Table Of Contents

What Is Dividend Recapitalization?

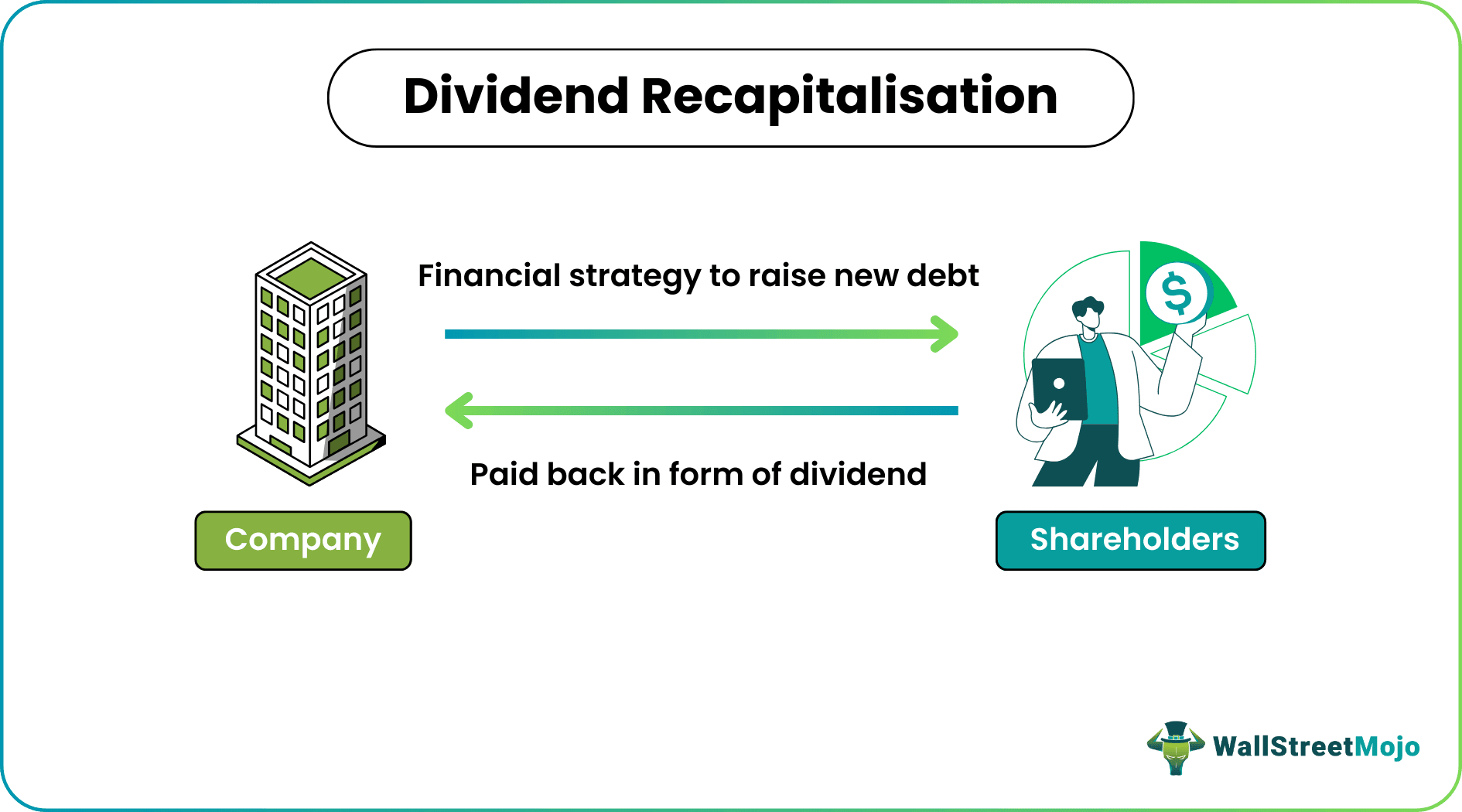

Dividend recapitalization, or dividend recap, is a financial strategy in which a company takes on debt to pay a special dividend to its shareholders. Dividend recapitalization aims to increase shareholder value by leveraging the company's assets and using the proceeds to pay a cash dividend.

They are often used when a company has excess cash or valuable assets but does not want to sell them outright. The company also employs this technique when it wants to reward its shareholders with a cash payout without reducing its cash reserves.

Key Takeaways

- Dividend Recapitalization is a technique companies use to issue debt and utilize the proceeds to provide a special dividend payment to their shareholders.

- Companies with significant cash reserves or valuable assets that prefer not to sell them immediately frequently employ this technique.

- It is attractive to investors who prefer cash payouts over long-term investments in the company.

- While dividend recapitalization is generally beneficial, it also offers a lot of challenges, such as a higher debt burden, high interest and reduced investment growth.

Dividend Recapitalization Explained

The dividend recapitalization model uses debt to pay a large dividend to shareholders without selling company shares. The company issues new debt, such as bonds or loans, to raise cash. The cash raised is then used to pay a large dividend to shareholders. The new debt usually finances this dividend. The company's balance sheet is then restructured to reflect the new debt and its interest payments.

Shareholders receive a cash payout, which is likely to increase the value of their investment in the company. After that, the company's debt-to-equity ratio is increased, which can be seen as a positive sign by investors. However, it also means that the company is taking more financial risk.

