Table of Contents

What Is Regulation NMS?

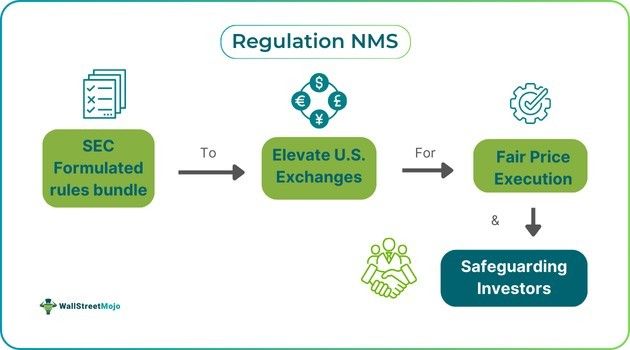

Regulation NMS (national market system) refers to a series of rules created by the Securities and Exchange Commission (SEC) to modernize, improve and strengthen U.S. exchanges using fair price execution of equity securities. It fosters rivalry among markets, ascertains orderly market functioning and safeguards investors.

It applies to all participants and trading venues in the U.S. It impacts the manner in which securities have to be reported, quoted, and traded. It promotes efficiency and transparency in the market. It helps prevention of trading at inferior prices and restricts stock price increments lower than a penny.

Key Takeaways

- Regulation NMS represents a set of regulations designed to modernize, improve, and strengthen U.S.U.S. exchanges and ascertain fair price execution for equity securities.

- It ensures that markets operate in an orderly manner while protecting investors and encouraging market competition.

- It has benefits such as promoting fair market pricing, transparency, and competition, enhancing market efficiency, promoting rivalry, standardizing trading practices, and strengthening the image of U.S.U.S. equity markets.

- It has been criticized for slowing trade execution, favoring high-frequency traders, creating uneven competition, increasing transaction complexity, and restricting innovation while also affecting retail and institutional investors.

Regulation NMS Explained

Regulation NMS (National Market System) represents a set of rules formulated by the SEC to enhance fairness and upgrade the price execution for securities trading throughout exchanges located in the U.S. It has 4 major elements - The access Rule, Market Data Rules, the Sub-Penny Rule, and the Order Protection Rule (or rule 611 of regulation NMS). These elements work together to ensure receipt of best practices for their trades by investors. Another important part of regulation NMS 606 mandates the disclosure of information regarding the routing and handling of customer orders in NMS stocks to increase transparency and benefit investors.

SEC regulation NMS operates by necessitating trading centers to stop trades at the lowest or inferior prices and enhance access to market information. The order protection rule guarantees the occurrence of trades at the best accessible prices. On the other hand, the access rule promotes equitable access to quotations throughout various trading locations. Hence, these help foster rivalry among exchanges, leading to healthier and more efficient trading.

The implications related to regulations of the national market system are many and important for all market participants. They improve efficiency and transparency, leading to easier investor acquisition of competitive prices. Nevertheless, it has also been argued that they favor high-frequency traders and increase costs for institutional investors struggling to implement large trades quickly.

The national market system's regulations have been designed to be user-friendly for investors. It has provided a regulated framework promoting exceptional access to data and pricing, leading to gains for institutional and retail investors.

It has led to a huge transformation of the U.S. financial realm through the establishment of a highly competitive environment between the exchanges. Its directed efforts at data access and price protection have strengthened investor confidence. Thus, it has solidified the reputation of the U.S. market as fair and efficient globally.

Examples

Let us use a few examples to understand the topic.

Example #1

An online article published on 23 Sep 2024 discusses the recent changes made by the U.S. Securities and Exchange Commission (SEC) with an aim to increase the market's transparency and efficiency. As per the article, the SEC adopted amendments related to reduced access fee caps and fresh minimum pricing increments for NMS stocks. Further, the SEC amendments brought forth a $0.005 minimal price increment concerning NMS stocks priced at equal to or more than $1.00 per share.

The access fees pertaining to protected quotations for such stocks have been capped at $0.001 per share, with a 0.1% cap related to stocks priced lower than $1.00 per share. These reforms intend to decrease transaction costs while improving market quality, aligning with the SEC's mission to support investor protection and fairness.

Example #2

Let us assume that a brokerage firm- Alpha Securen, in Old York City, deals with securities trading on the exchange. Now, under the regulations of NMS, the brokerage has to route all trades to the best available prices. Hence, they route the orders of 300 shares of company A at $40 per share of their client Sarah to select the best price offering from:

- XEXT exchange offering A’s share at $50.08

- NoWA exchange providing A’s share at $49.99

Moreover, as per regulations of NMS, Alph Securen has to direct Sarah's order to NoWA exchange as it has a lower price than the other. As a result, the fragmentation of the market does not happen, which ensures fair price access to all investors through rival exchanges in real-time.

Benefits

For markets, exchanges and investors, it has the following benefits;

- It ensures the occurrence of trades at the best-placed prices throughout exchanges, which encourages fair market pricing and increases the overall efficiency of markets.

- It requires all offers and bids to be publicly available, enhancing transparency and fostering confidence in investors.

- It encourages rivalry between trading exchanges, resulting in good pricing and implementation for investors and benefit in gnefits the market.

- It has helped standardize trading practices across various exchanges by minimizing price discrepancies through consolidated price quotes.

- Its established framework has strengthened the image of U.S. equity markets as efficient and competitive, leading to many participants flocking to it.

Criticism

It also has certain downsides for all, as shown below:

- It decreases the speed of trade execution and negatively impacts investors needing immediate transactions instead of the best price.

- It has been perceived as favoring high-frequency traders, setting an uneven playing field for smaller retail investors without any technological advantage.

- A few participants believe that enhanced transparency leads to the rise of dark pools, affecting transparency levels and creating hurdles for retail investors to compete with bigger ones.

- Institutional investors have started to feel that it has increased the complexity and cost of transactions and has made it difficult for them to do large volumes of trades effectively without extra fees.

- Many detractors claim that the rule of trade-through has contained innovation in trading as it has imposed trivial restrictions on trading systems that might benefit market dynamics.