Table Of Contents

What Is Asset Based Lending?

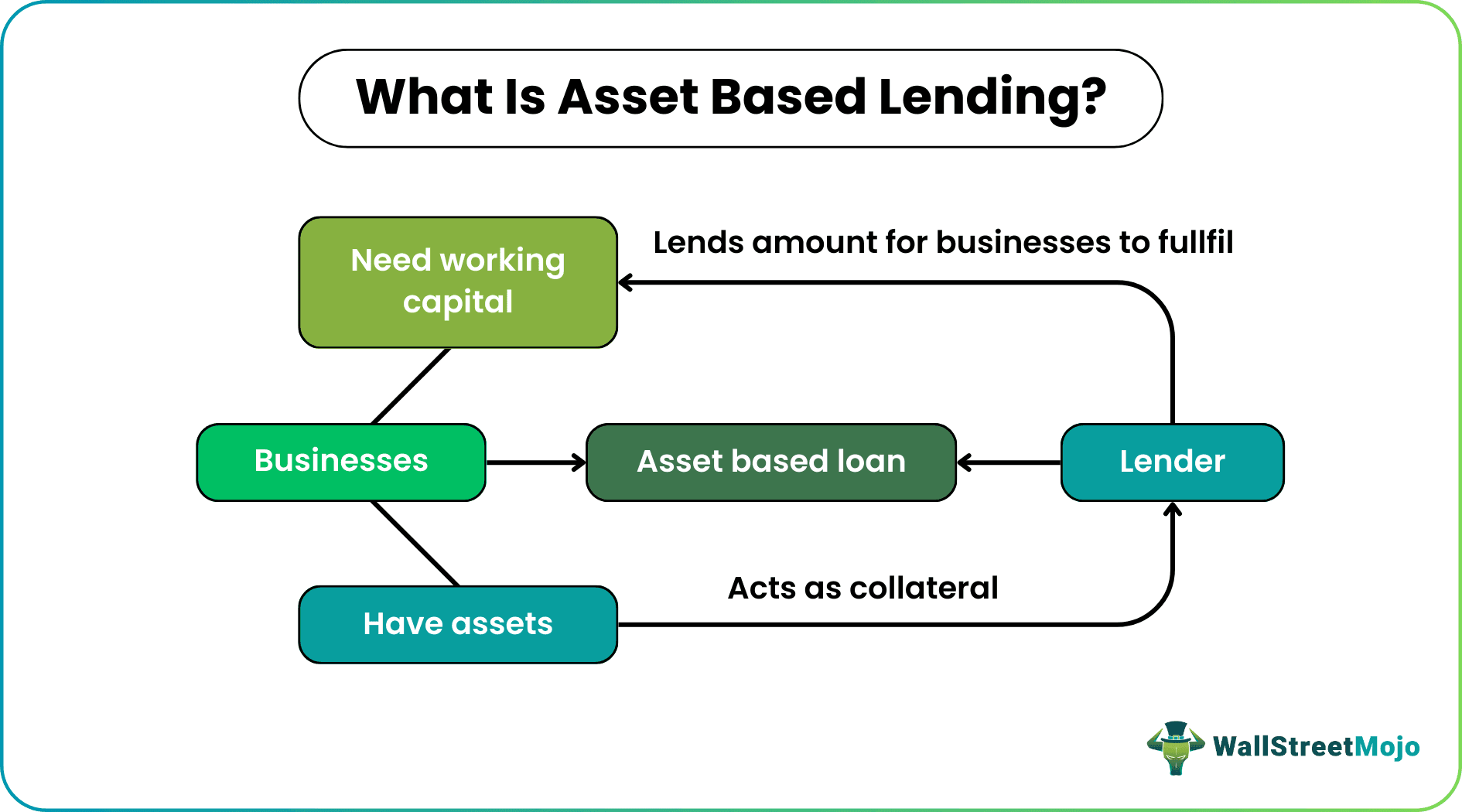

Asset based lending refers to the type of financing where lenders agree to offer loans to borrowers based on the value of the latter’s collateralized asset. Such assets include accounts receivables or property, plant, or machinery inventory. The entities offer such lending options only to businesses and not consumers.

