Table Of Contents

Difference Between CIPM and CAIA

Certificate in Investment Performance Measurement is the abbreviation for CIPM. It helps aspirants secure job roles in investment banks, plan sponsors, GIPS verification forms, etc. In contrast, CAIA is known as Chartered Alternative Investment Analyst Association. With this degree, an aspirant can secure a career as an analyst at private equity funds or hedge funds.

Choosing between two jobs – CIPM and CAIA- is easy and difficult. It depends on the aspirant's goals and what they want to achieve in finance.

- The CIPM exam is the right career option for a candidate pursuing and succeeding in investment performances as an analyst.

- Whereas the CAIA exam is the best suited for candidates looking for a career in Alternative Investments (like Hedge Funds, Private Equity, Real Estate, etc.).

We have brought the details of the CIPM and CAIA certifications to help decide between them and simplify the decision-making.

Table of contents

What is the CIPM?

The CIPM course is appropriate for a candidate pursuing and succeeding in investment performance as an analyst. The CIPM course includes performance measurements and attributes of an investment. It can be investment banking, investment analysis, investment management, investment advisory, etc.

Certificate of Investment Performance Management (CIPM)is offered to be appeared by the Association of CIPM, which is a part or is associated with the CFA Institute. Hence, CIPM is an international professional course. But, first, let us give the background for this course.

- Not knowing about the continuous changes in the investment industry, specific regulations, laws, and market trends that decide the measurement and the advertising trends of financial products. However, the previous advertisement trends are now not used and encouraged for advertising these products anymore, especially by the US Securities and Exchange Commission.

- The global investment management industry has set standards that cover returns calculations and advertising standards to adhere to it. As a result, it has achieved continuous growth worldwide. These standards are called the Global Investment Performance Standards, or GIPS.

- Now that GIPS is an international body, it has been evident that this industry will hire only appropriate professionals. This entire scenario led CFA to form the CIPM association.

- This certificate gives you proficiency in the investment performance of investment firms globally.

What is CAIA?

The CAIA course is designed to educate a candidate on alternative investments. What are alternative investments as per knowledge? Let us explain. It is an asset class except for common equity and fixed income products. Alternative investments deal in hedge funds, private equity, real assets, commodities, etc.

- The CAIA Association offers a CAIA course, founded by the Alternative Investment Management Association and the Center of International Securities and Derivative Markets in 2002.

- CAIA is a non-profit association, and an independent global organization focused on educating and creating professionalism in alternative investment.

- The members of CAIA are required to maintain their membership with the CAIA Association by adhering to the ethical and professional standards of alternative investments.

- This international course has two levels to clear before the candidate becomes a certified Chartered Alternative Investment Analyst.

- CAIA is also known as the most competitive exam in the world of business, commerce, or finance. This course is recognized as the best in its class. It provides immense knowledge and credibility and helps demonstrate expertise in this finance domain.

- It is best to make aspirants smart and updated about alternative investments.

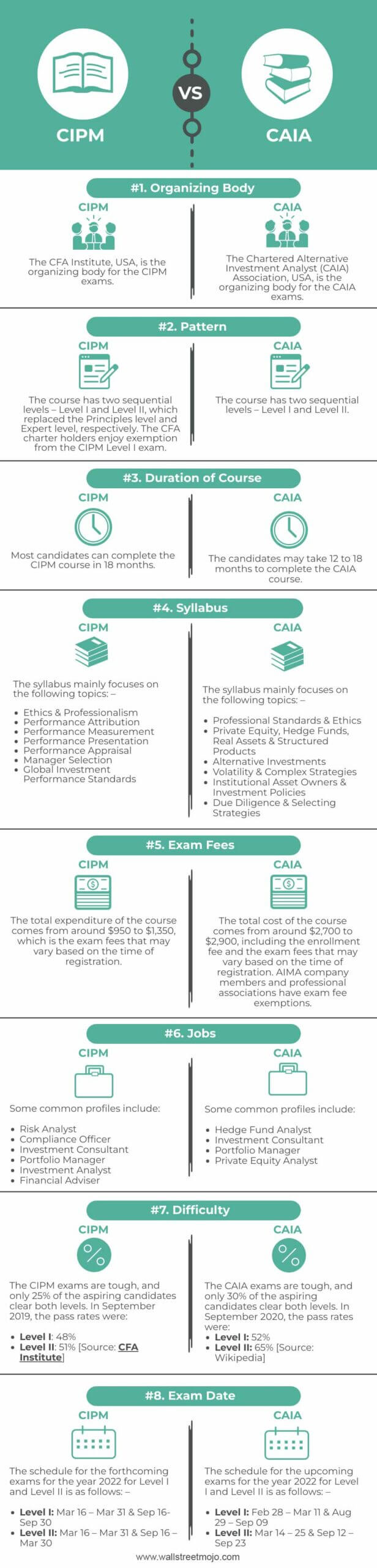

CIPM vs. CAIA Infographics

Reading time: 90 seconds

Let us understand the difference between CIPM and CAIA certifications.

