Table Of Contents

What Is Cash Flow Lending?

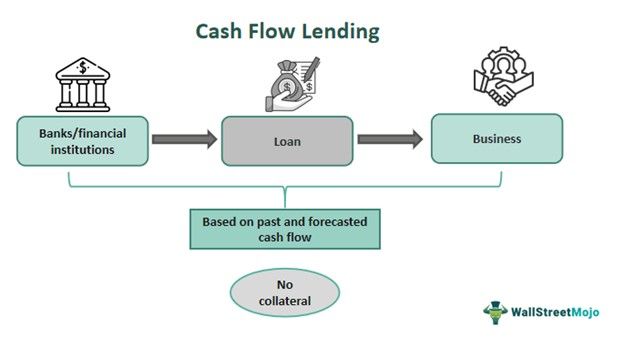

Cash flow lending is a method that assesses a company's past, present and future cash flows to provide loan. Lenders assess risk and set interest rates accordingly to ensure the business has sufficient cash flow to repay the loan.

Businesses can access capital based on their projected cash flow, enabling growth, operational investment, and debt repayment. There is enough information available to analyze in terms of past cash flows and projected future cash flows. Certain important criteria, such as the risk involved and the likelihood of default, can be estimated through the data.

Key Takeaways

- Cash flow lending is a form of loan based on a business's past and prospective cash flows.

- Cash flow loans are an attractive alternative if the company does not yet have many assets, has a low credit score, or requires finance quickly.

- CFBL eliminates the need for collateral, enabling the creation of loan products with shorter terms, smaller ticket amounts, faster approval times,

- and flexible repayment schedules. It helps enterprises that need money immediately manage their working capital and engage in growth.

How Does Cash Flow Lending Work?

Cash flow lending is a form of financing in which a lender determines whether a borrower has enough cash flow or creates such income to repay the loan based on past cash flow. It relies on the borrower's cash flow projection rather than depending on collateral or assets to secure the loan. Cash Flow Based Lending (CFBL) enables lenders to construct customized, short-term, small-scale credit products and risk analyses for small and medium-sized enterprises (SMEs) using real-time cash flow data.

Cash flow is a crucial indicator of a company's financial health since it shows how much money goes in and out of the organization. Generally. a positive cash flow is a desirable indicator for lenders since it shows that more money is pouring into the business and that loans will be repaid more easily. In contrast, negative cash flow isn't always a bad thing. It could suggest a growth investment, such as recruiting additional employees or running marketing campaigns. The aim should be to keep expenditure below acceptable limits while indicating sustainable growth to lenders to show a favorable picture.

Cash flow analysis eliminates the requirement for collateral, allowing for the development of new loan products with shorter terms, smaller ticket amounts, faster approval turnaround times, and more flexible repayment schedules. CFBL helps SMEs manage their working capital and engage in growth by offering flexible lending conditions based on cash flow data.

SMEs often face working capital constraints due to fluctuating demand, inadequate supply chains, a lack of facilities, and delayed customer payment. Additional factors contributing to it include insufficient cash-flow buffers and unpredictable inventory turnover, which can be properly controlled.

Examples

Let us look into a few examples to understand the concept better:

Example #1

Suppose ABC Ltd., a renowned manufacturer of high-quality winter clothing, aims to expand its summer clothing line by offering lightweight garments. They seek cash flow-based loans from a financial institution to finance this expansion. The lender performs cash flow analysis and offers a loan amount based on projected sales. ABC Ltd receives the loan, which they use to develop and manufacture the summer clothing collection and allocate funds for marketing campaigns. By utilizing a cash flow loan, ABC Ltd successfully expands its product line and sustains operations during the summer season.

Example #2

Another example is extracted from a research paper that studied the concept named "Impact of Cash Flow Statement on Lending Decision of Commercial Banks" by Dung Duc Nguyen and Anh Huu NGUYEN.

The paper examines how the statement of cash flows of listed companies influences the lending decisions of commercial banks in Vietnam. The researchers collected survey data from 160 credit officers from Vietnamese commercial banks to analyze their short-term and long-term lending decisions. They investigated whether the cash flow statement contained complete information or lacked information. Specifically, they explored cases where the cash flow information contradicted the profit information in the income statement. T-tests were utilized to address the research questions within the context of Vietnam's perceived market inefficiency.

The findings of the study demonstrate two key points. Firstly, the information presented in the cash flow statement significantly impacts the lending decisions of credit officers, both for short-term and long-term loans. Secondly, the absence of information in the cash flow statement, regardless of whether the company reports positive or negative profits, affects credit officers' confidence and comfort levels when making lending decisions. These results highlight the importance of cash flow statements in the lending decisions of credit institutions in Vietnam.

As a result, the paper offers valuable insights to managers by emphasizing the need to enhance the quality of cash flow statements to align with the requirements of lenders. By providing complete and accurate information in the cash flow statement, companies can improve their chances of securing loans from commercial banks in Vietnam.

Advantages & Disadvantages

Some of the advantages and disadvantages of cash flow-based lending are the following:

Advantages:

- Cash flow-based lending offers a pathway to funding for businesses with cash flow potential despite having minimal physical assets.

- Loan terms and structures under this type are adaptable, aligning with cash flow forecasts and needs.

- It facilitates growth, investment endeavors, and debt settlement without dependence on collateral.

- Operational expenses can be financed, and growth opportunities can be seized through cash-flow lending.

- Cash flow loans present a viable alternative financing avenue for companies with solid cash flow but restricted access to conventional lending.

Disadvantages:

- This type of loan typically involves higher interest rates than traditional asset-based lending.

- Rigorous eligibility standards and documentation prerequisites are common with cash flow loans.

- Accurate and dependable cash flow projections are imperative for securing cash flow loans, which may be difficult.

- Businesses with uncertain cash flow may find limited availability of cash flow loans.

- Lenders face potential risks if borrowers' cash flow projections fail to materialize as anticipated.

Cash Flow Lending vs Asset-Based Lending

The differences between both the concepts are given as follows

| Points | Cash Flow Lending | Asset-Based Lending |

|---|---|---|

| Concept | Cash flow lending is a lending method that focuses on cash flow to offer loans. | Asset-based lending method focuses on assets possessed to offer loans. |

| Type of loan | This type is focused on providing short-term, small-ticket-size loans tailored to the needs of SMEs. | The process of asset-based or balance sheet-based lending is specifically designed to cater to long-term, large-size loans. |

| Focus | In cash flow-based lending, the repayment is based on the projected cash flows of the business. | In asset-based lending, the loan payment is determined based on the value of the collateral assets provided by the borrower. |

| Eligibility | It is suitable for businesses with strong cash flow potential but limited physical assets. | Asset-based lending is more suitable for businesses with valuable collateral. |

| Financing amount | Financing amounts in cash flow loans are typically lower as they are designed to meet short-term working capital requirements. | In asset-based lending, the financing amount can be higher depending on the value of the assets used as collateral. |

| approval | Short-term loans generally have fewer stringent conditions, resulting in shorter approval times. | Asset-based lending may have stricter valuations to determine the worth of the collateral and hence can result in long waiting periods for approval. |

| Interest rates | Interest rates may be higher due to the more flexible rules and the shorter time taken to obtain funds. | In asset-based lending, interest rates may be lower because an asset back up the loan in case of payment default. |