Table Of Contents

What is Credit Risk?

Credit Risk is the probability of a borrower defaulting on debt obligations. Lenders risk not receiving the principal and interest component of the debt. This can result in an interrupted cash flow and increased cost of collection.

Financial institutions analyze the credit risk associated with each borrower to reduce losses and fraudulent activities. The term can be extended to other similar risks—a bond issuer may not be able to make payment at the time of its maturity, or an insurance company may not be able to pay a claim.

Key Takeaways

- Credit risk is the uncertainty faced by a lender. Borrowers might not abide by the contractual terms and conditions.

- Financial institutions face different types of credit risks—default risk, concentration risk, country risk, downgrade risk, and institutional risk.

- Lenders gauge creditworthiness using the "5 Cs" of credit risk—credit history, capacity to repay, capital, conditions of the loan, and collateral.

- The following formula is used to find the expected loss on debts:

- Expected loss = Probability of default × Exposure at default × Loss given default

Credit Risk Explained

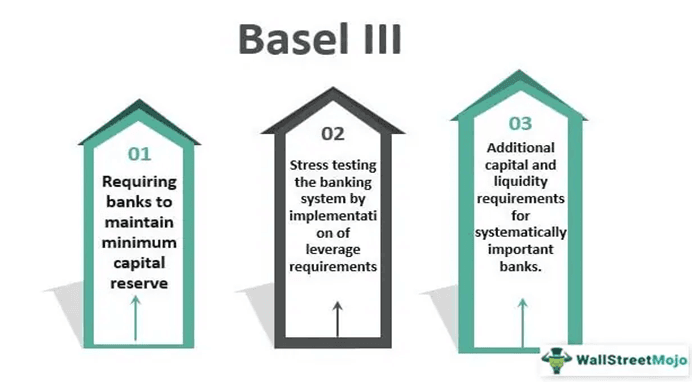

A robust credit risk management predicts negative circumstances and measures the potential risks involved in a transaction. To manage risk, most banks rely on technological innovations. But these, risk management systems are very expensive. The system measures, identifies, and controls credit risk as part of Basel III implementation.

To determine the right amount that can be lent to a borrower, financial institutions use credit risk modeling. It is an alternative to traditional pricing techniques and hedging. Lenders use various models to assess risks—financial statement analysis, machine learning, and default probability. But, at the end of the day, none of the methods provide absolute results—lenders have to make judgment calls.

Types of Credit Risk

Credit risks are classified into three types:

#1 - Default Risk

It is a scenario where the borrower is either unable to repay the amount in full or is already 90 days past the due date of the debt repayment. Default risk influences almost all credit transactions—securities, bonds, loans, and derivatives. Due to uncertainty, prospective borrowers undergo thorough background checks.

#2 - Concentration Risk

When a financial institution relies heavily on a particular industry, it is exposed to the risk associated with that industry. If the particular industry suffers an economic setback, the financial institution incurs massive losses.

#3 - Country Risk

Country risk denotes the probability of a foreign government (country) defaulting on its financial obligations as a result of economic slowdown or political unrest. Even a small rumor or revelation can make a country less attractive to investors. The sovereign risk mainly depends on a country's macroeconomic performance.

#4 – Downgrade Risk

It is the loss caused by falling credit ratings. Looking at the credit ratings, market analysts assume operational inefficiency and a lower scope for growth. It is a vicious cycle; the speculation makes it even harder for the borrower to repay.

#5 – Institutional Risk

Borrowers may fail to comply with regulations. In addition to the borrower, contractual negligence can be caused by intermediaries between the lenders and borrowers.

Calculation and Formula

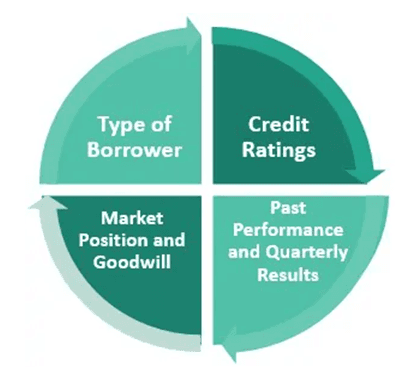

To gauge creditworthiness, lenders use a system called "The 5Cs of Credit Risk.”

- Credit history: Lenders look into borrowers' credit scores and check their backgrounds.

- Capacity to repay: To ascertain borrowers’ repayment ability, lenders rely on the debt-to-income ratio. It indicates efficiency in paying off debts from earnings.

- Capital: Lenders determine every borrower's net worth. It is computed by subtracting overall liabilities from total assets.

- Conditions of loan: It is important to determine if the terms and conditions suit a particular borrower.

- Collateral: Lenders assess the value of collateral submitted by borrowers. Collateralization mitigates lenders’ risk.

One of the simplest methods for calculating the expected loss due to credit risk is given below:

Expected Loss=PD×EAD×LGD

Here, PD refers to 'the probability of default.' And EAD refers to 'the exposure at default'; the amount that the borrower already repays is excluded in EAD. LGD here, refers to loss given default . If LGD is not given, it is calculated as ‘1 – recovery percentage.’

Credit Risk Example

Let us assume that a bank lends $1000,000 to XYZ Ltd. But soon, the company experiences operational difficulties—resulting in a liquidity crunch.

Now, determine the expected loss that could be caused by a credit default. The loss given default is 38%; the rest can be recovered from the sale of collateral (building).

Solution:

Given,

Exposure at default (EAD) = $1000,000

Probability of default (PD) = 100% (as the company is assumed to default the full amount)

Loss given default (LGD) = 38%

The expected loss can be calculated using the following formula:

Expected Loss = PD × EAD × LGD

Expected Loss = 100% × 1000000 × 38%

Expected Loss = $380000

Thus, the bank expects a loss of $380,000.