Table Of Contents

What Is Capital Loss?

Capital Loss is a loss when the value of the consideration received from the transfer of capital assets is less than the aggregate value of the cost of acquisition & cost of the improvement. In simpler words, it can be stated as the loss derived from the transfer of capital assets.

Capital Loss is different from an ordinary loss as the former is the term used only when the assets dealt with include capital assets, like bonds, stocks, etc. On the other hand, the latter is the term used with respect to normal business operations.

Key Takeaways

- A capital loss occurs when the value of transferred assets is lower than the total cost incurred for their acquisition and improvement. It represents a financial loss resulting from the disposal of capital assets.

- Long-term or short-term capital gains can be used to offset short-term capital losses, while long-term losses can only be offset against other long-term gains.

- The duration of asset ownership determines whether a capital loss is categorized as short-term or long-term.

- Selling an asset below its acquisition cost results in a capital loss, which can be utilized to offset capital gains of the corresponding duration.

Capital Loss Explained

Capital Loss is the loss incurred when the property or asset holder sells a capital at a greater value than what they paid to acquire it. Claiming this loss results in reducing the tax burden of the capital holders in the event of capital gains.

As per the income tax provision, if the assessee sells any capital assets, they need to calculate the gain or loss on assets. When the sales price of an asset is higher than the cost of acquisition, expenses for improvement of assets, and the cost of transfer of assets, then it is capital gain. If consideration doesn’t cover all these costs, it is a capital loss. Indexation is allowed in the cost of acquisition and improvement if an asset is a long-term asset. Long-term and short-term are calculated based on the holding period, i.e., from the acquisition date to the transfer/ sale of assets.

These losses can be of two types – short-term and long-term. Short-term capital loss and long-term capital loss are defined through an asset’s holding period. It decreases the value of capital assets. At the time of sale of capital assets, if the consideration received is lower than the cost of acquisition, expenses for the transfer of assets, etc., then this is a capital loss. It can be set off with capital gain only.

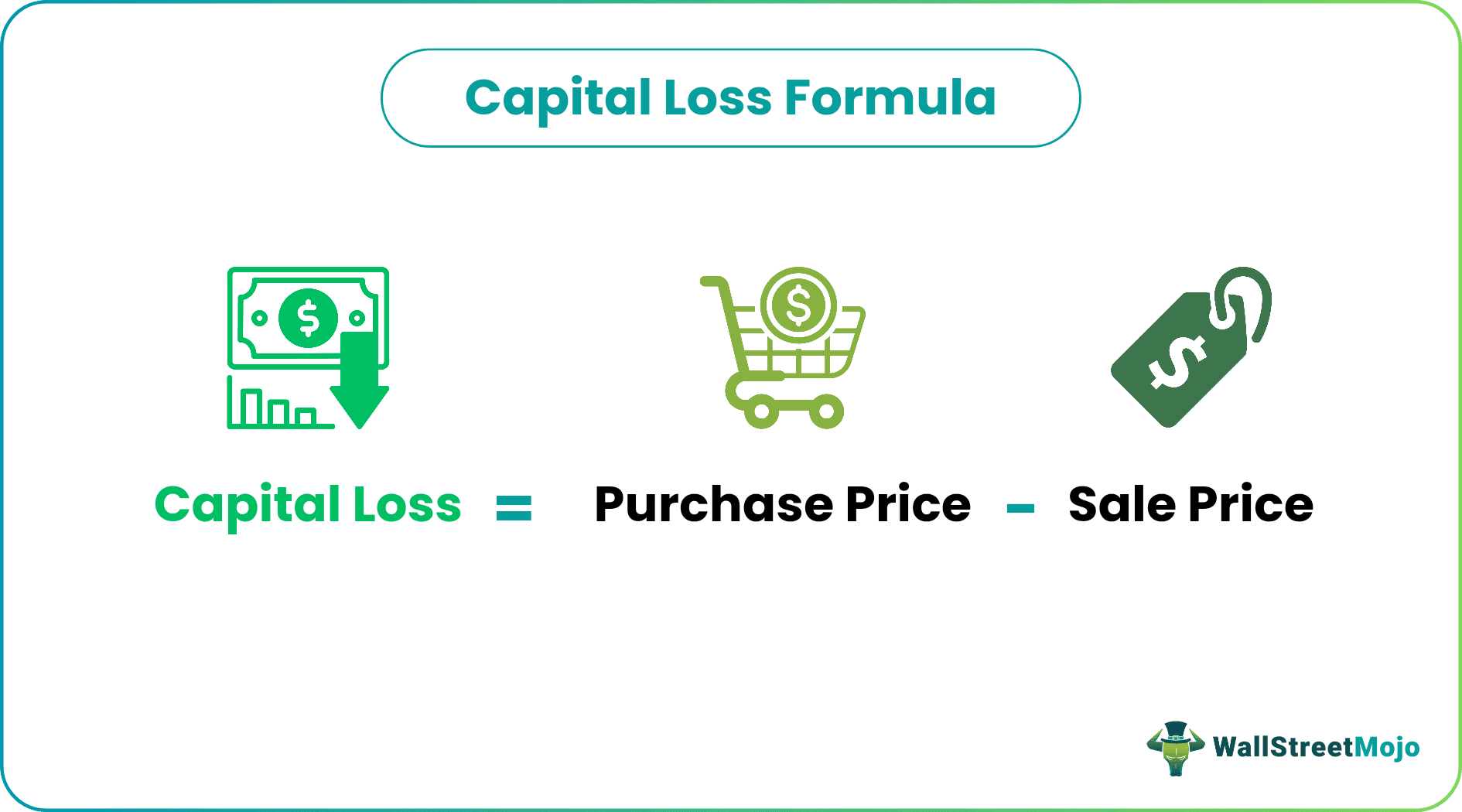

Formula

The equation that helps calculate such loss is mentioned below:

| Particulars | Amount |

|---|---|

| Consideration from Sales/Transfer of Asset | xxx |

| Cost of Acquisition/Index cost of Acquisition | (xxx) |

| Cost of Improvement | (xxx) |

| Cost of Transfer of the Asset | (xxx) |

| Capital Gain/Loss | xxx/(xxx) |

How To Calculate?

