Table of Contents

What Is Puttable Bond?

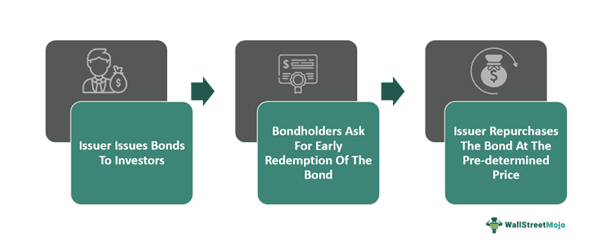

Puttable bond refers to a debt instrument that lets the holder of a bond demand the bond issuer to repurchase it before the maturity date. The puttable bond pricing is decided upon during issuance itself. The repurchase price is usually set at the par value or face value of the bond.

While the bondholder has the right to demand an early repurchase, the issuer is not obliged to redeem the security before the date of maturity. However, if the issuer agrees to redeem it early, the bondholder has a significant advantage in rising interest situations. They can invest the sum elsewhere, where they get better interest rates.

Key Takeaways

- Puttable bonds are debt securities that come with the option of the investor applying for redemption before the original date of maturity.

- Investors opt to redeem the bonds early in situations where the market interest rises. They redeem the bond that has a lower yield and invest the amount in an investment with a higher yield.

- These bonds, in general, have a lower rate of return as the flexibility to redeem early comes at a cost.

- The risk of the issuer defaulting is also lower as the payouts are split between puttable and non-puttable bondholders.

Puttable Bond Explained

Puttable bond, also referred to as retractable bond, is a security that comes with the ‘put’ option. The bondholder can ask for an early repayment. However, they are not obliged to do so.

The puttable bond issuance protects investors against rising interest rates after purchasing the bond. As we know, when interest rates rise, the value of coupon payments declines. Therefore, investors choose to redeem the amount early and invest the sum into another investment or avenue that gives them better returns.

It is important to note that the bondholders cannot ask for early repayment at any time according to their whims and fancies. The specific dates within which they can ask for redemption are disclosed during the time of issuance itself.

Nonetheless, the aspect of the issuer facing a liquidity crisis also is a factor to consider. In situations like these, they can only repay the sum if the investors wish. That is why issuers issue bonds with a customized mix of puttable and non-puttable bonds to ensure they do not have to pay out sums that might put a dent in their operational cash flow.

Features

The features of the puttable bond duration are discussed below.

- Interest Rate Protection: Investors can make sure that they are protected against rising interest rates. They can retract the amount from the bond and invest in an avenue that gives them better returns, especially when the interest rates are expected to rise.

- Lower Yield: With the power of early redemption comes a downside of lower yields. Retractable bonds generally offer lower returns in comparison to non-puttable bonds, as the latter is less flexible and carries more risk.

- Credit Risk Hedge: Since the issuer does not have to pay out a massive amount at once, the risk of default from the issuer’s end is minimal. The issuer pays the puttable bondholders at a different period compared to the non-puttable ones. The difference in period gives them the leverage to prepare for the next payout without affecting their cash flow.

- Investor Flexibility: Investors enjoy the flexibility to withdraw or redeem their invested sum when they sense that the interest rates are going to rise. Therefore, they can make necessary adjustments to maximize their returns.

Types

The types of bonds under the ambit of puttable bonds duration are as mentioned below.

- Multi-Maturity Bonds: As the name suggests, these bonds have multiple dates of maturity. An investor can choose to exercise their right of early redemption at any of the maturity dates at their convenience or in market conditions.

- Option Tender Bonds: These bonds follow a floating interest rate format. Classic examples of these bonds are tax-exempt bonds and municipal bonds. Their interest rates keep getting adjusted according to the increase and decrease of interest rates in the market.

- Variable Rate Demand Obligation: VRDOs are usually municipal bonds that have to be repaid on demand of the bondholder. However, the interest rates for these bonds during redemption are based on market rates.

How To Calculate The Value Of A Puttable Bond?

The calculation for a puttable bond pricing is different from that of a regular or plain-vanilla bond because of the put option. Since the investors have the right to redeem the bond early, the price of the retractable bond is affected.

The fair market value of a retractable bond can be found using the formula:

Price of the puttable bond = Price of the plain-vanilla bond + put option price.

Where,

- The price of the plain-vanilla bond is similar to that of the puttable bond.

- The price of the put option for redemption is before the maturity date.

Examples

The application of the puttable bond formula becomes more manageable if one understands the practicality and real-life application aspects. The examples below shall throw light on those fronts.

Example #1

Morgan purchased a bond with a face value of $1,000 at an interest of 4% in 2021. However, in 2022, the market interest rates increased significantly due to the pandemic.

Morgan decided to redeem the bond early. After redeeming the bond, he invested the sum into a flexible interest rate bond that gave him better returns.

Example #2

Dinesh purchased a bond with the following specifications:

- Par Value: $10,000

- Maturity: 10 years

- Coupon Rate: 5% PA

- Put Option: After the 4th year

If the interest rates had not increased, he would have gained $500 as per 5% of the $10,000 bond.

However, after the 4th year, the interest rates in the market rose from 5% to 7%. Dinesh could gain $700 instead of $500. Therefore, he decides to redeem the bond and invest in a bond that gives him interest rates in accordance with the new market rate.

Pros And Cons

The puttable bond pricing has its share of pros and cons. Both these facets are discussed below:

Pros

- Exercising the right to put protects investors against the risk of interest rates rising significantly.

- It gives investors the flexibility to redeem their investment before the maturity date.

- Due to the put option, these bonds have higher liquidity in comparison to non-puttable ones.

- Investors can be sure of a fixed return if the put option is used. The clarity in terms of calculation and returns attracts investors to these debt instruments.

- It safeguards investors against the issuer defaulting as the sum that has to be paid out is split between retractable and non-puttable bonds.

Cons

- The calculation and understanding of the features of these bonds are far more complicated than regular bonds.

- Because of the risk of repurchasing the bonds early, it might prove to be costlier for issuers.

- Investors have a looming threat of missing out on higher returns if the interest rates increase.

- The interest rate, in general, is lower than other bonds due to the flexibility aspect.

Puttable Bond vs Callable Bond

The differences between puttable bond pricing and non-puttable bonds are discussed in the comparison below.

Puttable Bond

- These bonds allow the investor to redeem their investment from the issuer well before the date of maturity.

- Once the bonds are redeemed early, the issuer has to re-issue them. The re-issue will potentially have higher coupons, which exposes the issuer to re-pricing risks.

- For the investor, the put option helps them redeem their investment from a low-paying bond and invest the same into a bond or other investments that give higher returns.

Callable Bonds

- Callable bonds allow issuers to change the tenure of the bond. They do so by redeeming them before the original maturity date.

- The option allows issuers to redeem bonds when the interest rates decline and re-issue them at a lower rate based on the changes in the market.

- In the case of investors, it does not allow them the opportunity to stay put and invest in a high-coupon bond. They are, therefore, exposed to reinvestment rate risk and call risk.