Table Of Contents

What Is A Virtual Data Room?

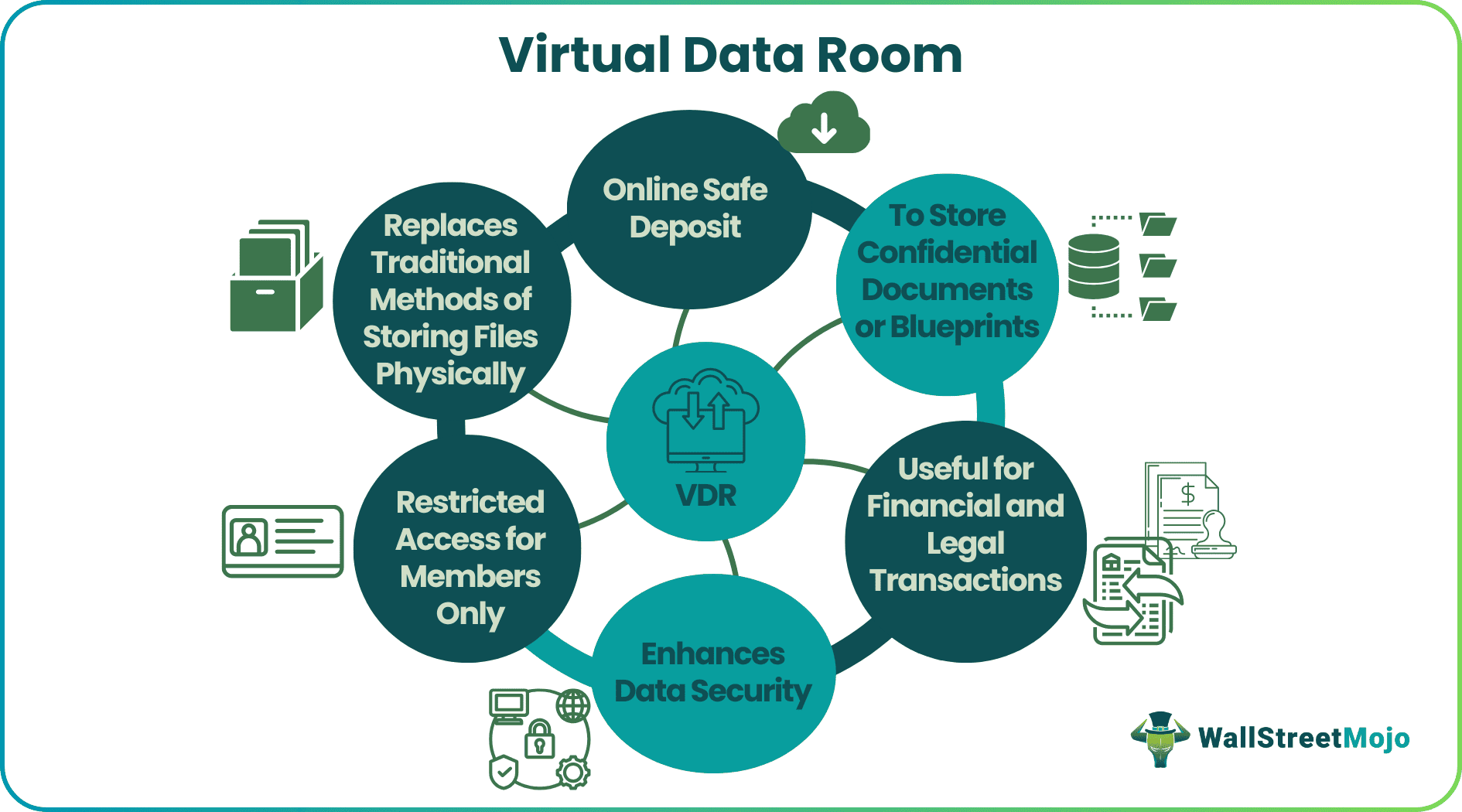

A virtual data room (VDR) is an online safe deposit or repository where businesses or other entities can virtually store their documents and blueprints. In an increasingly globalized world, virtual rooms ensure secure financial and legal transaction spaces to maintain confidential and sensitive information and data.

A virtual data room explains how organizations maintain data security and confidentiality while allowing their members to work remotely. These rooms have restricted access which empowers businesses to collaborate on projects, store important information, and grant real-time access to extremely confidential documents. This technology aims to revamp the traditional storing of information in physical files and store rooms.

Table of contents

- What Is A Virtual Data Room?

- A virtual data room is a data room managed online through servers and cloud systems that enhance the security and scrutiny of the data.

- Such a virtual space is manageable at a cheaper cost and lesser time when compared to physical data rooms. Additionally, these virtual spaces enhance data mobility when working remotely.

- These are immensely useful for finance and legal industries requiring excessive documentation. Thus, in cases such as mergers or acquisitions, these spaces enhance access for attorneys, legal and financial experts, venture capitalist firms, etc., and reduces overhead costs in the process.

Virtual Data Room (VDR) Explained

A virtual data room definition explains a strategic method of storing organizations' confidential data on cloud systems. It enhances the operations and functioning of processes like fundraising, releasing an IPO, mergers and acquisitions (M&A), and building strategic partnerships.

It is an online repository supported by servers and cloud systems. Thus, it requires less human intervention and management costs compared to physical data rooms. At the same time, for due diligence processes, VDRs provide a centralized platform and access to data for international teams. As a result, it allows interested stakeholders to speed up the process of scrutiny and transactions while enhancing trust and transparency in the process.

