Both savings and current accounts facilitate cash deposit and withdrawal. But they are very different when it comes to purpose and usage. The dissimilarities are as follows:

Table Of Contents

Checking Account Definition

A checking account is a bank account that allows multiple deposits and withdrawals. Additionally, it provides superior liquidity. The account holder can quickly deposit and withdraw funds multiple times using ATM, net banking, wire transfer, cheques, credit cards, and debit cards.

A checking account is also called a transactional account or a current account. This type of deposit account is held by one or more individuals of a financial institution and serves as a total banking solution.

Key Takeaways

- A checking account is a multipurpose deposit account used for everyday banking facilities like writing cheques, online transfers, wire transfers, ATM withdrawals, net banking, credit card payments, and debit card usage.

- Current accounts are opened with financial institutions (FIs) like banks and credit unions. There are different types of current accounts, the most popular being traditional, business, premium, student, and interest-bearing transactional accounts.

- Unlike savings accounts, current accounts do not impose any restrictions on the number of transactions made by the account holder.

How Does Checking Account Work?

A checking account got its name from banks’ conventional service, writing cheques. In the UK and many other countries, it is called a current account. An individual can open a current account with a bank or other financial institution like credit unions. These accounts do not usually return any interest. It is important to note that these accounts charge various fees for non-maintenance of minimum balance, ATM, overdraft, and wire transfers. While the financial institution does not view the customers’ credit scores, they may check the clients’ credibility through Chexsystems reports, which is somewhat equivalent. Current accounts have provisions for over-drafting amounts, though it is subject to credit history.

One of the popular current accounts is the Bank of America Advantage Plus Banking. This account has a minimum balance requirement of $12; if the account holder fulfills any of the following conditions, then this requirement can be waived off:

- One direct deposit of at least $250

- Minimum $1500 daily balance

- Registered under the preferred rewards program (limited to 4 current accounts).

Additionally, students in high school, university, college, or vocational programs under 24 years are exempted from maintenance of minimum balance.

There are no charges for balance inquiry, deposit, withdrawal, or transfer through Bank of America ATMs. For other ATMs, the charges imposed are $2.5 plus ATM operator fee, if any within the US. For other countries, the client is charged $5 plus ATM operator fees. BOA also charges $5 for hard copies of bank statements, $3 for monthly account statements, $3 for printed cheques, $5 for credit card replacement fee, and $15 for the fast delivery ATM cards. Moreover, the bank charges $30 for stop payment, $15 for domestic incoming wire transfers, and $30 for domestic outgoing wire transfers. For international wire transfers, the bank charges $16 for incoming and $45 for outgoing. All outgoing wire transfers in foreign currencies are free. The return on a deposited item is chargeable; a fee of $12 for a domestic item and $15 for a foreign item.

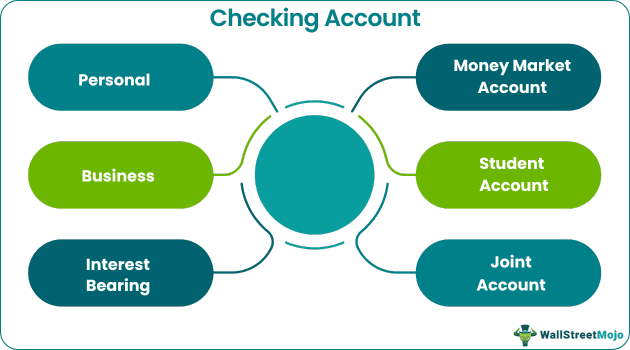

Types of Checking Account

Current accounts are further classified depending upon the features, usability, and customers’ age. Following are the different types:

- Traditional Checking Account: Such an account provides cheques and debit card facilities to make online or offline payments. In addition, this account also provides ATM withdrawals and deposits.

- Premium Checking Account: It provides a superior banking solution with extended features, bonuses, and rewards. However, the holder has to deposit a higher amount and pay heftier charges.

- Student Checking Account: This kind of account is available for college students and offers features like a sign-up bonus, zero minimum maintenance, ATM card, and overdraft facility. The overdraft facility comes with one day grace period.

- Senior Checking Account: As the name suggests, such accounts are allocated to senior citizens of 55 years or above. These are similar to regular current accounts but with some exclusive perks for the customers.