CIPM vs. CAIA Comparative Table

Section | CIPM | CAIA | |

|---|---|---|---|

|

Organizing Body | The CFA Institute, USA, is the organizing body for the CIPM exams. | The Chartered Alternative Investment Analyst (CAIA) Association, USA, is the organizing body for the CAIA exams. | |

|

Pattern | The course has two sequential levels – Level I and Level II, which replaced the Principles level and Expert level, respectively. The CFA charter holders enjoy exemption from the CIPM Level I exam. | The course has two sequential levels – Level I and Level II. | |

|

Duration of the Course | Most candidates can complete the CIPM course in 18 months. | The candidates may take 12 to 18 months to complete the CAIA course. | |

|

Syllabus | The syllabus mainly focuses on the following topics: -

| The syllabus mainly focuses on the following topics: -

| |

|

Exam Fees | The total expenditure of the course comes from around $950 to $1,350, which is the exam fees that may vary based on the time of registration. | The total cost of the course comes from around $2,700 to $2,900, including the enrollment fee and the exam fees that may vary based on the time of registration. AIMA company members and professional associations have exam fee exemptions. | |

|

Jobs | Some common profiles include:

| Some common profiles include:

| |

|

Difficulty | The CIPM exams are tough, and only 25% of the aspiring candidates clear both levels. In September 2019, the pass rates were:

| The CAIA exams are tough, and only 30% of the aspiring candidates clear both levels. In September 2020, the pass rates were:

| |

|

Exam Date | The schedule for the forthcoming exams for the year 2022 for Level I and Level II is as follows: -

| The schedule for the upcoming exams for the year 2022 for Level I and Level II is as follows: -

|

Exam Requirements

CIPM

Professional certifications have certain requirements to appear and clear them. The CIPM examination requirements are given below: -

- The aspiring candidates must have two or more years of experience in calculations, analyses, showing investment results, different evaluation investments, giving services such as consultation, legal and regulatory, technical and accounting direct supporting investments, GIPS standard compliance verification experience, monitoring people practicing investment activities directly or indirectly, or even teaching investments.

- Else, a candidate must possess four years of work experience in the investment industry that mainly consists of activities such as application or evaluation of financial, economic, and statistical data as one of the most important parts of investment, marketing services of investment management, keeping a close watch on investment firms that comply with the standards, regulations, and laws of the industry, recommending investment managers after evaluating them.

CAIA

There are no mandatory requisites to opt for this alternative investment examination. However, if candidates want to ensure that they are on the right track, they may check through the following criteria: -

- Do they understand the basics of finance and qualitative analysis?

- Are they interested in developing expertise in alternative investments as risk managers, analysts, portfolio managers, traders, consultants, and advisors, among others?

- Are they determined to learn the subject?

Why Pursue CIPM?

The candidate must opt for a course if it is beneficial. For example, suppose they are professionals in the related fields and want to get on to a higher designation or a student who wants to ensure to commence something big. In that case, this course can help them achieve success in every stage of their career. In addition, this course can add value to work and life in the following ways: -

- In a designation like a risk manager or an analyst, a candidate must deliver high returns by minimizing risk. And this course will help them develop an insight that enables more actionable results.

- To add to your recruitment quality, the content of this course will help analyze the right candidate for risk management, which improves contacts that may help search for and select the right manager.

- Studying, evaluating, and producing reports would be essential tasks. These reports require transparency and, as per the laws of the regulators. CIPM gives the ability to help create comprehensive and transparent information.

- Risk is a definite factor in this job. However, the risk needs to be calculated, measured, and minimum. An aspirant can create awareness of the increased risk in this profile.

Why Pursue CAIA?

Initially, the members of CAIA search and consider different standards for alternative investments industry and professions. However, they do enjoy certain benefits that are associated with this designation.

A candidate can consider working for many domains on different designations within alternative investments. This professional course provides innumerable choices to the candidates. It includes Hedge Funds, Private Equity Funds, Investment Banking, and, Commodity Desk.

- With the membership as a CAIA, a candidate can access many related events and conferences globally to share investment and improvement ideas.

- These conferences enable growth in terms of knowledge of alternative investments. In addition, at these conferences, a candidate can socialize with similar background professionals, which provides the candidate with contacts to retain.

- The association assures that the candidate can achieve the higher and professional designation of their interest and perks associated with the membership.

- Essentially, this program is valued and trusted by top employers across the globe. As it helps the candidates achieve very high standards in alternative investments.

- That allows the candidate to build a global community and provide international recognition. In addition, the candidate receives an opportunity of pursuing and update their knowledge of alternative investments all their life.

- A course with the help of just two levels can help aspirants change the face of their career; however, this course is not going to be rocket science if the passion is an alternative investment.

Conclusion

A candidate needs the enthusiasm to know the industry's market and make money sweat for specific courses. Suppose, as a candidate interested in investment performance measurements and their data, we suggest CIPM as a career option.

An alternative investment is a different ball game altogether. It is much different from the rest of the market. If passionate about private equities, hedge funds, commodity desks, and not the real stock market, then this is the right place.

However, remember that it includes many studies as suggested; the recommended study time is more than 200 hours. If determined to give in so much time and effort, aspirants must take CAIA as a career.

Recommended Articles

This article has been a guide to CIPM and CAIA. Here, we have discussed the top differences between CIPM and CAIA, job options, fees, pass percentage, and focus areas. You may also have a look at the following articles: -