Table Of Contents

Difference Between Wealth and Profit Maximization

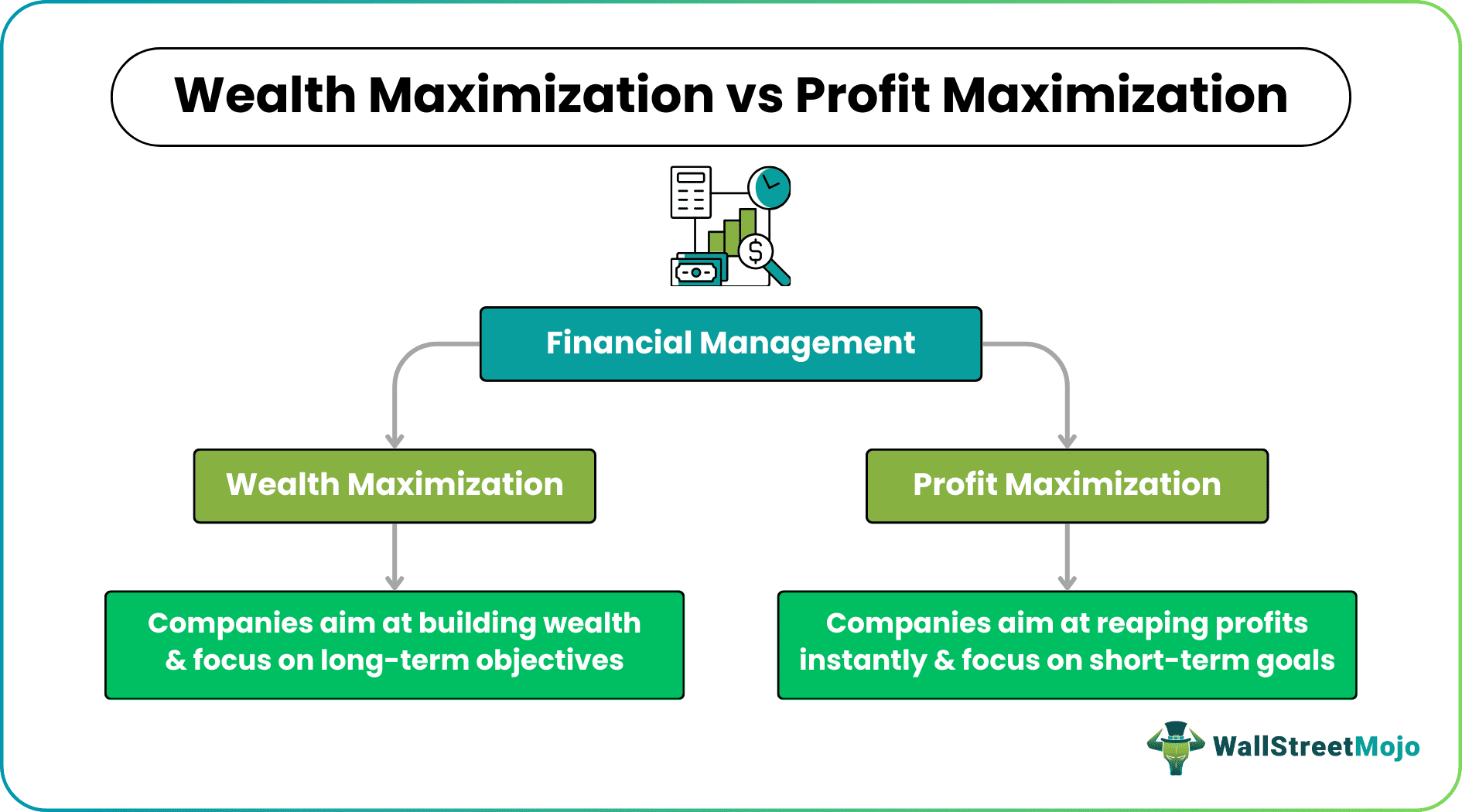

The key difference between Wealth and Profit Maximization is that Wealth maximization is the company's long-term objective to increase the value of the stock of the company, thereby increasing shareholder's wealth to attain the leadership position in the market. In contrast, profit maximization is to increase the capability of earning profits in the short run to make the company survive and grow in the existing competitive market.

Wealth Maximization consists of activities that manage the financial resources to increase the stakeholders' value. In contrast, Profit Maximization consists of the activities that manage the financial resources intending to increase the Company's profitability.

