Table Of Contents

Provision for Income Tax Meaning

Provision for Income Tax is the tax that the company expects to pay in the current year and is calculated by making adjustments to the net income of the company by temporary and permanent differences, which are then multiplied by the applicable tax rate.

Provision for Income Tax Calculation

Provision for Income tax will be calculated on the income earned by the individual or the company using the below-mentioned formula:

Provision for Income tax Formula = Income Earned Before Tax * Applicable Tax Rate

The following is an example to understand the concept in a better manner.

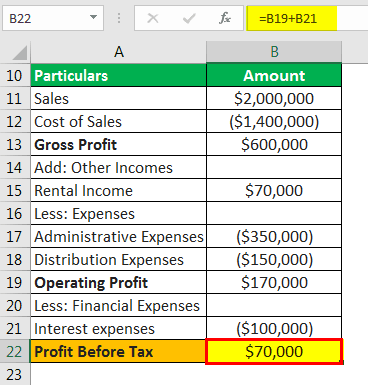

A ltd is the company which is manufacturing and selling the automobile products in the market reports following figures for the accounting year ending on December 31st, 2018. Suppose the applicable income tax rate on the company for the year under consideration is 30%. Calculate the profit before tax using the given figures and the provision to be made for the income tax for the accounting year ending on December 31st, 2018.

- Sales: $2,000,000

- Cost of Sales: $1,400,000

- Administrative Expenses: $350,000

- Distribution Expenses: $1,50,000

- Interest Expense: $100,000

- Rental Income: $70,000

Solution

In order to calculate it, first of all, the profit before tax will be calculated from the details given.

Statement of Calculation of Profit before taxes

- =$170000+100000

- =$70000

Thus from the above Statement of Calculation of Profit before taxes, $ 70,000 is the profit before tax of the company A ltd. for the accounting year ending on December 31st, 2018.

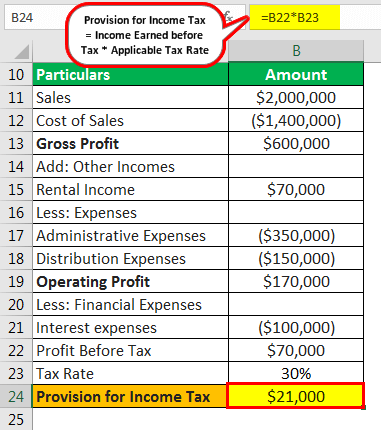

Now, the calculation of the provision of the income tax will be as follows:

- = $ 70,000 * 30%

- Provision for Income tax = $ 21,000

Thus the provision of the income tax for the accounting year ending on December 31st, 2018, for the company A ltd is $ 21,000.

Advantages

The various advantages related to these are as follows –

- It is the provision that is made by the company out of its profits of the current profits in order to meet its tax obligation, which will arise in the future. However, there will be a certain time gap between the date of the making of tax provision by the company and payment date. So the company can take the opportunity of the time gap and use the provision for tax as the source of short-term finance in the intermediate period. It does not mean any extra cost to the company as well as does not involve any legal formalities.

- With the help of the provision for income tax, the company makes the provision for future liability well in advance. It will make all the stakeholders aware of the tax liability, which will arise in the future to the company.

Revenue vs Income Explained in Video

Disadvantages

The disadvantages related to these are as follows:

- It is the source of finance for the company but only for the short term and cannot be used for financing the long term under the requirement of the company.

- It is possible some of the times that the company creates the excess provision for the income tax, which leads to the insufficient use of the funds of the company as that the company could have utilized funds in other productive areas.

Conclusion

Provision for Income Tax refers to the provision which is created by the company on the income earned by it during the period under consideration as per the rate of tax applicable to the company. The company makes this provision by making adjustments to the difference of permanent as well as the temporary nature in the company’s net income for the period.

As there is a certain time gap between the date of making the provision for tax by the company and the date when it is paid, the company can take the opportunity of the time gap and use the provision for tax as the source of the short-term finance in the intermediate period. However, it is the source of finance for the company but only for the short term and cannot be used for financing the long term under the requirement of the company. Also, it is possible some of the times that the company creates the excess provision for the income tax, which may lead to the insufficient use of the funds of the company.