Table Of Contents

What Is A Trade Sale?

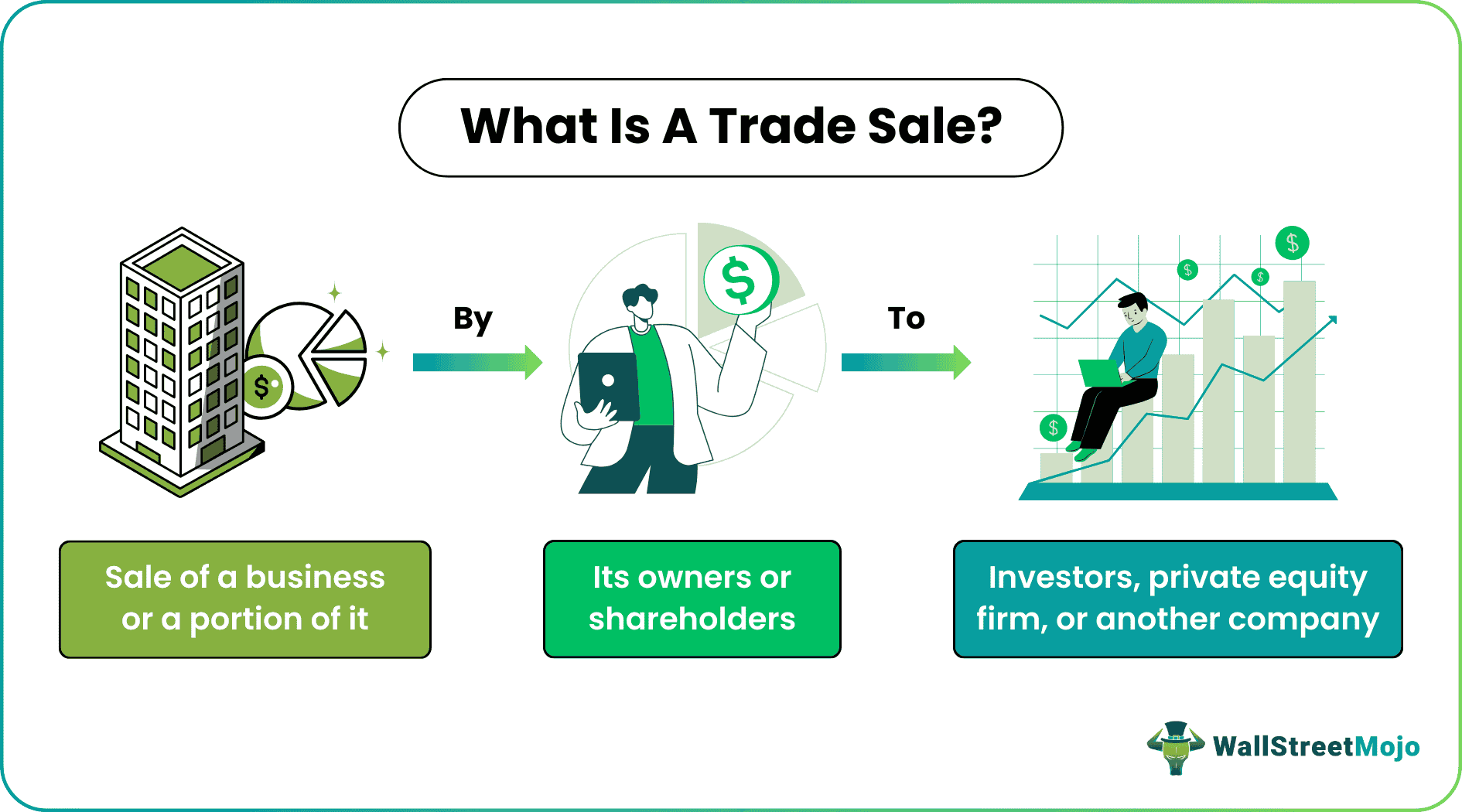

A trade sale is an exit strategy where the existing management sells the business or a part of business to an acquiring company. The assets, liabilities, ownership, brand reputation, and goodwill are transferred to the trade buyer. The buyer then continues to conduct the business with alterations that fit into their business model.

The trade sale model is prominent in the United States and the United Kingdom. Venture capital firms, private equity firms, etc., usually follow this approach. Smaller businesses being bought by larger firms holding a stake in them is a familiar scenario. The process is advantageous to both parties involved.

Table of contents

- What Is A Trade Sale?

- Trade Sale Explained

- Examples

- Advantages and Disadvantages

- Trade Sale Vs. IPO Vs. Secondary Sale

- Frequently Asked Questions (FAQs)

- Recommended Articles

- A trade sale meaning refers to the process of a business selling itself to prospective buyers. The buyer can be a private equity firm or another business.

- The business valuation is done based on its assets, liabilities, capital, brand reputation, and goodwill.

- It is an exit strategy where the owners hand out total control to the trade buyer. Some buyers allow the owners to hold certain positions after the acquisition.

- Due care should be taken so that business operations are not affected during the acquisition.

Trade Sale Explained

Trade sale is a common strategy followed by business owners who want to sell off their businesses. It involves a transfer of assets, liabilities, reputation, and stakeholders. It is a legal, financial, and structural process. However, what happens after the transfer depends on the trade buyer.