Comparative Table

| Basis | Wealth Maximization | Profit Maximization |

|---|---|---|

| 1. Definition | It is defined as managing financial resources to increase the value of the company's stakeholders. | It is defined as the management of financial resources to increase the company's profit. |

| 2. Focus | Focuses on increasing the value of the company's stakeholders in the long term. | Focuses on increasing the profit of the company in the short term |

| 3. Risk | It considers the risks and uncertainty inherent in the company's business model. | It does not consider the risks and uncertainty inherent in the company's business model. |

| 4. Usage | It helps achieve a larger value of a company's worth, which may reflect in the company's increased market share. | It helps achieve efficiency in the company's day-to-day operations to make the business profitable. |

What is Wealth Maximization?

The ability of a company to increase the value of its stock for all the stakeholders is referred to as Wealth Maximization. It is a long-term goal and involves multiple external factors like sales, products, services, market share, etc. It assumes the risk. It recognizes the time value of money given the business environment of the operating entity. It is mainly concerned with the company's long-term growth and hence is concerned more about fetching the maximum chunk of the market share to attain a leadership position.

Wealth Maximization considers the interest concerning shareholders, creditors or lenders, employees, and other stakeholders. Hence, it ensures building up reserves for future growth and expansion, maintaining the market price of the company's share, and recognizing the value of regular dividends. So, a company can make any number of decisions for maximizing profit, but when it comes to decisions concerning shareholders, then Wealth Maximization is the way to go.

What is Profit Maximization?

The process of increasing the profit earning capability of the company is referred to as Profit Maximization. It is mainly a short-term goal and is primarily restricted to the accounting analysis of the financial year. It ignores the risk and avoids the time value of money. It primarily concerns the company's survival and growth in the existing competitive business environment.

Profit is the basic building block of a company to accrue capital in the shareholder's equity. Profit maximization helps the company survive against all the odds of the business and requires some short-term perspective to achieve the same. Though the company can ignore the risk factor in the short term, it can not do the same in the long term as shareholders have invested their money in the company with expectations of getting high returns on their investment.

Wealth Maximization vs Profit Maximization - Infographics

Wealth Maximization vs Profit Maximization - Key Differences

Both these terms are significant in the context of financial management, but their difference is a must to know to ensure businesses know which one to focus on to meet their objectives.

Let us, therefore, look at the critical differences between the two below: –

#1 - Wealth Maximization

- Wealth Maximization is the ability of the company to increase the value for the stakeholders of the company, mainly through an increase in the market price of the company's share over time. The value depends on several tangible and intangible factors like sales, quality of products or services, etc.

- It is mainly achieved throughout the long-term as it requires the company to attain a leadership position, which translates to a larger market share and higher share price, ultimately benefiting all the stakeholders.

- To be more specific, the universally accepted goal of a business entity has been to increase the wealth for the shareholders of the company as they are the actual owners of the company who have invested their capital, given the risk inherent in the business of the company with expectations of high returns.

- Wealth maximization is a long-term objective that gradually happens and hence, the management is always ready to pay for the discretionary expenses, including research and maintenance.

- For effective wealth maximization, the companies normally choose to reduce the prices and have a strong backup in the form of market share.

- A wealth-oriented firm is focused on making expenses keeping in mind the long-term sales objectives. It believes that such expenditure will help increase the value of the business.

- Companies aiming to maximize wealth focus on risk mitigation measures to avoid risk of losses in future.

#2 - Profit Maximization

- Profit Maximization is the ability of the company to operate efficiently to produce maximum output with limited input or to produce the same output using much lesser input. So, it becomes the most crucial goal of the company to survive and grow in the current cut-throat competitive landscape of the business environment.

- Given this form of financial management, companies mainly have a short-term perspective when it comes to earning profits, which is very much limited to the current financial year.

- If we get into the details, profit is actually what remains out of the total revenue after paying for all the expenses and taxes for the financial year. Now to increase profit, companies can either increase their revenue or minimize their cost structure. It may need some analysis of the input-output levels to diagnose the company's operating efficiency and identify the key improvement areas where processes could be tweaked or changed in their entirety to earn larger profits.

- When it is about maximizing profits for a business, companies aim to make instant profits. Hence, they choose not to pay for discretionary expenses, which include advertising costs, research and maintenance expenditure, etc.

- Unlike wealth maximization, profit maximization favors the choice of increasing product prices to keep the margins as high as possible. Hence, the companies do so to ensure more and more instant profit making.

- Businesses aiming to maximize profits have a focus on managing their existing level of sales efficiently and productively. In short, they emphasize short-term sales goals for profits, which sometimes hampers their long-term goals.

- To show they are earning profits, companies choose to minimize expenditure, which makes them unprepared for the hedges required at a later stage.