate of inflation denoted by r.

By solving the above equation, we can find out the inflation rate, denoted by r.

Note: Instead of the Consumer Price Index (CPI), some other measures of inflation, such as the Wholesale Price Index (WPI), may be used. The steps would be the same.

Video Explanation of Inflation

Examples of Inflation Formula (with Excel Template)

Let’s see some simple to advanced examples of the inflation equation to understand it better.

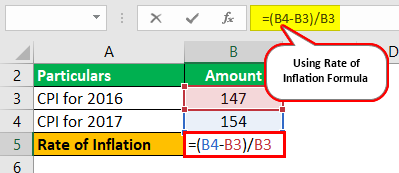

Inflation Formula Example #1

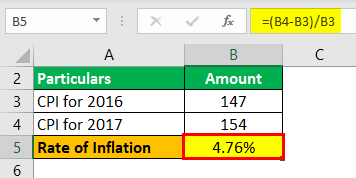

The Consumer Price Index (CPI) for 2016 for a certain country is 147. The CPI for 2017 is 154. Find out the rate of inflation.

Solution:

Use the given data for the calculation of inflation.

| Particulars | Amount |

|---|---|

| CPI for 2016 | 147 |

| CPI for 2017 | 154 |

Calculation of the rate of inflation can be done as follows:

Rate of Inflation = ( 154 - 147 ) / 147

Rate of Inflation will be -

Rate of Inflation = 4.76%

The rate of inflation is 4.76%.

Inflation Formula Example #2

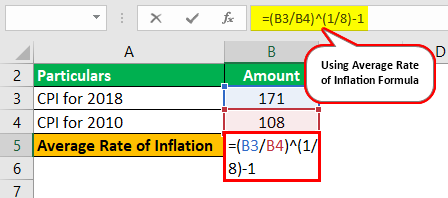

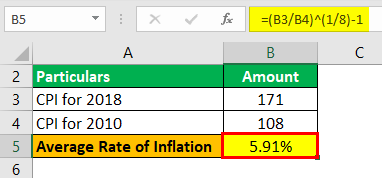

The Consumer Price Index (CPI) for 2010 is 108. The CPI for 2018 is 171. Calculate the average rate of inflation for the years.

Solution:

Use the given data for the calculation of inflation.

| Particulars | Amount |

|---|---|

| CPI for 2018 | 171 |

| CPI for 2010 | 108 |

Calculation of the average rate of inflation can be done as follow:

Here, the number of years (n) is 8.

CPIx+n= CPIx * ( 1 + r )^n

(1+r)^n = 172 / 108

1+r = ( 172 / 108 )^(1/n)

r = ( 172 / 108 )^(1/n) - 1

The average rate of inflation will be -

The average rate of inflation (r)= 5.91%

The average rate of inflation between 2010 and 2018 is 5.91%.

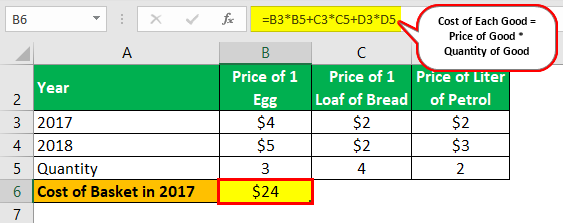

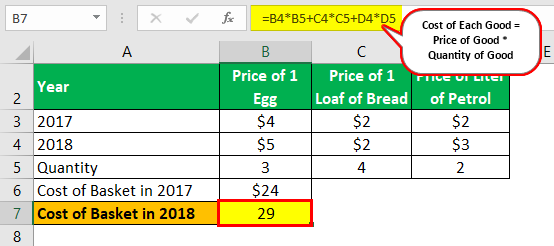

Inflation Formula Example #3

A common household in a country buys three eggs, four loaves of bread, and 2 liters of petrol each week. The prices of these goods for 2017 and 2018 are as under:

| Year | Price of 1 Egg | Price of 1 Loaf of Bread | Price of Liter of Petrol |

|---|---|---|---|

| 2017 | $4 | $2 | $2 |

| 2018 | $5 | $2 | $3 |

Calculate the rate of inflation for 2018.

Solution:

Calculation of Cost of Basket in 2017 will be -

Cost of Basket in 2017 = $4*3 + $2*4 + $2*2

Cost of Basket in 2017 = $24

Calculation of Cost of Basket in 2018 will be -

Cost of Basket in 2018 = $5*3 + $2*4 + $3*2

Cost of Basket in 2018 = $29

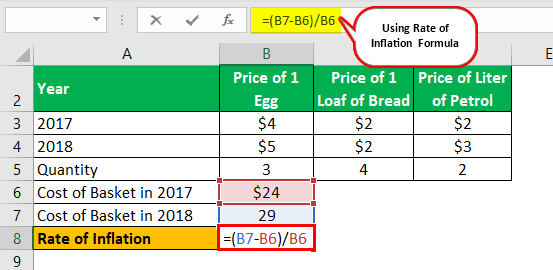

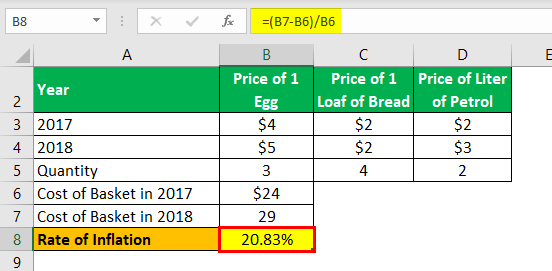

Calculation of the rate of inflation can be done as follows:

Rate of Inflation = ($29 - $24 ) / $24

Rate of Inflation will be -

Rate of Inflation = 0.2083 or 20.83%

The rate of inflation in 2018 is 20.83%.

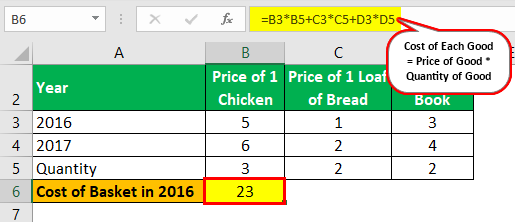

Inflation Formula Example #4

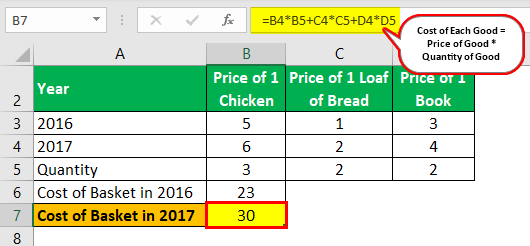

The prices of certain goods in 2016 and 2017 are as under:

| Year | Price of 1 Chicken | Price of 1 Loaf of Bread | Price of 1 Book |

|---|---|---|---|

| 2016 | 5 | 1 | 3 |

| 2017 | 6 | 2 | 4 |

A common household in a country buys three chickens, two loaves of bread, and two books in a week. Calculate the rate of inflation in 2017.

Solution:

Step 1: We have to calculate the cost of a basket in 2016.

Cost of Basket in 2016 =5*3+1*2+3*2

Cost of Basket in 2016 = 23

Step 2: We have to calculate the cost of a weekly basket in 2017.

Cost of Basket in 2017 = 6 * 3 + 2 * 2 + 4 * 2

Cost of Basket in 2017 = 30

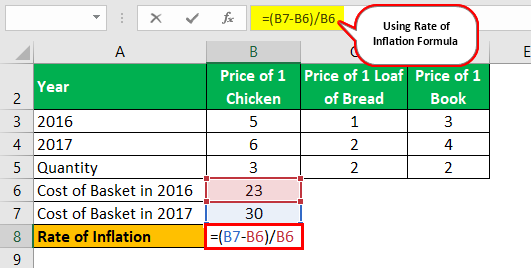

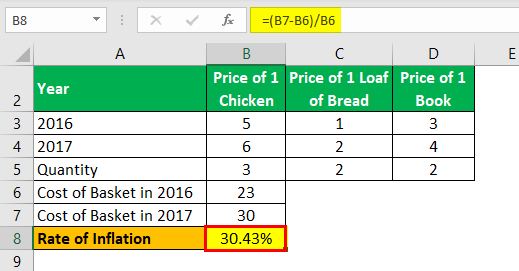

Step 3: We calculate the rate of inflation in the final step.

Rate of Inflation = ( 30 - 23 ) / 23

Rate of Inflation = 30.43 %

The rate of inflation is 30.43%.

Inflation Formula Calculator

You can use this inflation formula calculator.

Relevance and Uses

- The rate of inflation is an important input in the monetary policy framework by central banks. If inflation is too high, it may hike interest rates. If inflation is too low, central banks may lower the inflation rate.

- Intuitively, it may seem that if inflation is negative (known as deflation), it is good for the country. However, this is not true. The deflationary situation may lead to low growth.

- Having a low inflation rate is considered good for the economy. However, generally, economists may not agree on the ideal inflation rate in the economy.

- If inflation is high and volatile, it creates uncertainty about the future prices of goods and services. High inflation tends to discourage investment. It, in turn, reduces growth in the long run. High inflation may be caused by an increase in the money supply in the economy.

- When inflation is high, the cost of living of the wage earners increases. Hence, wage owners may demand higher wages. It, in turn, may increase the costs of goods and services, leading to more inflation. It may lead to a spiral of higher inflation.

- When inflation is too high, people may be discontented. It may lead to social and political unrest. The value of savings held by households and firms reduces in high inflation. Higher inflation increases the cost of goods produced in the country. It may reduce the export competitiveness of the country.

- The nominal Gross Domestic Product (GDP) of a country is the combination of real GDP and inflation. Thus, if the nominal GDP growth is 10% and the inflation rate is 4%, the real rate of GDP growth is approximately 6%. Thus, the real GDP growth that is widely reported is nothing but net growth.