Table Of Contents

What Is Accounting Statement?

An accounting statement or account statement refers to a document that summarizes the financial details of an account during a given period. It records every transaction detail that occurs between an entity and its customers within a specific time range. This makes retrieval of data and related details easier for the parties involved.

Accounting statements can be of many forms. While some allow firms to track transactions and detect loopholes in the accounting, others enable them to monitor their performance. In short, different statements of accounts have a different purpose to fulfill.

Table of contents

- An accounting statement provides a detailed overview of a customer’s financial activity within a defined period.

- Some components of an accounting statement are service fees, paid and unpaid invoices, invoice amount and numbers, and net remaining balance. They also contain historical transactions that can help calculate the outstanding balance.

- Accounting statements are legally bound and work as proof of transaction. They assist in several circumstances, such as settling disputes between lenders and borrowers, budgeting, and cross-verification of the amount involved.

Accounting Statement Explained

An accounting statement is a document that one party prepares to keep track of the transactions done with another party. This lets them have a clear picture of the amount given or to be taken from another party. An example is a bank account statement.

A bank account statement reflects the source and amount of every transaction within a selected period. Different statements serve different purposes, but they all act as written proof that helps resolve disputes.

Financial transactions such as payment of utility bills, ATM cash withdrawals, credit card purchases, etc. are all daily transactions that one makes. It is essential to keep track of them to stay on top of your expenses and earnings.

Financial institutions provide different types of accounting statements to summarize such transactions. These are generated for checking account statements, insurance account statements, brokerage account statements, bank account statements, and credit card statements. These statements help customers track their financial records for personal or legal purposes.

Features

Let us dive into some of the features of such a statement.

- Accounting statements apply to nearly all types of financial accounts with ongoing transactions (individual and corporate). Businesses like telecom, cable television, utility, payments services, credit cards, and insurance companies usually generate these statements.

- The contents, format, and template vary according to its purpose. For example, an electricity bill is generated every month after the consumer’s account has been adjusted for arrears. The electricity bill will usually contain total consumption in a billing cycle, fixed charges, arrears, due payment, last date, late fee, etc. On the other hand, a bank account statement will contain debits paid, funds credited, taxes charged, and the current account balance for a specific duration.

- An account statement provides an easy-to-understand account activity report to manage finances and detect financial anomalies. They are legal and could come in handy when there are conflicts, such as being doubly charged on your mobile phone bill.

- Customers usually have to opt-in for a particular method of communication to receive their account statement. With the advent of the internet and paperless drives, more and more companies send them through emails instead of regular posts.

- Account statements differ from a financial statement in that the latter comprises a balance sheet, an income statement, a cash flow statement, and an equity statement. An accounting income statement outlines the service and maintenance fees, credits due, money received, and prepayments over a given period.

Types

Accounting statements can be electronic or paper-based.

Electronic Statements

Electronic statements are generated, monitored, and delivered digitally in multiple formats, like PDFs, HTML, etc. It is facilitated through online portals. Statement prepared electronically offer more convenience, easier storage, and better reduction to environmental impacts.

Electronic statement saves space, restricts unauthorized access to data and limits paper usage to a great extent. The statement is password-protected and hence, much secure.

Paper Statement

Paper statements, as the name suggests, are printed on paper. These are delivered to the concerned parties manually by post to their physical address. Disposal of these statements can be risky as the information getting into the wrong hands may cause adverse effects on the holders' finances. Hence, it is important for one to be careful in disposing of these statements to protect sensitive information.

This is the statement that works in areas or entities that can do without a wider network and without the need for instant communication. However, it becomes the most reliable source of information in the event of failure of data retrieval electronically due to technical inconveniences.

Format

An accounting statement format varies with the company, its jurisdiction, and the information provided. However, they all give an accurate and complete overview of a customer’s account, including the transaction history with a beginning and ending date. Most companies follow a similar account statement template.

These statements also bear a mark like a stamp for hard copies or a QR code for soft copies to confirm their authenticity.

