Table Of Contents

Dawn Raid Meaning

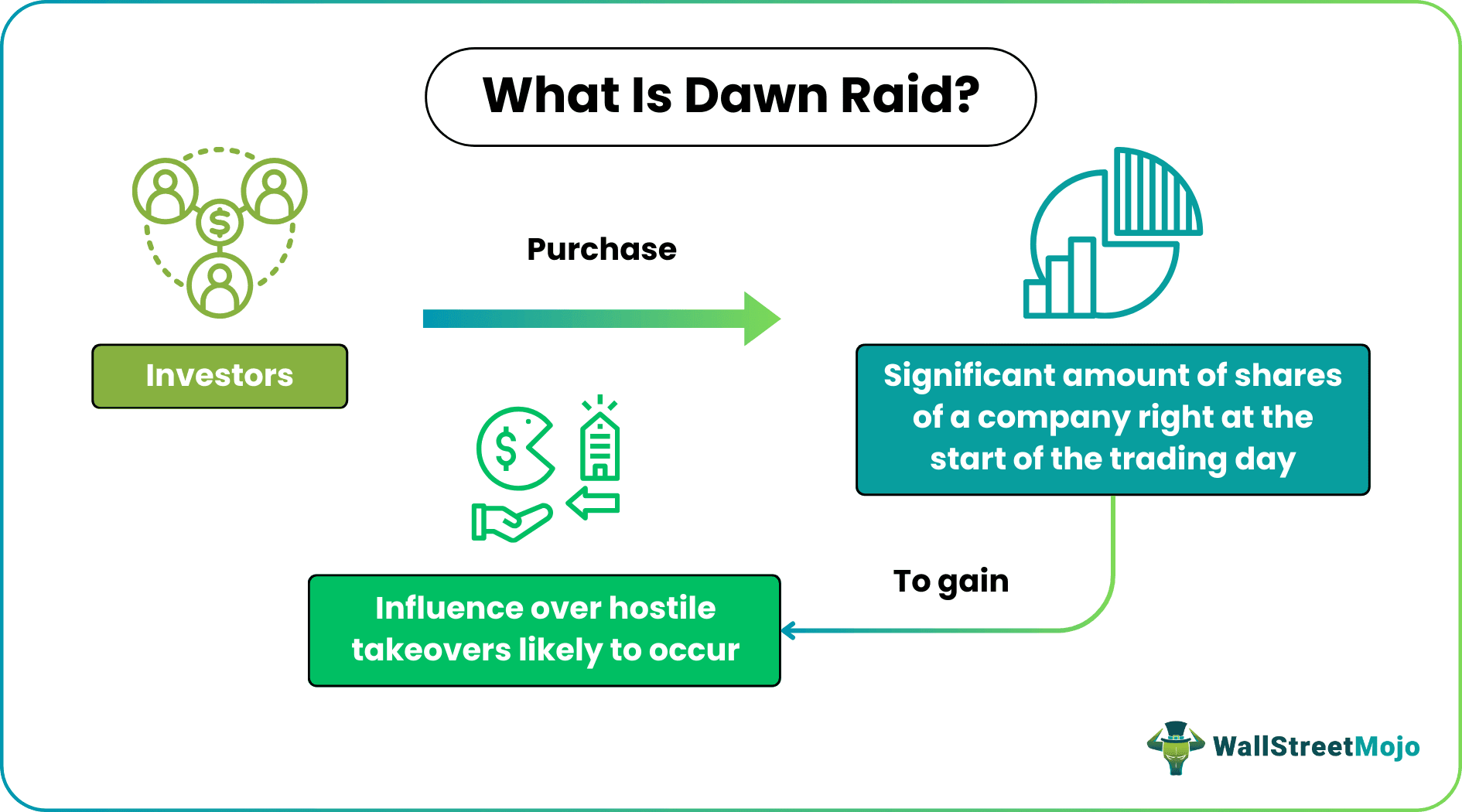

A dawn raid is a strategy of acquiring company shares in which an investor buys or receives a significant number of shares in the morning when the stock market opens. The acquisition is made at a very low price compared to an investor's announcement to acquire. As a result, it will lead to an increase in the stock price.

The reason behind this rush of the investors towards buying the shares of a particular company is the hostile takeover that the latter plans, targeting to acquire another firm. Purchasing more shares at a decent price helps these investors influence the takeovers to happen.

Table of contents

- Dawn Raid Meaning

- A dawn raid is when an investor buys or receives a sizable quantity of stock as the stock market opens in the morning.

- The acquisition is made at a meager price compared to an investor's announcement to acquire. As a result, it may lead to a rise in the stock price.

- It involves quickly purchasing a significant shareholding in a target company before any formal hostile takeover announcement is made public. Moreover, it explains the potential bidder's efforts to buy a substantial stake, often at the trade opening, to position the investor for a takeover bid.

- According to the rules, a bidder may purchase only a 14.9% stake once, waiting a week before buying more than 9.9% and another week before acquiring the other 4.9%. They make these rules to permit the target company to react to the bid and suggest to the shareholders.

Dawn Raid Explained

A dawn raid is a term popularly used in UK takeovers. It involves quickly purchasing a large shareholding in a target company before any formal announcement of a hostile takeover is made public. It describes the attempt made by the potential bidder to acquire a significant stake, often at the opening of the trade, to position the investor for a possible takeover bid.

