Table Of Contents

What Is Gray Knight?

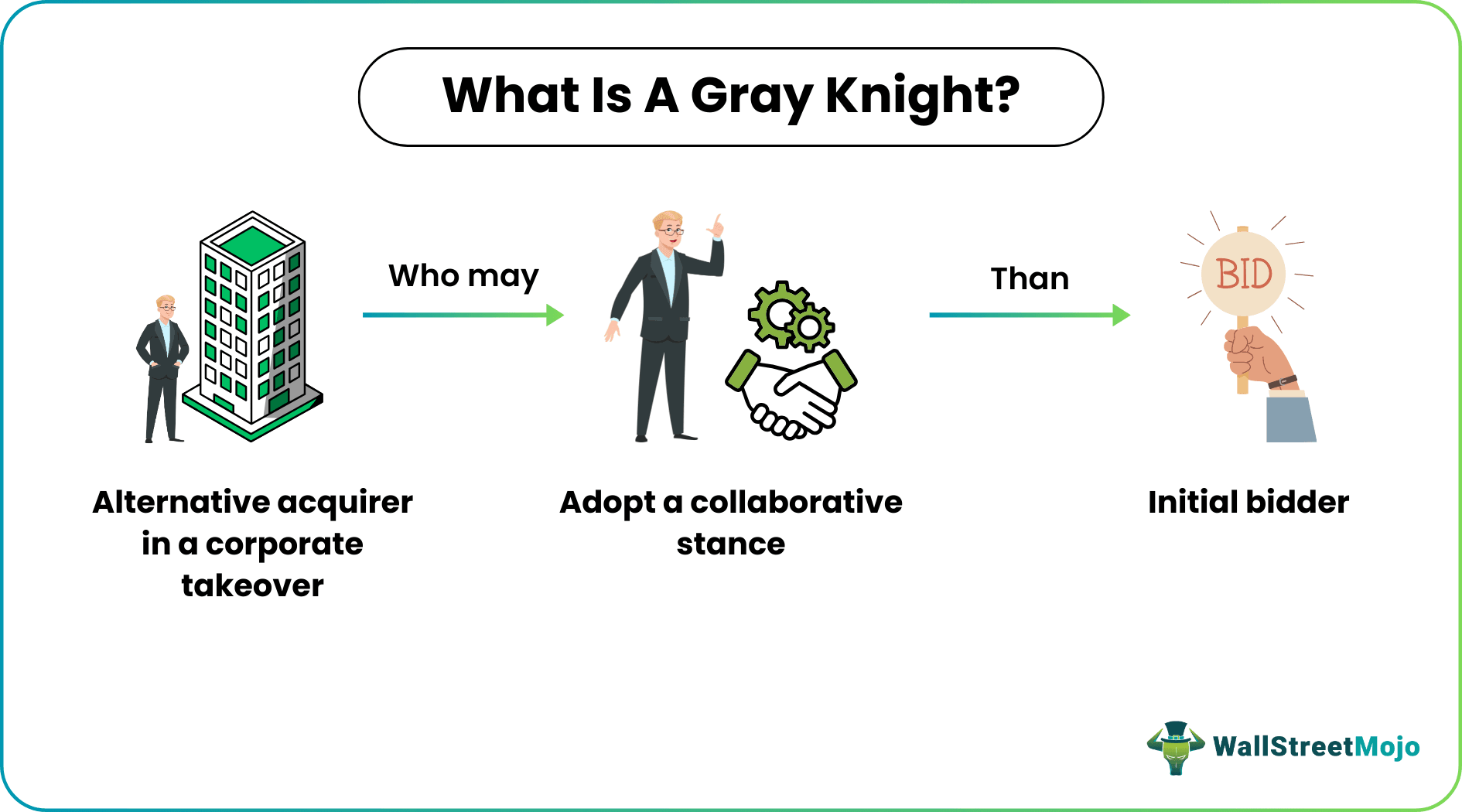

A Gray Knight is an entity that engages in the bidding process for a company takeover without being initially invited to do so. They typically hold potential interest in the target company but initially observe from the sidelines to assess the evolution of the bidding.

Businesses pursue acquisitions and takeovers for various reasons. A primary motivation is often significant corporations seeking to enhance their market share. Additionally, companies may target the acquisition of technology from smaller firms to expand their range of offerings. Another objective could be to bolster their competitive edge within the industry.

Table of contents

- What Is Gray Knight?

- A gray knight is a company that unsolicitedly bids to acquire another company.

- Several players are involved in the hostile takeover attempt: the target company, the acquirer, the white knight, and the gray knight.

- A black knight offers a takeover bid to a target company's board, but if unsatisfactory, the board may suggest a hostile bid. The target then negotiates a friendly bid with a third company, the white knight.

- The fourth company offers a more substantial offer, making it harder to reject.

