Table Of Contents

What Is Business Credit Score?

A business credit score, also a commercial credit score, is a number that indicates the ability of a business to apply for a loan. This score proves that a particular business has good finances and can repay the loan on time.

Good credit scores allow individuals or firms to save interest on loans. It helps in monitoring the health of a company. In addition, this score prevents fraud and safeguards business assets. Companies can easily avail of credit facilities with a good credit score. Without them, companies cannot receive funding from any investor.

Key Takeaways

- A business credit score is an indicator that reflects the historical repayment background and, thus, the ability of a business to pay back the debt.

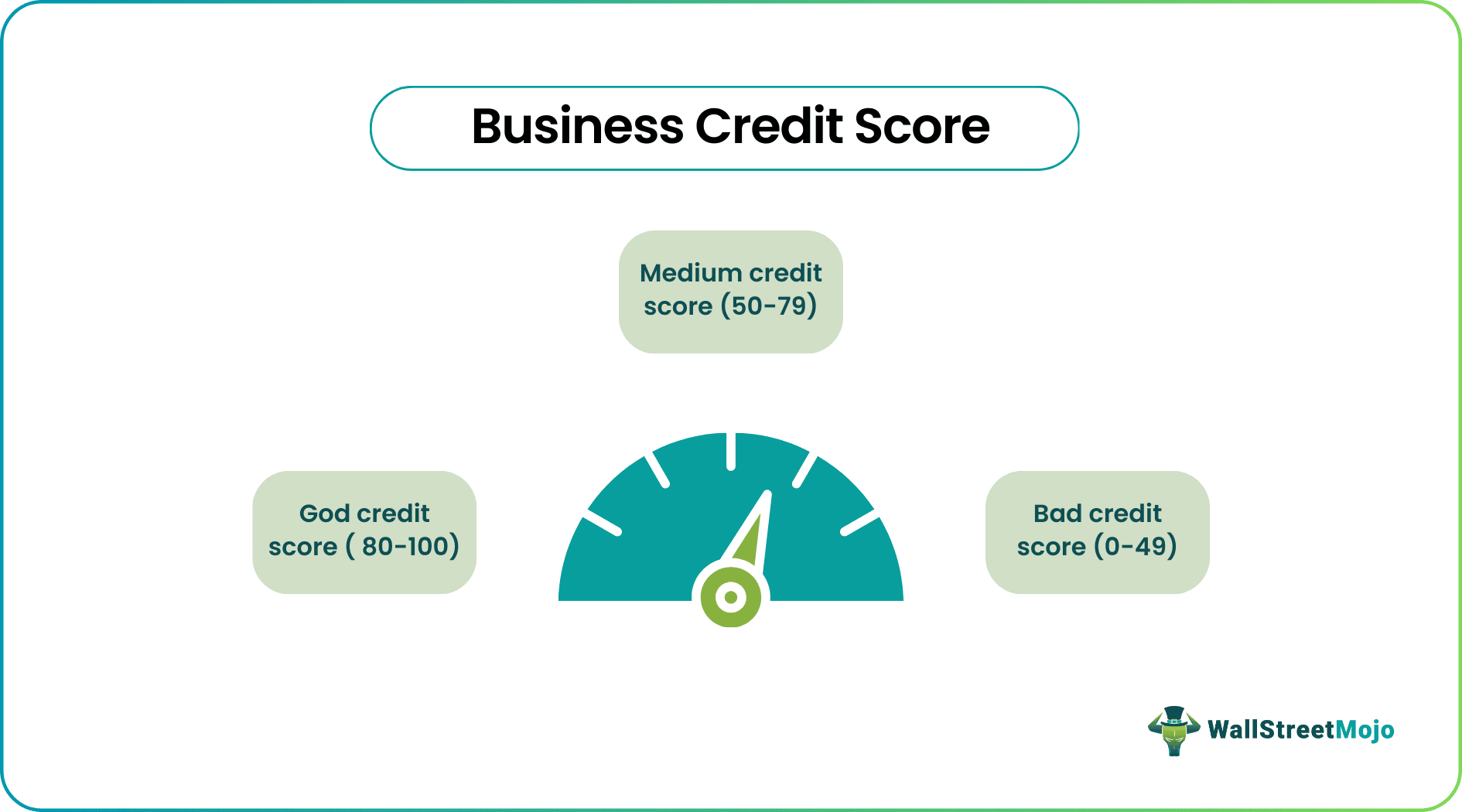

- It ranges from 0 to 100. A score below 49 indicates a bad score, while a score of more than 50 is a good credit score.

