Table Of Contents

What Is Cost Accounting?

Cost accounting refers to recording the costs of production involved in manufacturing the goods and delivering the services of a firm. It considers the fixed costs, which remain unchanged throughout the production process, and variable costs, which keep changing with respect to the stages through which the production passes.

Through cost accounting, firms can check where the money flows and how well organized it is to serve other business purposes. As a result, the businesses can manage their finances well and put internal controls in place to maintain monetary balance for running smoothly.

Key Takeaways

- Cost accounting meaning refers to recording, reading, and analyzing the costs involved in production.

- It is essential since management allocates limited resources to specific projects or production processes.

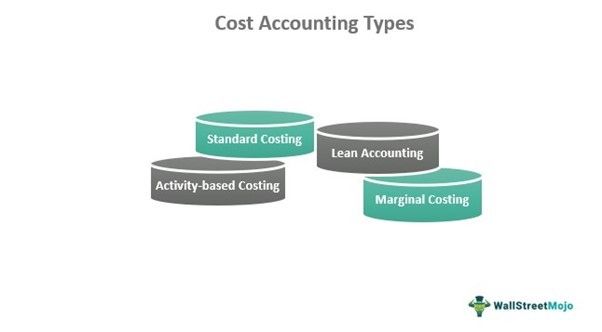

- This type of accounting is classified into standard costing, activity-driven costing, lean accounting, and margin costing.

- It considers different costs, including direct, indirect, fixed, and variable costs.

- A key cost accounting and management accounting difference is that the former is subject to statutory audit, unlike the latter.

- It helps control the cost within the budgetary constraints that the management has set for producing or manufacturing a particular product or service.

Cost Accounting Explained

Cost accounting meaning refers to a process that involves organizing the costs associated with the production of goods and delivery of services, helping firms analyze the data and keep track of the income and expenditure of the company. This accounting procedure considers different types of costs to make the analysis as accurate as possible. The objectives of cost accounting is to make a reliable comparison between the input costs and the output generated. As a result, it becomes easier for the companies to assess their performance and understand how effectively they use the funds.

The types of costs include fixed, variable, direct, and indirect costs. Fixed costs don’t change with the increase or decrease of production units. For example, rent is a fixed cost. Even if the production increases or decreases, the business must pay the same rent monthly. Variable cost changes per the increase or decrease of production units. For example, the cost of raw materials is variable. The total cost of raw materials changes if production increases or decreases.

If individuals wish to enhance their understanding of cost accounting, they can consider taking the Financial Planning & Analysis Course. This course, led by an industry expert has been created to provide a practical understanding of concepts like cost accounting, financial accounting, and financial modeling via examples.

Objectives

The objectives of this form of accounting are as follows:

- Cost Ascertainment: Through this process, cost accountants of an organization verify the costs incurred to purchase services or goods. For this, they spot, gauge, and record every cost associated with the service delivery or production.

- Cost Reduction: The accounting process assists the management team in selecting a cost-effective technique to minimize the cost of goods per unit without impacting the quality.

- Cost Control: Cost accountants study different processes and operations related to manufacturing to fulfill this objective. They carry out comparisons of the budgets allocated for labor, overheads, and materials. Moreover, they compare them with the expenses they actually incurred. The differences help the management team assess if the costs are under control. Moreover, cost accounting helps the team understand how they can control costs that are out of their control.

- Improved Decision-Making: Cost accounting allows accountants to provide accurate and comprehensive cost-related information. The information allows managers to make better decisions regarding resource allocation, expansion, pricing, etc.

- Forecasting And Budgeting: With the help of relevant cost data, organizations are able to create forecasts and budgets.

- Statutory Compliance: Per government regulations, companies manufacturing specific products or offering particular services maintain cost accounts. Moreover, an organization having an aggregate turnover of more than a certain income ceiling needs to submit its cost accounts as part of the tax filing process.

- Preparation of Financial Statements: Cost accounting data assists in the preparation and validation of a financial statement’s specific parts. For example, it can help determine whether the inventory value is accurate.

Cost Accounting - Video Explanation

Types

The concept of cost accounting is classified into different categories, given the nature of costs a company normally records.

Standard costing, as the name suggests, considers a standard cost for all direct costs involves in the production process. It is one of the best accounting methods for small or medium-sized businesses. Assigning average costs simplifies calculation and analysis to a great extent.

The second category is activity-based costing. Firms use this method to track and analyze the fixed and variable costs based on the business objectives that the direct costs of a product line fulfill.

Lean accounting is a practice that advocates the reduction of wastage and an increase in productivity. It deals with improving financial management techniques by identifying the costs wasted. As a result, the concerned department cuts down unnecessary costs and adds value to the more important tasks, increasing the firm’s productivity.

Also known as the Cost-Volume-Profit (CVP) Analysis, marginal costing considers total fixed and variable costs for all products produced. Then, the accountants use these expenditures to compute the product level where the company starts earning profits.