Spaces like VDRs increase the scope for continuing and building business partnerships. It provides unchallenging, effortless, and confined access to confidential and sensitive documents. Consequently, it builds confidence between businesses and reduces the risks of data leaking, thereby preventing failures in capitalizing on opportunities due to mishandling.

In today's world, businesses thrive and achieve exponential growth through data and customer information. Thus, after 2007 the growth of VDRs has proved to be more secure and feasible than physical data rooms. These ensure data integrity and control the mishandling of data by third parties such as business competitors. Consequently, VDR platforms restrict and control the documents' copying, printing, and editing.

For instance, iDeals is one of the significant virtual data room providers based in the U.S. that started in 2008. It began with a focus on serving the financial services and investment banking businesses. The company provides file management services, data security tools, auditing tools, document search functions, and document security. Additionally, one of the stand-out factors of this VDR provider is the Q&A messaging services it provides for its users.

How To Set Up VDR?

For setting up a VDR, below mentioned steps are useful for guiding and ensuring specifications for the set-up of a virtual space,

- Choosing the VDR service provider based on the needs and requirements of a business rather than looking for the best virtual data room software. It will help businesses determine which functions and features they require, such as security, reporting, pricing, ease of use, etc.

- Determining the type of VDR required for different purposes or stages of a process. For example, it might involve making virtual spaces open for many and then creating virtual spaces that become more confidential later.

- Preparing a checklist for the due diligence process will give all the stakeholders an idea about the flow of events and becomes handy for planning subsequent virtual rooms.

- Categorize or index the virtual room with files and documents in an orderly manner, such as alphabetically or per a due diligence checklist, differing for each organization.

- Figuring out and confirming the security levels and permissions and including and excluding members per access.

- Gather and upload the additional documents required in the room.

- Inviting third-party members such as investors, attorneys, and legal and financial experts to start the auditing, regulatory or due diligence process.

Evolution Of VDR In M&A

The merger and acquisition (M&A) process refer to transactions between two businesses to consolidate the operations and ownership of two or more organizations. The process for merger or acquisition involves excessive documentation, such as releasing and reviewing tenders, financial transactions, assets management, etc.

Thus, traditionally such business transactions to facilitate M&As took place inside four closed walls or in physical data rooms. These rooms had restricted entry of members or personnel from both sides- the seller and the buyer. Only buyers and hired experts could access these physical spaces. Consequently, this gave them access to confidential data and information other than the seller's team of auditors or legal experts.

However, the maintenance and cost of keeping these physical rooms intact and secure were high. Additionally, the physical data rooms were not fully secure from human intervention. While physical documentation rooms also restricted multiple bidders or potential buyers from accessing the documents and information at once. Thus, the evolution of virtual data rooms became essential to mitigate these obstacles and smoothen the M&A process.

The due diligence process involves examination, auditing, verification, and surveying. It requires a considerable amount of time and the involvement of multiple stakeholders. Thus, storing, managing, and securing data and information with VDRs became flexible and easier for all stakeholders and bidders. In addition, a virtual space eliminates the hassle of working with stacked paper documents and enhances data mobility when working remotely or internationally.

Additionally, it centralizes the review process for the buyers and gives them a cheaper alternative to incurring the traveling expenses of experts and stakeholders.

Rules

Let us look at some rules that VDR users shall follow and extrapolate the virtual data room meaning and understanding,

- The host or seller sets up terms and conditions for accessing the data and information in the room for the bidder or buyer in the M&A process.

- Each bidder must comply with the given instructions,

- Every visitor visiting a virtual documentation room must provide a declaration to follow all the rules and procedures for accessing the room.

- A seller or host of a VDR platform exercises controls over the inclusion and exclusion of members into the room. There may be a difference in members, documents, and timings for access to a VDR through the different stages of a due diligence or auditing process.

- Copying, printing, editing, and sharing data in a VDR-restricted area provides enhanced security and assurance against data leaks and inaccuracies.

Best Practices

In an age where data is comparable to currency, the best practice is to keep it confidential. It also includes keeping essential and sensitive data out of sight of competitors. Thus, virtual data room providers aim to include best practices and features to serve the maximum number of clients and businesses. These may include:

- The strict control of documents and sensitive information,

- Enhanced features for data organization, indexing, filing, and presentation,

- Maximizing cloud system security and making it more reliable,

- Comprehensive user activity monitoring and regulation by the host or seller,

- Efficient and speedy administration of the VDR platform, which smoothens the document preparation and reviewing process,

- Flexible integration into the business workflow allows the business to run smoothly and eliminates the initial hassle,

- Service and maintenance, plus the daily support system of VDR service providers, guarantees efficiency for the user.

Frequently Asked Questions (FAQs)

A VDR allows businesses to sync their workflow into a platform where they can store documents and information and manage access. However, a trial pack for VDR software for 30 days may range from $15 to $30. Although, depending on the features, a basic package for a VDR with monthly membership may start from $250 and go up to a few thousand dollars per month.

The idea of such a virtual space for businesses in financial, legal, and tech industries especially allows high-level categorization and management of data, allowing businesses to manage and access these documents remotely and at all times. Thus, in mergers and acquisitions, IPO releases, and fundraising by startups involving heavy documentation and scrutiny by various stakeholders, investors, and venture capitalists, a VDR provides a virtually managed space and assists in regulating the entire process.

Such rooms help ensure data security, protect against data leaks, eliminate mishandling of sensitive information, and prevent data corruption. At the same time, it enhances the mobility and accessibility of documents and data compared to physical data rooms.

Recommended Articles

This has been a guide to What is virtual data room and its definition. Here, we explain how to set up VDR, its evolution in M&A, rules, and best practices. You may learn more from the following articles -