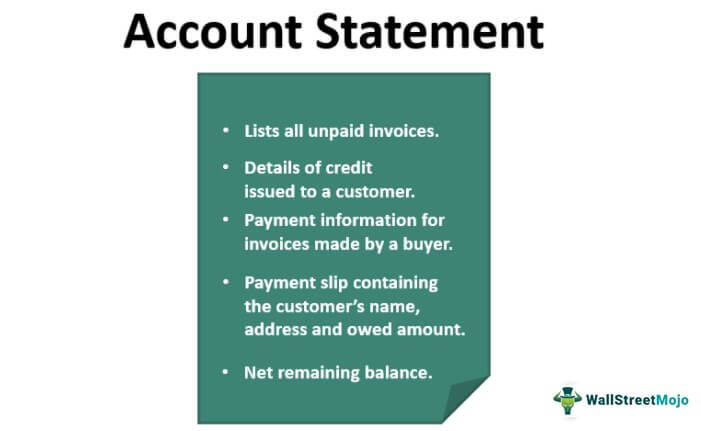

Common elements of such statement include:

- A payment slip with the customer’s name, address, and amount paid.

- A list of unpaid invoices with the total balance due.

- Credit number, credit date, total invoiced amount, the invoice amount paid, the date range for the statement, opening, and overall balance.

- Payment details for invoices billed by the service provider and paid by the customer within a specific duration.

- The net remaining balance from unpaid invoices.

Example

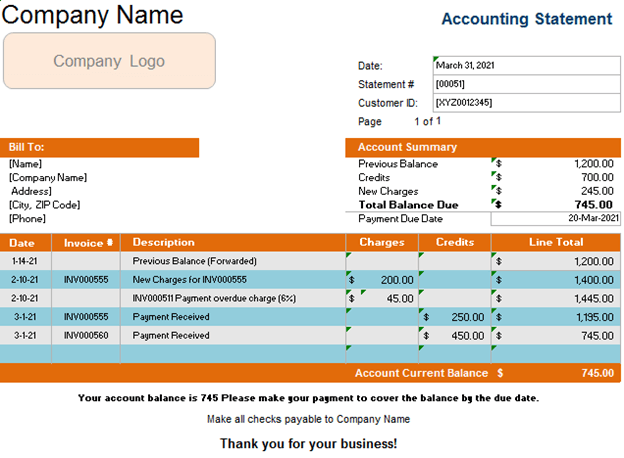

Let us consider the following example to understand how these accounting statements work:

An account statement is sent to the account holder for several reasons. The agreement between the account holder and the service provider is to have it sent periodically after an agreed-upon date. Below is an accounting income statement sample issued to the consumer by the service provider:

Uses

These statements that firms prepare help them make well-informed decisions. Some of the uses of account statements are as follows:

Identifying Financial Irregularities

An accounting statement keeps the customer and the business on the same page when it comes to revealing the status of the former’s account. By checking the account statement regularly, the account holder can spot any financial irregularities and fix them quickly.

For instance, a customer borrows money from a financial institution and makes regular payments to the firm. The account holder can use the statement to track all the transactions. If any details are missing due to clerical error or fraud, they can discuss them with the lender.

Budgeting

They are helpful for budgeting priorities. Account statements of cash flows hence helps in keeping track of the funds. In the case of a bank account statement, an individual or business may review it monthly. It helps a company recognize excessive cash outflow elements that they could minimize to boost their finances.

For instance, in the COVID-19 hit economy, various industries suffered revenue loss due to an unprecedented decline in customer purchasing power. Companies can use these statements to reduce non-essential spending or consider offering discounts to their customers to increase sales.

Similarly, an individual can see where most of their money goes and make plans to save more. Furthermore, assessing the effectiveness of financial prudence measures is possible with these statements.

Settling Disputes

Transactions can result in payment differences that the customer must resolve by legal means right away. The statement, in this case, would provide tangible, non-partisan information related to transactions to the parties involved to help reach an arbitration. Moreover, lawyers can use these documents to advise their clients on the matter.

Securing Debt

An account statement will also enable an individual or business to secure a debt. It will provide a debt limit that the lender can consider offering. Most lenders use this information to gauge the financial position of the borrower. It also provides a glimpse into the maximum debt that the potential borrower can pay.

Blacklisting Problematic Clients

An income statement is beneficial in identifying problematic clients. These statements become more relevant over time because they help an individual or company assess its financial value in the future. Information like late payments and financial disputes will help the lender learn about the borrower before lending a loan. Based on this, the lender could decide whether to extend the credit to the borrower.

Screening Overseas Students

Individual account statements are critical in screening students seeking education abroad. A personal statement reveals the student's financial history or caretaker. In this case, both the university and the country students emigrating need to be sure of their financial ability. The students need to be sure whether they will bear the costs of earning an education and staying in the country.

Recommended Articles

This has been a guide to Accounting Statement and its definition. Here we discuss the format and some common uses of accounting statements with a detailed explanation. You may learn more about financing from the following articles –