- A good credit score indicates low credit risk, whereas a bad credit score means a high credit risk.

- A lender like Dun & Bradstreet CreditSignal offers tools to measure free business credit scores. In contrast, others offer paid services for the same.

Business Credit Score Explained

A business credit score determines the financial health of a company/firm. Lenders ask for a credit score to get assurance from borrowers regarding payment. Creditors need to observe the firm’s revenues, profit and loss statements, balance sheets, and thus their gains, losses, liabilities & assets, and collateral value before approving the loan. Since personal and business finance of small & micro owners are interlinked, creditors check both the scores.

While consumer credit dates back to the 1840s, commercial credit scores have been around for decades. FICO Scores was the first firm to provide credit scores to companies in 1956. Gradually, firms like Experian, Equifax, and D&B (Dun and Bradstreet) also entered to provide business credit reporting services. Each has a different rating method. By the late 1960s, more than 2000 credit firms were providing credit reporting services in the United States.

The business credit score range is from 0 to 100. A score below 50 would indicate that a business is poorly managing its finances. Likewise, a score between 50 to 79 shows a moderate risk for that company. However, more than 80 depict the vital capacity of a business to repay the loan.

Lending institutions like banks and mortgages use credit scores as a metric to measure the repaying ability of a borrower company. These scores decide how much loan lenders can give to the borrowers. However, before making any decision, lenders consider certain factors. It includes payment history, industry risks, credit history, company size, and debt. As a result, based on these factors, credit rating agencies create a business credit report. In addition, this report includes the credit scores of a company.

How To Check Business Credit Score?

Scoring companies calculate these numbers based on the borrowing firms’ credit repayment history, credit obligations, judgments and legalities, tax liens, the company’s operation, firm size, management size, and similar things. While it is easy to calculate personal credit scores, it differs for enterprise ones. So let us look at how to check commercial credit scores with paid and complimentary services.

#1 - Free Credit Score Checking

Certain credit rating firms offer free tools to calculate a company's credit score. These sites allow users to track their credit score for a trial period of 14 days. After the trial period, businesses can avail of full access by paying a premium fee.

For example, enterprises can get a free business credit score check from credit rating agencies such as Dun & Bradstreet (D&B) or Experian. These agencies calculate the credit scores based on repayment history, company type, bankruptcy, and similar things. In addition, they offer a monthly credit summary. Also, it gives alerts at times of changing credit scores.

#2 - Paid Credit Score Checking

While some prefer free tools, companies opt for paid services to check their credit score. These services include business credit reports, factors affecting credit scores, and similar things. For example, Experian's business credit report details the company's financial history in the past years. Also, it informs about credit scores, commercial filings, and similar things.

What Is A Good Business Credit Score?

A good business credit rating refers to a score stating that the company will repay the loan on time. Unlike personal credit scores that range from 350 to 850, commercial credit scores usually range from 0 to 100. Although the score seems to be numeric, it is sometimes difficult for the firm to maintain this score.

Most lenders look out for a credit score above 75 for small businesses. For example, if D&B PAYDEX Score is above 80, it shows that the company will make timely debt payments. But, a score below that would endanger the debt amount. As a result, creditors will avoid providing finances to such companies. Hence companies aim to improve business credit scores.

However, FICO SBSS (Small Business Scoring Service) has a different credit score range. A small business credit score range from 0 to 300. A FICO score above 140 or 160 indicates a company's good financial health, enabling them to obtain a Small Business Administration (SBA) 7(a) loan.

Firms often have a good rating if they do not have too much debt or repay on time, has a good reputation and brand image, has low legal troubles, and have multiple good sources of revenue.

Example

Let us look at a company's credit score example to comprehend the concept better.

According to the Federal Reserve's 2020 Small Business Credit Survey, 79% of the businesses have an outstanding debt compared to 2019. Also, 45-48% of businesses in small and large banks have low credit risk (high credit score), and 38% have high credit risk. While in the case of fintech lenders, only 11% of companies have good credit scores. In conclusion, 65% of the companies have good credit scores, 28% have medium scores, and the rest, 8%, have high credit risk.