Table Of Contents

Counterparty Meaning

A counterparty in a financial transaction is the person or entity on the other side of the agreement. Any trade must have at least two parties who serve as counterparties for each other. For every buyer in a purchasing deal, there must be a seller. And for every seller, there must be a buyer willing to purchase.

It is not unusual to find a central counterparty in a financial market. Moreover, some monetary transactions may involve an unknown opposing party, such as exchange trading. While it gives rise to counterparty risk if any party fails to fulfill their obligations like payment default, clearinghouses can mitigate the risk.

Key Takeaways

- The counterparty definition refers to an individual or entity on the other side of a transaction involving another party, such as persons, governments, businesses, or other entities.

- If one buys something, the counterparty would be the seller. Likewise, the opposing party would be the buyer if someone sells something.

- A financial transaction involving the exchange of funds, products, services, or anything of value may have multiple counterparties.

- Several counterparties exist in securities trading, including individual investors, liquidity providers, scalpers, and fundamental traders.

Counterparty Explained

The word counterparty can be applied to different situations, particularly in the finance and insurance industries. To counter something means to go against or act in opposition. With that said, the counterparty will be on the opposite side of an arrangement. For example, the entity on the other side of the agreement can be a:

- Government

- Corporation

- Individual

- Bank

- Or any other entity

It is worth noting that the failure of any of the trading parties to exchange funds or securities might lead to counterparty risk. Therefore, it is recommended to use a central clearinghouse to collect margin and accelerate trade execution and settlement time to avert this risk.

Several events happen in many people’s everyday lives that can be considered examples of the counterparty. For example, when someone goes to the supermarket to purchase food, the grocery store is the counterpart since they are selling it. Likewise, when someone goes to the gas station and purchases gas, the gas station will be the counterparty.

Types

When trading financial assets, it is critical to understand the counterparty on the other side of the agreement. Different types of counterparties trade financial assets. A few common ones include:

Individual Investors

Individual investors are the non-professional, everyday investors that trade financial assets like:

- Stocks

- Bonds

- Exchange-Traded Funds (ETFs)

- Index Funds

These types of investors typically invest for long-term growth or speculation. They most likely build a portfolio with a brokerage firm to grow their wealth and save for retirement.

Their level of knowledge will vary from person to person, and the value of the trades will often be smaller than those of an institution. Individual investors can also be referred to as retail investors.