The following are the steps for calculation:

Step 1: Finds out whether assets are capital assets; In the case of capital assets, it is chargeable in income from capital gain.

Step 2: Find out the nature of capital gain, whether it is a short-term capital gain or long-term capital gain. The period of holding assets defines the nature of capital gain. For each class of assets, the holding period is different for long-term capital gain or loss. For example- in the case of immovable property, 24 months for long-term holding & less than this is short-term holding.

Step 3: Find the consideration as per the income tax provision.

Step 4: Calculation the cost of acquisition or index cost of acquisition. Indexation is required to calculate the acquisition cost if the asset is a long-term asset. In case the acquisition cost is not identifiable, then it is required to calculate the deemed acquisition cost.

Step 5: If any expenses are made for the acquisition of assets or expenses made after the acquisition of assets like an improvement, those expenses will be considered while calculating capital gain/Loss.

Step 6: If any expenses are made for the transfer of assets, those expenses will also be considered in the calculation.

Step 7: The cost of acquisition or index cost of acquisition will be deducted from consideration, any expenses made for improvement will be deducted from consideration, and any expense made for the transfer of capital gain will be deducted from capital gain. Suppose consideration is more than the cost of acquisition or index cost of acquisition, cost of improvement, and transfer of assets. In that case, it is capital gain, or if consideration is less than this, it is a capital loss.

Example

Let us understand the example in detail:

ABC LLP purchased land & building in 2010-11 of $30 million out of which $10 million. Is for the land and $20 million for the building. ABC LLP is selling this land and building for $45 million of which $15 million. For land and $30 million. for building. ABC also holds the following quoted equity shares-

- 4000 shares of SI limited @ $700 per share purchased as of March 2019

- 3500 shares of MR limited @ $450 per share purchased as of Feb 2019

- 6000 shares of RI limited @ $600 per share purchased as of June 2019

ABC LLP sold these shares in Dec 2019; the selling price is as follows-

- Shares of SI Limited @ 650 per share

- Shares of MR Limited @ 420 per share

- Shares of RI Limited @ 590 per share.

The indexation of 2010-11 is 167, and 2019-20 is 289. Calculation of capital gain/loss-

Solution:

For Building

- = 300000000 - 346107784.4

- = (46107784)

For Land

- = 150000000 - 173053892

- = (23053892)

Calculation on Shares-

#1 - SI Limited 4000 Shares

- = 2600000 - 2800000

- = (200000)

#2 - MR Limited 3500 Shares

- = 1470000 - 1575000

- = (105000)

#3 - RI Limited 6000 Shares

- = 3540000 - 3600000

- = (60000)

Now we will calculate total capital loss as shown below:

- = (46107784) + (23053892) + (200000) + (105000) + (60000)

- = (69526676)

As per the income tax provision, capital losses can only be set off with capital gain. It cannot set off with any other source of income.

Short-term capital gain can be offset with long-term capital gain and short-term capital gain. But the long-term capital gain can only be set off with long-term capital gain.

How To Claim?

When it comes to recording a capital loss, there are certain rules that one must be aware of.

Deductions Rules

A capital loss is recorded as a deduction on the tax returns of the investors or asset holders. Based on the capital loss deduction rules, these losses are divided into three categories:

- Realized losses: These are incurred when the asset or security is actually sold.

- Unrealized losses: These remain unreported.

- Recognizable losses: These are the figures that are recognized as the losses of a given year.

Though these losses can be reported for tax returns, the limit to such deductions is up to $3,000 per year.

Carryover Rules

Capital loss carryover, as the name implies, allows one to carry forward the capital loss figures of a given year and use them to receive tax deductions in future years. The instances of carryover are observed when the figures of capital losses for a year exceed the capital gains for the entity. The excess loss in this event is carried forward to claim tax deductions for the upcoming year. One must record the capital loss for a given year using Schedule D on Form 1040 of the tax return.

Capital Loss Vs Depreciation

Entities incur both capital losses and depreciation expenses. Hence, learning about the differences becomes important:

- While the former is the loss incurred when the sales price is lower than the cost price of the assets, the latter marks the decline in the value of a fixed asset because of damage or deteriorated condition.

- Capital losses hamper the production process as the business resources get impacted. On the other hand, depreciation has no effect on the production process.

- Assets that suffer wear and tear can be replaced in case of depreciation, while there is no such provision in case of capital loss as it is an unexpected instance.

Capital Loss Vs Capital Gain

A capital loss is the opposite of capital gain, which marks profit for property or asset holders.

- In the case of capital gain, the selling price of the asset involved is more than the cost price, the difference between which becomes the profit of the owners. Capital gain is raised in the value of capital assets or profit on the sale of capital assets. On the other hand, a capital loss occurs when the selling price of a security is less than what the investors paid to acquire it.

- While capital gain is recorded as an income, the latter is recorded as a deduction.