Table Of Contents

What Are Valuation Methods?

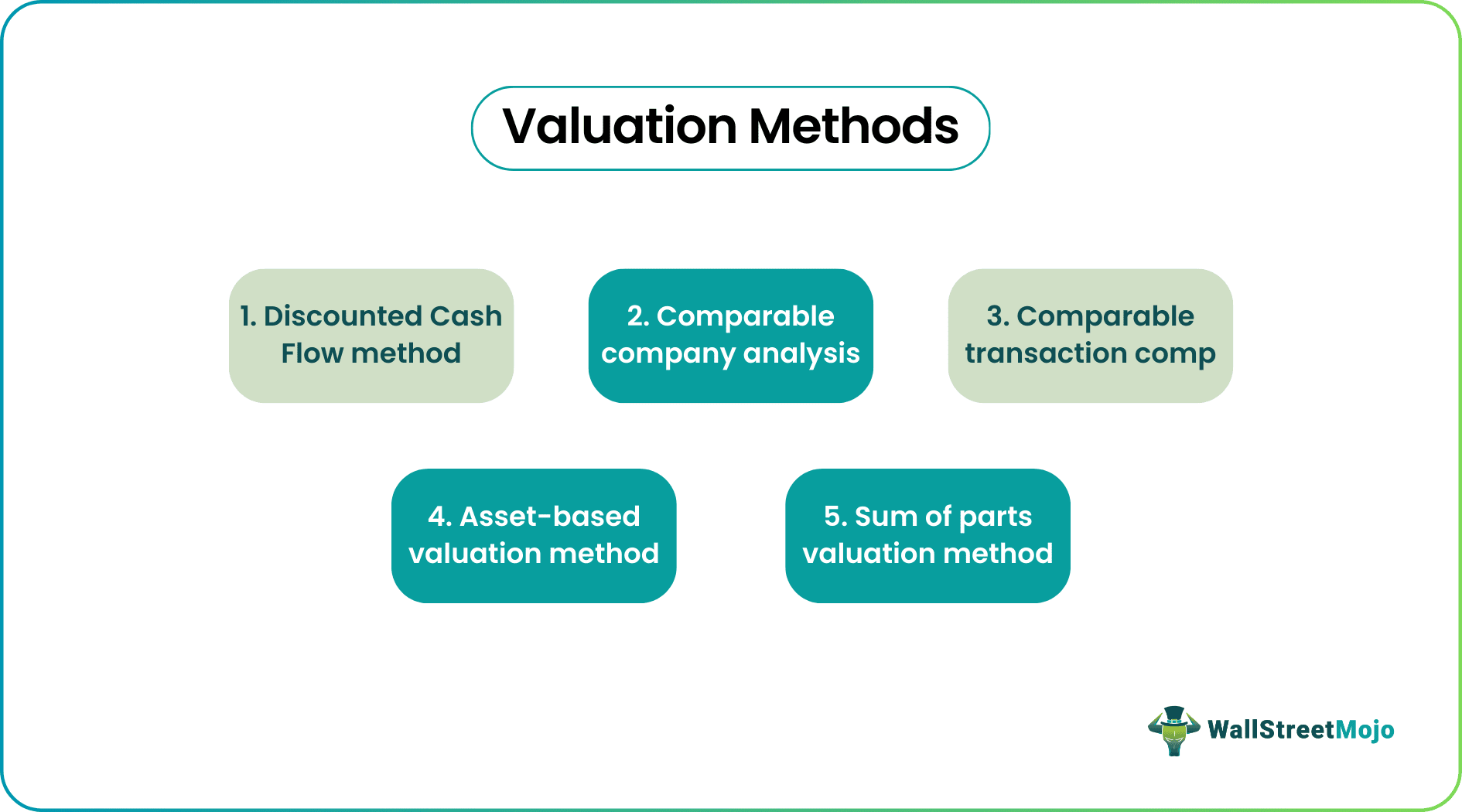

Valuation methods are the methods to value a business/company which is the primary task of every financial analyst. There are five methods for valuing company: Discounted cash flow which is present value of future cash flows.

Comparable company analysis, comparable transaction comps, asset valuation, the fair value of assets and sum of parts where different parts of entities are added. The main idea behind the concept is valuation or estimation of worth of an asset or business so as to determine whether it is under or overvalued. This helps management take future investment decisions and implement them as per operational requirement.

