Table Of Contents

What Is A Leveraged Recapitalization?

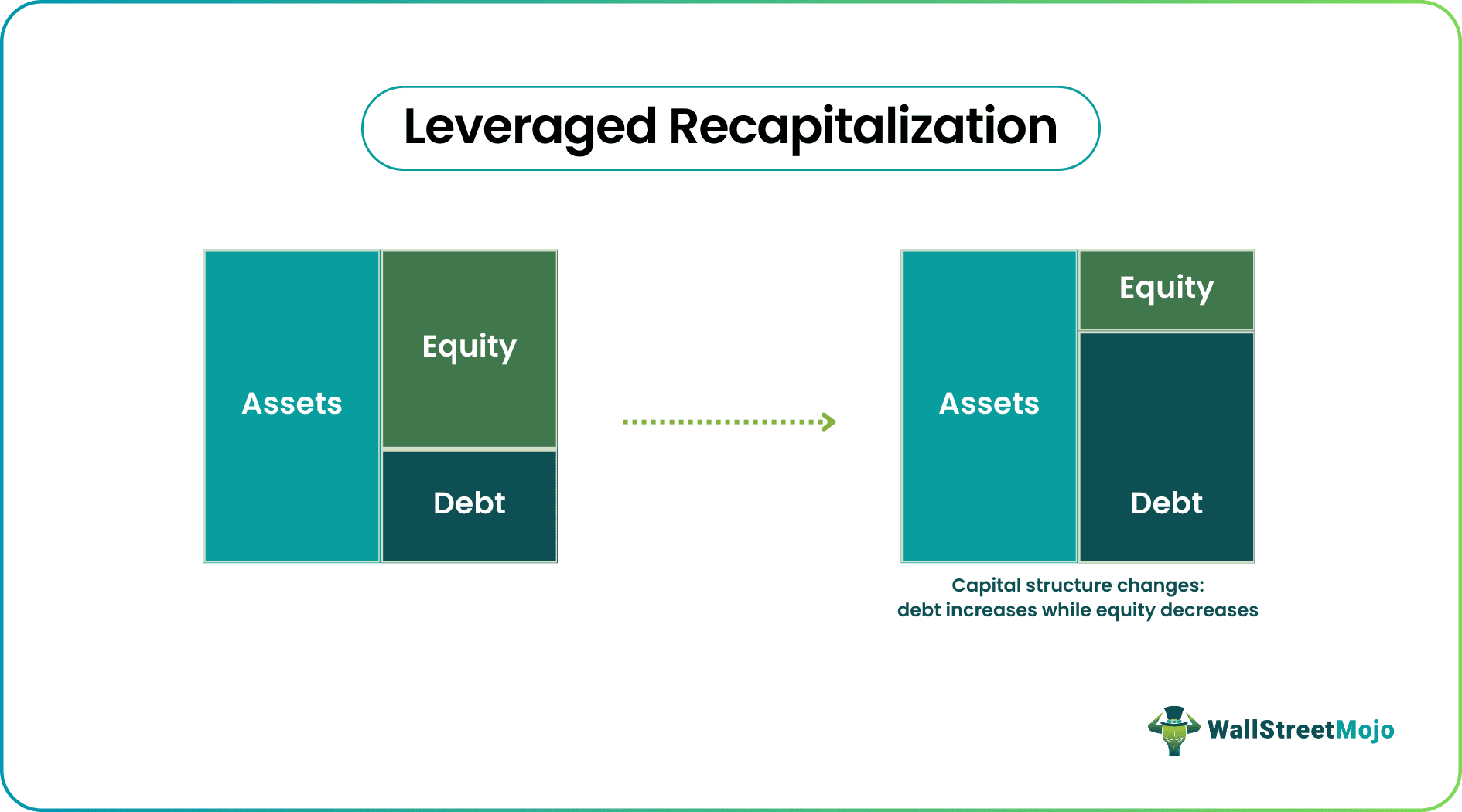

Leveraged recapitalization is a strategy whereby a company alters its capital structure by reducing equity and increasing debt. The main objective of executing leverage recapitalization model, the corporate finance transaction, is to pay out a substantial dividend or repurchase shares. The additional amount of debt raised usually exceeds the optimal debt capacity.

Organizations typically utilize this strategy to prepare for a growth phase or prevent a hostile takeover. They also use leveraged recapitalization when interest rates are low, as the cost of borrowing is much more affordable for them during these periods. The amount of debt a company can raise depends on its qualitative and quantitative aspects.

Key Takeaways

- Leveraged recapitalization in finance refers to a corporate strategy that involves increasing debt and reducing equity to alter the company’s capital mix.

- Leveraged recaps are of two types — leveraged cashouts and leveraged share repurchases, depending on whether a company utilizes the additional debt to pay dividends or buy back its shares.

- Organizations can use this strategy to prevent a hostile takeover. Typically, organizations opt for a leveraged recap when interest rates are low.

- The amount of debt a company can raise from a bank depends on various quantitative and qualitative factors.

Leveraged Recapitalization Explained

Leveraged recapitalization in finance is a process through which a company raises additional debt and reduces equity, thus changing its capital structure. It replaces a major portion of its equity with subordinate and senior bank debt. In simple words, a company borrows funds to generate cash proceeds. The organization then uses such proceeds to pay big dividends and repurchase previously issued shares. This strategy is also known as a leveraged recap.