Gray Knight Explained

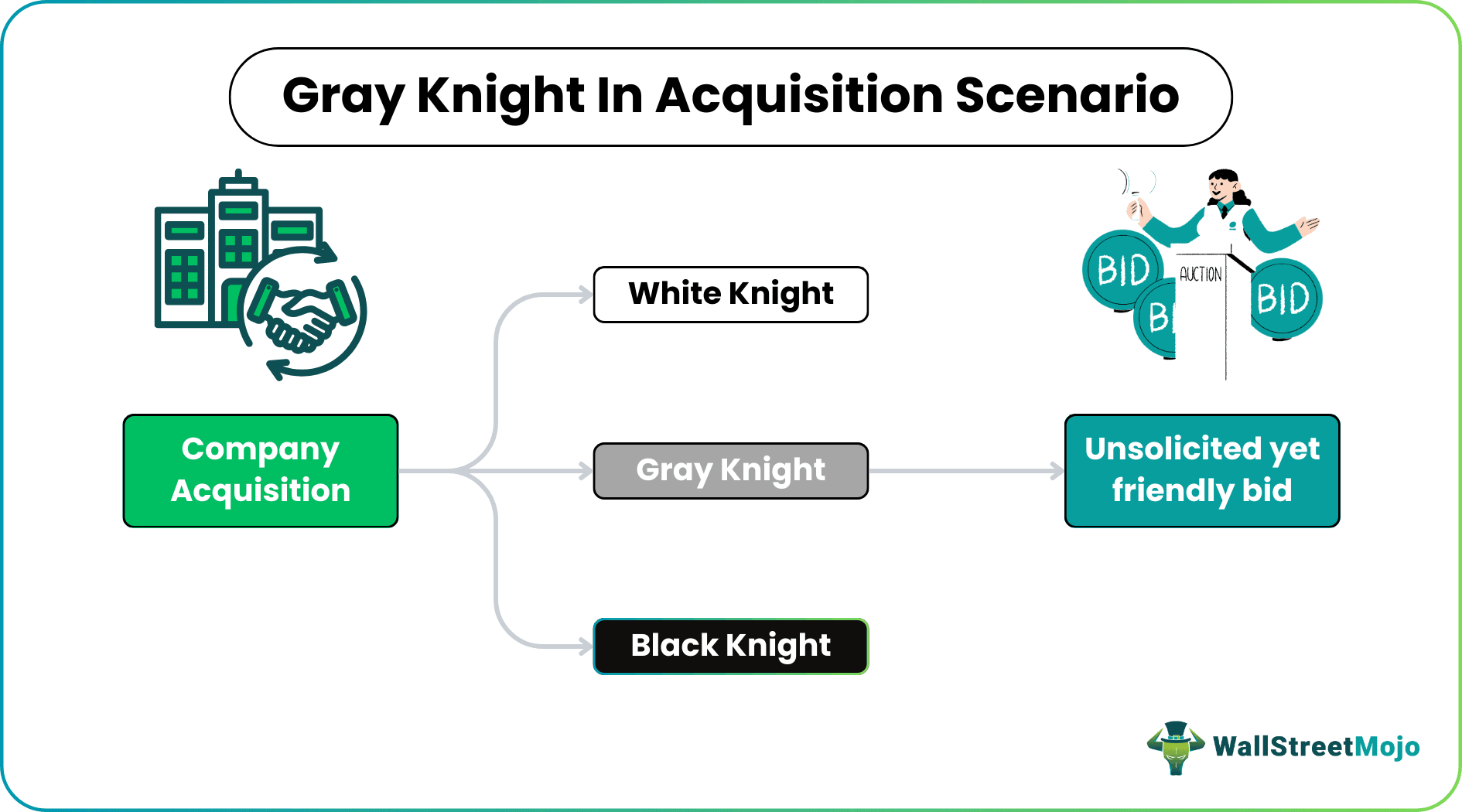

A gray knight is a company that initiates an unsolicited bid with the intention of acquiring another company after a white knight offers a fair deal. This hostile takeover attempt involves several parties, including the acquirer, the target company, and the gray and white knight.

A white knight is a potential friendly acquirer sought by a firm on the verge of being taken over by an unfriendly black knight. Despite not remaining independent, the target company is acquired at fair consideration, with current management remaining and investors better compensated. If a white knight encounters difficulties, a gray knight may intervene. Black knights are unwelcome, hostile takeover bidders, often surpassing the board of directors. White knights serve as a defense against hostile takeovers.

In the acquisition scenario, a black knight presents a takeover bid to a target company's board. If the board rejects the unsatisfactory bid, the black knight may suggest a hostile takeover bid. The target's board then approaches a third company, the white knight, to negotiate a friendly bid that they believe brings more value to the shareholders.

The target's objective is to counter the aggressive bid from the acquirer and sell to the white knight on more favorable terms. However, soon after the white knight makes a takeover offer, the gray knight, a fourth company, presents a more substantial offer. They are aware that it will be more challenging for the target's board to turn down a more significant offer if they accept the white knight's proposal.