Valuation Methods Explained

The concept of equity valuation method explains the techniques involved in evaluation of securities or firms for the purpose of estimating whether they are undervalued or overvalued. This is important from the point of view of investment decision and expansion plans undertaken by the company management as well as its stakeholders.

The methods include a number of assumptions and detailed analysis of historical as well as current data. The business might select from different valuation techniques that suit best as per the nature, size and type of business operation.

The common equity share valuation methods used include discounted cash flow, comparable company approach, valuation based on assets owned by the company and so on. The procedures basically estimate the intrinsic value of the firms, which is strongly based on fundamental analysis of company assets and its characteristics.

These valuation models are analyzed and used widely by analysts and investors to make decisions and give buy or sell recommendations. Primarily the stock prices, the volume of trade, the risk levels, market capitalization data, etc are used. Fundamental analysis of companies are also done to include information and financial data regarding industry and economy details. The estimated value of the security is compared with the market prices to get an idea about the valuation.

Video Explanation of Valuation Methods

Example

A per a report published by the brokerage firm Morgan Stanley, the equity valuation of the United States can take a serious hit and come down drastically and as a result lose the faith of investors. This can be due to downgrading of the sovereign debt by Fitch, which is a rating agency, based on which the government of the country will decrease its fiscal spending.

This fiscal stimulus had allowed the economy to grow and expand after the pandemic, which had ultimately resulted in rally of stock market in the US, majority of which were technology related stocks. Thus, it is estimated that the fall in valuation of equity will be seriously questioned by investors of the country.

List of Top 5 Valuation Methods

Given below are some commonly used equity share valuation methods and approaches that exist in the financial market. These models implicitly question how accurate and dependable the valuation of the enterprise is, which is extremely useful in case of portfolio management for the purpose of earning maximum returns within calculated risk.

- Discounted Cash Flow Method

- Comparable Company Analysis

- Comparable Transaction Comp

- Asset-based Valuation Method

- Sum of the Parts Valuation Method

It is important to be able to apply the analysis on the models in an informed and skilled manner because they are not just numerical calculation, but also include some part of subjective judgement based on experience. Vey often, analysts select model sthat are suitable as per the information available, which are to be used as inputs. However, it is proper to select models that are simple in calculation and easy to use and interpret.

Let's discuss each of them in detail.

#1 - Discounted Cash Flow

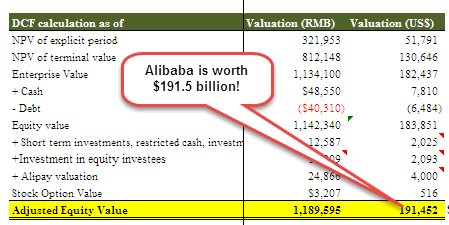

The below table summarizes Alibaba's Discounted Cash Flow Valuation model.

- DCF is the net present value (NPV) of cash flows projected by the company. DCF is based on the principle that the value of a business or asset is intrinsically based on its capability to generate cash flows.

- Hence, DCF relies more on the fundamental expectations of the business than on public market factors or historical models. It is a more theoretical approach that relies on various assumptions.

- A DCF analysis helps yield the overall value of a business (i.e., enterprise value), including both debt and equity.

- While calculating this, the present value (PV) of expected future cash flows is calculated. The disadvantage of this technique is an estimation of future cash flow & terminal value along with an appropriate risk-adjusted discount rate.

- All these inputs are subject to substantial subjective judgment. Any small change in input changes the equity valuation significantly. If the value is higher than the cost, the investment opportunity needs to be considered.

#2 - Comparable Company Analysis

Below is the comparable company analysis of the Box IPO Equity Valuation Model which is another one of some widely used equity research valuation methods.

- This equity valuation method involves comparing public companies' operating metrics and valuation models with those of target companies.

- Using equity valuation multiple is the quickest way of valuing a company. It is also useful in comparing companies that do comparable company analysis. The focus is to capture the firm's operating & financial characteristics, such as future expected growth in a single number. This number is then multiplied by a financial metric to yield enterprise value.

- This equity valuation method is used for a target business with an identifiable stream of revenue or earnings, which the business can maintain. For businesses still at the development stage, projected revenue or earnings are used as the basis of valuation models.

