Table Of Contents

What Is Predatory Lending?

Predatory lending is an aggressive approach the lender follows to entice borrowers to take a loan that carries a high fee, high-interest rate, unnecessary penalties, and other such aggressive credit terms.

Many practices conducted in predatory lending are not considered illegal, even though they might ruin the borrower's financial status. Therefore, the only way to save people from such practices is to educate them about their rights and lending procedure.

Key Takeaways

- Predatory lending is an aggressive strategy lenders use to persuade borrowers. Such actions have started becoming more prevalent in home mortgages.

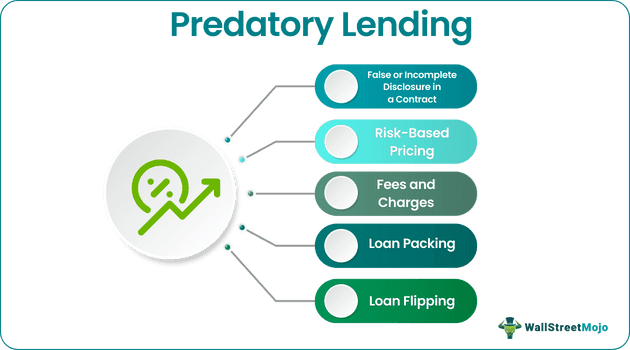

- Predatory lending comprises false or incomplete disclosure, risky pricing, loan flipping, fees, and loan packing.

- Predatory lending includes understanding pricing and terms, inconsistent payment structure, payday loans, and aggressive approach.

Predatory Lending Explained

Predatory lending is an unethical practice of lending money to borrowers by exploiting their lack of knowledge, or financial weakness and chargin high interest, hidden fees, loan flipping, etc. The lenders trap the borrowers in a debt cycle and this takes place in various sectors and types of loans like car loan, credit card loan, etc.

Often predatory lending practices targets minorities, poor, elderly, or less educated people in the society, as many of these people need immediate cash in various scenarios, e.g., billing, medical expense, etc. Moreover, such practices have increased in home mortgages, as real property lenders' back house mortgages can benefit from loan terms and the sale of the house in case the buyer defaults. Although many practices in predatory lending don't come under illegal activity, it affects people who get trapped in such practices and can ruin their lives due to huge debt or homelessness.

Many actions result in predatory lending. For example, not disclosing complete information while getting into the contract, false information, inflated charges, risk-based pricing, loan packing, asset-based lending, etc. Some of these practices are carried out by an individual or in a group creating a huge amount of debt, which results in financial distress to an individual or group.

Individuals need to understand the contract before getting into it. If the borrower needs to understand specific terms and calculations within such lending contracts, they should avoid signing them. In addition, every borrower must understand the difference between fair practice to get a loan and the easy availability of loans. Although the government is taking many steps against predatory lending practices, general awareness is required to understand and avoid falling into the trap of such practices.

Predatory Lending Practices

There are various types of conditions and ways that can be used to implement this kind of mortgage predatory lending practice. It is necessary to understand this methods so that borrowers can easily identify them in the loan contract.

- False or Incomplete Disclosure in a Contract: The lender hides many conditions, charges, fees, risks involved, or loan terms involved from the borrower while getting into the contract.

- Risk-Based Pricing: Although not considered illegal, risk-based pricing greatly impacts borrowers with bad credit histories. Many lenders use this to charge high-interest rates to borrowers who are more likely to default, which eventually increases the financial burden on the borrower.

- Fees and Charges: Many charges are applied while making a contract by the lender with an approach of, 'take it or leave it.' If the borrower is educated enough to understand these unnecessary chargers can deny contract terms and make the lender back off and move on instead of falling into the trap.

- Loan Packing: Many lenders include charges for products like credit insurance, which pays off the debt if the buyer defaults.

- Loan Flipping: The borrower takes an additional loan to pay off the current loan with a higher interest rate, eventually increasing the financial burden.

Examples

Let us understand the mortgage predatory lending method with some examples.

- Focusing on Small Periodic Payment: Lender often attracts borrowers with small periodic payments instead of total payment, which looks affordable to people with lower income levels. For example, a monthly payment of $400 instead of giving detail of the entire loan amount of $25,000.

- Balloon Payment: Easy payment at the early stage of increasing mortgage amount afterward results in an increasing burden on the borrower due to which they can default.

- Packing Loans: Extra fees, charges, penalties are charged while making a contract, which the borrower might not be completely aware of. In such practices, lenders concentrate on schemes that generate higher fees instead of looking into the consumer's requirements.