- Free Checking Account: Such accounts provide a particular feature of zero or minimal minimum balance requirement, thus serving low-end banking customers. These accounts do not require recurring maintenance fees.

- Interest-Bearing Checking Account: These accounts opened with banks or credit unions yield interest to the holders. However, the Annual Percentage Yield (APY) is significantly low.

- Second Chance Checking Account: These customers fall under the ChexSystems registry as defaulters for closing their bank accounts without clearing dues. Although they are labeled as high-risk customers, they get a second chance to open a bank account with lower banking limits and limited features.

- Rewards Checking Account: These are credit card accounts that allure the holders with different kinds of rewards like credit points, discounts, or cash backs awarded on frequent everyday use.

- Commercial Checking Account: These are the business accounts that facilitate companies in executing financial transactions, paying the operating expenses, and accepting payments from customers. Organizations can have separate current accounts for different purposes.

- Joint Checking Account: Individuals can also open bank accounts with their spouses, partners, or children.

- Teen Checking Account: These accounts are meant for minors between ages 13 and 17. While the Custodial Teen Checking Account allows parents to control, limit, and view their child's transactions, a Free Teen Checking Account has no minimum balance requirement.

Calculation Based Example

Consider the following numerical to better understand checking accounts.

Calculate the closing balance of Mr. David’s account with the following mentioned details:

- David opened an interest-bearing current account with $ 1,00,000 on January 1, 2016.

- David further invested $50,000 on January 1, 2019.

- The rate of interest is 12% p.a. to be compounded yearly.

- Calculate the closing balance, which will accrue to Mr. David on December 12, 2019.

Solution - Closing balance accruing on December 12, 2019, can be calculated as follows:

Therefore, the calculated Closing balance on December 12, 2019, is $2,13,352.

Advantages

A current account provides various services such as cash deposit, withdrawal, net banking, electronic fund transfer, ATM withdrawal, and cheques. It can even be used for making daily payments and meeting numerous expenses as there is no limit on the number of transactions. Moreover, keeping the record of these transactions gets simplified through the availability of online account statements.

Direct deposit of cash and cheques; and plastic money like debit and credit cards make it even more convenient for the account holders. The early direct deposit feature allows the holders to make early bill payments or receive advance payments through current accounts.

It is a complete banking solution for individuals and businesses. Further, many current accounts require zero or low minimum balance and have zero or nominal maintenance fees. Some also offer interest or APY on the deposits. Moreover, these accounts usually come with FDIC insurance, making them more secure for the customers.

Disadvantages

Banks and financial institutions usually impose certain monthly charges or fees. Most current account holders are required to maintain a minimum balance. Also, the customers may even have to pay additional fees for insufficient funds, ATM usage, overdraft option, and wire transfer.

The financial institution can take action against the customer found defaulting or misusing a current account by ceasing withdrawals or transferring money from such an account. The banks keep an eye on the spending pattern of the customers through artificial intelligence. Unlike a savings account, most current accounts do not provide interest to the customers.

Savings Account Vs. Checking Account

| Basis | Savings Account | Checking Account |

|---|---|---|

| 1. Meaning | It is simply a deposit account that provides security and interest on the sum deposited. | It is a multipurpose bank account that aids the account holder in making frequent transactions, deposits, and withdrawals. |

| 2. Purpose | Secured money-saving in a bank account. | Making daily financial transactions. |

| 3. Minimum Balance Requirement | Many savings accounts are zero balance savings accounts, while others require a low minimum balance. | Some current accounts, like a teen checking account, need zero or insignificant minimum balance. Other types have a minimum requirement. |

| 4. Annual Percentage Yield (APY) | Such accounts offer interest to the holders. | Most customers do not receive interest. Very few current accounts return an interest. |

| 5. Fees | May impose minimum balance fees and monthly maintenance charges. | May include various charges on maintenance, ATM, insufficient funds, and an overdraft. |

| 6. Transaction Limit | Yes | No |

| 7. Services | Only suitable for savings, limited withdrawals, and internal online transactions. | Provides different banking facilities like multiple deposits, multiple withdrawals, external online transactions, cheques, and overdrafts. |