Mergers, acquisitions, and takeovers are part of the business world, and companies keep pursuing them to increase shareholder value. It is a corporate action most popular in the UK where a company tries to acquire control through a hostile bid aiming at developing as many shares as possible of the target company early in the morning before the target firm becomes aware of the acquirer’s true identity and intent.

The dawn raid procedure helps an investor or acquirer company reduce its takeover cost substantially since acquiring shares before making a formal announcement for a takeover is comparatively more cost-effective than the cost incurred after completing a legal statement of acquisition. In addition, information will advance the prices of the target company’s shares, resulting in more cash outflow for the acquirer company. It is a stock market operation where many of its shares are suddenly bought, often anticipating a takeover bid. Then, with a successful dawn raid, the raiding firm makes a takeover bid to acquire the rest of the company.

Dawn Raid Takeovers Explained in Video

Guidelines

There are a few guidelines that companies must follow to ensure they use it tactfully. The Takeover Panel, through its Substantial Acquisition Rules, popularly known as SARs, earlier provided a delaying mechanism for how acquirer companies or investors can acquire up to 29.9% stake in a company through the dawn raid strategy. Originally, it was designed to prevent such a hostile takeover and allow management to advise their shareholders before it was too late to influence the course of events.

Under the said rules, a bidder could buy only a 14.9% stake at one time, waiting a week before buying a further 9.9% and another week before acquiring another 4.9%. They framed these rules to allow the target company to react to the bid and advise their shareholders.

As formerly imposed rules drop, a bidder (an acquired company or an investor) can quickly purchase up to 30% of the shares in the target company through a dawn raid. However, once the bidder has acquired a 30% stake, they may formally announce the bid.

These save a lot of money for the raiders or acquirers and are a good alternative to making a formal offer. That would involve paying a premium to shareholders from the traded price of the target company's share. These are also beneficial to the target company's shareholders. Post-dawn raids, the acquirer has to compulsorily make a formal takeover bid, which is usually a premium to the current price.

Examples

Example 1

Chinalco and Alcoa jointly bought a 12% stake in Rio Tinto’s London-based shares. Under this, the investor or acquirer company instructs its broker to buy as soon as the stock market opens a big stake possible by acquiring the shares available in the company. Trading begins without the market or the management of the target noticing.

By acquiring such large stakes, the investor or acquirer company can reduce its takeover cost as it might have already achieved many shares before the formal announcement of the takeover. Also, may have to acquire a smaller number of shares after the declaration to gain a significant stake in attaining majority control of the target company.

Example 2

Heal International Ltd. is a leading manufacturer of generic medicines based out of London. It intends to acquire Faze International Ltd., which is also in the same formulation and generic medication line with a large market share in areas that Heal International Ltd. does not cover. Heal International Ltd. intends to take over Faze International Ltd. using a dawn raid takeover strategy. Faze International Ltd. shares are listed on the London Stock Exchange (LSE) and traded at $40 per share.

Using this strategy, Heal International Ltd. acquired up to a 30% stake by acquiring shares of Faze International Ltd. from the open market and made an available offer to acquire a controlling stake (51%). If Heal International Ltd. had made a formal offer to buy 51% of Faze International Ltd., it would have to offer a premium to the current price ($40 in this case), resulting in millions of dollars more. Thus, Heal International Ltd. acquired a significant stake and saved a million dollars in the acquisition using the dawn raid.

Limitations

It is difficult to understand what a dawn raid is until the risks involved are explored. The process is a very offensive tactic. Its inherent technique of acquiring many shares in the morning as the capital market opens increases the demand for shares, which soars the stock prices further. That results in higher stock prices, leading to a rise in acquisition costs. Furthermore, the strategy is not fit for all countries as some countries' regulations impose limitations against the process.

Secondly, acquiring such a large number of shares from the open market requires adequate liquidity, which is also situational and may not be available at all times, thereby impacting the prices of the shares.

Thus, we can say that the dawn raid has its own merits and demerits as a takeover strategy. The acquiring company can opt for the same based on its current state of affairs and the target company which it intends to acquire.

Frequently Asked Questions (FAQs)

Dawn raid refers to a company premises investigation by the ICO without notice. Every company subject to data protection legislation(s) must cooperate and give relevant details to the ICO. Moreover, failure to cooperate may encourage the ICO to issue an assessment notice, per DPA section 146, to request entry into a company's premises on at least seven days' notice.

Suppose a competition authority suspects that a competition infringement law has happened. In that case, it may conduct inspections without notice ("dawn raids") at the company's premises of companies doubtful of involvement (also at their customers' and competitors' premises).

One must make notes or copies of all documents or data taken. Ensure to leave officials with the information or documents on the company premises alone. One must provide the statements in the lawyer's presence. Never tamper with any documents known during an investigation.

A dawn raid relating to a civil offense must be supported by written authorization, setting out the nature of the investigation. In addition, a warrant must access business or domestic premises, which will authorize utilizing force to enter and secure the specified premises if essential.

Recommended Articles

This article is a guide to Dawn Raid & its meaning. Here, we explain the guidelines to be followed to conduct the process along with examples and limitations. You may learn more about M&A from the following articles: -