Asset-based lending allows businesses with enough assets requiring working capital to continue with the manufacturing and production procedure. They, therefore, apply for these loans and acquire them against the existing assets as collateral.

Key Takeaways

- Asset-based lending refers to the loan provided by a financial institution to a business or a large corporation that is secured by asset collaterals.

- The assets can be equipment, inventory, accounts receivable, property like real estate, and other balance sheet assets.

- It provides financial aid for businesses struggling with working capital requirements or other cash flow demands.

- If non-payment or default, the asset is liquidated, and the lender recoups most or all of its losses.

How Does Asset Based Lending Work?

Asset based lending helps businesses continue to operate without any interruption. Companies with enough assets but urgent working capital requirements opt for these types of lending. They back their loan amount using the existing assets. The types of assets used include accounts receivables, marketable securities, inventory, property, plant, and equipment (PP&E).

The cash flow problem of companies may stem from various reasons like rapid growth, which requires additional capital apart from existing ones to invest and sustain business activities. However, it might occur due to a long debtor collection period or a brief delay in payments it expects to receive, which may create problems in paying dues to its employees, creditors, and supplier of capital.

The loan term for the lending options completely depends on the type of assets that back the amount. Usually, lenders prefer securing their loans against treasury bills, mutual funds, exchange-traded funds (ETFs), stocks, bonds, etc., as these are highly liquid. Assets with high liquidity are likely to have higher loan-to-value (LTV) ratios, lower interest rates, and lenient repayment terms.

Suppose a business that needs capital cannot show creditworthiness, or has no guarantor, or lack cash flows to cover a loan. In that case, it can monetize its assets by keeping them collateral with the bank or other lending institutions. Moreover, asset-based loans only sometimes total 100% of the value of the pledged asset. Therefore, there is always a margin to recover the liquidation costs when required.

Examples

Let us consider the following asset based lending examples to understand the concept well:

Example #1

A real estate company is constructing building A and wins a bid to construct building B. So, before it could receive cash flow from selling an apartment in building A, it had to start the construction of building B.

Thus, the company goes to a bank, keeps the building or equipment as collateral, and obtains the loan. The company gets its financing without other options by converting illiquid assets into liquid ones or sometimes pledging liquid assets.

This is how asset based lending in real estate or mortgage works.

Example #2

Suppose a company aims to expand its business and seeks $500,000. Given its highly liquid nature, it has enough marketable securities to use as collateral. The lender grants 90% of the face value of the securities. Hence, if the securities are worth 500,000, the loan would be worth 450,000.