Features And Functions

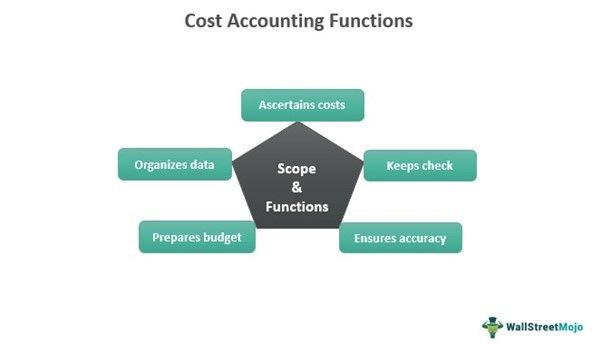

It is recommended to explore its features to understand the cost accounting definition better. These features also give an overview of the functions and objectives of cost accounting.

Let us have a quick look at them:

- It determines the price. Based on the production costs, firms fix the price of the products and services.

- As stated above, the scope of cost accounting also involves order management to keep a record of the exact quantity produced and volume sold. In addition, it also watches for any fund wastage that happens..

- The cost accounting procedure tracks the incomes and expenses and provides data that helps in submitting quotations and preparing the budget.

- The comparison between the costs and outputs is easier to make, thereby helping firms assess how effective their performance is.

- It ensures data accuracy and hence, offers reliable analysis for further decision-making.

- It makes available the organized data for better presentation and clarity.

- The process helps detect fraud and reduce it by putting internal controls in place, given the loopholes assessed during the accounting process.

Examples

Let us consider the following examples to understand the scope of cost accounting.

Example #1

Bank ABC decides to determine the cost of processing different transactions for customers. Thus, it undertakes advanced cost accounting and identifies different processing costs for checks and deposits. Besides presenting the data in a proper format, this process helps the bank to assess the costs involved in processing international wire transfers, maintaining a checking account, monitoring a mortgage loan, and other finances. In short, accounting for the costs offers firms a clear view of the costs involved, letting them fix the pricing of various banking products and services.

Example #2

Company MNC calculates its fixed costs for a month as $20,000. It finds out the variable cost per unit of product to be $8. Based on the assessment, it tries to determine the total expected cost for producing the required volume of products, i.e., 5000 at the same per unit rate. The company calculates the same based on the cost accounting formula below:

Total Cost = Fixed costs involved + Variable cost per unit

= 20,000 + 8*5000

= $60,000

Based on the total cost involved, the company decides the price at which it would sell each product to customers for booking profits.

Advantages & Disadvantages

While the importance of advanced cost accounting is significant, it is also important to go through its disadvantages. Here is a list of the benefits as well as limitations of cost accounting. Let us have a look at the same:

| Advantages | Disadvantages |

|---|---|

| Helps in setting prices | Records past data |

| Identifies unnecessary costs involved | Costs keep changing every interval |

| Enhances productivity | Expertise required |

| Helps the management make effective decisions | Expensive maintenance |

| Makes it easy to prepare the budget |

Cost Accounting Vs Financial Accounting

Cost accounting helps in tracking the costs related to various business activities, whereas financial accounting helps in recording financial transactions. The differences between them are as follows:

| Cost Accounting | Financial Accounting |

|---|---|

| It tracks the cost of business activities. | It tracks the financial transactions in a business. |

| Information is related to labor, overheads and raw materials. | Information is related to monetary transactions. |

| Valuation is done at cost. | Either cost of the net realizable value is used. |

| Reporting takes place as and when management needs them. | Reporting takes place quarterly, or yearly. |

| Purpose is to reduce and control the costs. | Purpose is to record financial transactions |

Cost Accounting vs. Management Accounting

Individuals new to accounting often have confusion regarding the concepts of cost and management accounting. That said, they can eliminate their doubts by understanding how the two processes differ. So, let us look at this table that highlights the key cost accounting and management accounting differences:

| Cost Accounting | Management Accounting |

|---|---|

| This accounting system helps analyze and record costs associated with the production process. | Management Accounting assists in accumulating, analyzing, and comprehending qualitative, statistical, and financial information, which, in turn, helps in improving decision-making. |

| It aims to determine the production cost. | The objective of this process is to give relevant information to the management team so that it can set clearly defined objectives and formulate forecast strategies. |

| It helps businesses avoid incurring costs that are beyond the budget. | This process provides businesses with a clear idea of how they can consider strategizing. |

| Shareholders, vendors, and the organization’s management team use this form of accounting, | Only a company’s management team uses management accounting. |

| Historical data provides the basis for decision-making. | Estimated and historical information provides the basis for decision-making. |

| Its scope is narrower. | The scope of this process is broader. |

| For successful execution, this process is not dependent on management accounting. | Management accounting depends on financial accounting and management accounting forr successful execution. |

| This involves recording present as well as past data. | It involves focusing more on the analysis of future estimates. |