#3 - Comparable Transaction Comp

Below is the Comparable Transaction Comp of Box IPO Valuation

- The company's value using this equity valuation method is estimated by analyzing the price paid for similar companies in similar circumstances. This kind of valuation method helps understand the multiples and premiums paid in a specific industry and how other parties assess private market valuations.

- This equity valuation method requires familiarity with industry & other assets. When choosing companies for this type of analysis, one needs to keep in mind that there are similarities between factors such as financial characteristics, the same industry, size of the transaction, type of transaction, and buyer characteristics.

- This equity valuation method saves time to use publicly available information. However, the major drawback of this valuation technique is the amount and quality of the information relating to transactions. Most of the time, this information is limited, making it difficult to conclude. This difficulty gets aggravated if the company is trying to account for differences in the market conditions during previous transactions compared to the current market. For example, the number of competitors might have changed, or the previous market might be different in the business cycle.

- While every transaction is different and thus makes direct comparisons difficult, precedent transaction analysis does help provide a general assessment of the market's demand for a particular asset in this equity research valuation methods.

- So valuation in this type of analysis would be first selecting a universe of transactions, locating the necessary financials, then spreading the key trading multiples, and lastly, determining the company's valuation. For example, if your company is predicted to have an EBITDA of $200 million in 2016 and the precedent transaction analysis shows target companies were purchased for 20x EBITDA, then your company would be worth approximately $4 billion.

#4 - Asset-Based

- The asset-based valuation method considers the value of the assets and liabilities of a business. Under this approach, the value of a business is equal to the difference between the value of all its relevant assets and the value of all its relevant liabilities.

It can be easily understood by the following simple Illustrative example:-

The Directors of a company, ABC Ltd, are considering the acquisition of the entire share capital of XYZ Ltd.

The following is the balance sheet of the company XYZ ltd.:

| Liabilities | Assets | ||

|---|---|---|---|

| Share Capital | 50000 | Fixed Asset | 735000 |

| Reserve and Surplus | 400000 | Stock | 500000 |

| Sundry Creditor | 700000 | Sundry Debtors | 700000 |

| Bank Overdraft | 800000 | Cash in hand | 15000 |

| Total: | 1950000 | Total: | 1950000 |

Valuation by using Asset-Based Approach:

| Particulars: | Amount |

|---|---|

| Assets: | |

| Fixed Asset | 735000 |

| Stock | 500000 |

| Sundry Debtors | 700000 |

| Cash in hand | 15000 |

| Total Assets | 1950000 |

| Liabilities: | |

| Sundry Creditor | 700000 |

| Bank Overdraft | 800000 |

| Total Liabilities | 1500000 |

| Total assets-Total Liabilities | 450000 |

| Value of the company | 450000 |

#5 - Sum of Parts Valuation Method

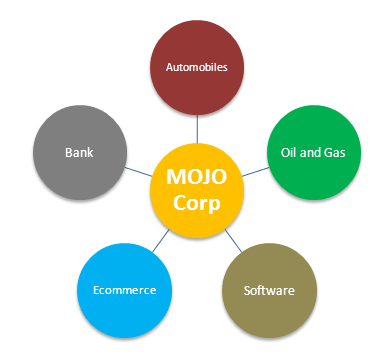

A conglomerate with diversified business interests may require a different valuation model. Here we value each business separately and add up the equity valuations. This approach is called a sum of parts valuation method.

Let us understand the Sum of the Parts valuation using an example of a Hypothetical company Mojo Corp.

To value a conglomerate like MOJO, one can use an equity valuation model to value each segment.

- Automobile Segment Valuation – Automobile Segment could be best valued using EV/EBITDA or PE ratios.

- Oil and Gas Segment Valuation – For Oil and Gas companies, the best approach is to use EV/EBITDA or P/CF or EV/boe (EV/barrels of oil equivalent)

- Software Segment Valuation – We use PE or EV/EBIT multiple to value Software Segment

- Bank Segment Valuation – We generally use P/BV or Residual Income Method to value Banking Sector

- E-commerce Segment – We use EV/Sales to value the E-commerce segment (if the segment is not profitable) or EV/Subscriber or PE multiple.

Mojo Corp Total Valuation = (1) Automobile Segment Valuation + (2) Oil and Gas Segment Valuation + (3) Software Segment Valuation + (4) Bank Segment Valuation + (5) E-commerce Segment.