Some of the uses of dividend recapitalization bonds are as follows:

- Rewarding shareholders: Dividend recapitalization is a way to reward shareholders by providing them with a large cash payout. It can help to increase investor confidence and attract new investors.

- Funding growth: Companies can use the cash generated from a dividend recapitalization to fund future growth opportunities, such as new product development, expansion into new markets, or mergers and acquisitions.

- Repurchasing shares: Dividend recapitalization can also be used to repurchase company shares, which can increase the value of remaining shares by reducing the number of shares outstanding.

- Reducing taxes: By using debt to pay a dividend, a company can reduce its tax liability, as interest payments on the debt are tax-deductible.

- Improving balance sheet: Dividend recapitalization can improve a company's balance sheet by reducing its cash reserves and increasing its debt-to-equity ratio, which can be seen as a positive sign by investors.

Examples

Let us look at the dividend recapitalization examples to understand the concept better:

Example #1

Let us say company XYZ has $10 million in cash on its balance sheet. It wants to reward its shareholders without selling shares. The company decides to pursue a dividend recapitalization strategy to achieve this goal.

It issues $10 million in new debt, such as bonds or loans, to raise cash. The company uses the $10 million in cash to pay a special dividend to its shareholders. The new debt finances this dividend. After the dividend is paid, the company's balance sheet reflects the new debt, which increases the company's debt-to-equity ratio. Shareholders receive a special dividend, which can increase the value of their investment in the company.

Consider Company XYZ, which has one million outstanding shares and decides to pay a special dividend of $10 per share. This would result in a total payout of $10 million to shareholders. The company's debt-to-equity ratio is now higher. The investors could view it positively as it suggests that the company is using debt to fund growth opportunities or reward shareholders.

Example #2

In April 2012, Apple issued $17 billion in debt. This was one of the largest corporate bond offerings at the time. The proceeds from the bond offering were used to finance a $10 billion share repurchase program and a $2.65 per share quarterly dividend. This dividend represented the first time Apple had paid a dividend in 17 years.

Investors viewed the dividend recapitalization positively, as it allowed Apple to return cash to shareholders without selling any shares or depleting its cash reserves. The move also increased Apple's debt-to-equity ratio. Investors took it as a positive sign and believed that the company was taking advantage of historically low interest rates to fund growth opportunities.

Overall, Apple's dividend recapitalization was a successful example of how companies can use debt to reward shareholders and increase investor confidence. It is worth noting, however, that this strategy is not without risks. Companies should carefully consider their financial position before deciding to pursue a dividend recapitalization.

Pros And Cons

Here are the major pros and cons of dividend recapitalization:

Pros

- Increased shareholder value: It can increase shareholder value by returning excess cash to shareholders without selling any company shares. This, in turn, can enhance investor confidence and attract new investors.

- Tax benefits: By using debt to pay a dividend, a company can reduce its tax liability. This is because interest payments on the debt are tax-deductible.

- Flexibility: It provides cash to shareholders while also maintaining control of the company. This can be particularly beneficial in cases where the company's management team is confident in the company's future prospects but wants to reward shareholders in the short term.

- Improved balance sheet: It can improve a company's balance sheet by reducing its cash reserves and increasing its debt-to-equity ratio. Investors can take it as a positive sign, as it suggests that the company is using debt to fund growth opportunities or to reward shareholders.

- Increased liquidity: By providing shareholders with cash, dividend recapitalization can increase the liquidity of a company's shares. This can make them more attractive to investors.

Cons

- Increased debt burden: It increases a company's debt load, which can reduce its financial flexibility and increase its risk of defaulting on its loans.

- Higher interest costs: The additional debt incurred to fund the dividend will typically come with higher interest costs than the company's existing debt. This can reduce the company's profitability and make it more vulnerable to changes in interest rates.

- Shareholder expectations: Paying a special dividend through dividend recapitalization may create an expectation among shareholders that the company will continue to pay out similar dividends in the future. If the company is unable to maintain this level of dividend payments, shareholders may be disappointed, which could lead to a decline in the company's stock price.

- Reduced investment in growth: By using cash to pay out a dividend, the company may have less money available to invest in growth initiatives or make strategic acquisitions. This could limit the company's ability to expand and compete in its market.

- Negative impact on credit rating: If a company's debt load increases significantly due to dividend recapitalization, it may negatively impact its credit rating. This could make it more difficult and expensive for the company to raise future debt financing.

Frequently Asked Questions (FAQs)

Generally, a dividend recapitalization transaction involves a company taking on additional debt to pay out a special dividend to its shareholders. This increases the company's leverage, which can increase its cost of capital and reduce its IRR.

On the other hand, a dividend recapitalization can also positively affect a company's IRR. For example, if the company's cost of debt is lower than its cost of equity, replacing equity with debt through a dividend recapitalization could lower the overall cost of capital and increase the IRR.

When a company borrows money to pay a special dividend through dividend recapitalization, it will typically incur interest expenses on the borrowed funds. These interest expenses can reduce the company's taxable income and lower its tax liability. Depending on the tax laws in their jurisdiction, shareholders may be subject to dividend taxes on the special dividend received through dividend recapitalization. The tax rate for dividend taxes can vary depending on the shareholder's tax bracket and other factors.

The purpose of dividend recapitalization is to extract cash from a company by borrowing money to pay out a special dividend to shareholders. In contrast, refinancing aims to replace existing debt with new debt with better terms, such as a lower interest rate or longer repayment period.