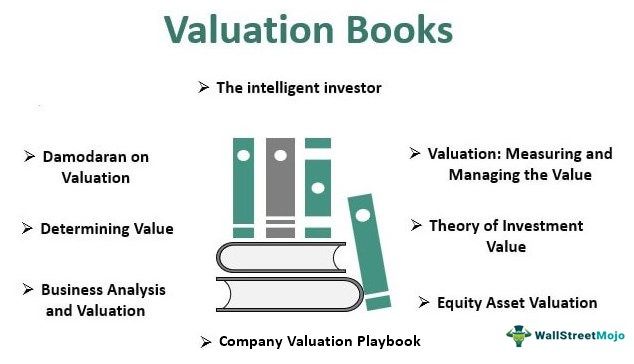

List of Top Valuation Books

Valuation books have different matters and facts related to the valuation using which one can gather knowledge about the valuation, which is very much necessary before entering the market. Below is the list of top books on valuation: –

- The intelligent investor ( Get this book )

- Theory of Investment Value ( Get this book )

- Valuation: Measuring and Managing the Value of Companies ( Get this book )

- Damodaran on Valuation: Security Analysis for Investment and Corporate Finance ( Get this book )

- Company Valuation Playbook: ( Get this book )

- Equity Asset Valuation ( Get this book )

- Business Analysis and Valuation: Using Financial Statements ( Get this book )

- Determining Value: Valuation Models and Financial Statements ( Get this book )

Let us discuss each valuation book in detail and its key takeaways and reviews.

#1 – The Intelligent Investor

by Benjamin Graham

It is considered the most important book ever written on investing and valuation. Although it was written in 1949, the book has many inspiring quotes by Benjamin Graham that can motivate you to a career in finance. In this book, Benjamin Graham enlightens us about the strategies one can use to reach our goals and how the risks involved can be minimized. Concepts of value investing are explained so well that you can easily understand how to invest based on assets and profits. Benjamin Graham has tried to cover all the important aspects of technical trading in the book. According to his investing philosophy, buy stocks and bonds at a discount to their intrinsic value. In addition, by including a margin of safety at the purchase, an investor does not have to rely on accurately forecasting what the future will bring. This book is considered the bible of finance and has been rated 4.25 stars out of 5 by goodreads.com.

Going through books can definitely enhance your theoretical knowledge, but browsing through advanced resources would lead to enhanced knowledge. If you are someone looking for a better understanding of equity valuation, this course on Fundamentals of Equity Valuation is for you.

#2 – Theory of Investment Value

by John Burr Williams

The theory of investment was printed first in 1938. It revolves around the idea that stocks are worth the present value of their dividends paid in perpetuity formula. In this book, the investment value of a stock is defined as the net present value of its future dividends. The book features the technique of DCF, which is the foundation of business valuation for making investment decisions. The well-known investor Warren Buffet was highly inspired by the “Theory of Investment Value” by John Burr Williams. Two major takeaways from this book are that one can take the intrinsic value out of discounted value throughout its lifetime. A business that can reinvest its earnings at a higher rate than the applied discount rate should do so. In contrast, a company that cannot reinvest should not do so. The classic book has a rating of 3.9 on goodreads.com.

#3 – Valuation - Measuring and Managing the Value of Companies

by McKinsey & Company Inc.

This book has been co-authored by Tim Koller, Marc Goedhart, and David Wessels and is one of the best guides for corporate valuation: –

- The book establishes some proven principles of value creation, completely denying the myths that prevail throughout the world.

- It provides the complete knowledge required by executives to make value-creating decisions.

- The book contains important case studies regarding analyzing a company’s historical performance and rearranging the financial statements of the company to have a closer look at the economic performance.

- Estimating the cost of capital has been explained thoroughly with the most useful practical tips.

- The book emphasizes linking a company’s trading valuation multiples to the core drivers of the performance.

It is the must-have book for all investment banking analysts and investors.

#4 – Damodaran on Valuation - Security Analysis for Investment and Corporate Finance

by Aswath Damodaran

Aswath Damodaran is a gifted teacher and a respected valuation authority. This book delves deeply into the three basic approaches to valuation, i.e., discounted cash flow valuation, relative valuation, and contingent claim valuation. The detailed explanation with ample real-world examples of many U.S.-based and other international firms makes it easy to understand each model’s motive, advantages, and disadvantages. Moreover, it motivates by developing readers’ ability to judge complex and precise valuation scenarios perfectly.

#5 – Company Valuation Playbook

by Charles Sunnucks

The book “Company Valuation Playbook” explains how to value a company and its shares in easy-to-understand steps. For example, it introduces how to interpret financial statements, project a firm’s long-term outlook, develop an economic model, calculate a discount rate, and produce a valuation output. It applies to all companies, no matter their size or industry. It also includes chapters on mergers, acquisitions, and leveraged buyouts.

The book shares the industry-standard tools professionals use globally, with plenty of examples to make it an engaging read. At its premise is a simple principle – if you overpay for a stock, you will likely get stung, and if you underpay, you will profit. Therefore, to stack the deck in your favor when investing, the ability to objectively assess and value a company is vital.

Key Highlights

- Not all good companies are good investments.

- Learn to think long-term to help avoid disaster.

- Investors need to be both disciplined and objective.

- A company’s value is based on the adjusted cash flows.

#6 – Equity Asset Valuation

by John Stowe

The book combines finance and accounting concepts into the discussion, providing the evenness of subject matter treatment, consistency of notation, and continuity of topic coverage. It covers the following topics: –

- Equity valuation—applications and processes

- Return concepts are essential for evaluating an investment.

- Discounted dividend valuation

- Free cash flow valuation

- Market-based valuation—including price and enterprise value multiples

- Residual income valuation

- Private company valuation

It is an extremely important read for students who want to strengthen valuation concepts before going into finance. In addition, many specific valuation examples are used throughout the book, making it very useful for finance students learning how to implement intrinsic stock valuation.

#7 – Business Analysis and Valuation: Using Financial Statements

by Krishna G. Palepu

The important topics are business strategy analysis, accounting analysis, financial analysis, and prospective analysis. In addition, the book depicts the application of this business analysis in securities analysis, credit analysis, corporate financing policies analysis, mergers and acquisitions analysis, and governance and communication analysis. The main advantage is that it features Harvard Business School cases, which provide an in-depth practical application of various subjects and the techniques one can use to handle a similar situation.

#8 – Determining Value - Valuation Models and Financial Statements

by Richard Barker

This book describes all the methods used to value companies. Various valuation methods like price-earnings ratio, dividend yield, and EVA have been discussed elaborately. A single that can contain the gist of the book is that the valuation model is chosen based on available data and the quality of data and not based on the theoretical validity of the model. The book identifies the relationship between various valuation models and brings to light the assumptions made by each model. The real-life cases in the book instill the learning that stays for a lifetime.

Also, several other books are available to learn valuation techniques, but these books are perfectly suitable for novices and experienced. Even the teachers use these books for reference. We hope you go through these valuation books and make the best.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com