Table Of Contents

What Is Real GDP?

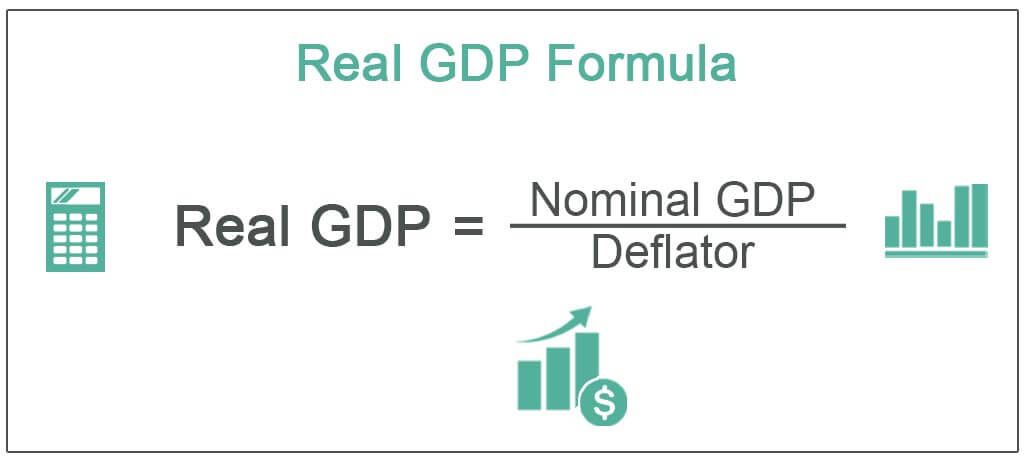

Real GDP can be defined as an inflation-adjusted measure that reflects the value of services and goods that are produced in a given single year by an economy which can be expressed in the prices of the base year, and that can be referred to as constant dollar GDP, or inflation corrected GDP. Below given is the formula to calculate real GDP.

Analyzing the real GDP equation helps measure domestic production and the country’s economic health. This gives economists, investors, and leaders of the economy an idea of the economy’s health and the trends of the near future of the economy in question. It is a better indicator as a comparison with the base year’s GDP is possible.

Key Takeaways

- One can calculate the real gross domestic product by multiplying the nominal GDP by a deflationary number (N) or dividing the nominal GDP by the same (N).

- Real GDP is a measure of the value of services and goods generated in an economy in a certain calendar year that is corrected for inflation.

- Suppose there is a significant discrepancy between a country's nominal and real gross domestic product.

- In that case, this indicates either a significant deflation (if the nominal is lower) or inflation (if the real is lower) in that country's economy compared to the deflator's base year.

Real GDP Explained

The real gross domestic product is derived as a nominal GDP over or dividing the same by a deflating number (N): (nominal GDP) / (N). Compared to the base year, the GDP deflator can be considered the measurement of inflation. Finally, dividing the nominal GDP number by this deflator shall remove any inflation effects.

Therefore, A huge difference between a country’s nominal and the real gross domestic product shall signify a substantial deflation (in case the nominal is lower) or inflation (in case the real is lower) in its economy in comparison to the base year of the deflator.

How To Calculate?

Real GDP Formula = Nominal GDP / Deflator

Where,

- Deflator is a measurement of inflation

Examples

Let us understand the concept of real GDP growth with the help of a few examples and calculations.

Example #1

Suppose an economy’s GDP is $2 million, and since the base year, the prices of the economy have increased by 1.5%. Let us use the real GDP calculator based on these estimates.

Solution

- Nominal GDP: $2,000,000

- Deflator Rate: $1.015

Using the above formula, let us calculate the real GDP:

= $2,000,000/ (1+1.5%)

=$2,000,000 /(1.015)

Real gross domestic product will be -

Real gross domestic product = 1,970,443.35

Hence, the real gross domestic product is $1,970,443.35

Example #2

ABC is one of the largest economies in the world. Mr. VJ has joined the statistics department which reports the country’s key statistics including gross domestic product calculation. Mr. VJ has to calculate real GDP based on the below information provided by his senior.

- Private Consumption Expenditure: 1000000

- Government Expenditure: 5000000

- Private Domestic Expenditure: 2500000

- Exports: 1500000

- Imports: 9000000

Solution:

Per the above information, let us use the real GDP calculator, assuming the inflation was 2% compared to the base year. Here, we do not have a direct nominal GDP value; hence, we must first calculate the nominal GDP.

To calculate the nominal GDP, we need to add all the expenditures and exports and reduce imports since that was not produced.

Therefore, let us calculate the nominal GDP:

Nominal GDP = 10,00,000 + 50,00,000 + 25,00,000 + 15,00,000 – 90,00,000

Nominal GDP = 10,00,000

Let us calculate the real gross domestic product:

= 10,00,000 /(1+2.00%)

=10,00,000/(1.02)

The real gross domestic product will be -

real gross domestic product = 9,80,392.16

Hence, the real gross domestic product is 9,80,392.16

Example #3

Rico is an emerging country. Mr. Waffet is considering investing in Rico and is long in the country. However, some street analysts don’t agree with him. Mr. Waffet believes that Rico is on the verge of listing in the top 10 emerging markets as currently, it stands at 20 as per the list published. However, street analysts believe that if the real gross domestic product is more than 1 million, it can be in the top 10 list next year. One of the renowned statistics websites provides details about the country.

- Rent Income: 115000

- Wages Earned by Labor: 420000

- Corporate Profits: 287500

- Depreciation: 172500

- Indirect Taxes Paid: 35000

Let's calculate real gross domestic product, assuming that the inflation rate compared to the base year was 3%.

Solution:

Here, we don't have the direct nominal GDP value, hence first we need to calculate the nominal GDP.

To calculate the nominal GDP, we just need to add all the income along with depreciation and indirect taxes since that reduces the gross income.

Therefore, Nominal GDP can be calculated as follows,

= 1,15,000 + 4,20,000 + 2,87,500 + 1,72,500 + 35,000

Nominal GDP = 10,30,000

Therefore, the calculation of real GDP can be done using the above formula:

= 10,30,000/(1+3.00%)

= 10,30,000/(1.03)

real gross domestic product will be -

real gross domestic product = 10,00,000

Since the real gross domestic product is not more than 1 million, the country might fail to make it to the top 10 list.

Limitations

Since the nominal GDP is calculated in the monetary value of all the services and goods produced, those shall be liable to change if there is a price change. For example, falling prices will lead to a decrease in the nominal GDP, and rising prices will make the nominal GDP depict as bigger or, say, larger.

But again, these changes shall not affect or depict any change in the quality or the quantity of all the services and goods being produced. Because of this, it would be difficult to answer just from the nominal GDP whether the production of the country or the economy is expanding. Amending or providing the adjustment for price changes will solve this.

The result, that is the real gross domestic product shall provide a better judgment or better basis for concluding the long-term national economic performance of the country.