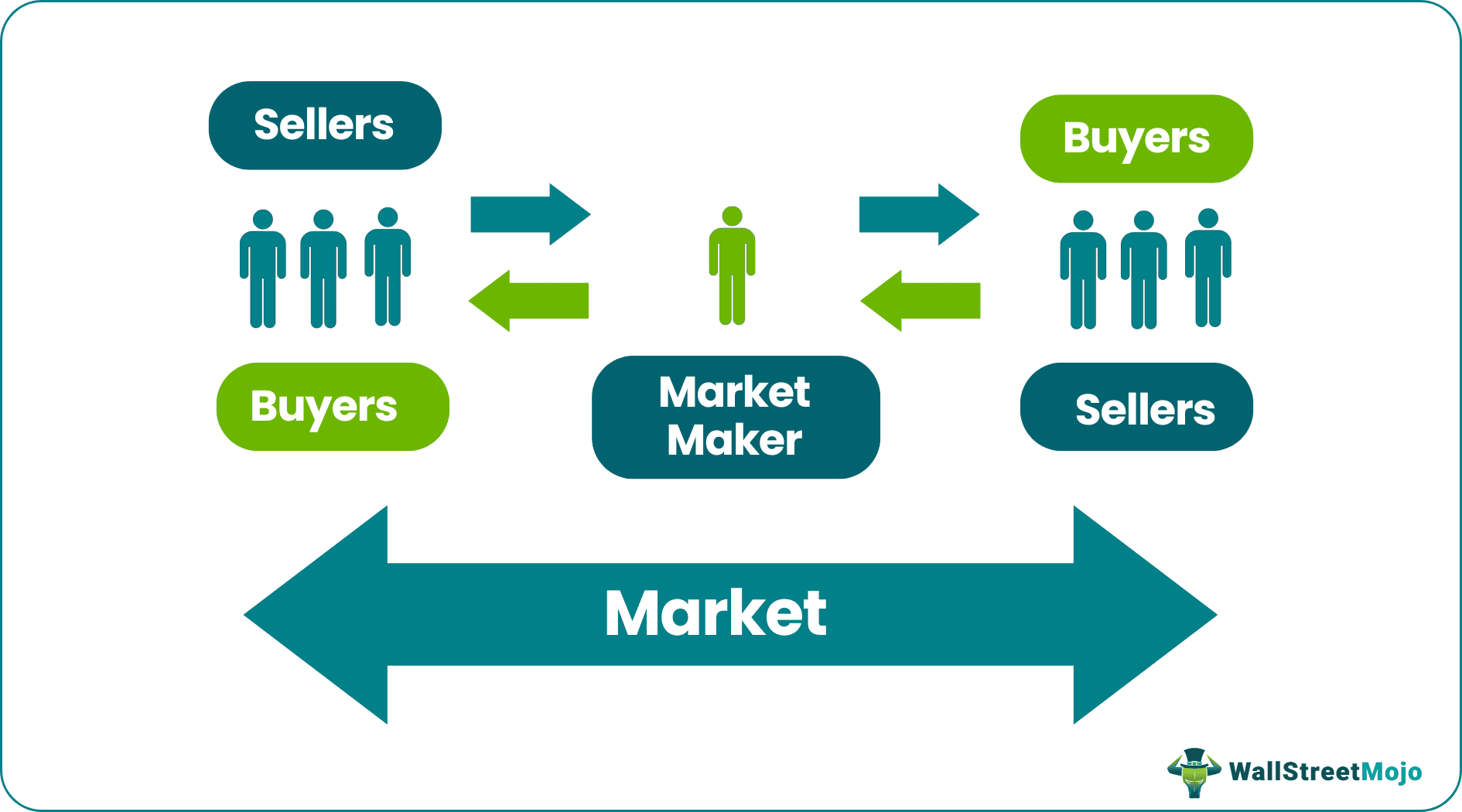

Liquidity Providers

Liquidity providers, also known as market makers, include individuals or institutions that provide the market with liquidity or the ability to buy and sell assets. Their job is to quote bids as well as ask prices.

The bid is the price at which investors are willing to buy shares, and the ask is the price at which investors are willing to sell shares.

Liquidity providers serve a critical purpose in the financial markets. When one initiates a trade, there must be someone on the other side of it willing to do the opposite.

For example, if an individual wants to buy 50 shares of Apple, Inc., someone else must be willing to sell them those 50 shares. However, it is not very often the individual will find another seller selling that amount of shares – this is when the liquidity providers will step in.

Without these types of traders, the time it takes to execute a trade could be significantly longer as it would be much more difficult to find a counterparty. With everything being instantaneous these days, traders are unwilling to wait for trades to execute.

Scalpers

Traders considered scalpers are individuals who will buy and sell an asset in a short amount of time, typically less than a day. However, scalpers can make a significant amount of trades throughout the day to profit.

Scalpers seem to be content with making a slight profit on traders, as they expect the profits to add up throughout the day, and they will realize more considerable gains. However, it is essential to understand that trading as often as scalpers can require certain costs, such as commissions, that can take away profits.

Technical Traders

Technical trading is an approach that uses historical data, such as volume and price levels, to determine when to enter and exit trades.

These traders will look at and analyze stock charts to decide which securities fit their support and resistance levels criteria. Support levels are where buyers seem to be stepping in and buying the stock. Resistance levels are price levels at which people sell, and the asset struggles with increasing value.

Examples

Let us check how the concept works in the field of finance and insurance:

Example 1 - Counterparty in Finance

Counterparties become slightly more complicated in the financial industry as there are not always face-to-face transactions. Some examples in the financial sector are:

- Investment bankers

- Securities dealers

- Stockbrokers

The term still applies in the same sense it would with the above examples. However, with these agreements, one will often not see or interact with the other party.

Many investors purchase shares with an online broker executing a trade for them in this digital age. According to the Financial Industry Regulatory Authority (FINRA), there are two types of brokerages, including:

- Carrying firms

- Introductory firms

With carrying or clearing firms, the brokerage will take the order to trade the security and handle any assets in the investor’s account. With brokerage, these firms will be the counterparty.

The brokerage will take the investor’s order in introductory firms, but they will pass it off to another carrying organization instead of handling the assets. In this instance, the investor can have multiple counterparties.