A leveraged recapitalization analysis can refer to slight adjustments to the capital mix. Alternatively, it can involve massive changes, including alterations in the power structure. Privately held organizations often use a leveraged recap as a source of financing. Moreover, they use it sometimes to offload investments early.

Debt usage can reduce a company’s taxable income, which equity cannot; the Modigliani-Miller theorem explains this. It describes how the tax benefits can outweigh the additional interest expense. Moreover, it explains how this strategy can increase return on equity (ROE), price-to-book ratio (P/B ratio), and earnings per share (EPS).

Although many people view leveraged recaps as a method to fend off hostile takeovers, organizations can use this strategy to improve organizational performance, thus increasing shareholder value. The market’s reaction to leveraged recaps depends on whether an organization adopts a proactive or defensive approach.

Purpose

The primary purpose is to restructure a company's capital by increasing its leverage. However, there are a few other points of incorporating the leveraged recapitalization model through the detailed discussion below.

- It often involves issuing additional debt and using the proceeds to repurchase shares or pay dividends.

- Aims to boost shareholder value by optimizing the capital structure.

- By leveraging more debt, companies can allocate excess cash to shareholders, signaling confidence in future cash flows.

- Leveraged recapitalization exploits this tax advantage to enhance overall financial efficiency.

- It is employed as a defense against hostile takeovers.

- The increased debt load may make the target company less attractive to potential acquirers.

- If the return on the investments funded by the additional debt exceeds the cost of debt, ROE is enhanced.

Types

Once individuals have a clear idea regarding leveraged recapitalization analysis vs leveraged buyout, they must know about the former’s two types. So, let us take a look at them.

- Leveraged Share Repurchase: In the case of a leveraged share repurchase or LSR, a company utilizes debt to repurchase or buy back shares. The repurchase increases the EPS owing as the total number of outstanding shares decreases. The increased EPS will, in turn, lead to a rise in the share price even if the price-to-earnings ratio stays the same.

- Leveraged Cashouts: This involves utilizing debt to pay out substantial dividends to shareholders.

Example

Now that we understand the basics, purpose, and related factors of leveraged recapitalization analysis, let us apply the knowledge to practical application through the examples below.

Example #1

Suppose XYZ Company has expressed interest in acquiring ABC Co., but the latter’s management team is against the takeover. In such a situation, ABC can take on substantial debt to make the company less financially appealing to XYZ. As a result, XYZ might lose interest, and ABC would be able to fend off the hostile takeover successfully.

Example #2

In February 2013, the billionaire founder Michael Dell wanted to offer a buyout of stake in his company. However, Southeastern Asset Management, the largest outside shareholder in the company disagreed with the founder’s price of the buyout. While the buyout was offered at $13.50-$13.75 per share, Southeastern’s partners felt that $23.72 was a more fitting price.

In their explanation the partners at Southeastern Asset Management said they would have supported this decision if it was as transformative as the founder claimed it to be and if this decision provided full value to Dell’s shareholders, including a leveraged recapitalization or go-private type sale could have made more sense.

Pros And Cons

Businesses must weigh the leveraged recapitalization method and its pros and cons before opting for this strategy.

Pros

The advantages of leveraged recaps are as follows:

- First, the usage of debt prevents equity dilution. In other words, a company’s promoters and existing investors can retain ownership.

- Organizations can implement this strategy confidentially, ensuring minimal disruption to the operations.

- The process is quick as a company has to negotiate with the financial institution only; usually, the time required ranges from three to four months.

- The additional debt offers a tax shield to a company implementing a leveraged recap.

- Utilizing debt to repurchase shares or pay off outstanding borrowings minimizes organizations’ opportunity cost of having to use the profits for the same purpose.

Cons

- Banks may require personal guarantees as secondary security against the extra debt obtained by an organization. These personal guarantees carry significant financial risk. If everything doesn’t go according to the plan, leveraged recap might severely impact shareholder value.

- Some experts believe this strategy might restrict long-term organizational growth and impact shareholder value. This is because the additional debt can cause cash flow stress.

- The debt environment does not remain the same. An organization’s interest expenses will increase if the interest rate increases. This, in turn, can affect the company’s bottom line.

Leveraged Recapitalization vs Leveraged Buyout

A leveraged buyout or LBO refers to the process through which a company acquires another organization utilizing a substantial amount of debt to finance the cost of the takeover. The assets of both companies serve as collateral for the debt.

The structure of a leveraged recap is similar to that of a leveraged buyout; the latter also significantly increases financial leverage. That said, LBOs can impact shareholders more than leveraged recaps as the issuance of new shares can dilute existing shares’ value while borrowing funds does not. As a result, shareholders consider leveraged recaps the more favorable option.

Like LBOs, leveraged recaps incentivize an organization’s management team to increase operational efficiency for meeting higher principal payments and interest. In addition, they often involve a restructuring wherein the organization offloads its assets that are surplus to requirements for reducing the debt burden.

Nevertheless, high leverage can be dangerous as a company can lose its strategic focus, becoming exposed to unforeseen economic shocks. Moreover, if the debt environment changes, the company’s interest expenses could surge significantly, thus impacting its financial position.