Table Of Contents

What Is Enterprise Value?

Enterprise value (EV) is the corporate valuation of a company, determined by using market capitalization and total debt. The market cap comprises preference stocks, common stocks, and minority interest; total debt comprises short-term and long-term liabilities of the company.

EV accurately evaluates the cost of acquiring a business by equally considering equity and debt. In a takeover, the acquirer will be liable to pay the corporate liabilities of the target company; therefore, relying upon market capitalization won't be enough.

Key Takeaways

- Enterprise value (EV) refers to the overall valuation—equity, debt, cash, and cash equivalents. In other words, it is the cost of acquiring a firm.

- The EV/EBITDA is an enterprise multiple. It correlates EV with earnings before interest, taxes, depreciation, and amortization. The metric determines whether the firm is undervalued or overvalued.

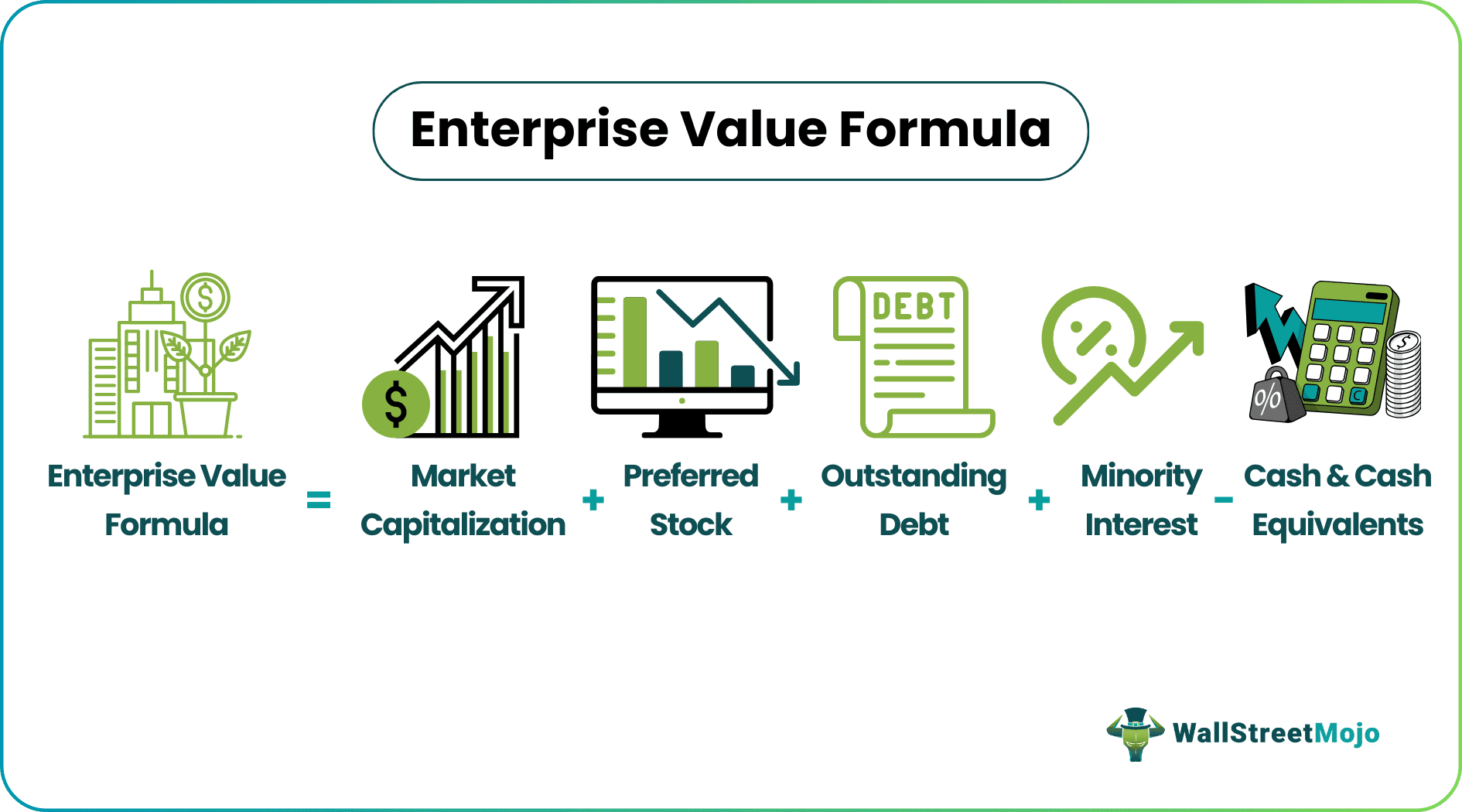

- EV is computed using the following formula:

- EV = Market Capitalization + Market Value of Debt - Cash and Equivalents.