Pros & Cons

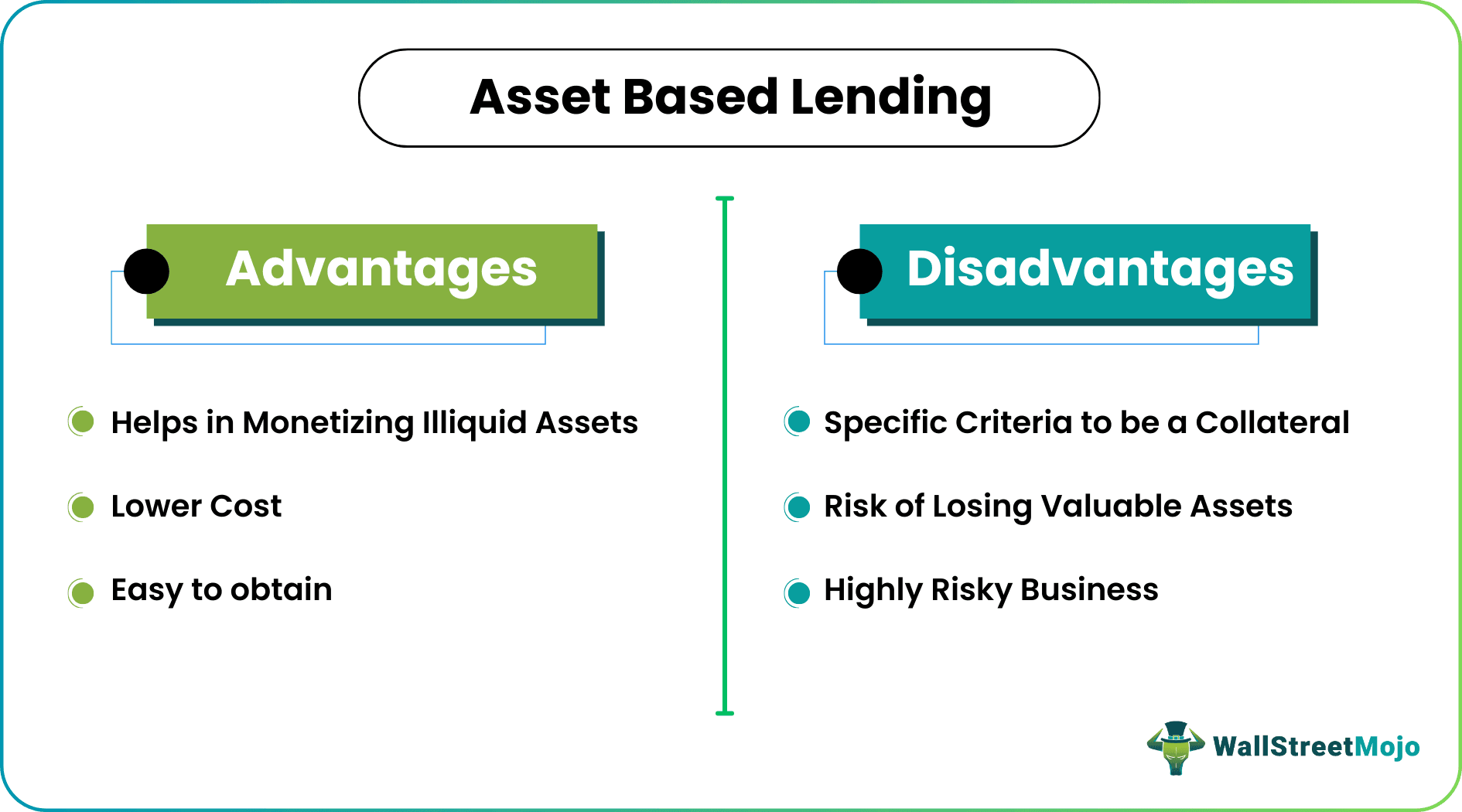

Asset-based lending helps in monetizing illiquid assets. For example, a business having fixed assets on a balance sheet can be leveraged to access additional working capital.

Whether it has inventory, equipment, or other illiquid assets, investments in them can secure additional funds. In addition, the lower cost of these collateral finances makes them more convenient than the unsecured loans. This is because the lenders can sell the pledged assets to recoup most of the losses in case of defaults.

Unlike conventional loans requiring a lot of documentation, borrowers can easily obtain these finances based on the value of the collateral. As long as it fits the condition or criteria of the lender, it is a hassle-free process.

So far as using assets as collateral is concerned, lenders require borrowers to have assets that fulfill specific criteria. In short, only some assets qualify for collateral. After its due diligence, the lender specifies which asset to use as collateral and what amount of money to raise based on the quality and risks associated with the collateral. Generally, lenders prefer assets having low depreciation and high liquidity. In case of defaults, businesses lose valuable assets. Hence, these are risky options.

An asset-based loan serves as a cushion in times of financial difficulty when a firm struggles with finances and has nothing other than assets to offer as collateral for restoring a stable financial state. It also helps prevent firms from selling their assets at a discount to meet their short-term emergency needs and helps convert an illiquid asset into liquid.

Asset Based Lending vs Cash Flow Lending

Asset based and cash-flow lending symbolize secured loan types. These terms depict the two parameters to assess if borrowers are eligible for the loans. Below are the points that broadly differentiate the two:

- While the former considers the pledged assets, the latter is provided to borrowers depending on their past and current cash flows or expected future cash flows.

- Prospects are key when lenders approve or disapprove cash flow loan applications. On the other hand, the value of the pledged assets is an important concern before lenders obtain consent for asset based loans.

- While asset-based finances are collateral ones, cash-flow lending is a non-collateral loan. Thus, obtaining the latter is more difficult.

- The assessment metric for cash flow lending is EBITDA, which keeps aside the accounting impacts on income and emphasizes the net cash available. On the contrary, asset based loans help retain the flow of income. In this case, liquidity is an important factor.