Role In M&A

A gray knight analyzes the interactions between the initial bidding company and the target company to identify potential issues. If challenges arise, they strategically leverage them for their benefit. They typically operate in a space between white knights, who collaborate with the management of the target company, and hostile firms pursuing a takeover.

Instead of bidding out the initial bidder, gray knights often counter with a competitive offer, positioning themselves as an attractive option for the target company. Their goal is not to present a poor offer or acquire the target at a low price but to provide a compelling alternative that is advantageous for both the target company and its stakeholders.

Examples

Let us take a few examples to understand the concept better.

Example #1

Suppose there is an imaginative scenario where company ABC Ltd. has developed a new potential formula for a drug. It could be a breakthrough for science. However, this is a small company and has few resources to do further research on the topic.

Company XYZ Ltd (black knight) thinks it would be an excellent potential acquisition. However, ABC Ltd. does not want to sell, so XYZ Ltd. submits a plan for a hostile takeover. To defend itself, ABC Ltd. approached a third company, B2C Ltd. (white knight).

Company B2C agrees to submit a friendly takeover bid on better conditions for Company ABC than Company XYZ's. However, a new company, B2B (gray knight), sees an opportunity to acquire Company ABC at a better cost, despite the higher acquisition cost, and believes the takeover will bring value to shareholders. As a result, Company B2B submits a higher offer, resulting in a friendlier bid from Company B2B.

Example #2

Picture this: In the corporate landscape of 2021, ABC Enterprises becomes the target of an aggressive takeover attempt by a major competitor. Sensing the impending threat, enterprising investor John Anderson steps forward as a gray knight to navigate the company through these challenging waters. Recognizing the untapped potential of ABC, Anderson devises an alternative proposal that not only protects the interests of existing shareholders but also infuses capital to drive strategic growth.

Despite facing initial resistance from ABC's board, Anderson's strategic intervention triggered a series of competitive bids, transforming the situation into a dynamic and evolving corporate drama. This unique narrative of a gray knight's involvement unfolds against the backdrop of contested acquisitions, showcasing the intricate maneuvers and tactical decisions that shape the destiny of companies. Let's imagine that Anderson's proposal eventually triumphs, highlighting the instrumental role gray knights can play in steering the outcomes of hostile takeover endeavors.

Gray Knight vs White Knight vs Black Knight

Let us look at some of the differences between the three concepts.

| Points | Gray Knight | White Knight | Black Knight |

|---|---|---|---|

| Concept | The party that brings up the idea of a better bid against the hostile takeover. | A white knight is a third party that is friendly and helps the target company by making a rival bid to the hostile buyer. | A business that starts a hostile takeover by making an unattractive bid to the target company is known as a "black knight." |

| Point of view | From the target company's view, they are neither friends nor foes. They are, however, considered friendlier. | From the target company's view, the white knight is a friend. | From the target company's view, the black knight is hostile. |

| Aim | They have high self-interests. However, they are considered a friend as they give a better offer than black ones. | White Knights have shared objectives, and hence, their priority is the growth of both companies. | The black knight company prioritizes self-interest more and looks to attain the target company at an undesirable cost. |

Gray Knight vs Yellow Knight

Let us look at some of the differences between the two concepts.

| Points | Gray Knight | Yellow Knight |

|---|---|---|

| Concept | It is an acquiring business that outbids a white knight in an attempt to acquire a firm. They usually make unsolicited proposals for target companies following a white knight's bid. | A corporation that first suggested a hostile acquisition but ultimately decided to integrate for a variety of reasons is known as a "yellow knight." |

| Motive | The proposal can be mainly due to self-interest. | A backout can result from a number of circumstances, including the target company's higher cost or stronger takeover defenses than first thought. |

| Hostility | In a corporate takeover attempt, it is the second hostile bidder. However, they are considered to be friends. | Yellow Knight is a hostile bidder that changes its approach and proposes a more amicable merger of equals. |

Frequently Asked Questions (FAQs)

It's not an explicit invitation for them to buy a business. Rather than referring to a hostile takeover bid by another party, known as the "black knight," the term "gray" is used instead. This act is intended to convey a possible acquirer who steps forward.

For a number of reasons, it can be viewed as a superior possible acquirer. They might present the target company's stockholders with a more enticing deal structure, which might include a higher price or better conditions. They might also offer possible synergies or growth opportunities with the target company, making them a better strategic fit.

Companies engaging with them should prioritize compliance with securities laws and regulations governing takeover activities. Ensuring transparency, fairness, and equal treatment of shareholders is essential. Legal advisors play a crucial role in navigating the intricate regulatory landscape, helping companies mitigate risks and adhere to ethical standards throughout the contested acquisition process.

Recommended Articles

This article has been a guide to what is Gray Knight. Here, we explain its role in M&A, examples, and comparison with white, black and yellow knights. You may also take a look at the useful articles below –