Enterprise Value Explained

Enterprise value (EV) is a financial metric used in business valuation, financial modeling, accounting, portfolio analysis, and risk analysis. EV is more accurate than market capitalization when representing real corporate value.

EV accounts for other significant implications faced by an acquirer. Along with the current assets and non-current assets, a new acquirer acquires debt liabilities as well. Short-term debts, long-term debts, and outstanding interest payments add to the acquisition cost.

Similarly, an acquirer will take over the target firm's cash balance and other liquid assets, which can be used to clear liabilities. Therefore, these costs are subtracted to arrive at the correct theoretical value of a target company.

Given below are the primary components of EV calculation:

- Equity Value: It is the market value of a company's total outstanding common shares.

- Total Debt: It refers to overall external liabilities—short-term and long-term debts.

- Preference Stock: It is the value of a company’s outstanding preference shares.

- Cash: When EV is computed, quick cash items are deducted—they have debt repayment and share buyback potential.

- Non-controlling Interest: The minority interest or the non-controlling ownership stake (stakeholders' share of less than 50%) is also added to EV.

Video Explanation Of Enterprise Value

Formula

The following formula represents the enterprise value:

or,

In the above formula, market capitalization is the product of each current stock's price and the number of outstanding shares. The current stock comprises all the outstanding preferred shares and common shares in the market.

Also, the market value of debt refers to total liabilities—short-term and long-term obligations of the company.

Enterprise Value Examples with Calculation

Let us understand Enterprise Value calculation using examples.

Example #1

Let us assume ABC Ltd. is considering the acquisition of XYZ Corp. Then, based on the following financial details, determine the correct market value of XYZ Corp.

- Total outstanding shares = $1579500

- Stock price = $20.18 per share

- Market value of debt = $9365400

- Cash and cash equivalents = $8280700

Solution:

EV = Market Cap + Market value of debt – Cash and cash equivalents

Market Cap = Price Per Share × Total Outstanding Shares

Market Cap = 20.18 × 1579500 = $31874310

EV = 31874310 + 9365400 – 8280700 = $32959010

Comparing the XYZ Corp.’s enterprise value with its market capitalization:

Premium = × 100

Premium = 3.4%

Therefore, based on EV, the price per share will be $20.87.

XYZ Corp's value is 3.4% higher than its market capitalization. Therefore, if ABC Ltd. buys XYZ Corp., it will be paying 3.4% more than the current stock price. This implies that ABC Ltd. will be paying $20.87 per share to buy XYZ Corp., although its stock price is only $20.18 per share.

Example #2

Further, let us assume ABC Ltd. gets access to the following financial insights about the XYZ Corp.:

- Common Stocks = $20074000

- Preference Stocks = $9800310

- Minority Interest = $2000000

- Market value of debt = $9365400

- Cash and cash equivalents = $8280700

Based on the given data, determine the enterprise value of XYZ Corp.

Solution:

EV = Common Stock + Preference Stock + Minority Interest + Market Value of Debt - Cash and Equivalents

EV = 20074000 + 9800310 + 2000000 + 9365400 – 8280700 = $32959010

Hence, to acquire XYZ Corp. ABC will have to pay $32959010.

Enterprise Value of Amazon & Apple Stock

Let us have a look at top market players and their EVs.

#1 - Amazon.com Inc

On February 2, 2022, the company's EV was $1.485T; by February 3, 2022, the company's EV dropped to $1.366T. Also, in February 2022, the firm's market capitalization was $1.598T. Amazon's market cap is higher than its enterprise value—Amazon's external liabilities are less than its cash and equivalents.

#2 - Apple Inc.

As of February 4, 2022, Apple had an EV of $2.872T. However, its February 2022 market capitalization was $2.861T, slightly less than its EV. This means a takeover will cost $11B more than its market cap.

Enterprise Value Multiple

EVs can be used to derive some integral multiples—enterprise multiples. EV multiples are used very often in equity research and investment banking for performing the following relative valuations:

- EV/EBITDA: The relation between the market value of total capital from all sources and the operating earnings. The EV/EBITDA multiple has a positive correlation with the increase in free cash flow to the firm (FCFF) and a negative correlation with risk levels and the weighted average cost of capital (WACC).

Image Source: Valuation Course

- EV/EBIT and EV/Sales: EV considers the total debt owed by a company and the quick assets, i.e., cash and equivalents. Hence, the EV/Sales multiple is a better indicator than the Price/Sales ratio.

Image Source: Financial Modeling and Valuation Course

Thus, EV multiple is chosen over the PE ratio when firms with different degrees of financial leverage (DFL) need to be compared.