Reasons For Getting Trapped

There are various reasons why customers or borrowers get trapped into such unethical practices. The reasons are listed below.

- Lack of knowledge of rights and terms of the contract: Predatory lending companies target many customers due to their lack of knowledge. Many customers sign contracts without understanding entire terms, which results in unnecessary hidden charges, high-interest rates, higher payments, penalties, etc.

- Less Groundwork: Due to less groundwork, many lower-income people take a loan from lenders without understanding terms and conditions completely and end up paying a much higher interest rate or higher charges during repayment.

- Urgent financial need - Predatory lending targets minorities, senior citizens, the poor, less educated, and people with low credit scores who might need immediate cash in an emergency. Since many of these people cannot directly approach traditional lenders due to requirements and procedures, they fall into this trap.

Warning Signs

Let us identify some warning signs that will help us understand that the lender is making a predatory offer of loan and thus avoid predatory lending lawsuit.

#1 - Understanding of Pricing and Terms

- If there is a lack of transparency in the contract that the borrower does not understand, they should walk away.

- In reality, lenders provide the full calculation of fees, risks, terms while getting into an agreement. If the lender is not doing that, it is ideal for clarifying your doubts before signing the contract.

- If you don't understand certain terms, fees, penalties, it is ideal to consult with a lawyer or educate yourself before signing the contract.

#2 - Aggressive Approach

Many lenders take an aggressive approach while lending. For example, there is much jargon used in a contract for higher fees or high-interest rates, resulting in much higher payment from your side.

#3 - Easy Approval

- In general lending, the contract requires documentation, detailed information about the borrower, review process.

- If the lender provides loans before conducting proper due diligence, you should be alert as it might be a trap.

- Such lenders provide an offer that sounds tempting with less groundwork.

#4 - Inconsistent Payment Structure

The borrower should never agree to the payment structure, which changes periodically. Ideally, payment should be consistent with the schedule. The borrower needs to know how much further payment has to be done by them to complete the repayment of the loan.

#5 - Payday Loans

Short term loans like payday loans charge a very high rate of interest, with penalties and charges in case of late payment, resulting in borrowers' inability to pay off loans and increasing financial burden. Unfortunately, lenders who do not come inside regulation that applies to traditional lenders often carry such practices, and you don't get legal protection against such practices.

Therefore it is important to take necessary action and report predatory lending so that lenders should also refrain from such unfair methods.

How To Report?

Reporting a predatory lender can be complex. But if the borrower feels that they are victims of such an unfair practice, then there are ways to seek some legal help. Let us understand the various steps to do so.

- Collect evidence – The borrower has to collect the necessary documents and proofs in support of the unfair practice. These include the mails, letters of correspondences, payment records, the borrowing agreement or any other relevant document that the borrower feels, should be gathered.

- Consult legal expert – A specialized legal expert will be the best person to guide the borrower in evaluating the situation, understanding the possibility of winning the case and providing legal guidance.

- Understanding the laws – The borrower should keep track of the applicable rules and laws related to such lending. This helps in making the case stronger and easily identify the areas where the law has been violated. Alternative resolution technique – Any alternative process to settle the matter out of court should also be explored.

- Filing complaint – The legal expert should help the borrower file a predatory lending lawsuit with the civil court detailing the unfair practice which the borrower faced or is currently facing and the losses due to it.

- Negotiating Settlement - The attorney will guide the borrower in settle the dispute through proper negotiation representing the borrower’s interest and getting a fair compensation for the unfair loan terms and losses incurred due to it.

- Trial and judgement – If settlement is not satisfactory, then proper trial and court judgement should be exercised, where the judge or the jury will decide the compensation for damage.

However, consulting an attorney and evaluating all options and then deciding the next course of action is very important.

Predatory Lending Vs Redlining

| Predatory Lending | Redlining |

|---|---|

| The aggressive approach was taken by the lender with some unethical practices to entice borrowers into taking loans with a high-interest rate, high fees, and charges. | Redlining is an unethical practice, which puts financial service out of reach in certain areas based on race and ethnicity. E.g., systematic denial of mortgages, insurance, loans based on area history instead of looking into an individual’s creditworthiness. |

| Predatory lending focuses on profit from lending instead of providing proper services to the borrower and understanding his/her ability. | Redlining completely denies services to neighborhoods based on race or area history. |

| Some practices are unethical but not considered as illegal. | Redlining is illegal as per The community reinvestment act 1977. |