Trade buyers primarily handle the business. However, they might seek to reduce certain liabilities by selling off assets from the business. They can continue working with the same workforce, suppliers, investors, etc. However, some companies redeem existing shares and issue fresh equity shares to new investors. The sales deal is valued based on these assets, capital, liabilities, and goodwill.

Trade buyers acquire a business for a lot of reasons:

- Private equity firms' scope is to acquire and run weak businesses. It is an investment for them.

- Larger firms acquiring smaller competitors enable them to hold a larger market share. Alternatively, it gives them entry to newer markets.

- Some start-ups have a unique component, such as an innovation or technology with a loyal customer base.

Bankrupt companies seek out the help of larger firms to pull them out of the situation. Start-ups gaining much attention for innovative concepts fail after a few years since ideas alone cannot sustain a business. Also, some business owners want to reduce their commitment to their company for personal reasons.

Examples

Let us discuss hypothetical and real-world examples to understand the concept better.

Example #1

Illustrating a private equity trade sale, let's take the case of XYZ, which initially thrived as a digital marketing start-up. XYZ's innovative ideas and technology led to a remarkable 30% surge in website traffic. However, a year later, financial challenges emerged due to rising costs, ultimately resulting in the company's bankruptcy declaration. At this juncture, ABC, a private equity firm, stepped in to acquire XYZ, marking a strategic move in private equity transactions.

Example #2

In a recent trade sale transaction in August, JLL Capital Markets facilitated the $41 million sale of 7 Post Office Square, a prominent seven-story office building in Boston's Financial District. Nuveen Real Estate, the seller, was represented by JLL, which also identified the buyer, Azora Exan Capital. This transaction marked the first office trade in Boston since January 2022.

7 Post Office Square's prime location, featuring floor-to-ceiling windows, efficient floorplates, and a highly visible lobby, contributed to its attractiveness. Anchored by Fidelity Investments since 1996, the building boasts a 91 percent lease rate with eight tenants.

This real-world example showcases a trade sale where Nuveen Real Estate sold the property to Azora Exan Capital, emphasizing the importance of location and strong tenancy in such transactions.

Advantages And Disadvantages

Let us study the pros and cons of this concept.

#1 – Advantages

- It brings together business owners who want to sell off their companies and buyers interested in the business.

- For trade buyers, the business will help them accomplish their objectives of expansion into a new market, product development, using the acquired firm's goodwill, addition to private equity, etc.

- Trade sellers benefit from their decreased commitment to their business. They can focus on new opportunities or use their time.

- Some acquiring companies allow the seller to contribute by occupying a smaller role.

- Depending on the firm's goodwill, the seller can demand a higher price for the business. This company's goodwill gets added to that of the acquiring company, which becomes beneficial in the long run.

#2 – Disadvantages

- One of the most significant disadvantages is that business operations might be affected during the acquisition. Steps should be taken to avoid any severe losses to the business during this time.

- It might affect the morale of the employees, suppliers, investors, and other stakeholders because the work ethics and organizational culture differ from company to company.

- Companies have to share sensitive information while looking for prospective buyers. If these prospects misuse the data, it can affect the company badly.

- Finally, if the firm is bankrupt and acquired by another company, the seller might not make any profits. The buyer, too, would buy trade sales for the unique component, like a coveted technology, niche market, etc., and not the business itself.

Trade Sale vs IPO vs Secondary Sale

Let us explore the distinctions among IPO (Initial Public Offering), Trade Sale, and Secondary Sale in this comparative table, highlighting critical aspects of these essential business transactions.

| Basis | Trade Sale | IPO (Initial Public Offering) | Secondary Sale |

|---|---|---|---|

| Ownership Transfer | It is for Business or asset transfer | Share ownership to the public | Share transfer to third parties |

| Happens in Public Companies | It can occur in both private and public | Yes | No |

| Exit Strategy Type | Exit strategy for owners | Exit strategy for businesses | Exit strategy for individual investors |

| Owner Responsibilities Post-Transaction | Dissolves ownership responsibilities | Still holds responsibilities | Reduced responsibilities |

| Suitability for Complete Exit | Allows complete business exit | Unsuitable for a complete exit | Allows individual exit |

| Purpose and Benefits | Realizing maximum proceeds, reducing regulatory oversight, starting new ventures, diminishing overall risk | Transition to public markets, capital raising | Liquidity for investors, portfolio diversification |

Frequently Asked Questions (FAQs)

Trade sales promotions represent a distinct marketing strategy. They are designed to attract new customers and retain loyal ones, ultimately boosting sales revenue. Companies allocate a significant portion of their budgets to promotional activities to increase customer engagement.

Private equity trade sales involve acquiring smaller companies, which may or may not be in financial distress. These acquisitions serve as investment opportunities for private equity firms. Private equity firms aim to realize higher investment returns by restructuring these smaller companies.

In a broad sense, sales encompass various transactions where customers exchange goods or services for money. In contrast, trade sales specifically refer to the sale of an entire business or a portion of it to another entity, often as part of a strategic acquisition or exit strategy for the business owners. Trade sales entail the transfer of ownership, assets, and liabilities, setting them apart from typical sales transactions.

Recommended Articles

This has been a guide to What Is Trade Sale. Here, we explain it with its examples, comparison with IPO and Secondary sale, advantages, and disadvantages. You can learn more about it from the following articles –