Table Of Contents

What is Variable Cost Per Unit?

Variable cost per unit refers to the cost of production of each unit produced in the company, which changes when the volume of the output or the level of the activity changes in the organization, and these are not the committed costs of the company as they occur only in case there is the production in the company.

It is important to note that these costs are short-term and can be adjusted rather instantaneously to maintain a variable cost per unit graph within feasible limits. It has a direct correlation to production; it increases with the increase in every unit of production. They are exactly the opposite of fixed costs that do not change due to changes in production.

Variable Cost Per Unit Explained

Variable cost per unit refers to the incremental cost associated with producing one additional unit of a product or providing one more unit of a service. Unlike fixed costs, which remain constant regardless of production levels, variable costs fluctuate based on the quantity of output. These costs are directly tied to the production process and rise or fall as production volumes change.

For instance, in manufacturing, the cost of raw materials, labor, and energy consumption often constitutes variable costs. As production increases, more raw materials are required, more labor hours are worked, and more energy is consumed, leading to a proportional increase in variable costs. Conversely, if production decreases, variable costs decrease as well.

Thus, the variable cost per unit is the cost per unit incurred by the company, which changes with the change in the company's production level. To calculate the variable cost per unit, the company requires two components, which include total variable expenses incurred during the period and the total level of production of the company.

It helps in the calculation of the contribution per unit and break-even analysis of the company, which will help the company's management in the decision-making process that may be required in the future for expanding the business and approval of new orders. Using a variable cost per unit calculator involves dividing the total variable costs by the total units produced. This calculation helps businesses determine the incremental cost impact of scaling production up or down.

Having a clear understanding of variable cost per unit is crucial for decision-making, pricing strategies, and assessing the breakeven point – the level of production at which total revenue matches total costs, including both variable and fixed costs.

Formula

The formula that acts as a basis for using the Variable Cost Per Unit calculator is as follows. This formula acts as a basis for our calculations and understanding of the intricacies of the concept.

Variable Cost Per Unit = Total Variable Expenses / Output of the Company

Where,

- Total Variable Expenses = Total variable expenses refers to all those costs incurred by the company during the period total of which change when the volume of the output or the activity changes in the company where the change in the variable expenses will be in the proportion of the difference in the output of the company. Some common variable costs include the cost of the raw material, cost of the direct labor or the casual labor, fuel expenses, packaging expenses, etc.

- The Output of the Company = Output refers to the total number of units produced by the company during consideration.

Examples

Now that we have the knowledge about the basics, formula, and related details, let us apply the theoretical knowledge to practical application through the examples below that shall help us with a variable cost per unit calculator.

Example #1

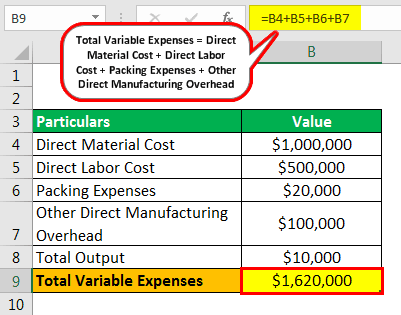

X l\Ltd. has the business of manufacturing and selling readymade garments in the market. In September 2019, it incurred some of the expenses given below. Also, during the same month, it produced 10,000 units of the goods. Mr. X now wants to know the variable cost per unit for September 2019.

Transactions during the month are as follows:

- Direct material Cost for the month: $ 1,000,000

- Direct labor cost for the month: $ 500,000

- Paid the rent for the whole year, amounting to $ 48,000.

- Paid for the packing expenses required in September amounting $ 20,000

- Other direct manufacturing overhead for the month amounts to $ 100,000

- Insurance Expenses for the whole year paid in September amounting to $ 24,000.

Calculate the variable cost per unit for September.

Solution

Calculation of Total Variable Expenses using the below formula is as follows,

Total Variable Expenses = Direct Material Cost + Direct Labor Cost + Packing Expenses + Other Direct Manufacturing Overhead

- = $ 1,000,000+ $ 500,000 + $ 20,000 + $ 100,000

- Total Variable Expenses = $ 1,620,000

Output of the company = 10,000 units

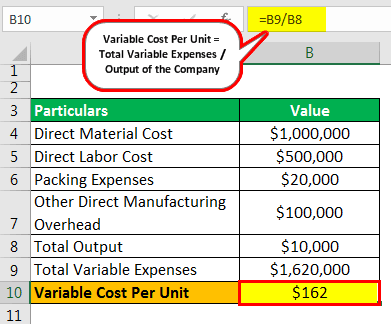

Calculation of Variable Cost Per Unit

- = $ 1,620,000 / 10,000

- = $ 162

Thus for September 2019, the variable cost per unit of the company comes to $162.

Working:

- Direct material expenses change with change in the production level and thus will be considered a variable cost.

- Direct labor expenses change with change in the production level and thus will be considered a variable cost.

- The company pays rent in advance for the whole year, so it is a fixed expense and will not be a part of the variable cost.

- Packing expenses change with change in the production level and thus will be considered a variable cost.

- Other direct manufacturing overhead changes with changes in the production level and thus will be considered a variable cost.

- Insurance expense in advance for the whole year, so it is a fixed expense and will not be part of the variable cost.

Example #2

In India, the prices of purchasing coal saw a major difference at the per unit level. This came into effect due to the mandate issued to import up to 6 percent of their imports of blended imported coal. This would add up to Rs. 11,000 crores towards power purchase costs.

In January 2023, 5.4 percent was applicable for the blending rate for that fiscal. However, the increment in the rate to 6 percent would increase the per unit variable cost by Rs 0.226 per unit.

Nonetheless, market experts claim that the per unit cost would decrease by Rs. 0.067 due to an expected 33 percent decrease in the price of import of coal.

Advantages

Let us understand the advantages of using a variable cost per unit calculator through the explanation below.

- It helps the company know what will be its per-unit cost of production and hence helps in the calculation of the contribution per unit and break-even analysis of the company.

- With the calculation of the variable cost per unit, top management gets more defined data, which will help them make decisions that may be required in the future for expanding the business.

- With the help of the variable cost per unit, management will be able to know that what is the minimum price that the company is required to offer to its new customer in case it gets bulk order by considering the fixed cost as the sunk cost as it will be incurred in case even if there is no production in the company.

Disadvantages

Despite the various advantages mentioned above, there are a few factors from the other end of the spectrum that act as a hassle for businesses. Let us understand the disadvantages of the interpretation of a variable cost per unit through the points below.

- Complexity in Calculation: Calculating variable cost per unit requires accurate tracking and allocation of various variable costs, which can be time-consuming and challenging, particularly in complex production processes.

- Fluctuating Pricing: Relying solely on variable cost per unit might lead to pricing decisions that do not adequately cover fixed costs. Over time, this could result in inadequate revenue to cover all expenses and potentially lead to financial instability.

- Neglects Fixed Costs: Variable cost per unit focuses solely on the variable costs associated with production. It ignores fixed costs, which are necessary for the operation of the business even if production stops. Ignoring fixed costs could lead to an incomplete understanding of the true cost structure.

- Doesn't Consider Economies of Scale: Variable cost per unit assumes that variable costs remain constant per unit regardless of production volume. However, in reality, economies of scale can lead to decreasing variable costs per unit as production volume increases. This aspect is not captured by the simple variable cost per unit calculation.