Table of Contents

What Are Options Strategies?

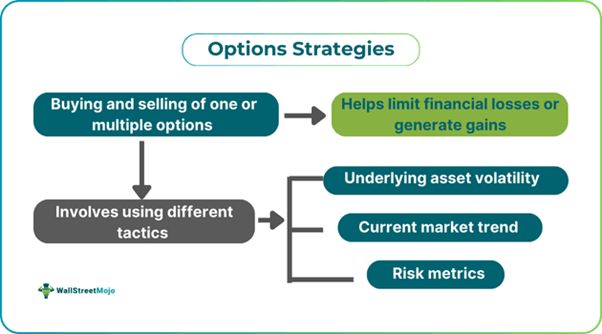

Options strategies involve buying at least one option using a combination of multiple tactics, like underlying asset volatility and risk metrics. They help restrict financial losses. One can also use these strategies to speculate on the underlying asset’s future price movement and generate gains.

The combination in the case of such strategies differs from one another on the basis of certain elements, which are expiry date, strike price, and out-of-the-money (OTM), in-the-money (ITM), or at-the-money (ATM). Broadly, there are different kinds of strategies that options traders can utilize to fulfill their objectives. Some of them are long call, bull call spread, and long put.

Key Takeaways

- Options strategies involve utilizing one or more options contracts and using different tactics, for example, the underlying asset’s volatility, to hedge positions and generate income.

- There are three kinds of option strategies — neutral, bearish, and bullish options strategies.

- Long put is an example of a bearish strategy, while short strangle and synthetic calls are examples of neutral and bullish strategies in options trading.

- Long put is an example of a bearish strategy, while short strangle and synthetic calls are examples of neutral and bullish strategies in options trading.

- However, the short straddle strategy can be executed successfully if the expected volatility is low.

Options Strategies In Trading Explained

Options strategies refer to guidelines or rules traders follow when using options to fulfill their trading objectives. Such strategies assist individuals in deciding how, which, and when to sell or purchase to safeguard their investment portfolio or make financial gains on the basis of price changes and anticipated market movements. The tried and tested strategies concerning options have made traders interested in utilizing these financial instruments to project market movements and make profits.

These derivatives have three key components determining their cost or premium. The price of the underlying asset, for example, stock, the strike price of the contract, and the expiration date. The trading of options enables individuals to adopt a more dynamic approach compared to when trading stocks. One must note that options are available to trade an extensive range of exchange-traded funds or ETFs and stocks.

Based on the anticipated price movement of the underlying asset, individuals can pick from a variety of strategies to reach their goal when trading.

Types

Broadly speaking, there are three kinds of options strategies — neutral, bullish and bearish options strategies. Let us dive into some noteworthy strategies that fall into these three categories.

#1 - Bullish Options Strategies

- Bull Call Spread: This strategy involves utilizing two call options having different strike prices for creating a range. Both contracts must have an identical expiration date and underlying asset. Nevertheless, traders purchase 1 ATM call option and sell one OTM call option simultaneously.

- Bull Put Spread: This bullish options strategy is like a bull call spread. In this case, traders use a couple of put options having different strike prices and identical expiration dates for creating a range. That said, the trader purchases an OTM put option while offloading an ITM put option at the same time.

- Synthetic Call: Traders utilize this strategy when they are optimistic regarding the underlying asset’s long-term outlook but are concerned about the associated downside risks. As part of the strategy, traders purchase the same underlying asset’s put option. In case the underlying asset’s price increases, the profit potential will have no limit. On the other hand, the loss potential cannot be higher than the premium amount.

- Call Ratio Back Spread: This strategy involves traders purchasing a couple of OTM call options while offloading an ITM call option simultaneously. While there is unlimited profit potential, in this case, one would incur financial losses if the price of the underlying asset remains within a certain range.

#2 - Neutral Option Strategies

- Short Straddle: In this case, traders sell both put and call options on the exact underlying asset with the same expiry dates and ATM strike prices. It is ideal if the anticipated volatility is low and the writer can accumulate options premiums without having the underlying asset’s ownership.

- Long Straddle: It is the opposite of the short straddle strategy. This means traders make profits if volatility is anticipated to be high. As part of the strategy, traders purchase call and put options having similar expiration and strike prices. If the asset’s price remains flat, the contracts expire worthless with the trader losing their premium. However, if the asset is volatile, one out of the two options contracts will increase in value.

- Long Strangle: This strategy can be ideal if one is anticipating high volatility but is unsure about the future price movement. It involves first buying a call option that has an OTM strike price and then purchasing a put option having an opposite out-of-the-money strike price. Note that both must have an identical expiry date.

- Short Strangle: Contrary to the long strangle strategy, individuals generally use short strangle when the anticipated volatility is low, and the movement of the underlying asset’s price is flat.