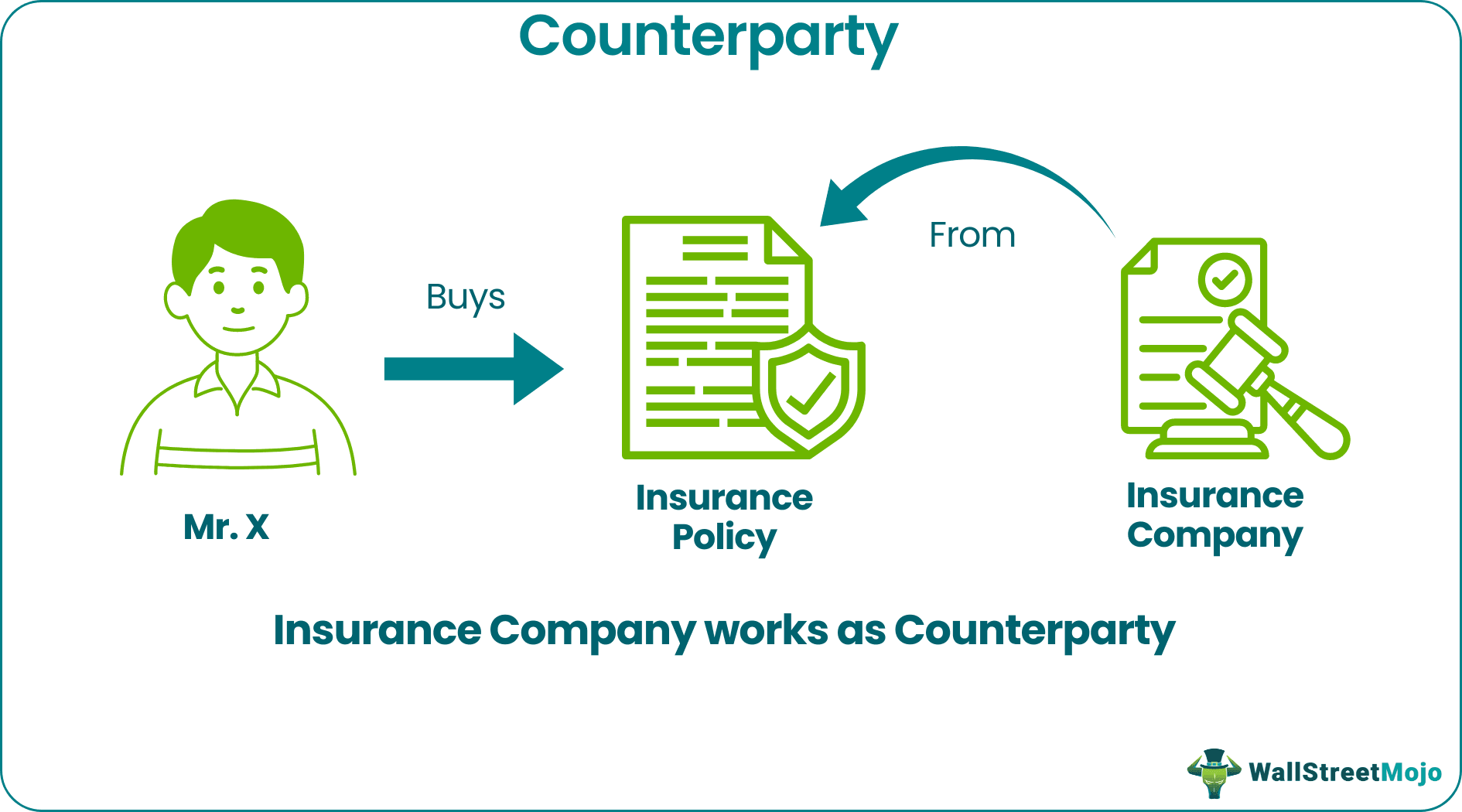

Example 2 - Counterparty in Insurance

The counterparty in the insurance industry is similar to that of the financial sector. For example, when someone purchases an insurance policy, the insurance company will be the counterparty. However, there are examples in the insurance industry that can also produce multiple counterparties.

For example, several insurance companies will buy insurance from other companies called reinsurance. This practice allows insurance companies to manage risk and maintain their capital requirements.